I Have A Product Idea But No Money

The scent of freshly brewed coffee mingled with the nervous energy hanging thick in the air at the local library. Sarah, notepad overflowing with sketches and scribbled notes, stared intensely at the ceiling, a kaleidoscope of possibilities swirling behind her eyes. Her revolutionary idea for a self-watering planter, designed to make urban gardening accessible to everyone, felt tantalizingly close, yet frustratingly out of reach. The only barrier? A chasm of financial limitations.

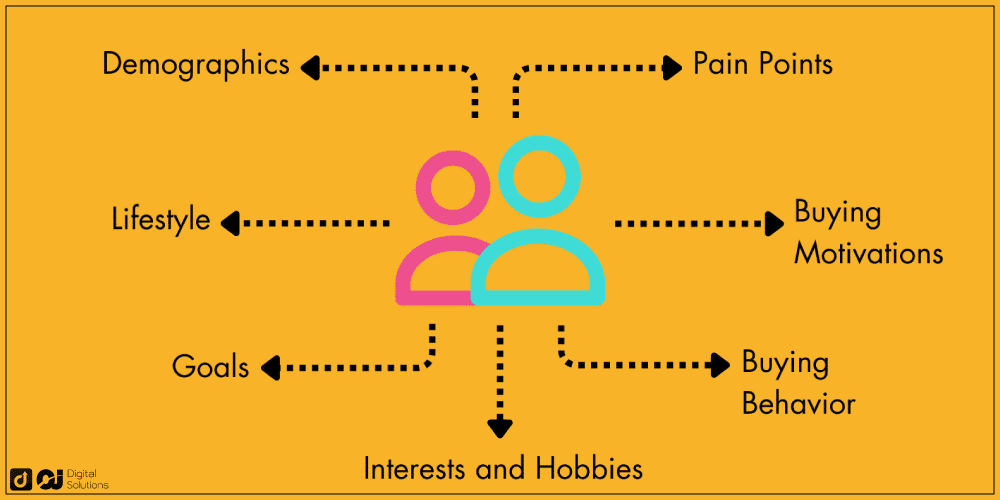

Countless individuals, brimming with groundbreaking ideas that could reshape industries and improve lives, find themselves in Sarah's predicament. They possess the vision and the drive, but lack the capital to transform their concepts into tangible realities. This article explores the challenges and opportunities faced by budding entrepreneurs navigating the tricky terrain of innovation on a shoestring, offering insights and resources to help turn dreams into flourishing businesses.

Sarah's journey began with a simple observation: her own struggles keeping her balcony herbs alive. Working a demanding full-time job left her little time for diligent watering, resulting in withered basil and drooping mint. Fueled by frustration and a passion for sustainable living, she envisioned a planter that would automate the watering process, making it easy for anyone, regardless of their schedule or experience, to cultivate their own food.

She spent countless evenings researching existing solutions, identifying their shortcomings, and refining her own design.

"It was a labor of love," Sarah admits, "fueled by countless cups of coffee and the unwavering belief that I could create something truly useful."

But the path to production quickly hit a wall. Manufacturing prototypes, securing patents, and launching a marketing campaign all require significant upfront investment. According to a study by the Small Business Administration (SBA), lack of capital is a primary reason why many small businesses fail within their first few years.

One avenue many entrepreneurs explore is bootstrapping – building a business with minimal personal funds. This often involves making sacrifices, working long hours, and creatively leveraging existing resources. For Sarah, bootstrapping meant using her savings to create a rudimentary prototype and relying on free design software.

Crowdfunding platforms like Kickstarter and Indiegogo offer another increasingly popular option. These platforms allow entrepreneurs to pitch their ideas to a global audience and solicit donations in exchange for early access to the product or other rewards. The success of crowdfunding campaigns depends heavily on compelling storytelling and effective marketing.

Microloans, offered by organizations like Kiva, provide small amounts of capital to entrepreneurs who may not qualify for traditional bank loans. These loans often come with lower interest rates and more flexible repayment terms, making them an attractive option for startups with limited credit history.

Local business incubators and accelerators also play a crucial role in supporting early-stage ventures. These programs provide mentorship, networking opportunities, and access to resources that can help entrepreneurs refine their business plans and secure funding.

Networking is paramount. Attending industry events, joining online communities, and connecting with experienced entrepreneurs can provide invaluable insights and open doors to potential investors or partners.

The Power of Perseverance

Ultimately, turning an idea into a thriving business with limited resources requires unwavering determination and a willingness to learn from setbacks. It's a marathon, not a sprint, demanding resilience, adaptability, and a genuine belief in the value of the product or service being offered.

