Stocks Benefiting From Hhlr's Heavy Investment In Chinese Concept Stocks.

The reverberations of Hillhouse Capital's (HHLR Advisors') strategic pivot towards Chinese concept stocks are being felt across global markets. Several companies, largely under-the-radar until recently, are now experiencing unprecedented surges in their stock values. This is fueled directly by HHLR's significant investments, igniting a renewed interest in the potential of Chinese innovation and consumer markets.

The ripple effect of these strategic moves extends beyond immediate financial gains. The increased investor confidence is prompting a broader re-evaluation of Chinese equities.

Understanding HHLR's Investment Strategy

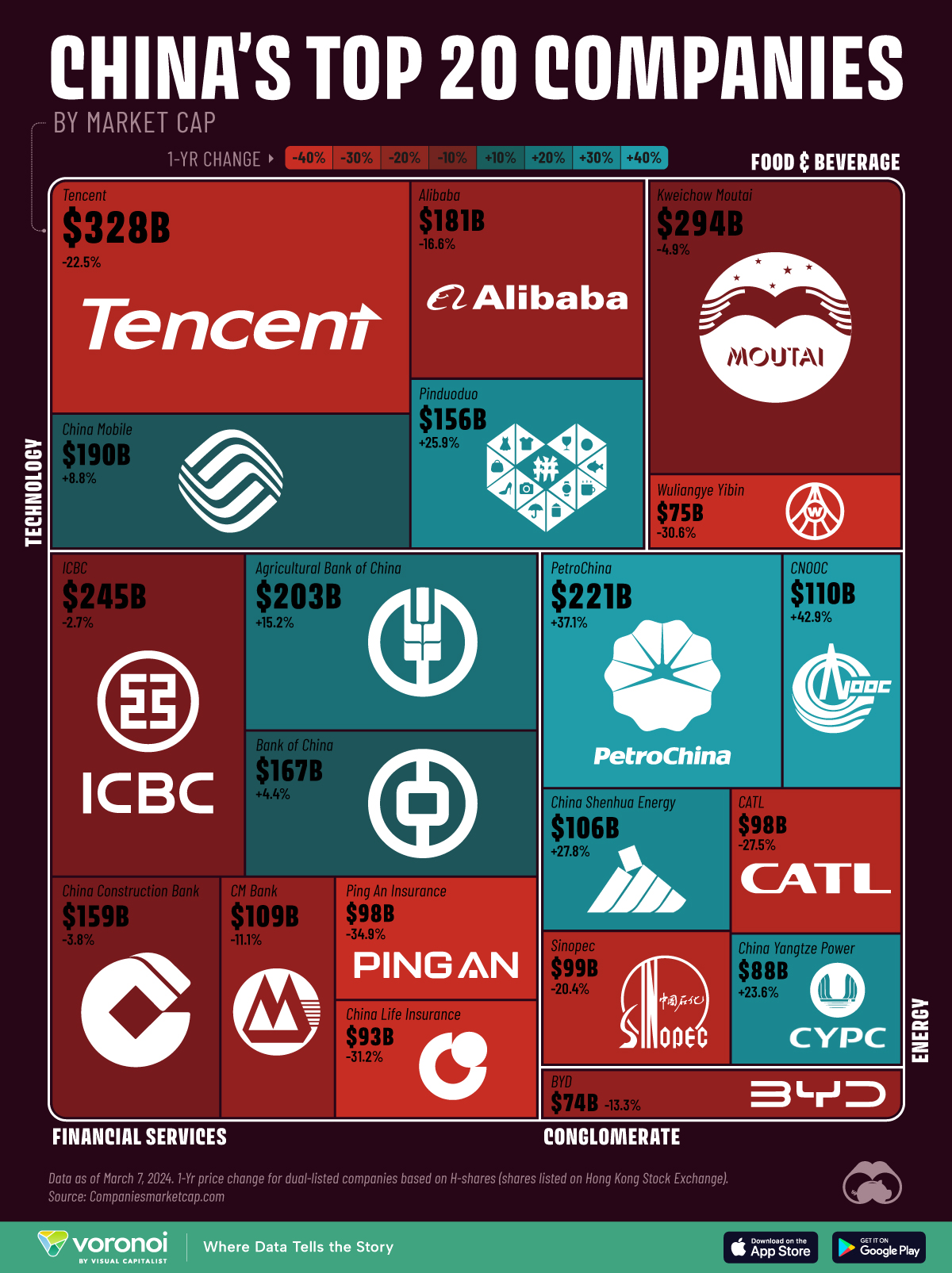

The core of this market shift lies in HHLR's focused investment strategy. The firm, renowned for its prescience in identifying high-growth sectors, has made substantial investments in Chinese companies. These companies span diverse sectors, including e-commerce, healthcare, and technology.

