If A Company Has 150 Shares

In the intricate world of corporate finance, the seemingly simple figure of 150 shares outstanding can unlock a complex narrative of ownership, valuation, and strategic decision-making. While appearing minuscule compared to publicly traded giants, a company with 150 shares presents a unique landscape demanding careful scrutiny. Every share holds substantial weight, and decisions impacting them resonate profoundly.

This article delves into the multifaceted implications of a company structured with a limited number of shares. We will explore the significance of such a structure for control, valuation, and potential investment. This analysis will provide insights into how such a tightly held ownership impacts the business and its stakeholders.

Understanding Ownership and Control

With only 150 shares outstanding, ownership concentration is inherently high. A small number of individuals, or even a single person, could hold a majority stake. This level of control can offer swift decision-making and strategic agility, bypassing the often cumbersome processes of larger, more dispersed ownership structures.

However, such concentrated control can also present challenges. The interests of minority shareholders might be overshadowed, and corporate governance practices could face scrutiny. Transparency and accountability become paramount in ensuring fair treatment for all stakeholders.

The lack of liquidity is another significant factor. Trading 150 shares is unlikely to attract high trading volumes, making it difficult for shareholders to easily buy or sell their holdings. This illiquidity can impact the perceived value of the shares and limit investment appeal.

Valuation Considerations

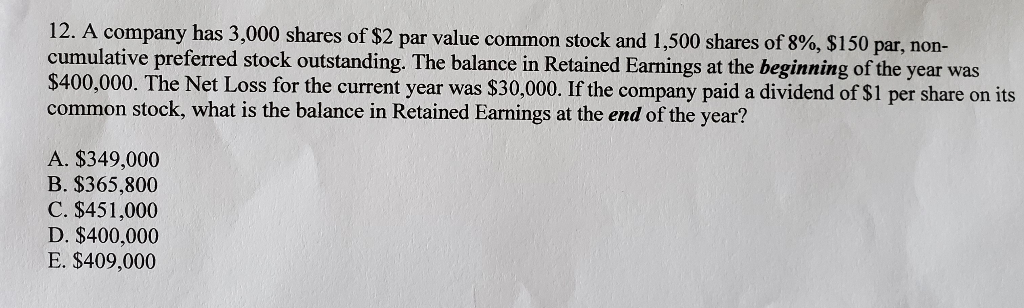

Valuing a company with such a small share float requires careful consideration. Traditional market-based valuation methods, such as comparing to publicly traded companies, may be less relevant. Instead, approaches like discounted cash flow (DCF) analysis or asset-based valuation become more critical.

The value of each share in a company with 150 shares is intrinsically tied to the overall valuation of the business. Any change in the company’s prospects or financial performance will have a magnified effect on the value of each individual share. Securing funding and attracting investors becomes a particularly strategic effort.

"The scarcity of shares amplifies the impact of any news, positive or negative, on the perceived value," explains Dr. Anya Sharma, a finance professor specializing in private equity valuation.

Investment Implications

Investing in a company with 150 shares presents both opportunities and risks. The concentrated ownership structure can provide a clear vision and swift execution of strategy. However, potential investors need to carefully assess the risk of limited liquidity and the potential for conflicts of interest.

Due diligence is crucial. Investors should scrutinize the company's financials, governance structure, and the track record of its management team. Understanding the motivations and alignment of interests among the major shareholders is paramount.

For early-stage ventures or small private companies, a limited number of shares is common. This facilitates easy tracking of ownership and streamlines initial capitalization. However, as the company grows, it may need to consider issuing more shares to raise capital or incentivize employees.

Strategic Considerations for the Company

For companies operating with 150 shares, strategic financial planning is essential. Raising capital requires careful consideration of the potential dilution of existing shareholders. Alternatives like debt financing or strategic partnerships may be more attractive in certain circumstances.

A well-defined shareholder agreement is vital. This agreement should outline the rights and responsibilities of each shareholder, including provisions for transferring shares, resolving disputes, and governing corporate decisions. This helps to maintain clarity and prevent conflicts down the line.

Furthermore, companies need to proactively address potential governance concerns. Establishing an advisory board or engaging independent directors can enhance transparency and accountability. This is especially important if the company seeks external funding or plans for future growth.

Potential for Future Growth and Expansion

A company with 150 shares can still pursue significant growth opportunities. While the initial structure may be restrictive, it can be modified as needed. Options include issuing additional shares, conducting a stock split, or even considering an initial public offering (IPO) if the company reaches sufficient scale.

However, any decision to alter the share structure must be carefully evaluated. The impact on existing shareholders' ownership percentage and control needs to be clearly communicated. Legal and financial advisors can help navigate these complex considerations.

"Ultimately, the success of a company with 150 shares hinges on strong leadership, sound financial management, and a clear vision for the future," states Robert Miller, a corporate lawyer specializing in small business ventures.

Looking Ahead

While a company with 150 shares presents a unique set of circumstances, it does not limit its potential for success. By understanding the implications of such a structure, companies can make informed decisions that support their long-term growth and value creation. Transparency, communication, and a commitment to fair treatment of all stakeholders are crucial.

The future of such companies depends on adapting to evolving needs. Whether through strategic financing, careful planning of share issuance, or maintaining strong corporate governance, these organizations can leverage their concentrated ownership to their advantage. The journey for a small, tightly held company can be filled with possibilities.

As businesses continue to navigate the complexities of the modern economic landscape, the lessons learned from companies with limited share floats will provide valuable insight. These insights provide valuable knowledge for understanding the dynamics of ownership, control, and valuation in a wide array of business structures.