Icici Bank Re Kyc Form For Non Individual

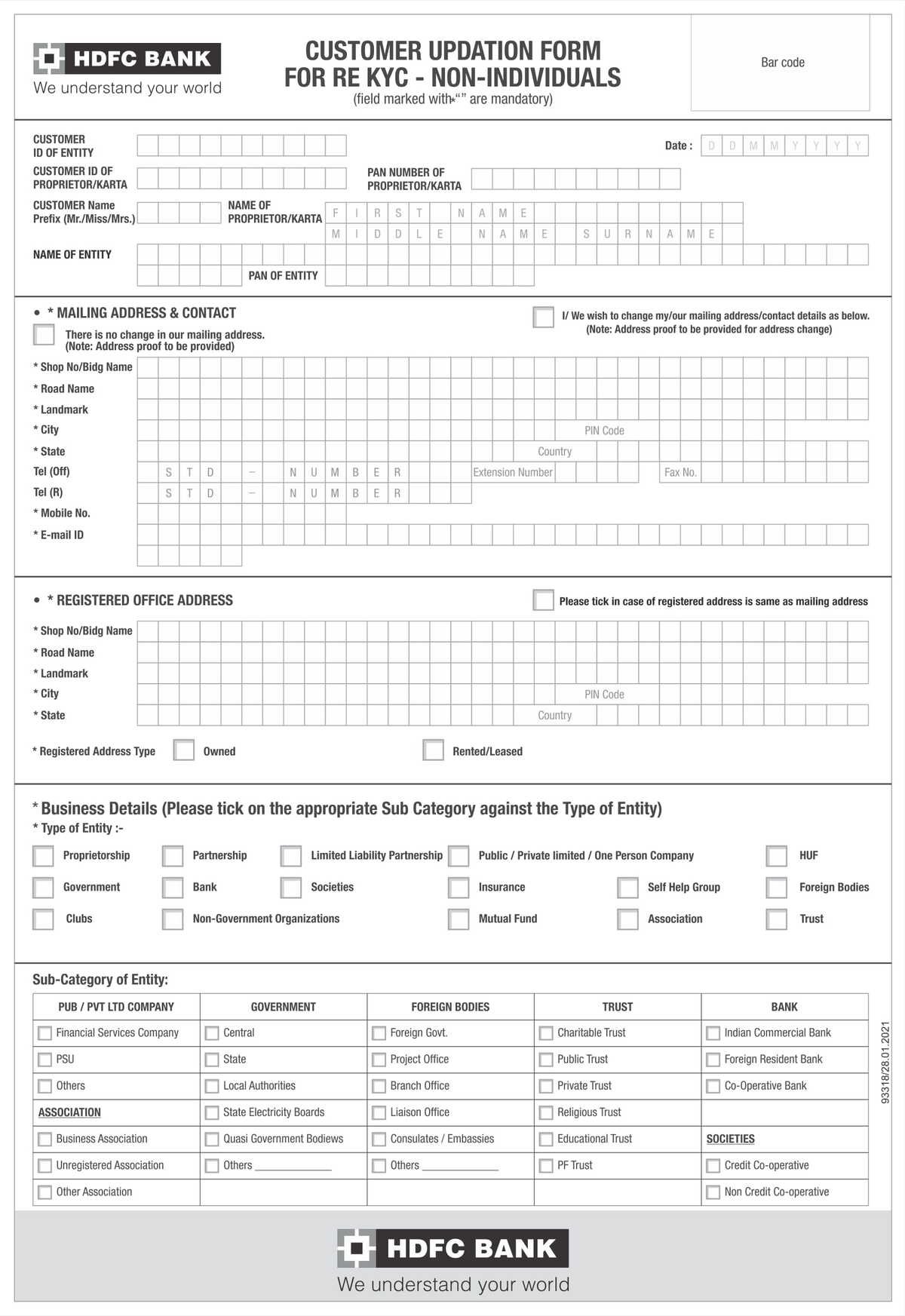

A wave of concern is sweeping through non-individual account holders of ICICI Bank as the institution mandates a renewed Know Your Customer (KYC) process. Businesses, trusts, and other entities are now required to submit updated information, causing some disruption and raising questions about the necessity and implications of this large-scale update.

