In Preparing A Company's Statement Of Cash Flows

Companies face critical deadlines for preparing their Statement of Cash Flows (SCF), a document scrutinized by investors and regulators alike. Errors or delays can trigger penalties and erode investor confidence, demanding meticulous attention to detail and stringent adherence to accounting standards.

The accurate preparation of the SCF is paramount for providing stakeholders with a clear view of a company's liquidity and financial health. This article outlines the key steps and common pitfalls in preparing the SCF, offering practical guidance to ensure compliance and avoid costly mistakes.

Understanding the Statement of Cash Flows

The Statement of Cash Flows reports the movement of cash both into and out of a company during a specific period. It's divided into three main sections: operating activities, investing activities, and financing activities.

Operating activities reflect the cash generated from the company's core business operations. These involve transactions related to revenue generation and expenses incurred.

Investing activities include the purchase and sale of long-term assets, such as property, plant, and equipment (PP&E). These transactions reflect a company's investments in its future.

Financing activities relate to how a company is funded, including debt, equity, and dividends. These activities show how a company raises and returns capital.

Key Steps in Preparing the Statement of Cash Flows

Preparing an accurate SCF involves a structured process. This includes gathering data from the income statement, balance sheet, and other relevant sources.

1. Choosing the Method: Direct vs. Indirect

Companies can use either the direct or indirect method for the operating activities section. The direct method reports actual cash inflows and outflows.

