Importance Of Budgeting In Business

Businesses operating without a budget are navigating a minefield. Ignoring this critical financial tool significantly elevates the risk of failure and missed opportunities.

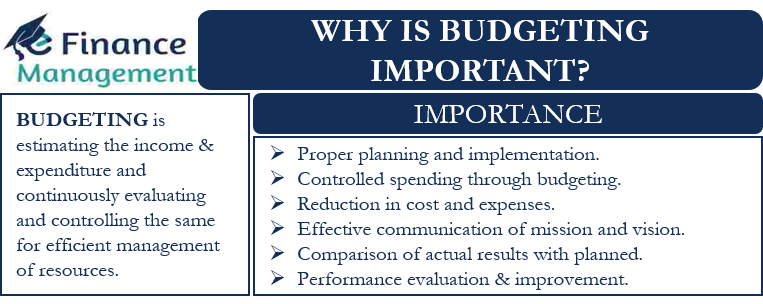

Budgeting, the process of creating a detailed financial plan, is the bedrock of sound business management. It provides a roadmap for resource allocation, performance evaluation, and strategic decision-making, yet remains tragically underutilized by many organizations.

The Core of Budgeting

At its essence, budgeting is about forecasting revenue and expenses over a specific period. This process forces businesses to confront potential challenges and proactively develop strategies to overcome them.

According to a recent study by PwC, companies with robust budgeting processes are 15% more likely to achieve their financial targets than those without.

This planning process encompasses several key areas:

Revenue Forecasting

Accurately predicting sales is the cornerstone of any budget. This involves analyzing market trends, historical data, and sales pipeline information.

Overly optimistic or pessimistic forecasts can lead to resource misallocation and missed revenue opportunities.

Expense Management

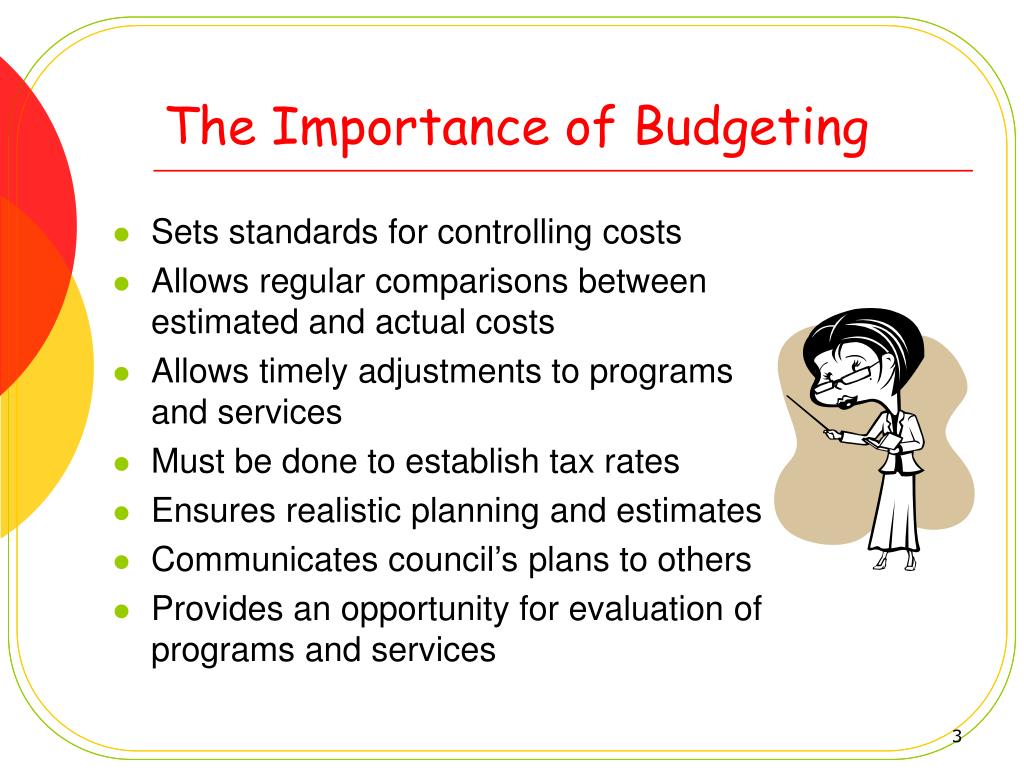

Controlling costs is equally vital. Budgeting provides a framework for tracking and managing all expenditures, from salaries and marketing to rent and utilities.

Identifying areas for cost reduction and efficiency gains is crucial for maximizing profitability.

