Prairie Operating Company Stock Buy Or Sell

The volatile ride of Prairie Operating Co. (PROP) shares has left investors grappling with a critical question: buy, sell, or hold? Recent market fluctuations, coupled with the company's strategic moves in the energy sector, demand a thorough analysis to determine the optimal course of action. The company's commitment to acquiring and developing oil and gas assets in the Denver-Julesburg (DJ) Basin presents both opportunities and risks.

This article delves into the intricate factors influencing Prairie Operating Co.'s stock performance. We will scrutinize market trends, the company's financial health, industry expert opinions, and potential future catalysts. Our goal is to provide investors with a balanced perspective to make informed decisions about their holdings.

Prairie Operating Co.'s Current Market Position

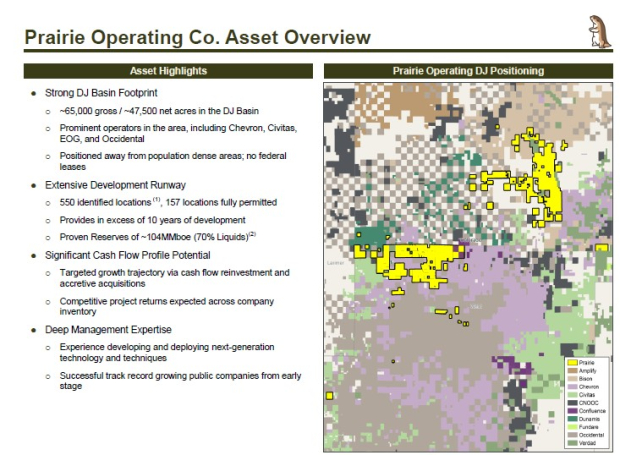

Prairie Operating Co. focuses on acquiring and developing oil and gas assets. Their core area of operation is the Denver-Julesburg (DJ) Basin in Colorado. This region is known for its rich hydrocarbon reserves but also faces environmental scrutiny and regulatory challenges.

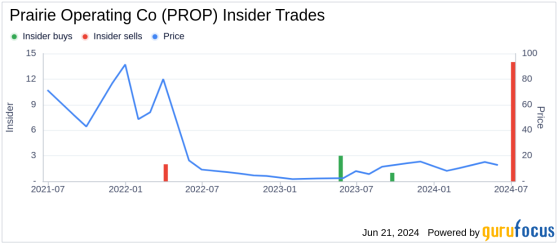

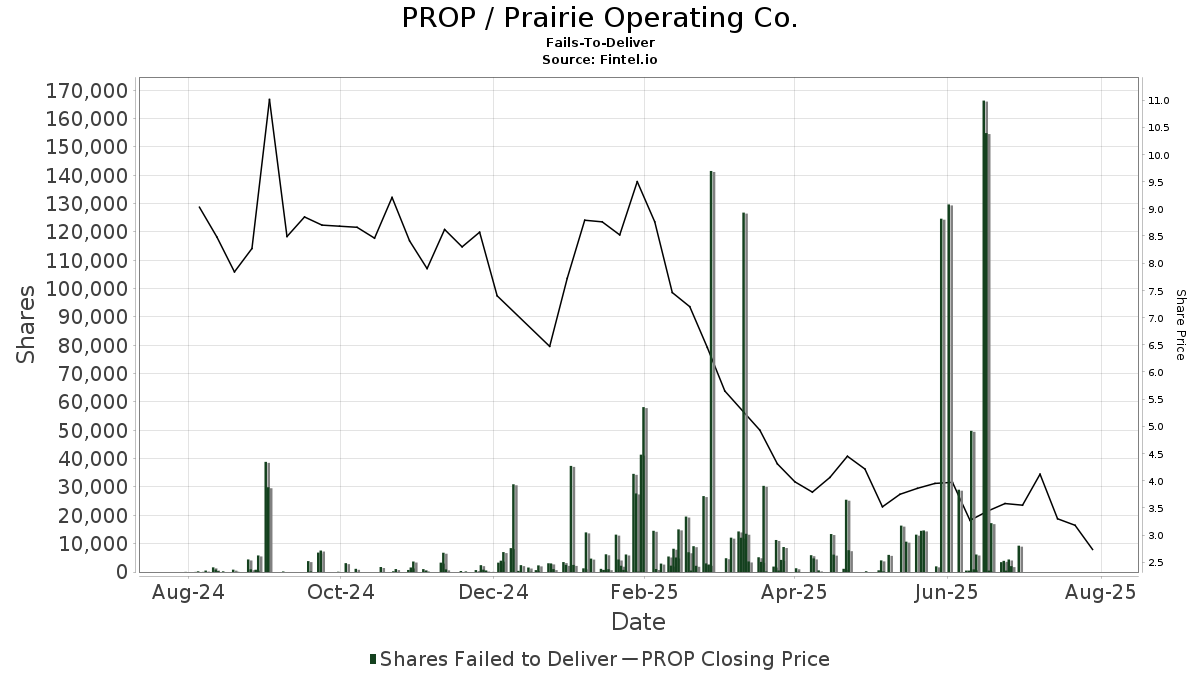

Recent trading activity has shown significant volatility. Share prices have swung dramatically, influenced by oil price fluctuations and company-specific announcements. Investors are closely watching Prairie's ability to execute its development plans and generate positive cash flow.