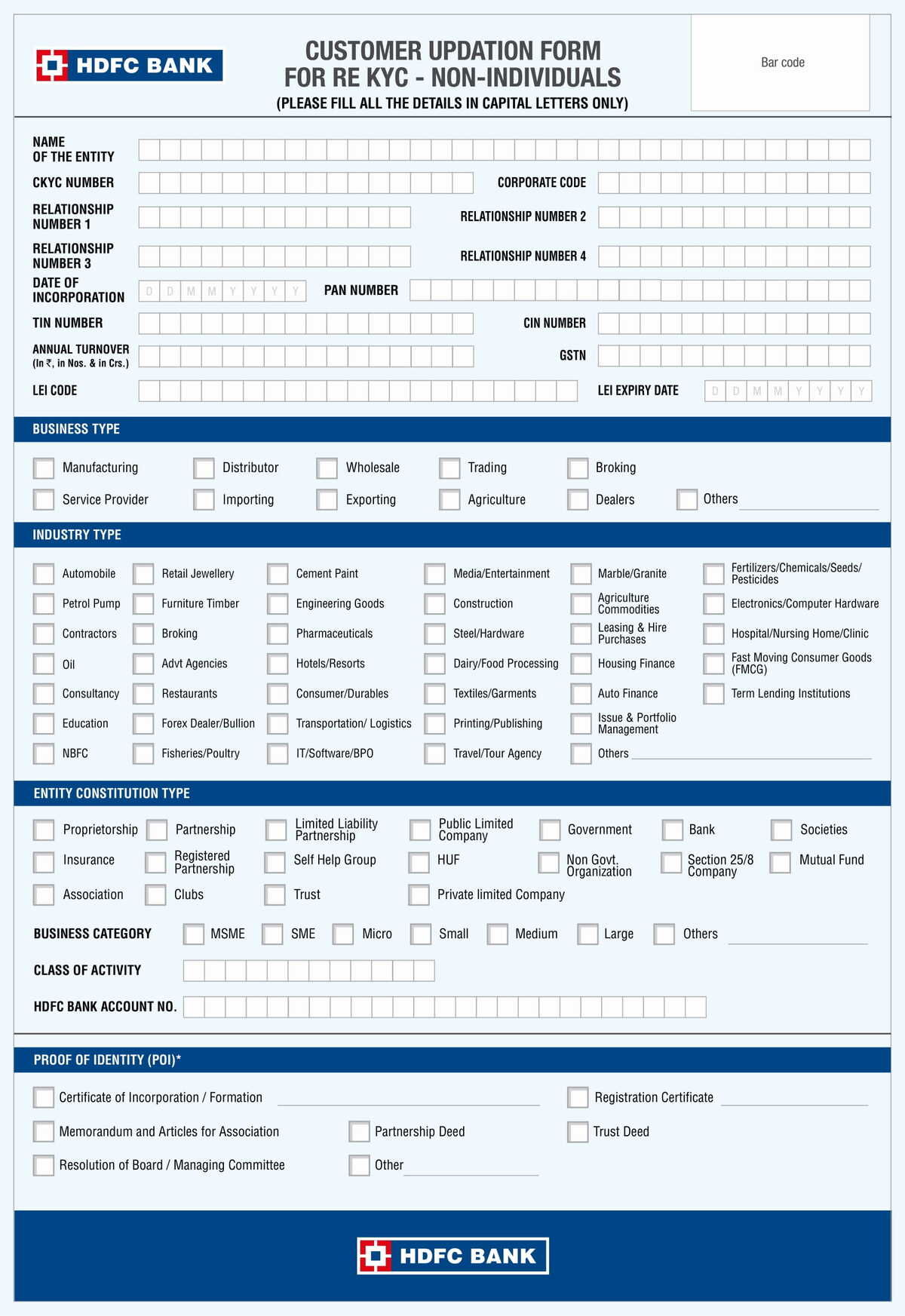

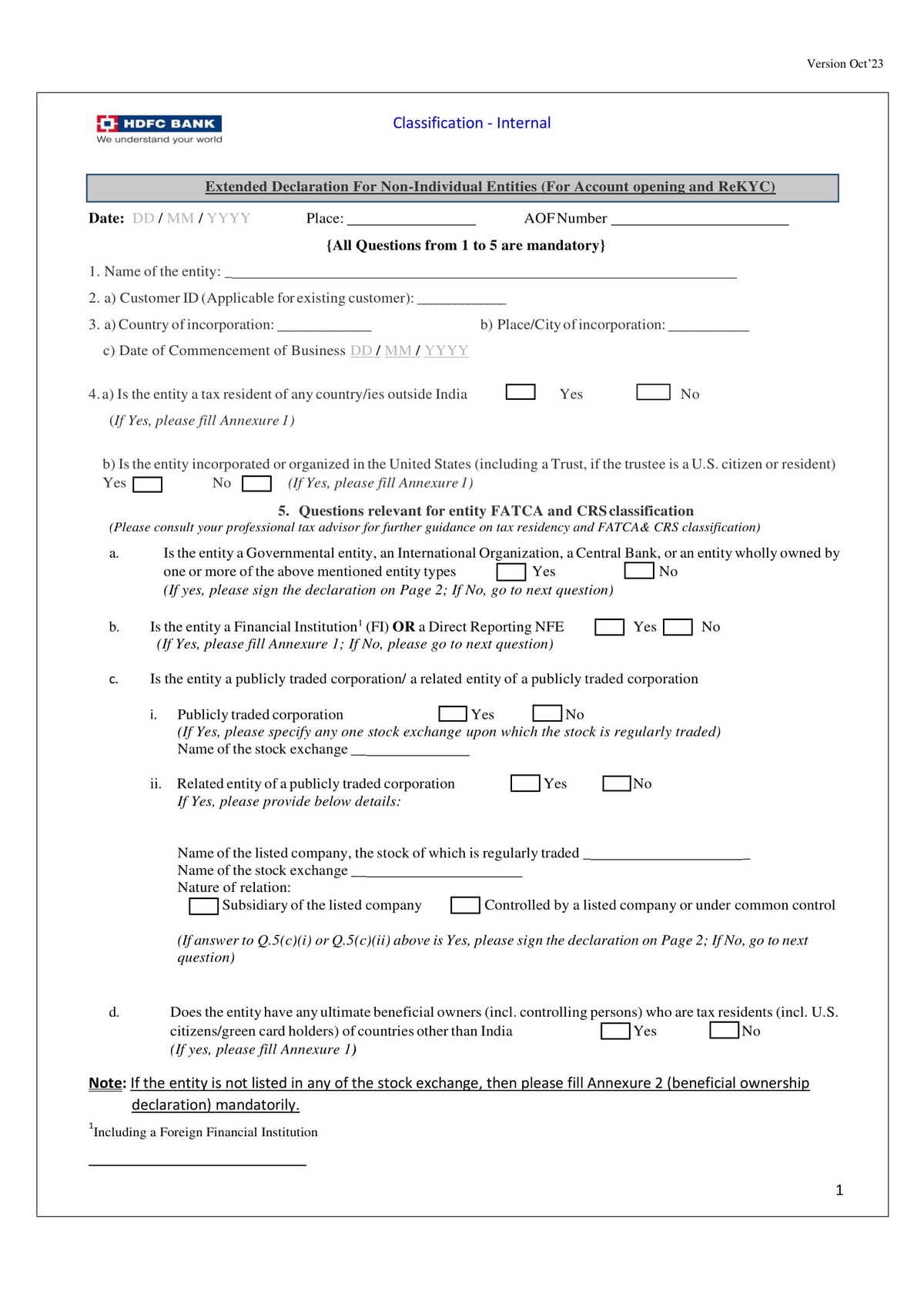

The directive, confirmed by ICICI Bank spokespersons and outlined in official circulars, necessitates the submission of a revised KYC form along with supporting documentation by a specified deadline. This initiative, affecting a substantial portion of the bank's non-individual client base, seeks to ensure compliance with evolving regulatory guidelines and bolster the bank's internal risk management framework. While ICICI Bank asserts the process is designed to enhance security and prevent financial crime, many account holders express frustration over the administrative burden and potential operational delays.