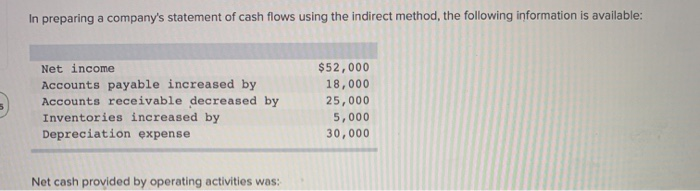

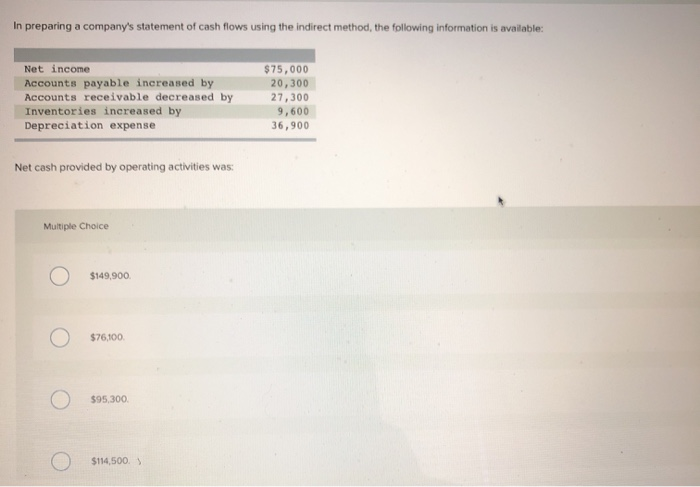

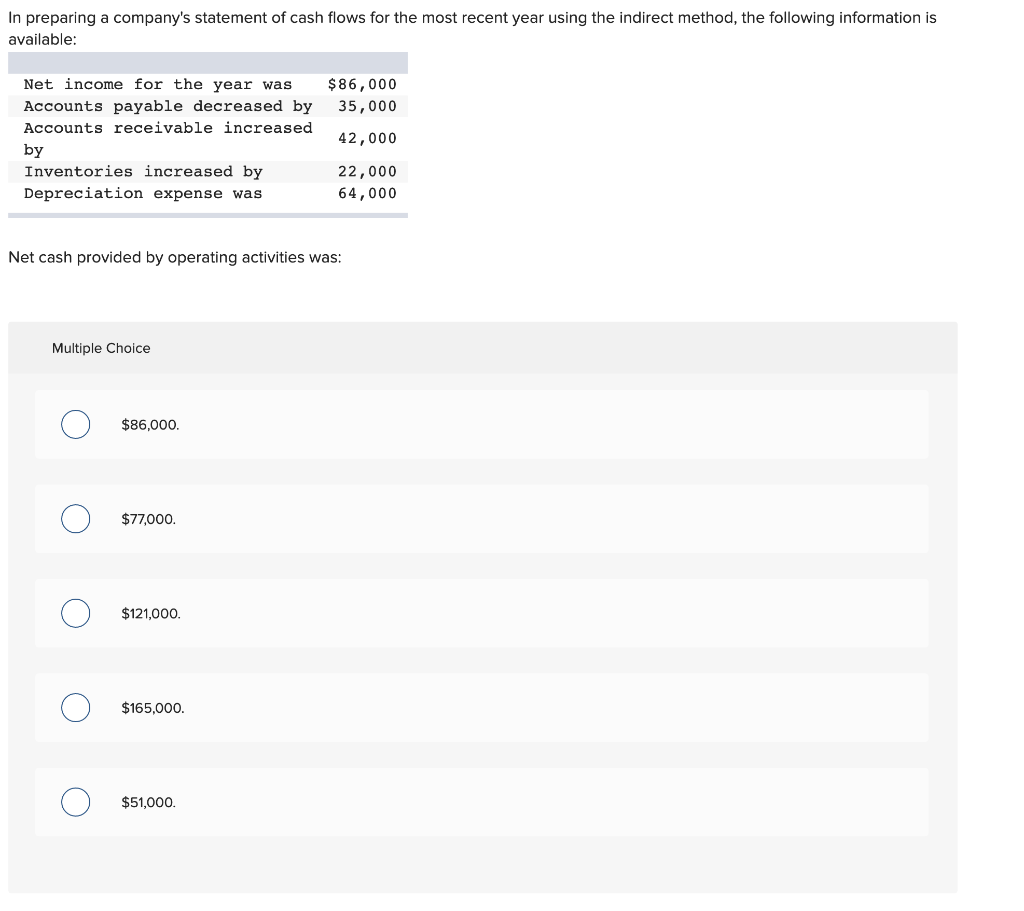

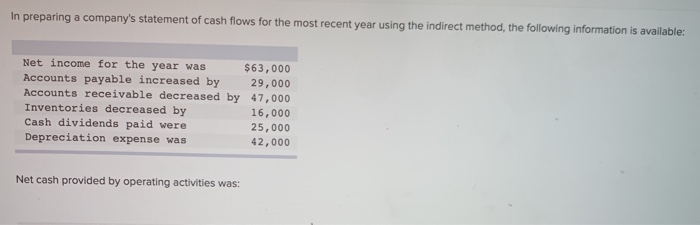

The indirect method starts with net income and adjusts it for non-cash items. Most companies favor the indirect method due to its relative ease of preparation.

2. Calculating Cash Flows from Operating Activities

Under the indirect method, begin with net income and add back non-cash expenses like depreciation and amortization. Also adjust for changes in current assets and liabilities.

An increase in accounts receivable is subtracted, as it means less cash was collected. An increase in accounts payable is added, indicating cash hasn't been paid out yet.

