How Much Is Optima Tax Relief

Navigating tax debt can be a daunting task, leading many individuals and businesses to seek professional assistance. Optima Tax Relief, a prominent player in the tax resolution industry, offers a range of services to help clients manage and resolve their tax issues. Understanding the cost associated with these services is a crucial step in making an informed decision about engaging their assistance.

The cost of Optima Tax Relief's services is not a one-size-fits-all figure. Instead, it is highly individualized, depending on the complexity of the client's tax situation, the specific services required, and the scope of work involved. This personalized approach makes it challenging to provide a single, definitive answer to the question: How much is Optima Tax Relief?

Understanding the Cost Structure

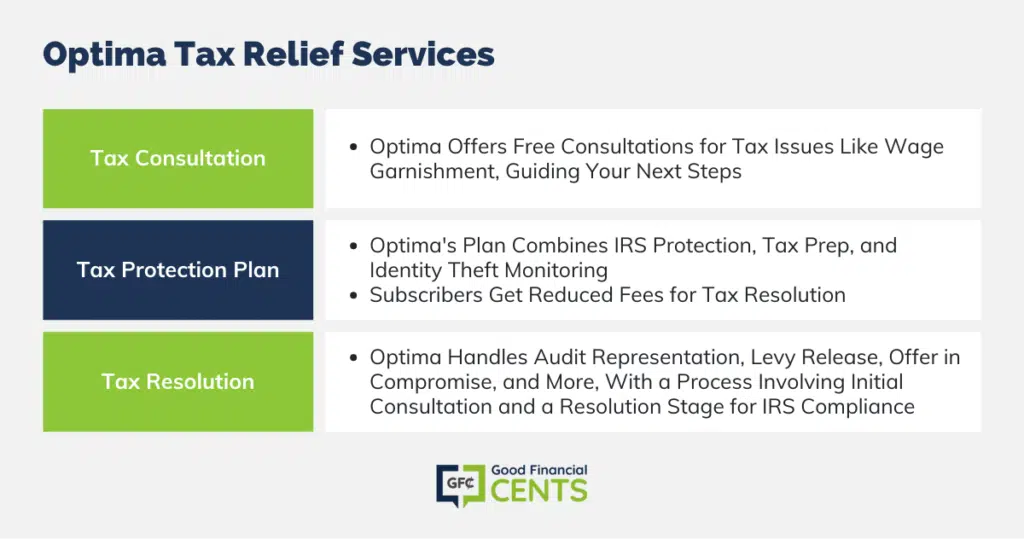

Optima Tax Relief operates on a fee-based structure, meaning clients pay for the specific services they utilize. It is important to note that the company does not provide free, up-front services beyond an initial consultation.

During this initial consultation, an Optima Tax Relief representative will assess the client's tax situation. This assessment involves reviewing their tax history, outstanding tax liabilities, and overall financial circumstances. Based on this assessment, the representative will recommend a tailored plan of action to address the client's specific needs.

The cost of the recommended plan will be discussed transparently with the client before any work begins. This transparency is crucial for clients to understand the financial commitment involved in engaging Optima Tax Relief's services.

Factors Influencing the Cost

Several factors contribute to the overall cost of Optima Tax Relief's services. The complexity of the tax issue is a significant determinant. Simple cases, such as negotiating a payment plan with the IRS, may be less expensive than complex cases involving audits, appeals, or tax litigation.

The amount of outstanding tax debt also plays a role. Clients with larger tax liabilities may require more extensive negotiations with the IRS, leading to higher fees. The specific services required are another key factor.

Services such as Offer in Compromise (OIC) applications, penalty abatements, and audit representation each have their own associated costs. The more services a client needs, the higher the overall cost will be.

Transparency and Payment Options

Optima Tax Relief emphasizes transparency in its fee structure. Clients should receive a clear and detailed breakdown of all costs associated with their chosen plan of action.

This breakdown should include information on the specific services included, the estimated time frame for completion, and the total cost of the engagement. It is advisable for prospective clients to carefully review this information and ask clarifying questions before committing to any services.

To make their services more accessible, Optima Tax Relief typically offers various payment options. These options may include installment plans, allowing clients to spread the cost of their services over time. Clients should discuss payment options with their representative to determine the best fit for their budget.

Alternatives to Optima Tax Relief

While Optima Tax Relief can be a valuable resource for those facing tax challenges, it is important to consider all available options. Free or low-cost resources exist that can provide assistance with tax debt.

The IRS offers several programs to help taxpayers manage their tax obligations, including installment agreements, Offers in Compromise, and penalty abatements. Taxpayers can contact the IRS directly to explore these options.

Additionally, non-profit organizations like the Tax Counseling for the Elderly (TCE) and the Volunteer Income Tax Assistance (VITA) program offer free tax assistance to qualified individuals.

Making an Informed Decision

Ultimately, the decision to engage Optima Tax Relief, or any tax resolution service, should be made after careful consideration. Potential clients should thoroughly research their options, compare pricing and services, and read reviews from other customers.

Understanding the factors that influence the cost of tax resolution services, such as the complexity of the tax issue and the specific services required, is essential for making an informed decision.

While the cost of Optima Tax Relief varies depending on individual circumstances, transparency in pricing and flexible payment options can help make their services more accessible. By weighing the costs against the potential benefits and exploring alternative resources, taxpayers can choose the solution that best fits their needs and budget.