Identification To Open Bank Account

Imagine stepping into a bank, the scent of polished wood and hushed conversations filling the air. Sunlight streams through the tall windows, illuminating the friendly faces of the staff ready to assist. You're there to open a new account, a fresh start, a gateway to financial possibilities. But before you can embark on this journey, there's a crucial first step: presenting your identification.

This article explores the importance of identification when opening a bank account, explaining the reasons behind the requirements and how they contribute to a safe and secure banking environment for everyone.

The Foundation of Trust: Why ID Matters

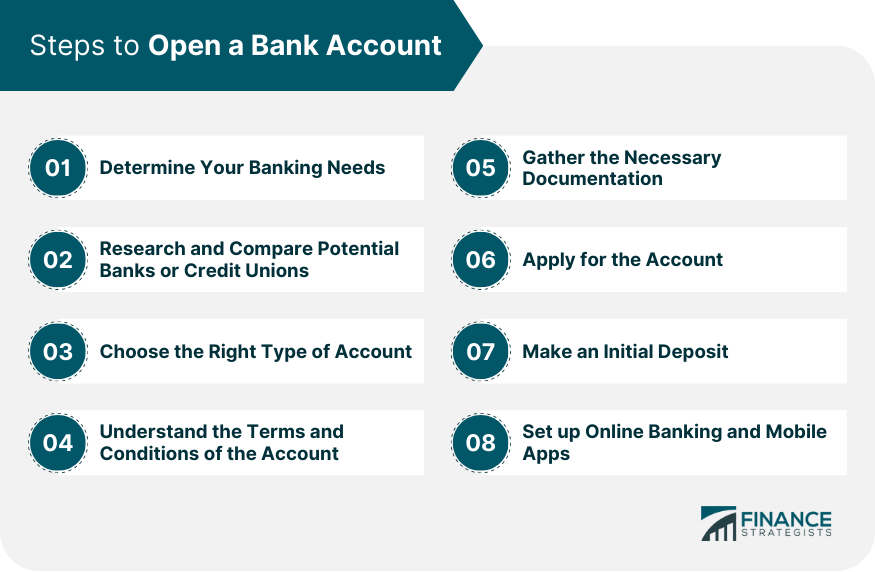

Opening a bank account is more than just depositing money; it's establishing a relationship built on trust with a financial institution. Identification serves as the cornerstone of this trust, verifying your identity and providing the bank with essential information.

