Ngpf 7.1 Investing Basics Answer Key

The scent of old textbooks and the nervous energy of a packed classroom filled the air, a familiar scene for countless students grappling with the complexities of personal finance. Heads were bent low, brows furrowed in concentration as they navigated the world of stocks, bonds, and mutual funds. The specific challenge looming large: Next Gen Personal Finance (NGPF) Unit 7.1, Investing Basics, and the ever-elusive answer key.

While the NGPF curriculum aims to empower students with essential financial literacy, the accessibility of answer keys for its assignments, including the Investing Basics module, raises significant questions about the true value of the learning experience. This article explores the context of NGPF's curriculum, the temptation of readily available answers, and the potential implications for students' long-term financial well-being.

NGPF: A Mission for Financial Literacy

NGPF, or Next Gen Personal Finance, is a non-profit organization dedicated to providing high-quality, engaging personal finance curriculum to teachers and students nationwide.

Their mission is to ensure that all students graduate high school with the knowledge and skills necessary to make sound financial decisions throughout their lives. The organization was founded by Tim Ranzetta, and he focused on providing resources to educators for free.

The curriculum covers a broad spectrum of topics, from budgeting and saving to credit and investing.

Investing Basics: A Crucial Foundation

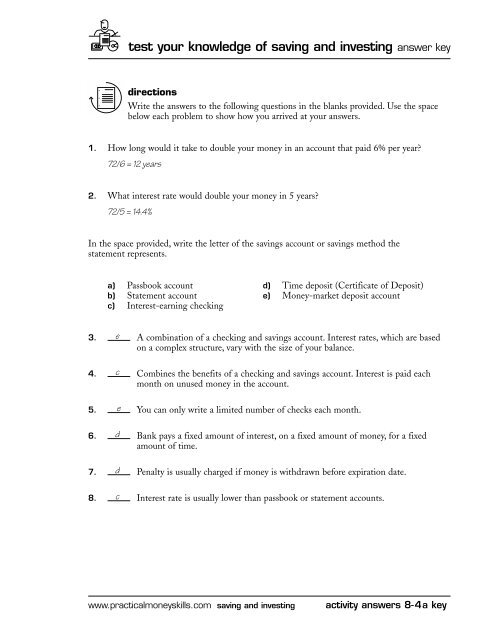

Unit 7.1, Investing Basics, serves as a foundational module within the broader investing curriculum.

