Is Orchid Island Capital A Good Investment

Orchid Island Capital, Inc. (ORC), a real estate investment trust (REIT) specializing in residential mortgage-backed securities (MBS), presents a complex investment proposition. The allure of high dividend yields can be tempting, but a deep dive into its financial performance, market conditions, and risk factors is crucial before committing capital.

This article aims to provide a balanced analysis of Orchid Island Capital as an investment, dissecting its business model, financial health, and the external factors influencing its performance. It will explore the potential rewards, alongside the inherent risks, offering readers the necessary information to make informed investment decisions, examining both bullish and bearish perspectives on ORC's future.

Understanding Orchid Island Capital's Business Model

Orchid Island Capital operates as a specialty finance company, focusing primarily on investing in agency MBS. These securities are guaranteed by government-sponsored enterprises like Fannie Mae and Freddie Mac, offering a layer of credit risk protection. However, these securities are still subject to interest rate risk and prepayment risk.

The company profits from the spread between the interest income it earns on its MBS portfolio and the cost of borrowing funds to finance those investments. This difference, known as the net interest margin, is a key indicator of ORC's profitability. The company uses leverage to amplify returns, which can magnify both profits and losses.

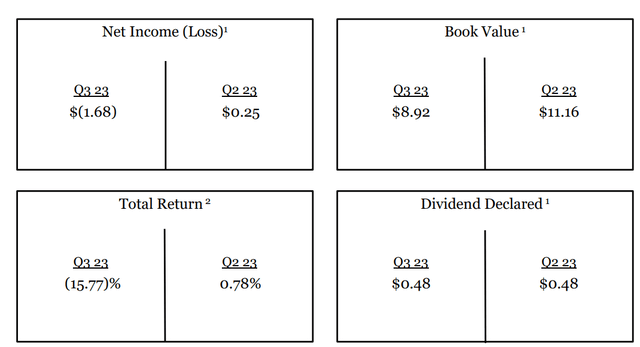

Financial Performance and Dividend Sustainability

Orchid Island Capital is known for its high dividend yield, which can be significantly higher than the average dividend yield of other REITs or stocks in general. This high yield is often a major draw for investors seeking income. However, it is important to assess the sustainability of these dividends.

The company's earnings can be volatile, influenced by factors like interest rate fluctuations and prepayment speeds. Analyzing ORC's historical dividend payouts and its core earnings (earnings excluding non-recurring items) is essential. A history of dividend cuts or inconsistent earnings should raise red flags.

Moreover, analyzing the company's Net Interest Margin (NIM) helps understand the ability of ORC to maintain dividend payouts in the future. The higher the NIM, the better is the company's prospects for dividends.

Interest Rate Sensitivity and Prepayment Risk

REITs like Orchid Island Capital are highly sensitive to changes in interest rates. Rising interest rates can increase borrowing costs, narrowing the net interest margin and reducing profitability. This can also lead to a decline in the value of the MBS portfolio.

Prepayment risk is another significant concern. Homeowners have the option to refinance their mortgages when interest rates fall, leading to faster prepayment speeds. This reduces the duration of ORC's assets and can negatively impact its earnings. ORC uses hedging strategies to mitigate these risks, but they are not always fully effective.

Analyzing the company's hedging strategies, including the types of instruments used and their effectiveness, is crucial. Understanding the potential impact of different interest rate scenarios is paramount for assessing the risk associated with ORC.

Market Conditions and Economic Outlook

The overall economic climate and the state of the housing market significantly impact Orchid Island Capital. Factors like unemployment rates, inflation, and consumer confidence all influence mortgage rates and prepayment speeds. The company's performance is closely tied to the health of the housing market.

Changes in monetary policy by the Federal Reserve, such as interest rate hikes or quantitative easing, also have a direct impact on ORC. A recessionary environment can lead to increased mortgage delinquencies and foreclosures, impacting the value of MBS.

Inflation and the actions of the Federal Reserve are critical factors to watch when evaluating ORC.

Competitive Landscape and Management Team

The REIT sector is highly competitive, with numerous companies vying for investment opportunities. Analyzing ORC's competitive advantages and disadvantages is crucial. Factors like management expertise, access to capital, and portfolio composition can differentiate ORC from its peers.

The management team's track record and experience are important considerations. Understanding their investment strategy and risk management approach is essential for evaluating the company's long-term prospects. It is vital to ensure that the management team has a proven track record in navigating challenging market conditions.

Bearish and Bullish Perspectives

Bearish Arguments

Bears argue that Orchid Island Capital's high dividend yield is unsustainable given the current interest rate environment and the potential for further rate hikes. They point to the company's volatile earnings history and its sensitivity to prepayment risk as reasons for concern. Bears may also emphasize the potential for a recession to negatively impact the housing market and ORC's portfolio.

Rising interest rates and economic uncertainty pose significant threats to the company's profitability. A significant decrease in housing affordability can impact the entire portfolio.

Bullish Arguments

Bulls argue that Orchid Island Capital's management team is adept at navigating market volatility and effectively managing risk. They believe the company's hedging strategies will protect it from significant interest rate shocks. The company's high dividend yield makes it an attractive investment for income-seeking investors, and continued low interest rates could benefit ORC.

The guarantees provided by agencies like Fannie Mae and Freddie Mac mitigates the credit risk in Orchid Island Capital's portfolio. A strong and stable housing market could further support the company's performance.

Risk Factors to Consider

Investing in Orchid Island Capital carries several inherent risks. Interest rate risk, prepayment risk, and credit risk are major concerns. The company's use of leverage amplifies these risks. Regulatory changes and economic downturns can also negatively impact ORC.

Before investing, carefully review the company's 10-K and 10-Q filings with the Securities and Exchange Commission (SEC). These documents provide detailed information about the company's financials, risk factors, and management's discussion and analysis of operations.

Conclusion: Is Orchid Island Capital a Good Investment?

Orchid Island Capital presents a high-risk, high-reward investment opportunity. The company's high dividend yield is attractive, but it is essential to carefully consider the associated risks. A thorough understanding of the company's business model, financial performance, and the external factors influencing its performance is crucial.

Ultimately, whether Orchid Island Capital is a good investment depends on individual risk tolerance, investment goals, and market outlook. Investors should carefully weigh the potential rewards against the inherent risks before making a decision.