These investments are viewed by many analysts as a significant endorsement of China's economic resilience and future growth potential. The firm's moves signal a belief that the Chinese market remains a fertile ground for innovation and value creation.

The underlying thesis revolves around tapping into the vast potential of the Chinese consumer market. This market is characterized by its increasing sophistication, rapid adoption of new technologies, and growing demand for high-quality goods and services.

Stocks on the Rise: A Closer Look

Several Chinese concept stocks have benefited directly from HHLR's investments, witnessing notable increases in their share prices. Let's examine a few key examples:

E-Commerce Platform: Pinduoduo

Pinduoduo, a prominent e-commerce platform known for its innovative group-buying model, has experienced a significant boost. HHLR's investment has coincided with a period of robust growth for the company. This growth is fueled by its success in penetrating lower-tier cities and its focus on agricultural products.

The company's stock has seen a considerable uptrend, reflecting increased investor confidence. This confidence is not only in Pinduoduo's business model, but also in its ability to navigate the complexities of the Chinese e-commerce landscape.

Healthcare Innovator: BeiGene

BeiGene, a leading biopharmaceutical company focused on developing innovative cancer therapies, has also garnered substantial investor attention. HHLR's backing underscores the growing importance of China's healthcare sector. This sector is driven by an aging population and increasing healthcare expenditure.

BeiGene's commitment to research and development, coupled with HHLR's financial support, has positioned it as a key player in the global oncology market. The company’s stock performance reflects its promising pipeline of novel drugs and its strategic partnerships with international pharmaceutical giants.

Technology Pioneer: Xiaomi

Xiaomi, a global technology company known for its smartphones and smart home devices, has similarly benefited from the renewed interest in Chinese tech stocks. HHLR's continued investment reinforces the long-term growth potential of Xiaomi. This potential stems from its diversified product portfolio and expanding international presence.

While facing increased competition in the smartphone market, Xiaomi continues to innovate and expand into new areas such as electric vehicles. This has helped the company maintain a strong position in the market.

Market Reaction and Expert Opinions

The market response to HHLR's investment strategy has been largely positive. Analysts point to the firm's track record of identifying undervalued assets and its ability to generate substantial returns for its investors.

However, some caution that the surge in Chinese concept stocks may be driven by speculative trading. They suggest that investors should carefully evaluate the fundamentals of each company before making investment decisions.

"While HHLR's investment is a positive signal, it's crucial for investors to conduct their own due diligence and understand the risks associated with investing in emerging markets," said [Hypothetical Market Analyst, Jane Doe] from [Hypothetical Investment Firm, ABC Capital].

Potential Risks and Challenges

Despite the optimistic outlook, investing in Chinese concept stocks is not without its risks. Regulatory uncertainties, geopolitical tensions, and fluctuating economic conditions can all impact the performance of these companies.

The evolving regulatory landscape in China, particularly regarding data privacy and antitrust measures, poses a significant challenge. Companies must adapt to these changes and ensure compliance to avoid potential penalties.

Geopolitical tensions, particularly between the United States and China, can also create headwinds for Chinese companies. These tensions can affect trade relations and access to international markets.

Looking Ahead: The Future of Chinese Concept Stocks

The future of Chinese concept stocks remains promising, albeit with inherent uncertainties. HHLR's investment serves as a catalyst for increased investor interest. However, sustainable growth will depend on the ability of these companies to innovate, adapt to changing market conditions, and navigate regulatory challenges.

The long-term success of these stocks will hinge on their ability to deliver sustainable profitability. They will have to establish a competitive advantage, and effectively manage operational risks.

As China continues to emerge as a global economic powerhouse, its innovative companies will undoubtedly play a crucial role in shaping the future. The stock market's reaction to these companies will likely remain closely watched by investors worldwide.