Importance Of Cash Flow Management In Business

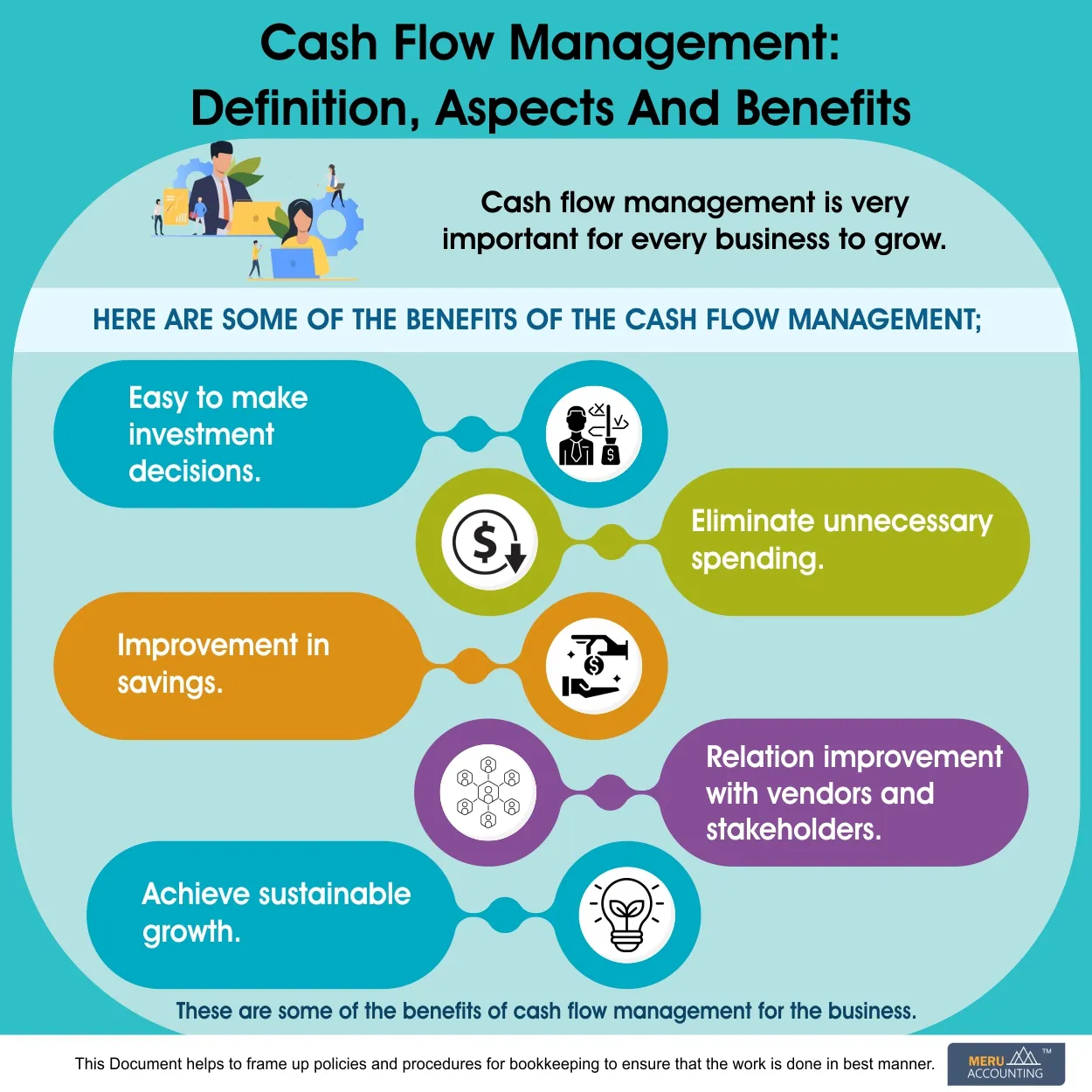

For any business, regardless of size or industry, maintaining a healthy cash flow is paramount to survival and sustainable growth. Insufficient cash flow is a leading cause of business failure, often more so than a lack of profitability. Effective cash flow management provides the financial flexibility to meet obligations, invest in opportunities, and navigate unforeseen challenges.

The ability to monitor and control the movement of money in and out of a business is the nut graf of successful financial administration. This includes not only tracking actual cash flow but also forecasting future needs and implementing strategies to optimize cash inflows and outflows. Neglecting this aspect can leave businesses vulnerable, even if they are generating substantial revenue.

