Importance Of A Budget In An Organization

Imagine a ship sailing across a vast ocean. The crew works tirelessly, the sails billow, and the destination shimmers on the horizon. But without a map and a compass, without a clear understanding of supplies and fuel, that journey, however enthusiastic, could easily veer off course, running aground on unseen reefs or lost in endless waters.

Just like a ship needs navigation tools, an organization requires a budget. A well-crafted budget isn't just about numbers; it's a strategic roadmap, a vital communication tool, and a cornerstone of financial stability. This article explores why budgeting is not merely an administrative task, but a crucial ingredient for organizational success.

The Budget: More Than Just Numbers

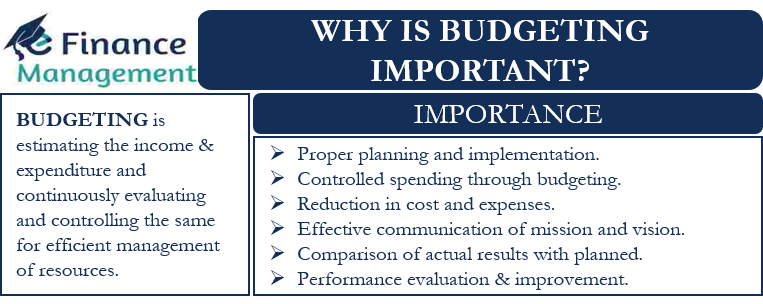

At its core, a budget is a financial plan outlining expected revenues and expenditures over a specific period. It's a quantitative expression of an organization's plans and intentions.

However, its significance extends far beyond balancing the books. The budget acts as a compass, guiding resource allocation, facilitating informed decision-making, and fostering accountability across the organization.

Strategic Alignment and Goal Setting

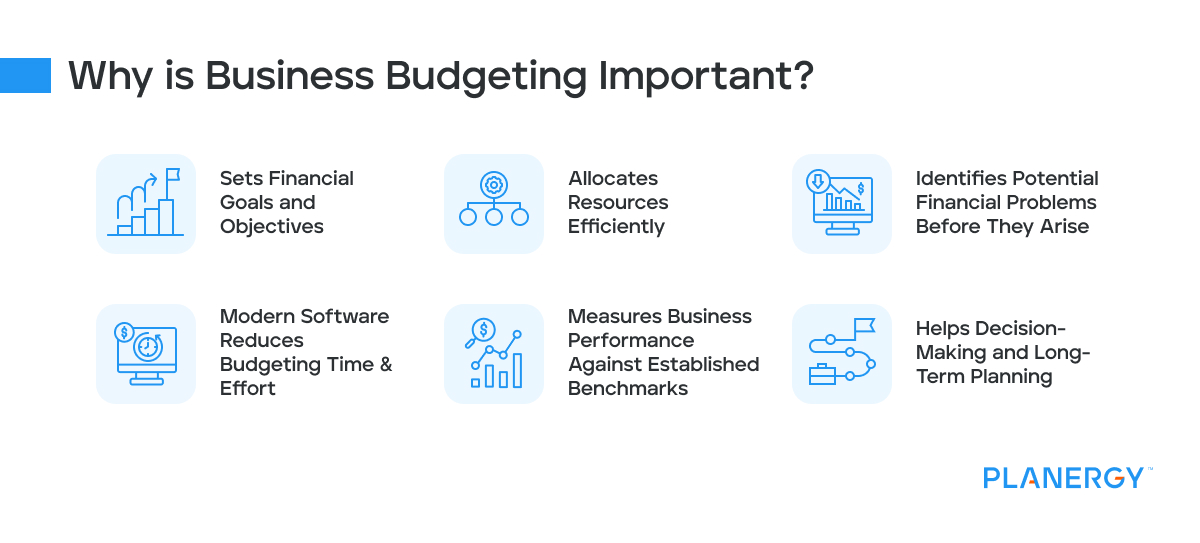

A budget compels organizations to think strategically about their priorities. According to a report by the Chartered Institute of Management Accountants (CIMA), effective budgeting requires aligning financial resources with strategic objectives.

This process ensures that every expense is justified and contributes to achieving the overall mission. Departments can then translate these strategic goals into tangible, measurable targets, ensuring that everyone is pulling in the same direction.

Resource Allocation and Efficiency

Resources are finite, and a budget helps optimize their use. It forces careful consideration of where money should be spent, enabling the organization to prioritize essential activities and identify areas for potential cost savings.

According to a study by Deloitte, organizations with mature budgeting processes are better equipped to identify and eliminate wasteful spending. This can free up resources for innovation, growth, or other strategic initiatives.

Enhanced Communication and Coordination

A budget is a powerful communication tool that transcends departmental silos. It facilitates dialogue and collaboration across different teams, ensuring everyone understands the organization's financial position and priorities.

When everyone is aware of the budget constraints and strategic direction, it fosters a sense of shared responsibility and encourages more efficient collaboration. Regular budget reviews can provide a platform for departments to share progress, address challenges, and adjust their plans accordingly. Transparency builds trust and accountability.

Performance Measurement and Accountability

The budget serves as a benchmark against which actual performance can be measured. By comparing budgeted figures with actual results, organizations can identify variances, analyze their causes, and take corrective action.

This process promotes accountability at all levels, as managers are responsible for delivering results within their allocated budgets. It also provides valuable insights into operational efficiency and areas that require improvement. "A budget isn't about restricting but empowering," says Professor Emily Carter, a renowned expert in financial management.

Risk Management and Contingency Planning

A well-structured budget incorporates risk assessments and contingency plans. By identifying potential risks and allocating resources to mitigate them, the organization can be better prepared for unexpected events, such as economic downturns, changes in market conditions, or unforeseen emergencies.

Organizations that have clear contingency plans are more resilient and better positioned to weather storms. A robust budget allows for the creation of reserve funds to handle these unforeseen circumstances.

Beyond the Bottom Line: A Culture of Financial Responsibility

Ultimately, the importance of a budget lies in its ability to cultivate a culture of financial responsibility throughout the organization. It encourages employees to think critically about their spending, to be mindful of resources, and to contribute to the organization's financial well-being.

By promoting transparency, accountability, and strategic alignment, the budget becomes a powerful instrument for organizational success, driving sustainable growth and fostering a culture of excellence. Just as a ship's captain relies on their navigational tools to reach their destination, so too can an organization navigate the complexities of the business world with a well-crafted and diligently followed budget.