Which Statements Are True According To The Law Of Demand

Economic confusion grips the nation as misconceptions about the Law of Demand swirl. Understanding its core principles is now more crucial than ever for informed financial decisions.

This article cuts through the noise, delivering a laser-focused examination of which statements accurately reflect this fundamental economic law. Ignoring these truths can lead to misinformed decisions in both personal finance and broader economic policy.

The Core Principle: Price and Quantity

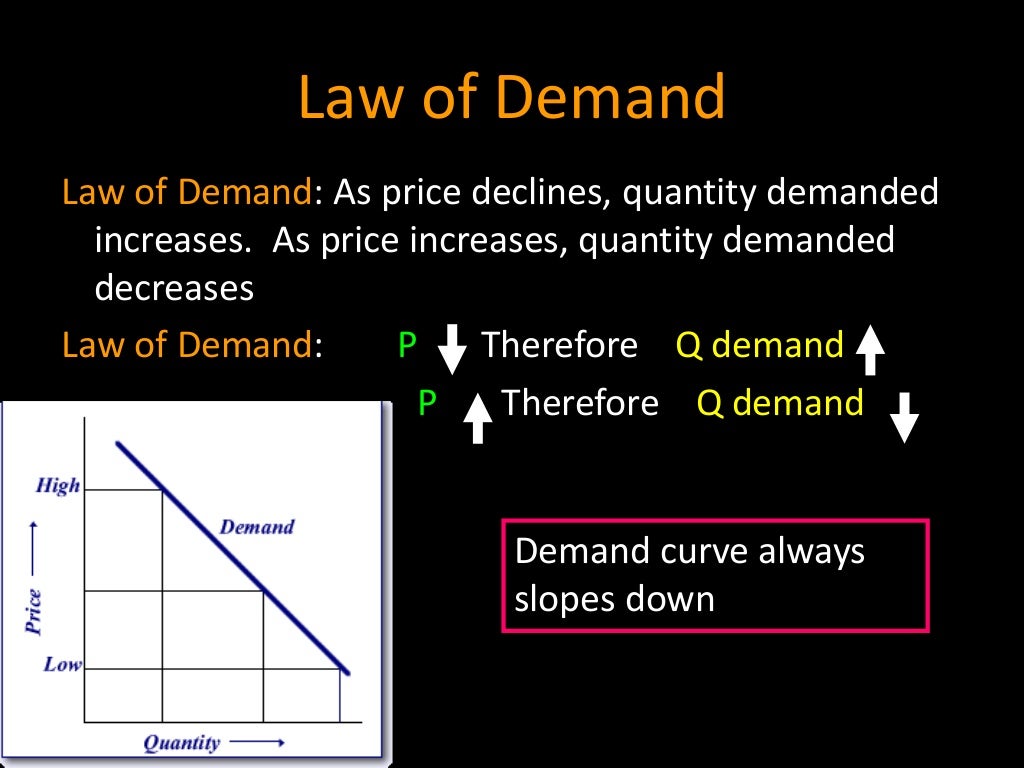

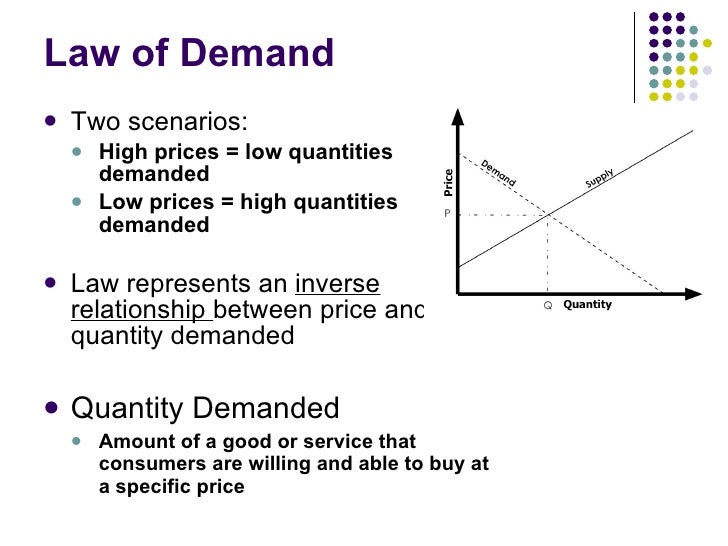

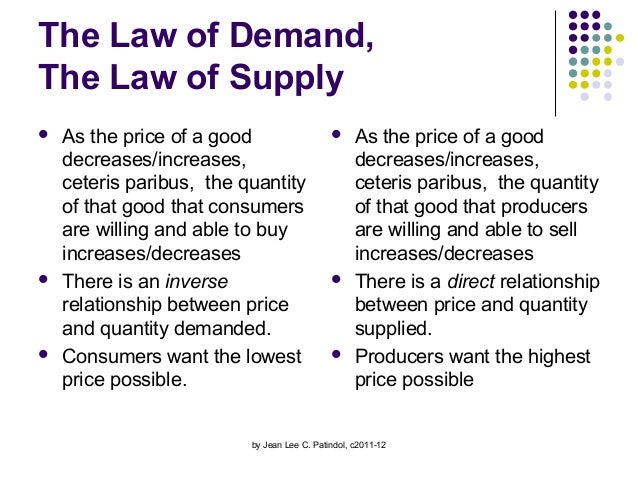

The Law of Demand states that, all else being equal, there is an inverse relationship between price and quantity demanded. This means that as the price of a good or service increases, the quantity demanded decreases, and vice versa.