The Mandate and Its Scope

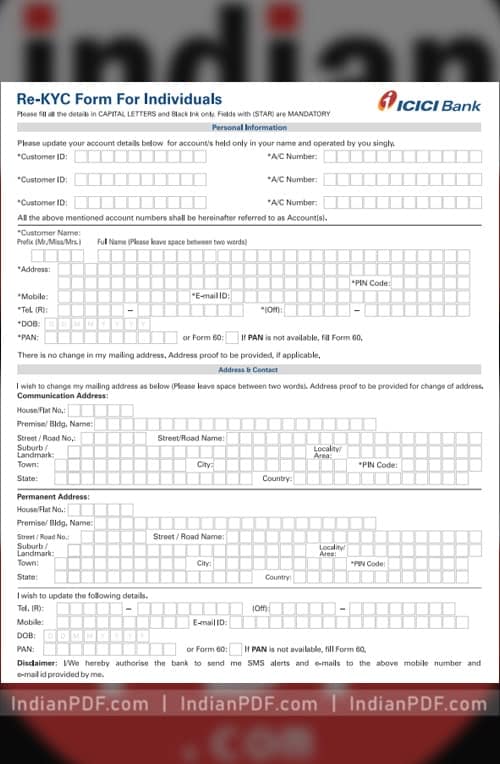

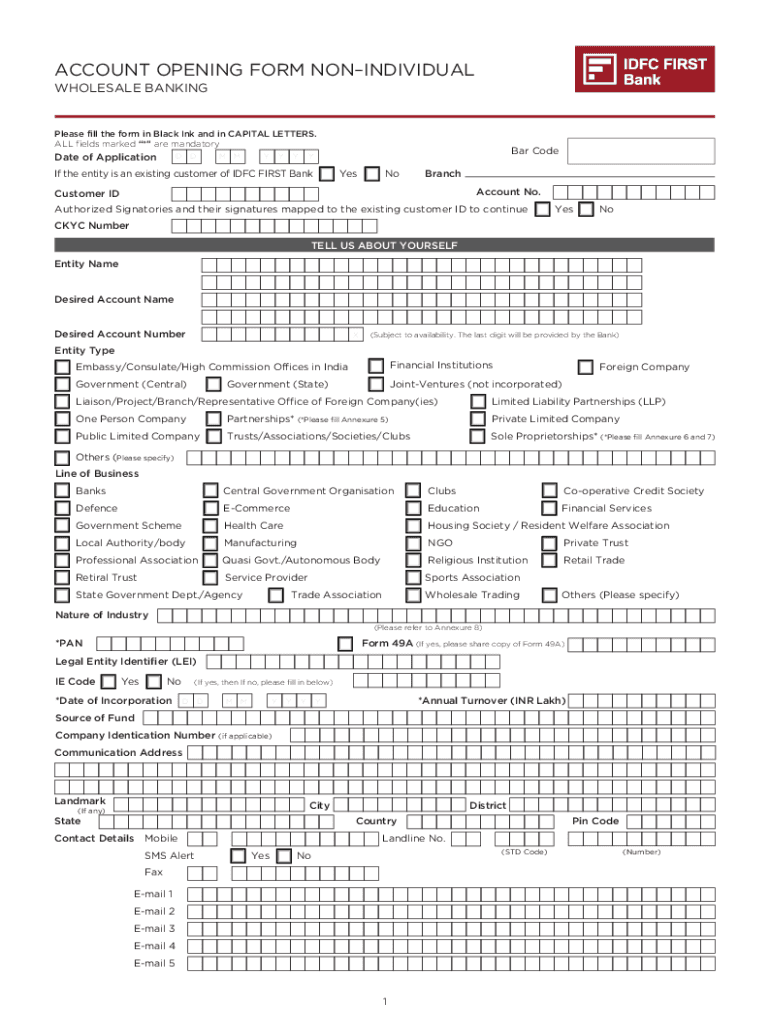

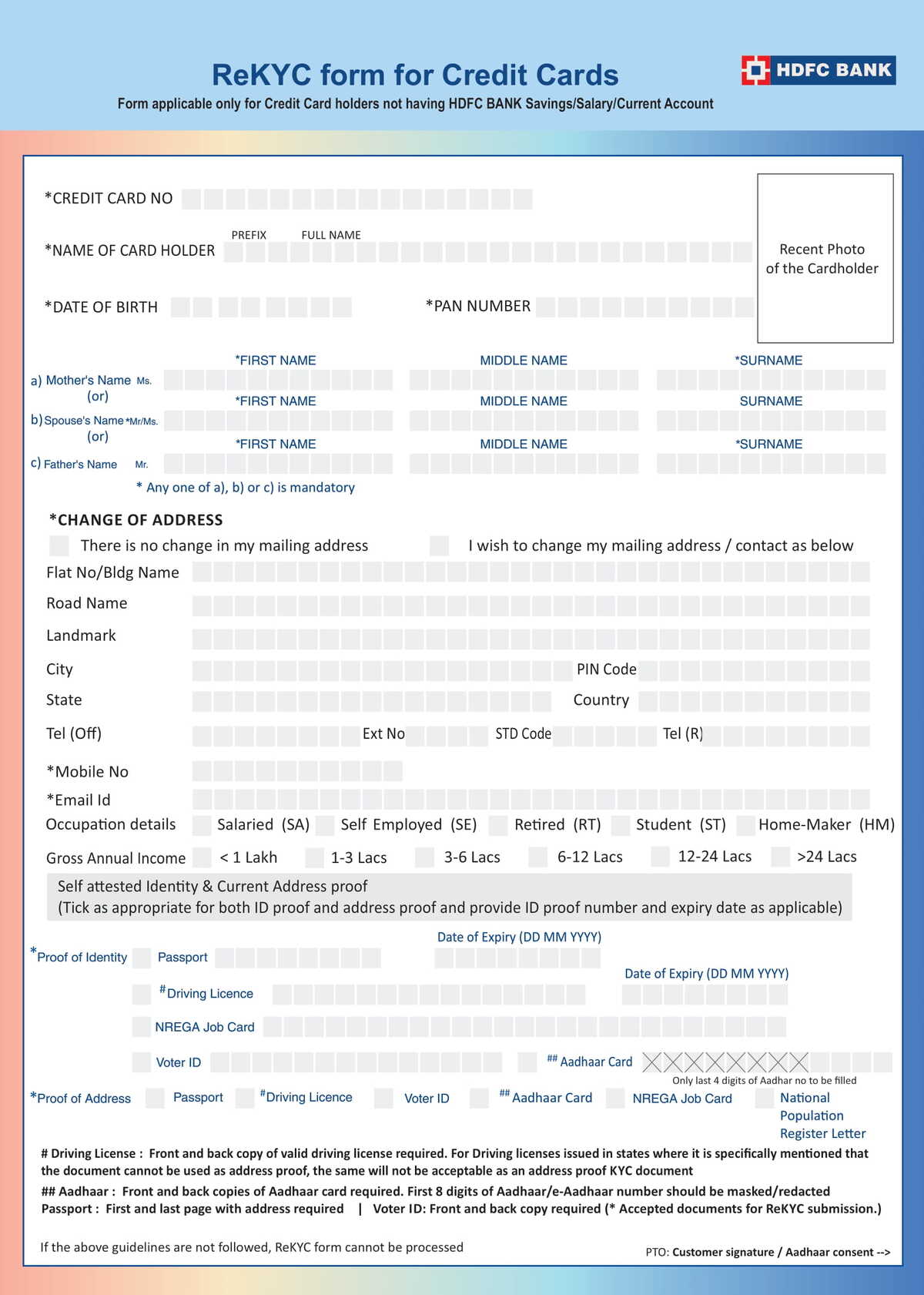

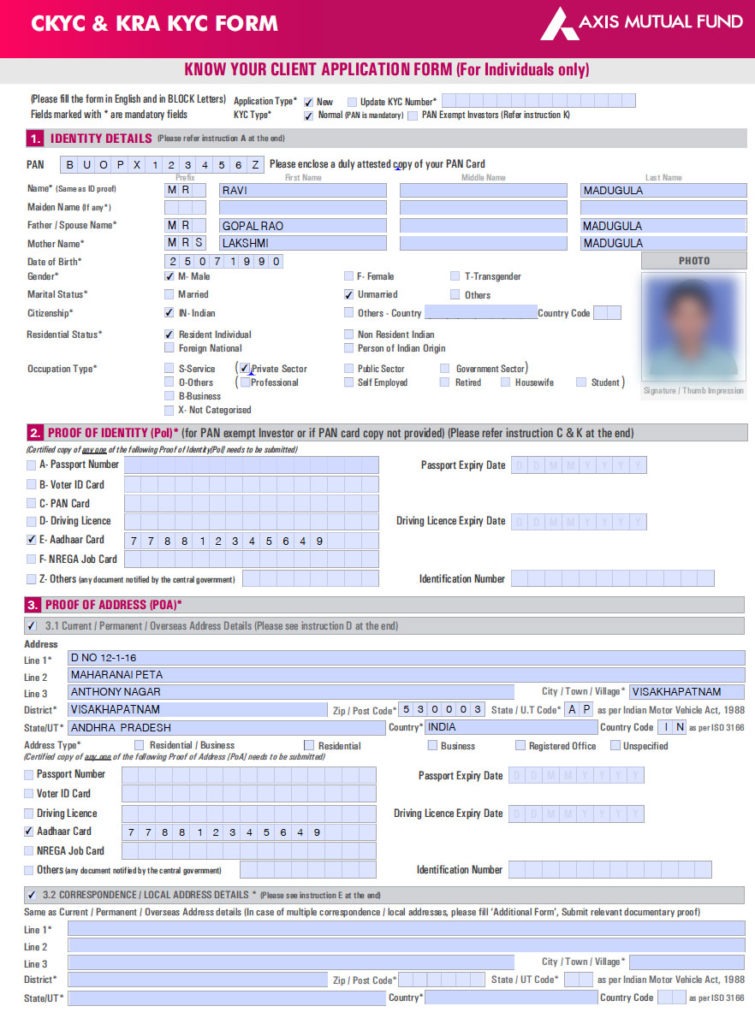

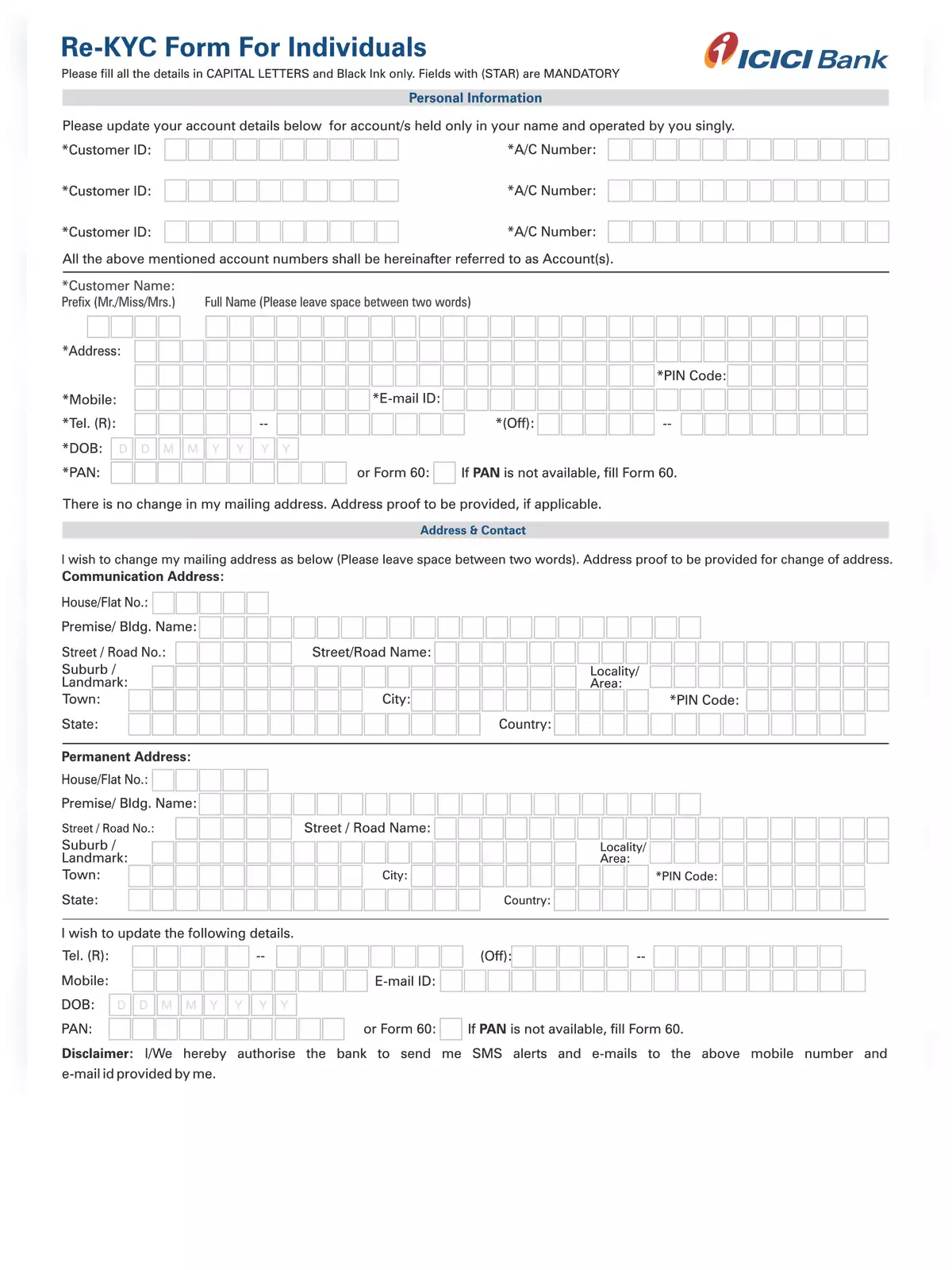

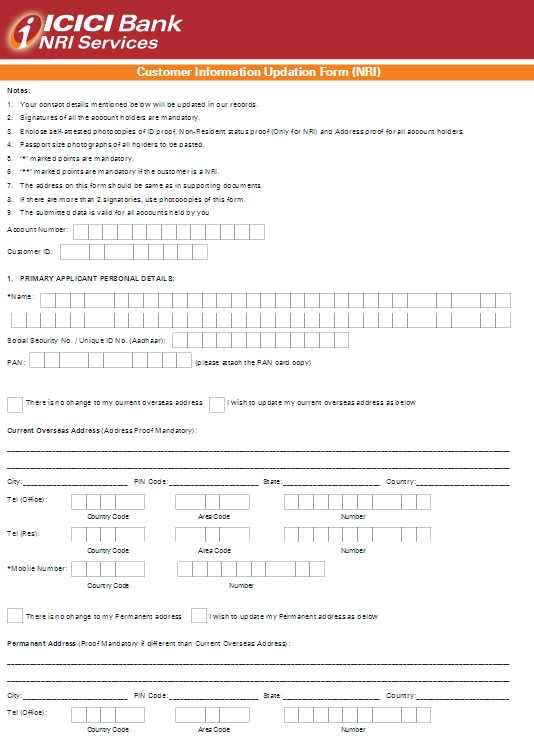

The revised KYC form requires entities to furnish detailed information regarding their structure, ownership, and activities. This includes, but is not limited to, details about the entity's directors, partners, trustees, and beneficial owners. Supporting documents such as registration certificates, partnership deeds, trust deeds, and identification proofs for key personnel are also required.

According to an ICICI Bank official statement, the re-KYC exercise aligns with the Reserve Bank of India's (RBI) guidelines on KYC