Financial Health and Key Metrics

A deep dive into Prairie's financials reveals a mixed bag. Revenue figures have been inconsistent, largely tied to the fluctuating price of oil and gas. The company's debt levels are a significant concern, impacting its ability to invest in new projects and potentially threatening its long-term solvency.

Cash flow from operations is a critical metric to watch. Consistent positive cash flow would signal the company's ability to sustain its operations and repay debt. However, negative or inconsistent cash flow raises red flags and requires further investigation.

Analysts are closely monitoring PROP's key financial ratios. These include debt-to-equity, current ratio, and price-to-earnings ratio. These ratios provide insights into the company's financial leverage, liquidity, and valuation compared to its peers.

Analyst Perspectives and Ratings

Wall Street analysts hold varying opinions on Prairie Operating Co. Some analysts express optimism, citing the potential of the DJ Basin and the company's asset base. Others remain cautious, pointing to the company's debt load and execution risks.

Price targets set by analysts range widely. This divergence highlights the uncertainty surrounding the stock's future performance. Investors should carefully consider the rationale behind each analyst's rating and price target.

It's essential to remember that analyst ratings are just one piece of the puzzle. Investors should conduct their own due diligence and consider their individual risk tolerance before making any investment decisions.

Industry Trends and Competitive Landscape

The oil and gas industry is subject to cyclical trends and external pressures. Fluctuations in global oil prices significantly impact profitability. Regulatory changes and environmental concerns also play a crucial role.

Prairie Operating Co. operates in a competitive landscape. It competes with larger, more established players in the DJ Basin. These competitors often possess greater financial resources and operational expertise.

The company's ability to innovate and adapt to changing market conditions is crucial. Embracing new technologies and optimizing operational efficiency can provide a competitive edge.

Potential Risks and Opportunities

Investing in Prairie Operating Co. entails inherent risks. These include commodity price volatility, operational challenges, and regulatory uncertainties. High debt levels also pose a significant risk to the company's financial stability.

However, there are also potential opportunities for growth. Successful execution of its development plans in the DJ Basin could lead to increased production and higher revenue. A strategic acquisition could also boost the company's asset base.

Investors should weigh the potential risks and rewards carefully. A thorough understanding of the company's operations and the broader industry landscape is essential.

Expert Insights on the Energy Sector

"The energy sector is undergoing a significant transformation," notes Dr. Emily Carter, a leading energy economist. "Companies that can adapt to the changing energy landscape and embrace sustainable practices will be best positioned for long-term success."

John Smith, a senior energy analyst at a major investment bank, adds, "Prairie Operating Co. has the potential to unlock significant value in the DJ Basin. However, they need to address their debt burden and demonstrate consistent profitability."

These expert opinions provide valuable context for investors. Understanding the broader industry trends and challenges is crucial for making informed investment decisions.

The Bottom Line: Buy, Sell, or Hold?

The decision to buy, sell, or hold Prairie Operating Co. shares is a complex one. It depends on individual investment goals, risk tolerance, and time horizon. There is no universal answer.

For risk-averse investors, selling may be the most prudent option. The company's high debt levels and volatile stock price present significant risks. Investors seeking growth and willing to accept higher risk may consider holding or even buying.

Carefully consider all the factors before making a decision. Consult with a financial advisor if necessary, to discuss your personal circumstances and develop a suitable investment strategy.

Looking Ahead: Future Catalysts and Developments

Several potential catalysts could influence Prairie Operating Co.'s future performance. A significant increase in oil prices would be a positive development. Successful completion of new drilling projects could also boost production and revenue.

Regulatory changes could also have a significant impact. Stricter environmental regulations could increase operating costs. Conversely, favorable policy changes could create new opportunities.

Monitoring these future developments is crucial. Investors should stay informed about industry trends and company-specific news to make timely investment decisions.

Ultimately, investing in PROP requires a calculated approach. By understanding the risks and opportunities, investors can navigate the complexities of the energy market and potentially capitalize on future growth. The energy sector presents opportunities, and also demands vigilance.