Governmental and Non-profit Support

Many countries and regions offer grants, subsidies, or tax breaks to encourage innovation and entrepreneurship. Resources like the U.S. Economic Development Administration can help navigate these opportunities.

Organizations dedicated to fostering economic development often provide free or low-cost business training and consulting services, assisting entrepreneurs in developing sound business plans and securing funding.

Challenges and Opportunities

While the lack of funding presents a significant hurdle, it can also foster creativity and resourcefulness. Entrepreneurs who are forced to operate on a shoestring often find innovative ways to cut costs and maximize their impact.

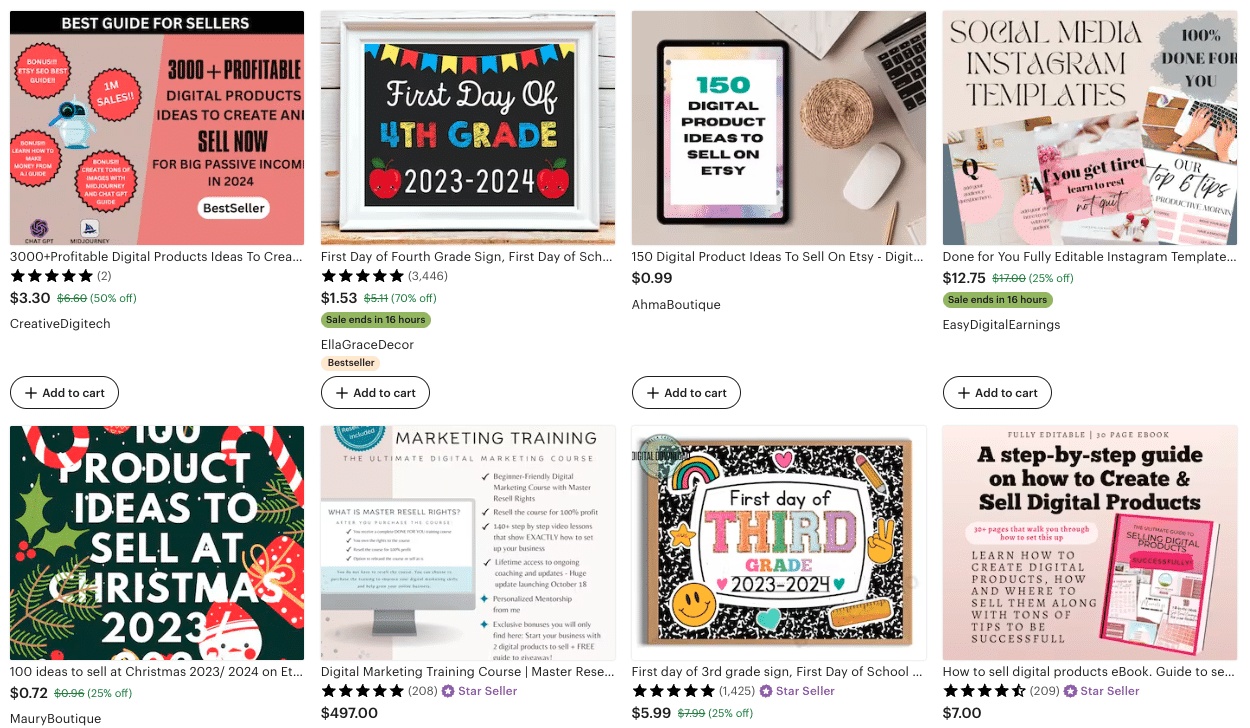

Focusing on building a strong online presence through social media and content marketing can be an effective way to reach potential customers without spending a fortune on traditional advertising.

Sarah is now exploring crowdfunding and microloan options, armed with a refined business plan and a compelling prototype. Her journey is a testament to the power of innovation and the unwavering spirit of entrepreneurs who refuse to let financial limitations stand in the way of their dreams.

As Sarah aptly puts it, "Having a great idea is only the first step. The real challenge lies in finding creative ways to bring that idea to life, regardless of the obstacles." Her journey, and those of countless others like her, serve as a potent reminder that innovation isn't solely the domain of well-funded corporations. It's a spark that resides within anyone with a vision, a passion, and the grit to make it happen.

![I Have A Product Idea But No Money How To Make Money Online [6 #infographics]](https://3.bp.blogspot.com/-1xeKTJcqauI/U0z14WmyM1I/AAAAAAAAa0M/pqPZJRm427s/s1600/infographic-breaking-down-the-way-an-entrepreneur-goes-from-idea-generation-through-to-initial-public-offering-How-to-Start-a-Startup-and-how-to-make-money.png)