and Anti-Money Laundering (AML) standards. The statement emphasized the bank’s commitment to maintaining the integrity of the financial system.

Navigating the Requirements

Many non-individual account holders are grappling with the complexities of gathering and submitting the required documentation. The process can be particularly challenging for older or less technologically savvy entities, some business owners are experiencing difficulties understanding the forms and assembling the necessary paperwork.

ICICI Bank has provided online and offline channels for submission. However, reports indicate that some branches are experiencing long queues and processing delays, adding to the inconvenience.

Impact and Concerns

The re-KYC drive has triggered a range of reactions from ICICI Bank’s non-individual clients. Some express understanding, recognizing the importance of compliance in preventing financial crime, while others voice concern about the potential disruptions to their operations.

Small business owners, in particular, are finding the process burdensome. "We are already dealing with so many compliance requirements," said Mr. Sharma, owner of a small manufacturing unit. "This re-KYC adds another layer of administrative work, taking away valuable time from our core business."

Concerns also exist regarding the security of the submitted information. Some entities worry about the potential for data breaches and identity theft.

Expert Perspectives

Financial analysts suggest that the re-KYC exercise is part of a broader trend in the banking sector. Stricter regulatory scrutiny and increasing concerns about money laundering and terrorist financing are driving banks to enhance their due diligence processes.

"KYC compliance is becoming increasingly crucial for banks globally," notes financial compliance expert, Ms. Verma. "Banks face hefty penalties for non-compliance, so these exercises are necessary, although they can be disruptive for customers."

The RBI has been actively pushing banks to strengthen their KYC and AML frameworks. This ensures better monitoring of transactions and helps identify suspicious activities.

Looking Ahead

As the deadline for re-KYC submission approaches, ICICI Bank is urging all non-individual account holders to comply with the requirements. The bank has also announced plans to increase its support staff and streamline the submission process.

The long-term impact of this re-KYC exercise remains to be seen. While it may cause short-term inconvenience, it is expected to contribute to a more secure and transparent financial system. Banks like ICICI are likely to continue refining their KYC processes to stay ahead of evolving regulatory requirements and emerging threats.

Ultimately, the success of this initiative hinges on ICICI Bank's ability to effectively communicate with its clients and provide adequate support throughout the process. The balance between regulatory compliance and customer experience will be crucial in shaping the overall outcome.

![Icici Bank Re Kyc Form For Non Individual [22 PDFs] KYC Forms PDF Free Download - InstaPDF](https://instapdf.in/wp-content/uploads/img/2022/03/pnb-kyc-ckycr-form-for-individual.webp)