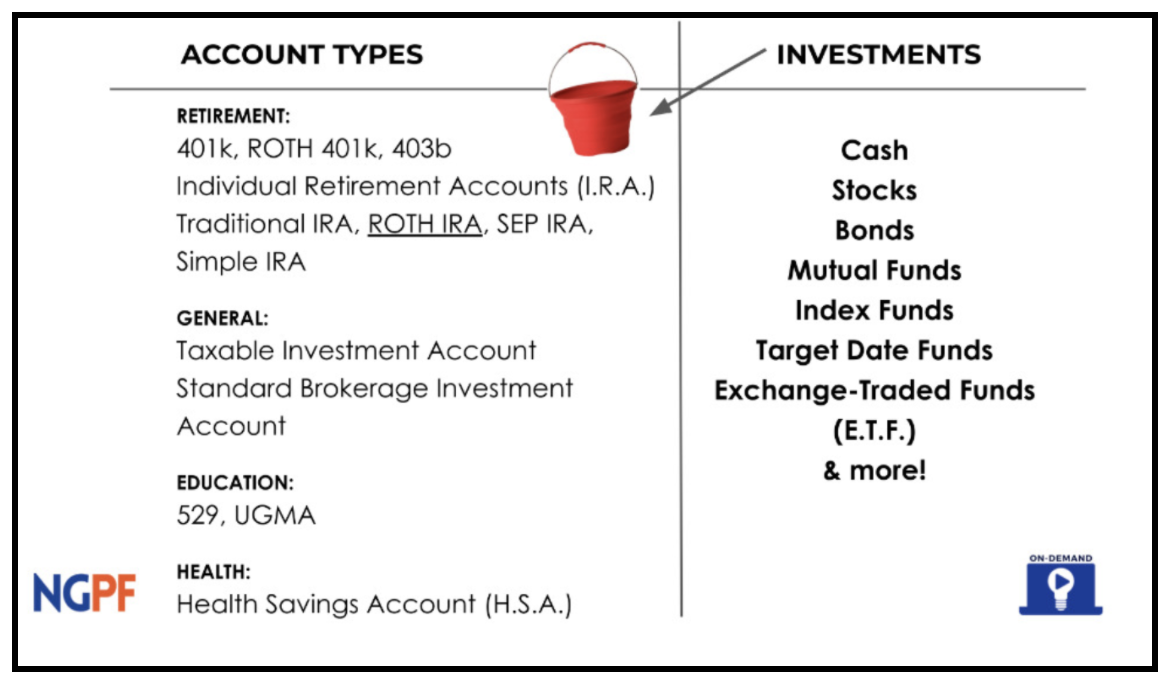

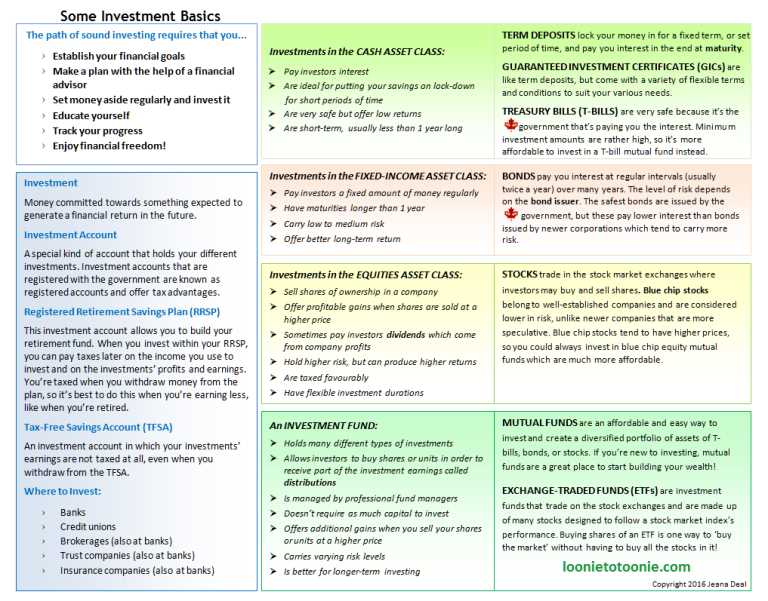

It introduces students to the fundamental concepts of investing, including different asset classes, risk tolerance, and the importance of long-term financial planning.

The unit typically involves interactive activities, case studies, and assessments designed to solidify students' understanding of these crucial principles.

The Allure of the Answer Key

In today's digital age, finding information – including answer keys – is often just a few clicks away. A quick online search for "NGPF 7.1 Investing Basics Answer Key" yields numerous results, ranging from student forums to quizlet pages.

The temptation to simply copy answers, rather than genuinely engaging with the material, can be strong, especially when students are under pressure to perform well in school.

The ready availability of these answers undermines the very purpose of the curriculum, potentially hindering the development of critical thinking and problem-solving skills.

The Real Cost of Cutting Corners

While accessing answer keys may provide a short-term boost to grades, the long-term consequences for students' financial literacy can be significant. Personal finance is not a subject that can be mastered through rote memorization or by simply copying answers.

It requires a genuine understanding of underlying principles and the ability to apply those principles to real-world situations. Without this foundational knowledge, students may be ill-equipped to make informed investment decisions later in life.

This can lead to poor financial outcomes, such as accumulating excessive debt, failing to save for retirement, or falling victim to financial scams.

Encouraging Genuine Learning

The issue of readily available answer keys highlights the importance of fostering a learning environment that prioritizes understanding over simply achieving a high grade.

Teachers can play a crucial role by emphasizing the practical application of personal finance concepts and creating assessments that require critical thinking and problem-solving.

Furthermore, open discussions about the ethical implications of cheating and the long-term benefits of genuine learning can help students develop a stronger sense of personal responsibility.

“Financial literacy is an essential life skill. It is important for students to learn the basics of investing so that they can make informed decisions about their money.” - Tim Ranzetta, Founder of NGPF

Ultimately, the goal of NGPF and other financial literacy initiatives is not simply to help students pass a test, but to empower them with the knowledge and skills they need to build a secure financial future.

By focusing on genuine understanding and critical thinking, we can help ensure that students are truly prepared to navigate the complexities of the financial world.

And that's a far more valuable outcome than any answer key could ever provide.