Understanding Cash Flow

Cash flow, at its core, is the net amount of cash and cash equivalents moving into and out of a company. Positive cash flow indicates more money is coming in than going out, allowing a business to cover its expenses and invest in growth. Conversely, negative cash flow suggests that a company is spending more than it is earning, potentially leading to financial strain.

The Institute of Management Accountants (IMA) emphasizes the importance of understanding the difference between profit and cash flow. A business can be profitable on paper but still face difficulties if it lacks sufficient cash to meet its short-term obligations. Profit is an accounting concept, while cash flow represents the actual money moving through the business.

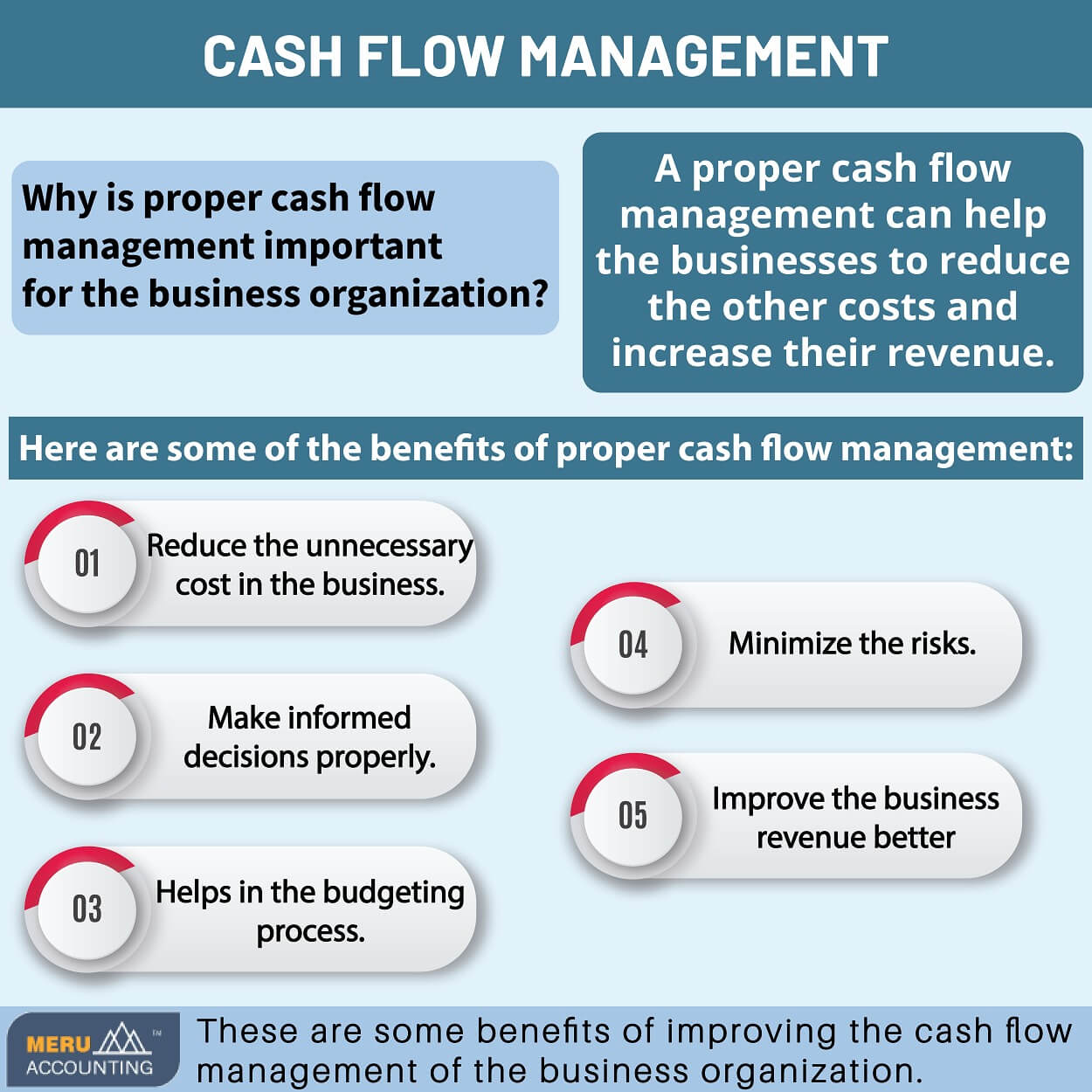

Key Elements of Cash Flow Management

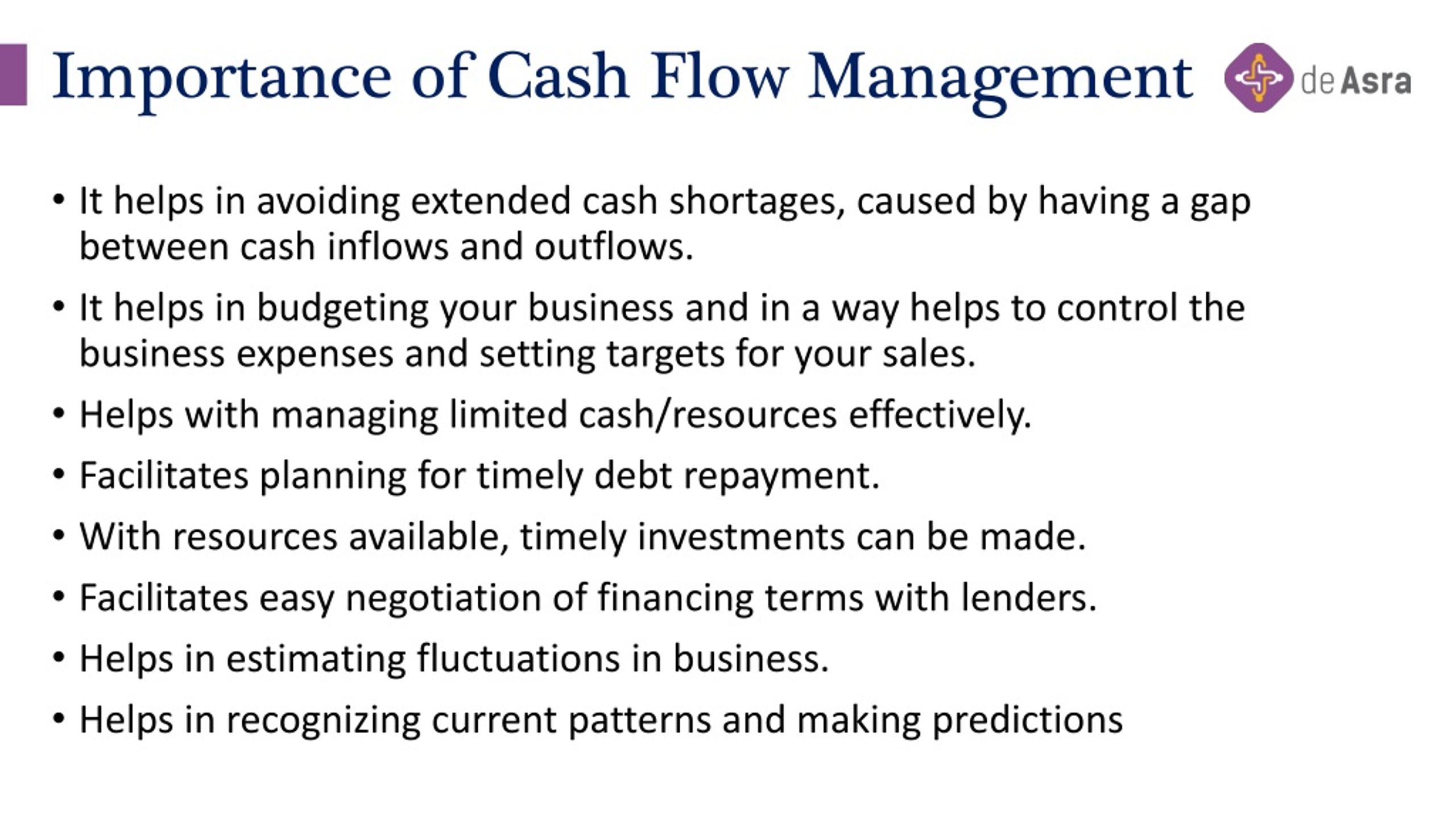

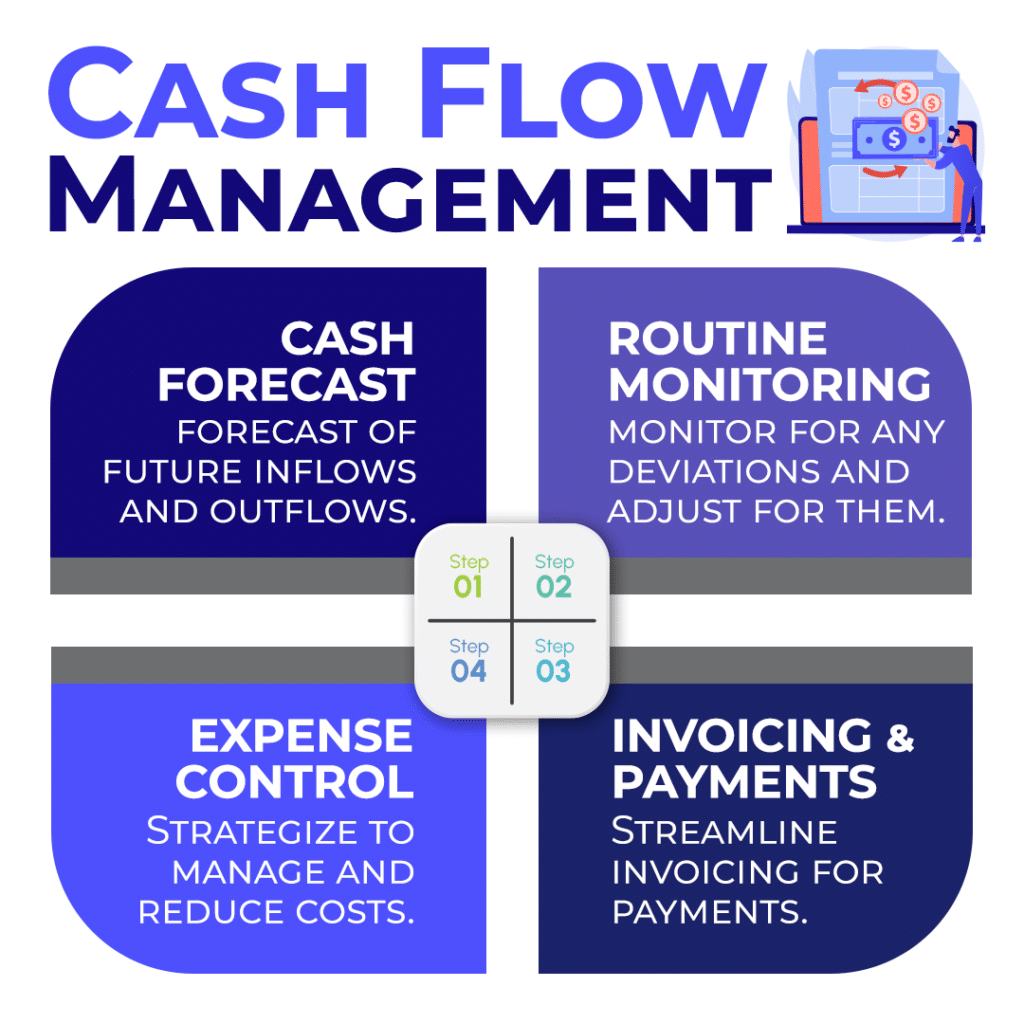

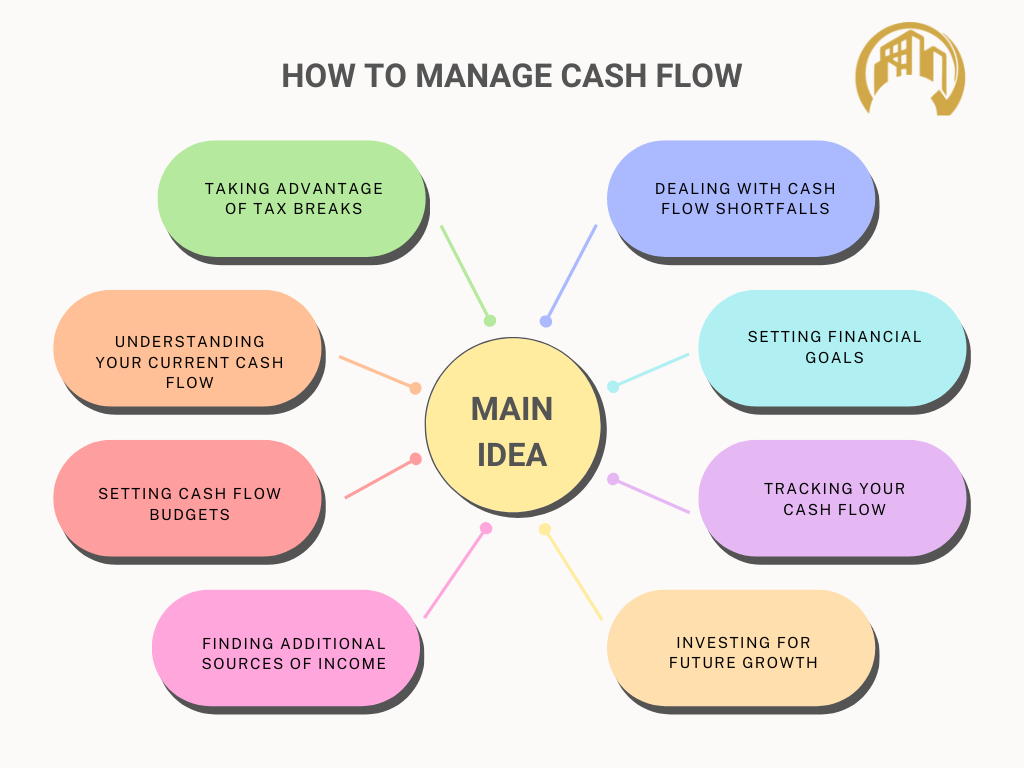

Effective cash flow management involves several critical components. Accurate forecasting is essential for predicting future cash needs and identifying potential shortfalls. By projecting revenues and expenses, businesses can proactively address any anticipated imbalances.

