Importance Of Cash Flow Management

In an era of rapid technological advancement and fluctuating economic landscapes, businesses of all sizes face a constant struggle for survival. While profitability often takes center stage, a more fundamental aspect often determines a company's fate: cash flow management. Neglecting this vital function can quickly turn even the most promising ventures into cautionary tales of financial distress.

Effective cash flow management, the art of monitoring and controlling the movement of money in and out of a business, is not merely an accounting exercise. It's the lifeblood of any organization, enabling it to meet its obligations, invest in growth, and weather unexpected storms. This article delves into the critical importance of robust cash flow management, exploring its impact on business stability, strategic decision-making, and long-term sustainability.

The Foundation of Business Stability

Consistent and positive cash flow is the bedrock upon which a stable business is built. It allows companies to pay employees on time, settle supplier invoices promptly, and meet loan obligations without resorting to desperate measures.

According to a report by the U.S. Small Business Administration (SBA), a significant percentage of small business failures are attributed to inadequate cash flow management, even in profitable companies.

Without sufficient cash, businesses are forced to delay payments, potentially damaging their credit ratings and relationships with vendors. This can lead to higher costs, reduced access to credit, and ultimately, a downward spiral of financial instability.

Fueling Growth and Investment

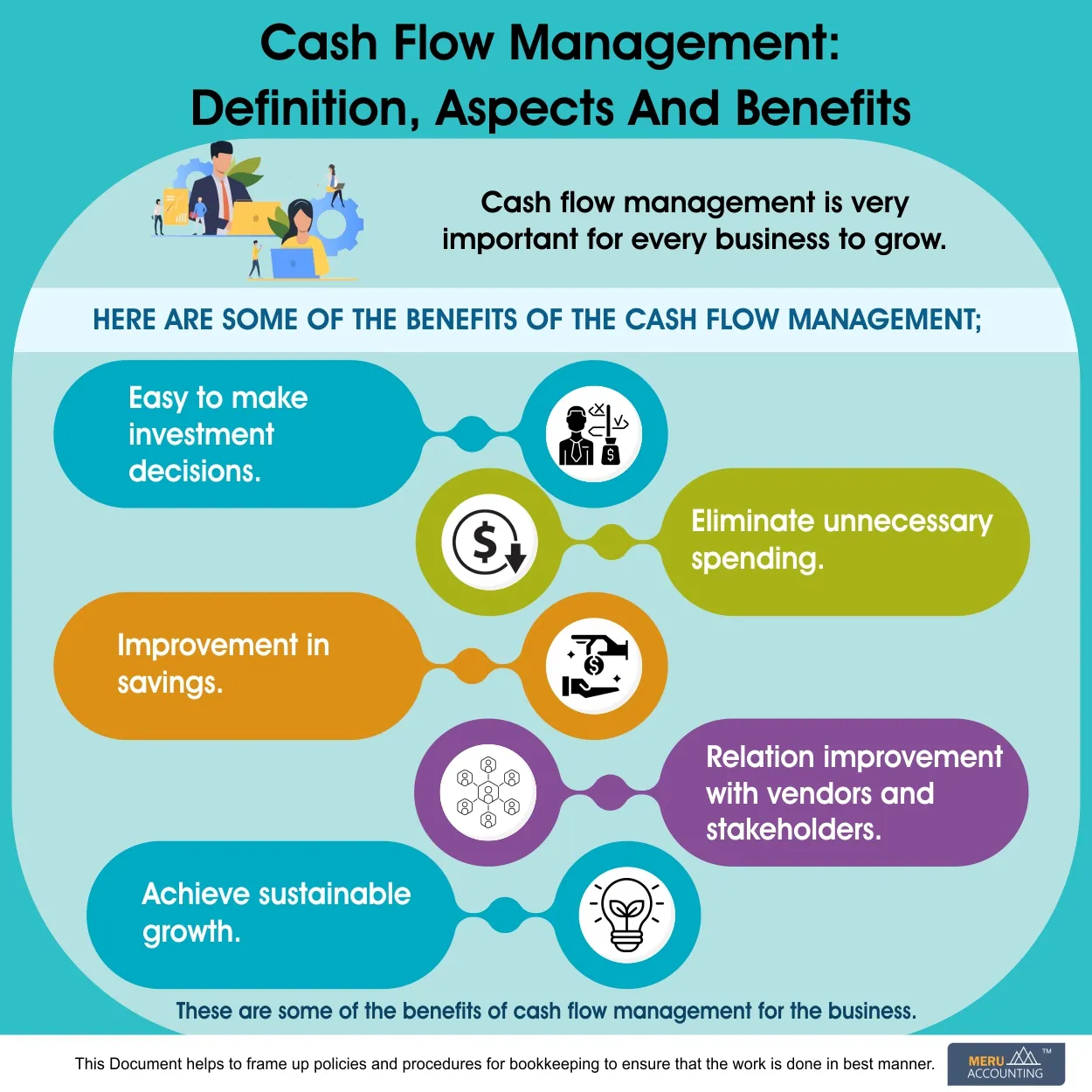

Beyond simply staying afloat, effective cash flow management empowers businesses to pursue growth opportunities. Access to readily available cash allows companies to invest in new equipment, expand into new markets, and hire talented personnel.

A 2023 study by Deloitte highlights the correlation between strong cash flow and a company's ability to innovate and adapt to changing market conditions.

Furthermore, healthy cash reserves provide a buffer against unforeseen challenges, such as economic downturns or unexpected expenses. This resilience allows businesses to navigate turbulent times and emerge stronger on the other side.

