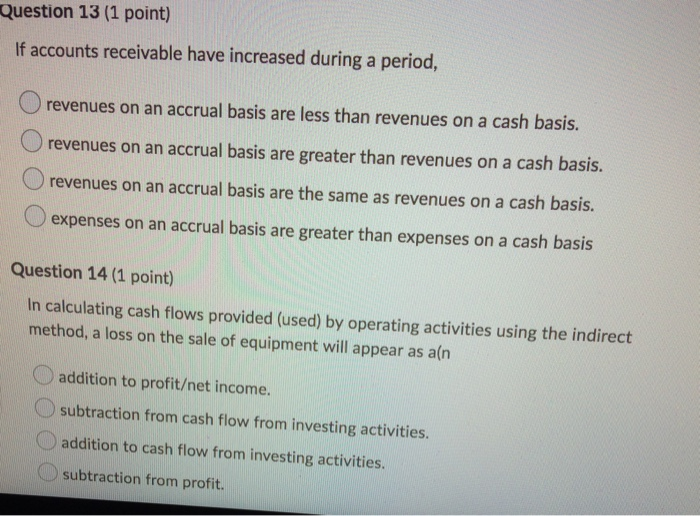

If Accounts Receivable Have Increased During The Period

A seemingly simple line item on a company's balance sheet – accounts receivable – is increasingly under scrutiny across various sectors. A rise in these receivables, representing the money owed to a company by its customers for goods or services delivered on credit, is triggering alarms among financial analysts and investors alike. Is it a sign of robust sales growth, or a harbinger of potential liquidity problems and weakening customer solvency?

This article delves into the complex implications of rising accounts receivable. We will explore the nuances of interpreting this financial metric and examining the underlying factors that can drive its increase, while also assessing the potential risks it poses to a company's financial health and future prospects. Experts warn that a superficial reading of the data can be misleading, urging a deeper dive into the company's sales strategies, credit policies, and broader economic environment.

The Double-Edged Sword: Growth vs. Risk

An increase in accounts receivable can, at first glance, appear to be a positive indicator. It might simply reflect a rise in sales, signaling strong demand for the company's products or services. Companies expanding into new markets or offering more flexible credit terms to attract customers could naturally see their accounts receivable swell.

However, a sustained or disproportionate increase in accounts receivable relative to sales raises red flags. This could indicate a growing inability of customers to pay their invoices on time. It also raises concerns about the effectiveness of the company's credit control and collection procedures.