Controlling expenses is another crucial element. This includes identifying areas where costs can be reduced without compromising the quality of goods or services. Negotiating favorable payment terms with suppliers and carefully managing inventory levels are also important strategies.

Efficiently managing accounts receivable is also crucial. Promptly invoicing customers and implementing effective collection procedures helps to ensure timely payments. Offering early payment discounts can incentivize customers to pay sooner, improving cash flow.

Tools and Techniques

Several tools and techniques can aid in effective cash flow management. Cash flow statements provide a historical record of cash inflows and outflows, allowing businesses to analyze past performance and identify trends. Budgeting and forecasting software can streamline the process of projecting future cash needs and identifying potential risks.

The Small Business Administration (SBA) recommends using cash flow projections to assess the impact of different business decisions. This allows business owners to evaluate the potential effects of new investments, pricing changes, or marketing campaigns on their cash flow.

Consequences of Poor Management

The consequences of neglecting cash flow management can be severe. Businesses may struggle to pay their bills, meet payroll obligations, or invest in growth opportunities. A lack of cash can also damage a company's reputation and credit rating, making it more difficult to secure financing in the future.

In extreme cases, poor cash flow management can lead to insolvency and business failure. According to a study by Dun & Bradstreet, a significant percentage of business bankruptcies are attributed to cash flow problems.

Real-World Examples

Numerous examples illustrate the importance of cash flow management. A manufacturing company that experiences a sudden increase in demand may face cash flow challenges if it cannot secure financing to purchase additional raw materials. A retail business that offers overly generous credit terms to customers may struggle to collect payments in a timely manner.

On the other hand, businesses that prioritize cash flow management are better positioned to weather economic downturns and capitalize on new opportunities. A restaurant that carefully manages its inventory and negotiates favorable payment terms with suppliers can improve its profitability and cash flow.

The Human Element

Beyond the numbers and spreadsheets, cash flow management has a direct impact on the people involved in a business. Employees rely on timely paychecks, suppliers need to be paid for their goods and services, and investors expect a return on their investments.

A business owner who prioritizes cash flow management is demonstrating a commitment to the well-being of their employees, partners, and stakeholders. This can foster a sense of trust and loyalty, leading to increased productivity and long-term success. "It's about securing the future for everyone involved," says Sarah Chen, CFO of a tech startup.

Conclusion

In conclusion, effective cash flow management is not just a financial imperative; it is a cornerstone of business sustainability and growth. By understanding the principles of cash flow management, utilizing appropriate tools and techniques, and prioritizing the needs of stakeholders, businesses can build a solid foundation for long-term success. Proactive cash flow management allows for better decision-making, and ultimately, ensures the viability of any business venture in an ever-changing economic landscape.