Strategic Decision-Making and Planning

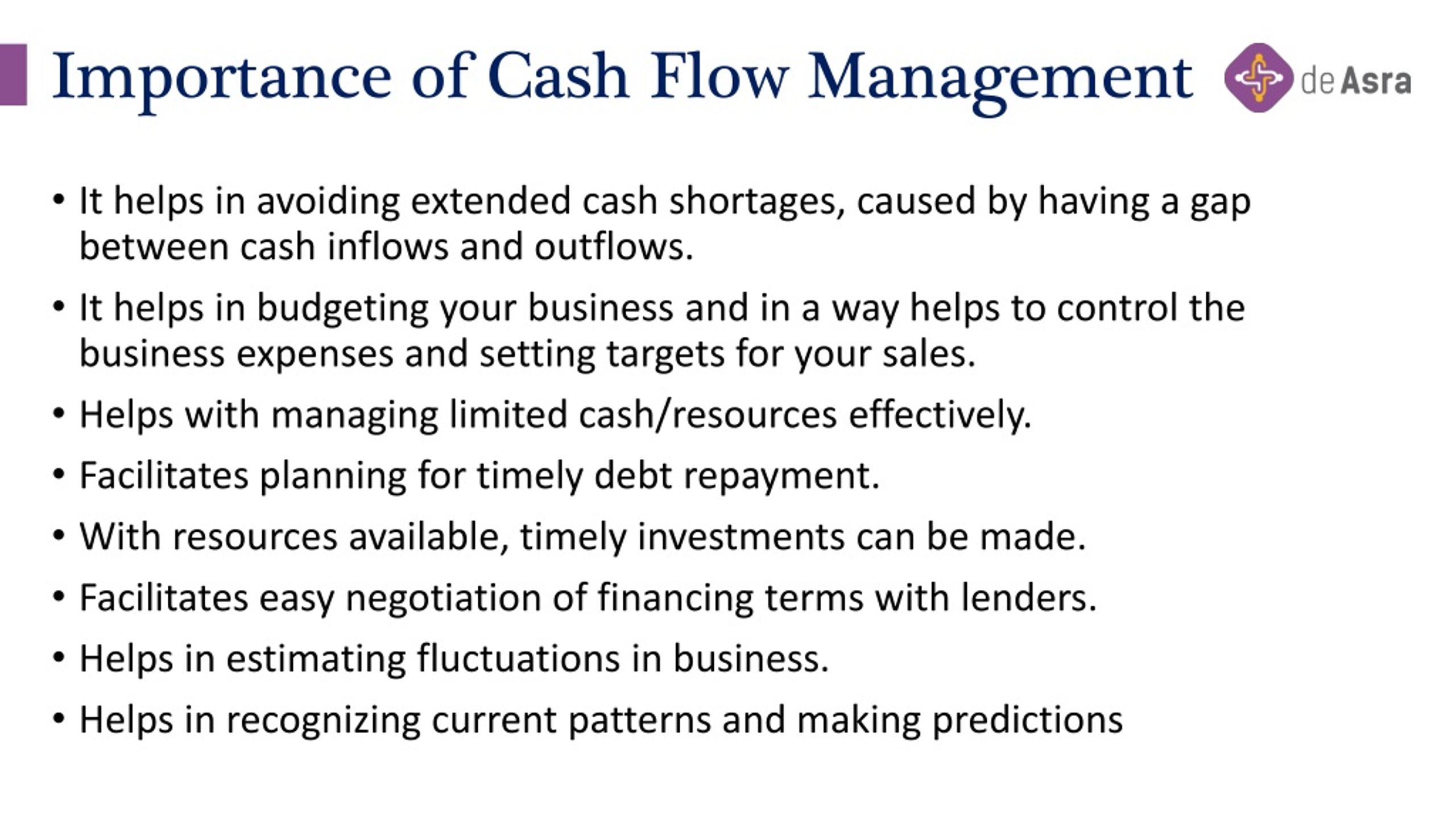

Accurate and timely cash flow forecasting is a crucial element of strategic decision-making. By understanding future cash inflows and outflows, businesses can make informed decisions about investments, pricing, and resource allocation.

The Chartered Institute of Management Accountants (CIMA) emphasizes that cash flow forecasting should be an integral part of the budgeting process.

It enables businesses to identify potential funding gaps in advance, allowing them to secure financing or adjust their spending accordingly. It also helps them to evaluate the viability of new projects and assess the impact of different scenarios on their financial health.

Tools and Techniques for Effective Management

Several tools and techniques can assist businesses in managing their cash flow effectively. These include:

- Accurate cash flow forecasting: Projecting future inflows and outflows.

- Invoice management: Ensuring timely invoicing and collection of payments.

- Inventory control: Optimizing inventory levels to minimize holding costs.

- Expense management: Monitoring and controlling spending to identify cost-saving opportunities.

- Negotiating payment terms: Establishing favorable payment terms with suppliers and customers.

Technology plays a significant role in modern cash flow management.

Accounting softwareand

online banking platformsprovide real-time visibility into a company's financial position, enabling businesses to make proactive decisions and respond quickly to changing circumstances.

Multiple Perspectives

While the importance of cash flow management is widely recognized, different stakeholders may have varying perspectives on its priorities. Owners and investors often focus on maximizing profitability and return on investment, while managers prioritize operational efficiency and short-term cash needs.

Employees may be concerned about job security and timely payment of wages. Balancing these competing interests requires careful communication and a commitment to transparency.

A holistic approach to cash flow management that considers the needs of all stakeholders is essential for fostering long-term success.

Looking Ahead

In an increasingly volatile and unpredictable business environment, effective cash flow management is more critical than ever. Businesses that prioritize this function will be better equipped to navigate challenges, seize opportunities, and achieve sustainable growth.

By embracing technology, adopting best practices, and fostering a culture of financial discipline, organizations can build a strong foundation for long-term success. Ignoring cash flow can lead to business failure.

Continuous monitoring and adapting to the ever-changing economic landscape are crucial for maintaining financial stability and achieving sustainable growth in the years to come.