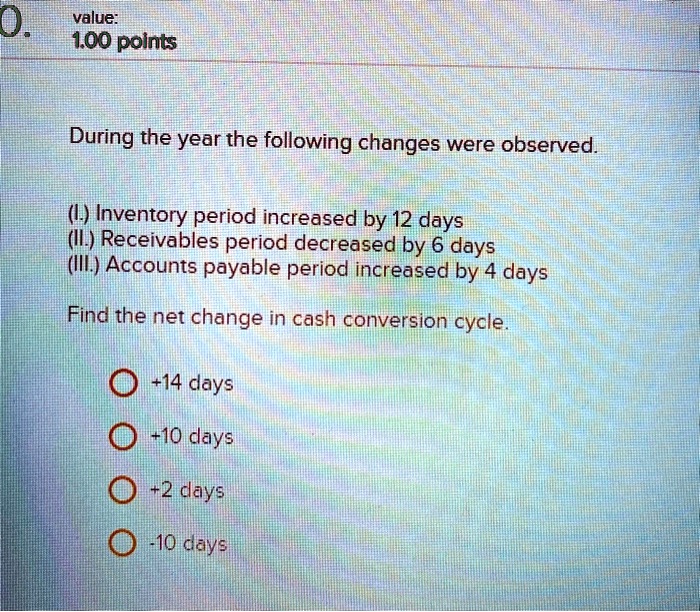

Key Indicators and Ratios

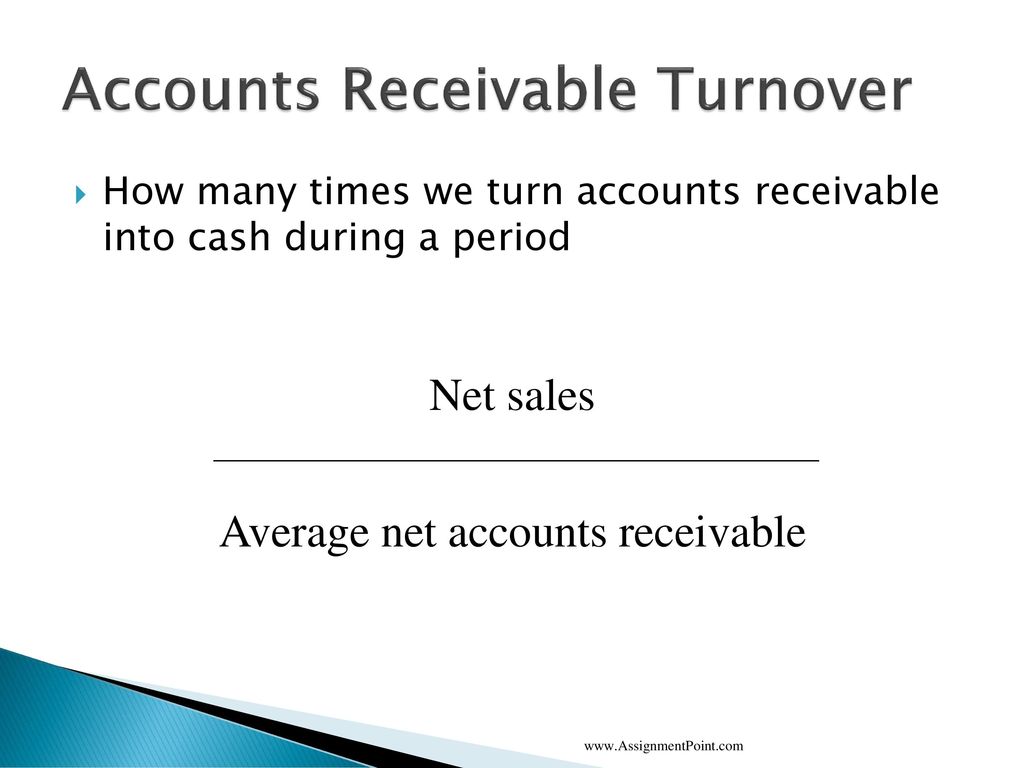

Financial analysts employ several key indicators to assess the health of accounts receivable. The Days Sales Outstanding (DSO) ratio, for example, measures the average number of days it takes a company to collect payment after a sale.

A rising DSO suggests that customers are taking longer to pay, potentially straining the company's cash flow. Other important ratios include the receivables turnover ratio, which indicates how efficiently a company is collecting its receivables, and the allowance for doubtful accounts, which reflects the company's estimate of uncollectible receivables.

Factors Driving the Increase

Numerous factors can contribute to an increase in accounts receivable. Changes in credit policies, such as extending longer payment terms to customers, can lead to a higher outstanding balance. So can aggressive sales strategies aimed at boosting revenue, even if it means selling to customers with a higher risk profile.

Economic downturns can also play a significant role. Customers facing financial difficulties may struggle to pay their invoices on time, causing a ripple effect throughout the supply chain. Industry-specific factors, such as seasonal fluctuations in demand or increased competition, can further exacerbate the problem.

"It is crucial to understand the underlying reasons for the increase in accounts receivable before jumping to conclusions," says Dr. Anya Sharma, a professor of finance at the Wharton School. "A thorough analysis should consider both internal factors, such as the company's credit policies and sales strategies, and external factors, such as the economic environment and industry trends."

The Impact of Credit Policies

A company's credit policies have a direct impact on its accounts receivable balance. Looser credit terms, while potentially attracting more customers, can also increase the risk of default. Conversely, stricter credit policies may reduce the risk of bad debt but could also deter potential customers and hinder sales growth.

Striking the right balance between attracting customers and managing credit risk is a delicate act. Regular review and adjustment of credit policies are essential to ensure they remain aligned with the company's financial goals and the prevailing economic conditions. Companies often use credit scoring models and risk assessment tools to make informed decisions about extending credit to customers.

Potential Risks and Mitigation Strategies

A significant increase in accounts receivable can pose several risks to a company's financial health. The most immediate risk is a strain on cash flow, as the company may have difficulty meeting its short-term obligations if it cannot collect payments from customers on time. This can lead to liquidity problems and even threaten the company's ability to continue operating.

Furthermore, a higher accounts receivable balance increases the risk of bad debt. If customers become insolvent or are unable to pay their invoices, the company may have to write off these receivables as uncollectible, resulting in a direct loss. This can negatively impact the company's profitability and erode shareholder value.

To mitigate these risks, companies should implement robust credit control and collection procedures. This includes thoroughly vetting new customers before extending credit, regularly monitoring outstanding balances, and proactively pursuing overdue payments. Investing in technology and automation can improve efficiency and accuracy in managing accounts receivable.

Technology and Automation

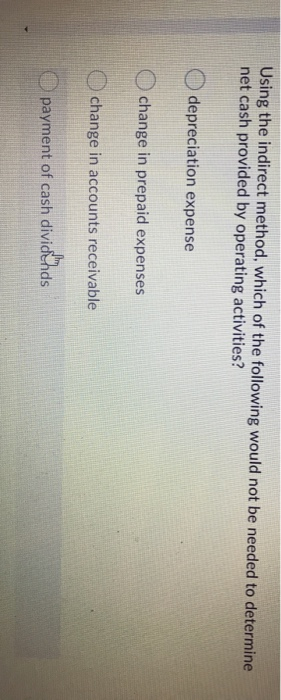

Modern accounting software and automated collection systems can significantly streamline the accounts receivable process. These tools can automate tasks such as invoicing, payment reminders, and reconciliation, freeing up staff to focus on more complex issues.

They also provide real-time visibility into the status of accounts receivable, allowing companies to identify potential problems early on. Advanced analytics can be used to predict the likelihood of default and prioritize collection efforts.

Looking Ahead: A Cautious Approach

The increase in accounts receivable is a complex issue that requires careful analysis and a nuanced understanding of the underlying factors. While it may reflect strong sales growth, it can also be a warning sign of potential financial problems. Companies should adopt a cautious approach, closely monitoring their accounts receivable balance and implementing robust credit control and collection procedures.

As the global economy faces increasing uncertainty, effective management of accounts receivable will be crucial for maintaining financial stability and ensuring long-term success. Companies that proactively address this issue will be better positioned to weather economic storms and capitalize on future opportunities. A proactive approach to credit management, coupled with advanced technological solutions, will be the key to navigating the complexities of accounts receivable in the years to come.

:max_bytes(150000):strip_icc()/AverageCollectionPeriod-4201163-Final-2eeeb0f96410477c8016a7d936a28932.jpg)