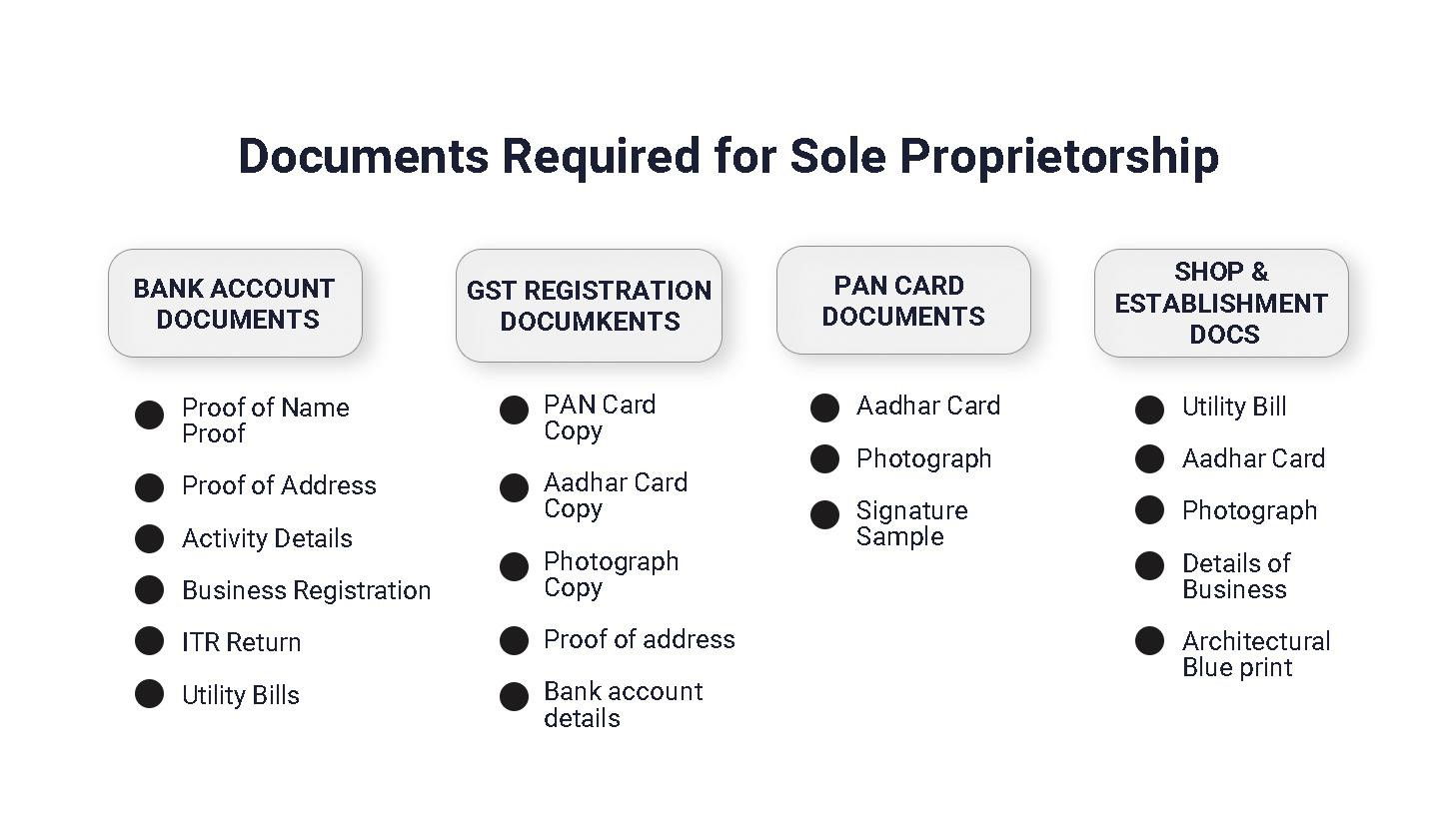

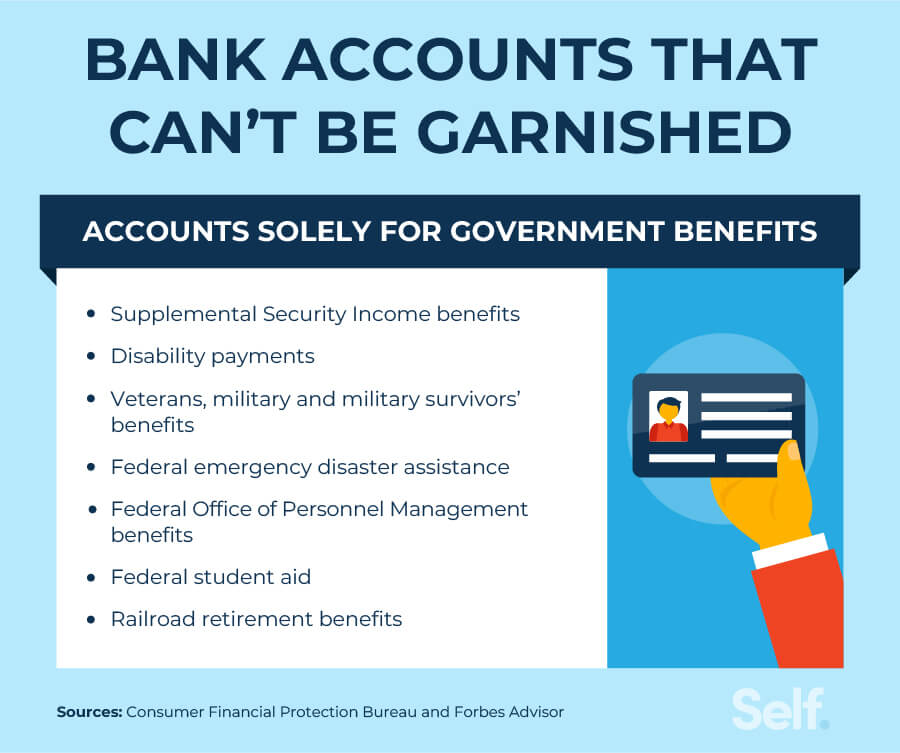

It's a key measure to comply with regulations designed to combat financial crime, such as money laundering and terrorist financing, as stated by the Financial Crimes Enforcement Network (FinCEN).

These regulations require banks to "know your customer" (KYC), which involves verifying the identity of their customers.

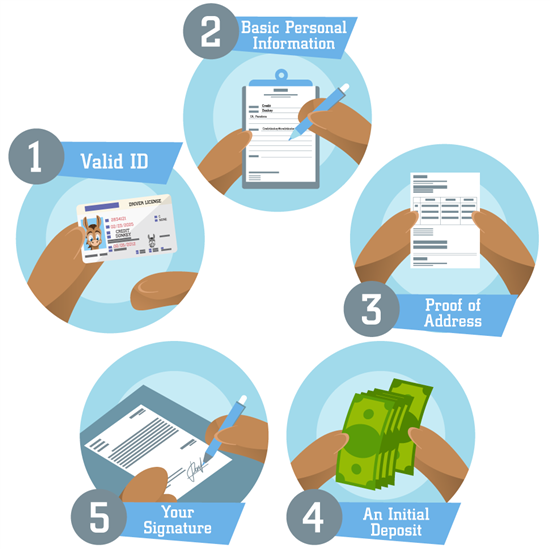

What Forms of ID Are Typically Accepted?