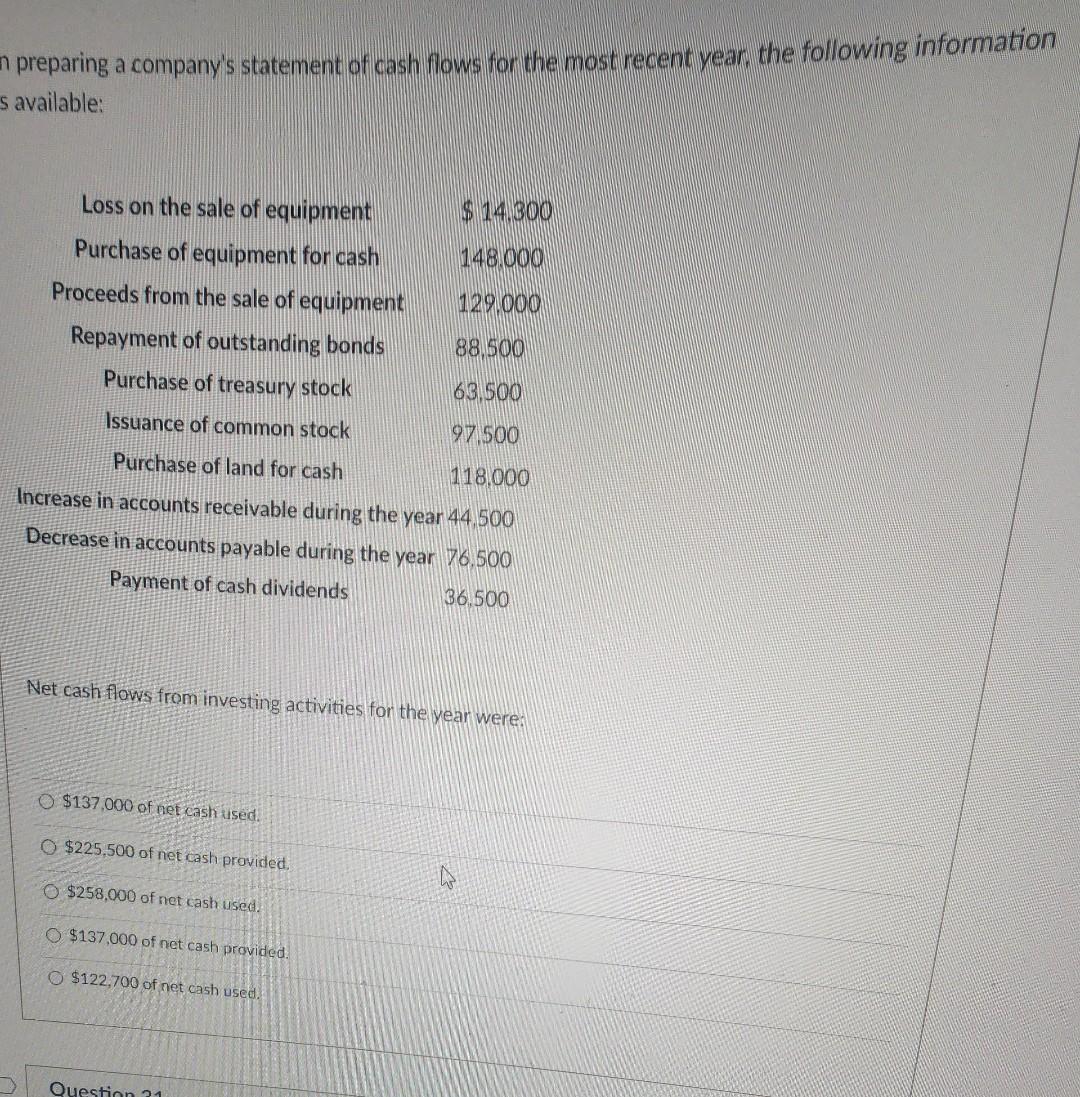

3. Determining Cash Flows from Investing Activities

Calculate cash flows from investing activities by analyzing changes in long-term assets. Purchasing equipment results in a cash outflow.

Selling a building results in a cash inflow. These are straightforward and usually involve little adjustment.

4. Identifying Cash Flows from Financing Activities

Analyze changes in debt and equity accounts to determine cash flows from financing activities. Issuing stock generates a cash inflow.

Paying dividends or repaying debt results in a cash outflow. These activities reflect how a company manages its capital structure.

5. Reconciling Cash Balances

Reconcile the beginning and ending cash balances by adding the net cash flows from all three activities. The resulting figure should match the change in cash reported on the balance sheet.

Any discrepancies indicate errors that need to be identified and corrected. This reconciliation is a critical quality control step.

Common Pitfalls to Avoid

Several common errors can undermine the accuracy of the Statement of Cash Flows. Understanding these pitfalls is key to producing a reliable financial statement.

Misclassifying Transactions: Ensure transactions are correctly categorized within the appropriate section. Classifying an operating activity as financing can distort the entire statement.

Ignoring Non-Cash Transactions: While the SCF focuses on cash, non-cash transactions can impact future cash flows. These should be disclosed in the notes to the financial statements.

Errors in Depreciation: Incorrectly calculating or applying depreciation can lead to inaccuracies in the operating activities section. Double-check calculations and ensure consistent application.

Overlooking Foreign Exchange: If the company operates internationally, currency fluctuations can impact cash flows. Account for these fluctuations accurately to avoid errors.

Failing to Reconcile: Not reconciling the cash balance can mask underlying errors. Always perform a thorough reconciliation to ensure accuracy.

The Impact of Technology and Automation

Modern accounting software automates many aspects of SCF preparation. This includes data collection, calculations, and report generation.

Automated systems reduce the risk of manual errors. However, human oversight is still essential to ensure data accuracy and proper classification.

Data analytics tools can also identify trends and anomalies in cash flows. This enables businesses to proactively manage their cash position and mitigate risks.

Ensuring Compliance and Accuracy

Accuracy in the Statement of Cash Flows is not just about avoiding errors, it's about compliance. Companies are responsible for following relevant accounting standards.

Regular internal audits and reviews can help identify and correct errors before they escalate. External audits provide an independent assessment of the company's financial reporting.

Staying informed about changes in accounting standards is crucial. Consult with accounting professionals to ensure compliance and best practices are being followed.

Next Steps

Companies must immediately review their procedures for preparing the SCF. They need to ensure adherence to accounting standards and implement robust quality control measures.

Ongoing monitoring of cash flows is critical for maintaining financial health. Utilize the information from the SCF to make informed business decisions.

Consult with qualified accounting professionals to address any uncertainties. This will ensure the accuracy and reliability of financial reporting.