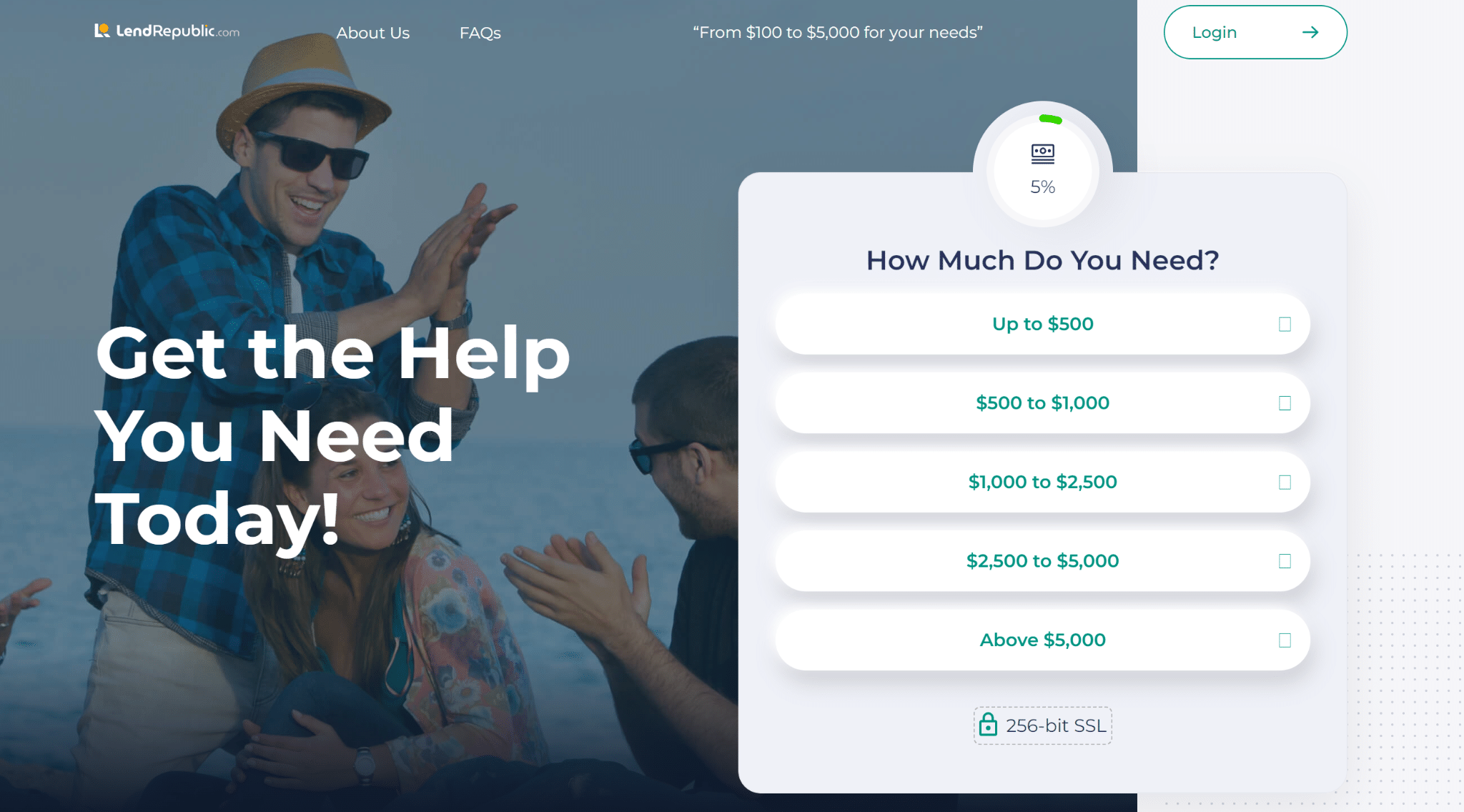

Income Based Loans No Credit Check Instant Approval

The promise of instant financial relief, particularly for those struggling with low incomes and limited credit history, is powerfully alluring. Advertisements promising "Income-Based Loans, No Credit Check, Instant Approval" are becoming increasingly prevalent, preying on vulnerability with the siren song of easy access to funds. But beneath the veneer of convenience lies a complex web of potential pitfalls, raising serious concerns about predatory lending practices and long-term financial stability.

