Online Loans No Credit Check Direct Lenders

Urgent warnings are being issued regarding the surge in online loans offered by direct lenders promising "no credit check" approvals. These loans often come with exorbitant interest rates and hidden fees, trapping vulnerable borrowers in cycles of debt.

This report investigates the risks associated with these readily available online loans, highlights the predatory practices employed by some direct lenders, and provides crucial information for consumers seeking financial assistance.

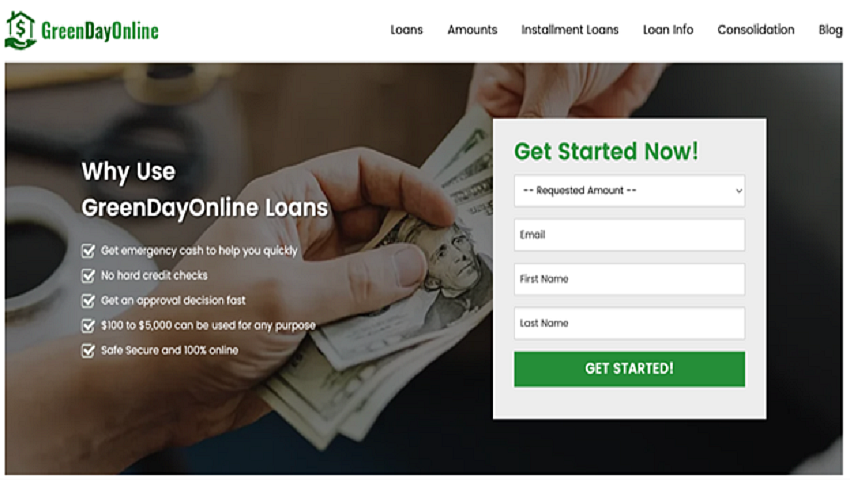

The Lure of "No Credit Check" Loans

Online direct lenders advertising "no credit check" loans target individuals with poor or no credit history. These advertisements often promise quick access to funds without the hassle of traditional credit assessments.

According to a 2023 report by the Consumer Financial Protection Bureau (CFPB), consumers with low credit scores are disproportionately targeted by these lenders.

This can be a major issue for consumers that can't obtain traditional loans to pay for emergency expenses or bills.

Predatory Lending Practices Unveiled

The lack of credit checks often masks predatory lending practices. Many of these loans carry annual percentage rates (APRs) exceeding 300%, far higher than traditional loan products.

The National Consumer Law Center (NCLC) has documented numerous cases of borrowers facing aggressive collection tactics and escalating debt burdens due to these high-interest loans.

Hidden fees, such as origination fees and prepayment penalties, further inflate the cost of borrowing, making it difficult for borrowers to repay the loan.

Who Are the Direct Lenders?

Identifying the legitimate direct lenders from the predatory ones can be a challenge. Many operate online, making it difficult to track their physical locations and legal compliance.

Some direct lenders are based offshore, making them difficult to hold accountable under U.S. law. The Federal Trade Commission (FTC) actively monitors and prosecutes fraudulent lenders but catching them can be difficult.

Consumers should be extremely cautious of lenders that lack clear contact information, avoid disclosing their interest rates upfront, or pressure borrowers into accepting a loan.

What Are the Risks?

The risks associated with "no credit check" online loans are substantial. Borrowers can quickly become trapped in a cycle of debt due to high interest rates and fees.

Defaulting on these loans can damage credit scores and lead to aggressive debt collection efforts. Some lenders may even resort to illegal tactics, such as harassing phone calls and threats.

According to a survey conducted by Pew Charitable Trusts, borrowers who take out online loans are more likely to experience financial distress and report negative experiences with lenders.

Where and When is This Happening?

These online loans are available across the United States, primarily targeting states with weaker consumer protection laws.

The rise of these loans has coincided with the increasing use of online platforms and the growing demand for quick access to funds, especially during economic downturns. The COVID-19 pandemic has accelerated this issue.

According to data by the Department of Justice, investigations into these online lenders have increased by 40% since 2021. The department recommends consumers to be aware of the risks and to consult non-profit organisations.

How to Protect Yourself

Consumers should explore alternative options before resorting to "no credit check" loans. Consider options like credit union loans, personal loans from banks, or borrowing from friends and family.

Check with your local banks before considering any loans. They may have resources or programs available that would work.

If you must take out a loan, carefully review the terms and conditions, including the interest rate, fees, and repayment schedule. Look for lenders that are transparent about their fees and comply with state and federal regulations.

Ongoing Developments and Next Steps

The CFPB and FTC are actively working to crack down on predatory lending practices in the online loan industry. They are increasing enforcement actions against lenders that violate consumer protection laws.

Consumers who have been victimized by predatory lenders can file complaints with the CFPB and FTC. These complaints help these agencies identify and prosecute fraudulent lenders.

Lawmakers are also considering legislation to strengthen consumer protection laws and regulate the online loan industry more effectively. More investigations are in place by the Federal Reserve to determine the root cause of this problem.