A crucial element of this law is the "all else being equal" condition, technically known as ceteris paribus. This means that only the price changes, and all other factors that could affect demand remain constant.

Therefore, a statement that accurately reflects the Law of Demand must focus on this isolated price-quantity relationship.

Valid Statements Under the Law of Demand

Here are statements that are considered true according to the Law of Demand:

Statement 1: Increased Price, Decreased Demand (Ceteris Paribus)

A valid statement would be: "If the price of gasoline increases, and all other factors remain constant, the quantity of gasoline demanded will decrease." This directly reflects the inverse relationship.

The emphasis on "all other factors remain constant" is vital. Without it, other influences could negate the expected outcome.

Statement 2: Decreased Price, Increased Demand (Ceteris Paribus)

Another correct statement: "If the price of coffee decreases, and all other factors remain constant, the quantity of coffee demanded will increase." This, too, shows the inverse relationship.

Consumers are generally more willing to purchase more of a good when it becomes cheaper. This is the cornerstone of the Law of Demand.

Statement 3: Movement Along the Demand Curve

Statements referencing a "movement along the demand curve" due to a price change are also accurate. A decrease in price causes a move down and to the right along the curve, indicating increased quantity demanded.

Conversely, an increase in price causes a move up and to the left, reflecting decreased quantity demanded.

Invalid Statements: Shifts in Demand

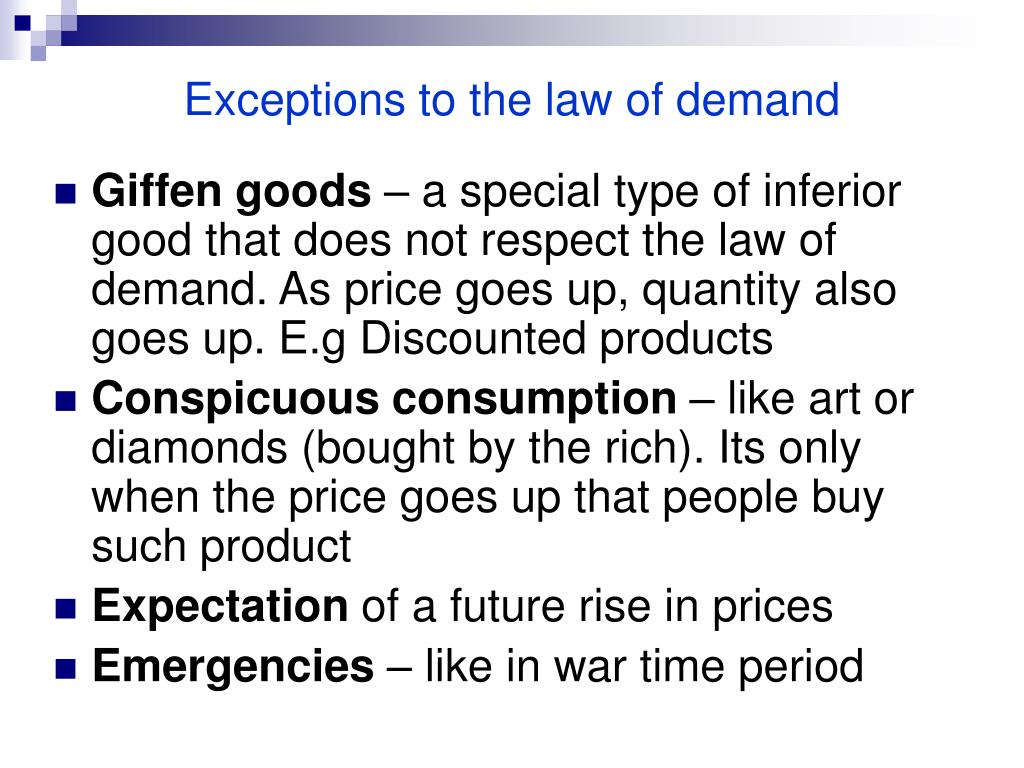

Statements that confuse changes in quantity demanded with shifts in the entire demand curve are incorrect.

A shift in the demand curve is caused by factors other than price, such as changes in consumer income, tastes, or the price of related goods (substitutes or complements).

Example of an Invalid Statement

Consider this statement: "If people's incomes increase, the demand for luxury cars will increase." This describes a shift in the demand curve, not a movement along it.

The increased demand is due to the change in income, not a change in the price of luxury cars themselves. This is not the Law of Demand.

Impact of Substitutes and Complements

Statements involving substitutes and complements without the ceteris paribus condition are also often incorrect. For example, "If the price of coffee increases, the demand for tea will increase" describes the relationship between substitutes, not the Law of Demand acting solely on coffee.

The increased demand for tea is a consequence of the coffee price change, but it's a separate market effect.

Data & Real-World Examples

Economic data consistently supports the Law of Demand across various markets. For instance, studies on gasoline consumption show a clear decrease in demand when prices spike during supply disruptions.

Conversely, temporary sales or discounts often lead to a surge in demand for products, demonstrating the price-quantity relationship in action.

Analyzing historical sales figures alongside price fluctuations provides empirical evidence confirming the Law of Demand.

Conclusion: Immediate Action Required

A clear understanding of the Law of Demand is vital to avoid costly mistakes in economic forecasting and financial planning. Misinterpreting the law can lead to inaccurate market predictions and poor resource allocation.

Further educational resources and economic analyses are crucial to reinforce these principles. The public needs to grasp this basic economic truth.

Stay informed, question assumptions, and rely on confirmed facts to navigate the complexities of the market. The future of economic stability may depend on it.