Cash Flow Projection

Budgeting allows businesses to anticipate cash inflows and outflows, ensuring they have sufficient funds to meet their obligations.

Poor cash flow management is a leading cause of business failure, particularly for startups and small businesses.

The Impact of Inadequate Budgeting

Businesses that neglect budgeting often experience several negative consequences. Uncontrolled spending and wasted resources become rampant.

Financial instability is more likely, hindering growth and investment opportunities.

Strategic decision-making is impaired, leading to suboptimal choices and missed market opportunities. According to a Deloitte survey, 60% of businesses without a formal budgeting process struggle to adapt to changing market conditions.

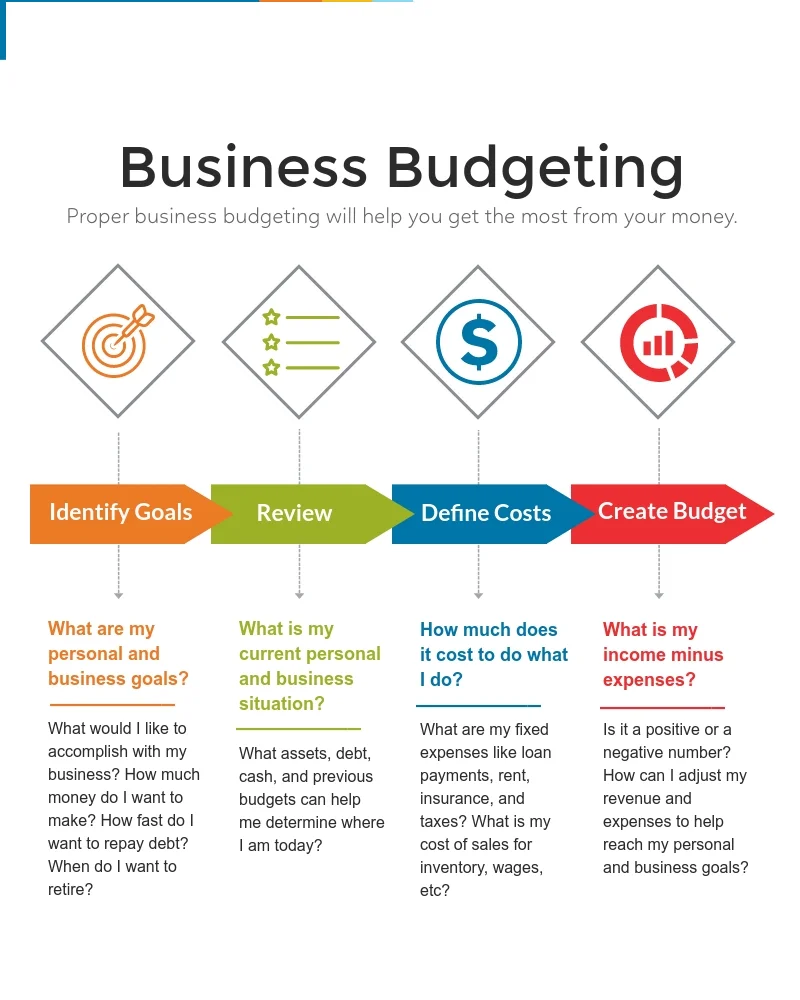

Implementing a Budgeting Process

Developing a budget is a multi-step process that requires input from various departments. Start by gathering historical financial data and market research. Set realistic and measurable financial goals.

Allocate resources strategically based on priorities and expected returns. Regularly monitor and review the budget against actual performance.

Make necessary adjustments based on changing market conditions or unforeseen events.

Who Benefits from Budgeting?

From multinational corporations to small startups, every business can benefit from budgeting. Entrepreneurs can use budgets to secure funding and track progress towards their goals.

Managers can use budgets to allocate resources effectively and hold their teams accountable. Investors can use budgets to assess the financial health and potential of a business.

The Future of Budgeting

Budgeting is evolving alongside technological advancements. Software and artificial intelligence are streamlining the budgeting process and providing deeper insights.

Tools like QuickBooks and Xero make it easier to track expenses and generate reports. More businesses are embracing rolling budgets, which are continuously updated to reflect changing conditions.

Adaptability and agility are becoming increasingly important in today's rapidly changing business environment. For small businesses, the SBA (Small Business Administration) offers resources and guidance on budgeting best practices.

Next Steps

Businesses must prioritize budgeting as a core management function. Investing time and resources into developing a robust budgeting process will yield significant returns in terms of profitability, stability, and strategic decision-making.

The long-term viability and success of any business hinges on its ability to effectively manage its finances. Ignoring this fundamental principle is a risk no business can afford to take.