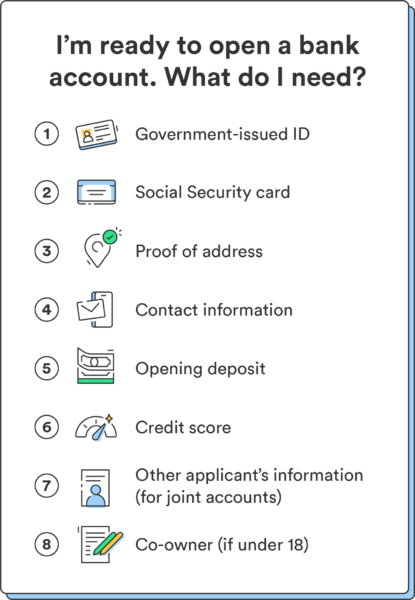

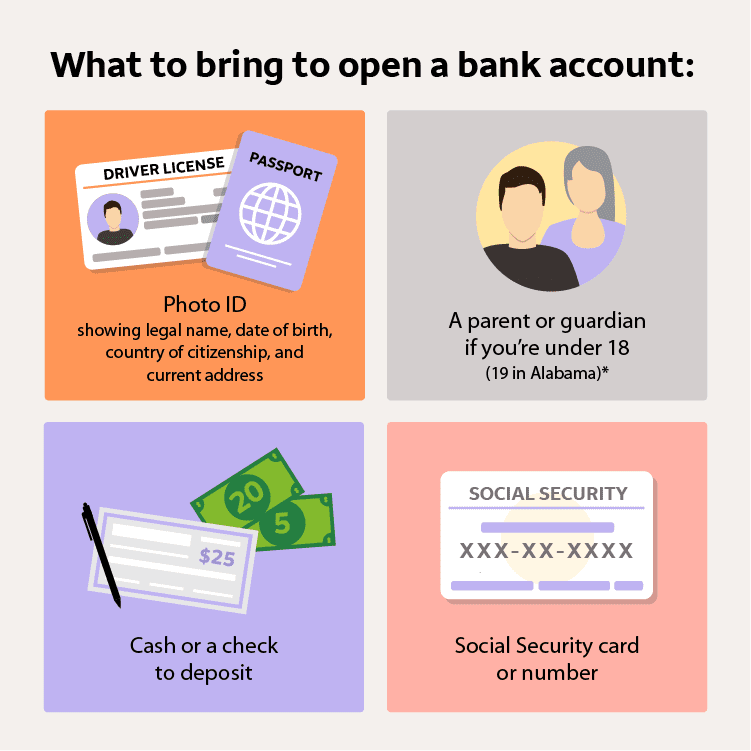

While specific requirements may vary between banks, several common forms of identification are generally accepted. A valid driver's license, state-issued identification card, or a passport are the most frequently used.

These documents typically include your photograph, full legal name, date of birth, and address, providing a comprehensive means of verification.

Some banks may also accept other forms of identification, such as a permanent resident card or a social security card, often in conjunction with another primary form of ID.

Behind the Scenes: Protecting Your Finances

The process of verifying identification extends beyond a simple visual check. Banks utilize sophisticated systems and databases to authenticate the information provided.

This helps prevent identity theft, a serious crime that can have devastating financial consequences.

By ensuring that only you can access your account, banks safeguard your hard-earned money and protect you from fraudulent activities.

The Digital Age: Online Account Opening

With the rise of online banking, the process of opening an account has become increasingly convenient. However, the need for identification remains paramount.

Banks employ various digital methods to verify your identity online, such as using secure document upload portals or utilizing third-party identity verification services.

These methods often involve analyzing images of your ID and comparing them against databases to confirm authenticity.

Looking Ahead: A Secure and Accessible Future

As technology evolves, so too will the methods used to verify identity. Biometric authentication, such as facial recognition and fingerprint scanning, is becoming increasingly prevalent.

These technologies offer a more secure and seamless way to confirm your identity, further enhancing the safety of your banking experience.

Opening a bank account and providing proper identification are important steps towards financial security.

Identification is not just a formality, but a crucial safeguard that protects both you and the broader financial system.

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)