This article delves into the burgeoning market of income-based loans offered without credit checks, examining their purported benefits and inherent risks. We will explore the mechanics of these loans, analyze the potential impact on borrowers, and consider the regulatory landscape surrounding them. Understanding the true cost and consequences is critical for individuals considering these options, as well as for policymakers seeking to protect vulnerable populations.

The Allure of Instant Approval

For individuals facing immediate financial hardship, the prospect of obtaining a loan without a credit check is undeniably attractive. Traditional lenders often rely heavily on credit scores to assess risk, leaving those with poor or nonexistent credit histories shut out from conventional financing options. The promise of "instant approval" eliminates this barrier, offering a seemingly quick and easy solution to pressing financial needs.

These loans are often marketed towards those with irregular income streams, such as gig workers or freelancers. Because income is the primary factor, the accessibility is appealing to those who can't show consistent pay stubs from traditional employment.

How Income-Based, No Credit Check Loans Work

Unlike traditional loans that scrutinize creditworthiness, income-based loans without credit checks primarily focus on the borrower's income to determine eligibility. Lenders typically require proof of income, such as bank statements or pay stubs, to assess the borrower's ability to repay the loan. The loan amount and interest rate are then determined based on this income assessment.

The absence of a credit check means that the lender is taking on a higher level of risk. This increased risk is often mitigated by charging significantly higher interest rates and fees.

Repayment schedules are usually structured around the borrower's pay cycle, with payments automatically deducted from their bank account. This direct deduction method, while convenient, can also be problematic if the borrower's income fluctuates or unexpected expenses arise.

The Dark Side: High Costs and Predatory Practices

The convenience and accessibility of income-based loans without credit checks come at a steep price. The interest rates associated with these loans are often exorbitant, far exceeding those charged by traditional lenders. These high rates can quickly trap borrowers in a cycle of debt, making it difficult to repay the loan and accumulating further interest and fees.

Many of these loans also come with hidden fees, such as origination fees, late payment fees, and prepayment penalties. These fees can further inflate the overall cost of the loan, making it even more difficult for borrowers to manage their finances.

Consumer advocacy groups warn that some lenders engage in predatory lending practices, targeting vulnerable individuals with deceptive marketing tactics and unfair loan terms. These practices can exacerbate existing financial problems and leave borrowers in a worse situation than before.

Regulatory Scrutiny and Consumer Protection

The rapid growth of the income-based, no credit check loan market has drawn increased scrutiny from regulators. State and federal agencies are working to combat predatory lending practices and protect consumers from unfair loan terms. The Consumer Financial Protection Bureau (CFPB) has been actively investigating and regulating payday lenders and other high-cost lenders, although its authority has been challenged in recent years.

Many states have laws in place to cap interest rates and limit the fees that lenders can charge. However, these laws vary significantly from state to state, creating a patchwork of regulations that can be difficult for consumers to navigate. Furthermore, some lenders operate online, making it difficult to enforce state laws across state lines.

The Federal Trade Commission (FTC) also plays a role in protecting consumers from deceptive advertising and unfair business practices in the lending industry. The FTC can take action against lenders who make false claims or engage in other deceptive practices.

Alternatives to Income-Based, No Credit Check Loans

For individuals struggling with financial hardship, there are often better alternatives to income-based loans without credit checks. These alternatives may require more effort to access, but they can ultimately save borrowers money and avoid the pitfalls of high-cost lending.

Credit counseling agencies can provide valuable assistance in managing debt and developing a budget. These agencies can also help borrowers negotiate with creditors to lower interest rates or establish more manageable repayment plans.

Community-based organizations and non-profits often offer financial assistance programs, such as emergency grants or low-interest loans. These programs are designed to help individuals meet their basic needs and avoid resorting to high-cost borrowing options.

Exploring options like secured loans from credit unions or even borrowing from family and friends can provide a far more sustainable way to address pressing financial needs.

Looking Ahead: The Future of Income-Based Lending

The market for income-based loans, especially those without credit checks, is likely to continue to evolve in the coming years. Technological advancements, such as the use of alternative data sources to assess creditworthiness, could potentially lead to more responsible and affordable lending options.

Increased regulatory oversight and consumer education are crucial to ensure that borrowers are protected from predatory lending practices. Policymakers must continue to strengthen consumer protection laws and enforce existing regulations to prevent the exploitation of vulnerable individuals.

Ultimately, the key to addressing the demand for income-based loans lies in addressing the underlying causes of financial insecurity. By promoting financial literacy, expanding access to affordable financial services, and creating economic opportunities, we can reduce the reliance on high-cost lending options and help individuals achieve long-term financial stability.