Income Contingent Repayment Plan By Yelofunding

The burden of student loan debt looms large over millions of Americans, stifling economic mobility and shaping life decisions. A new player, Yelofunding, aims to reshape this landscape with its innovative Income Contingent Repayment (ICR) plan, promising a more flexible and manageable path to debt freedom. But can this alternative truly deliver on its promise, and what are the potential pitfalls for borrowers?

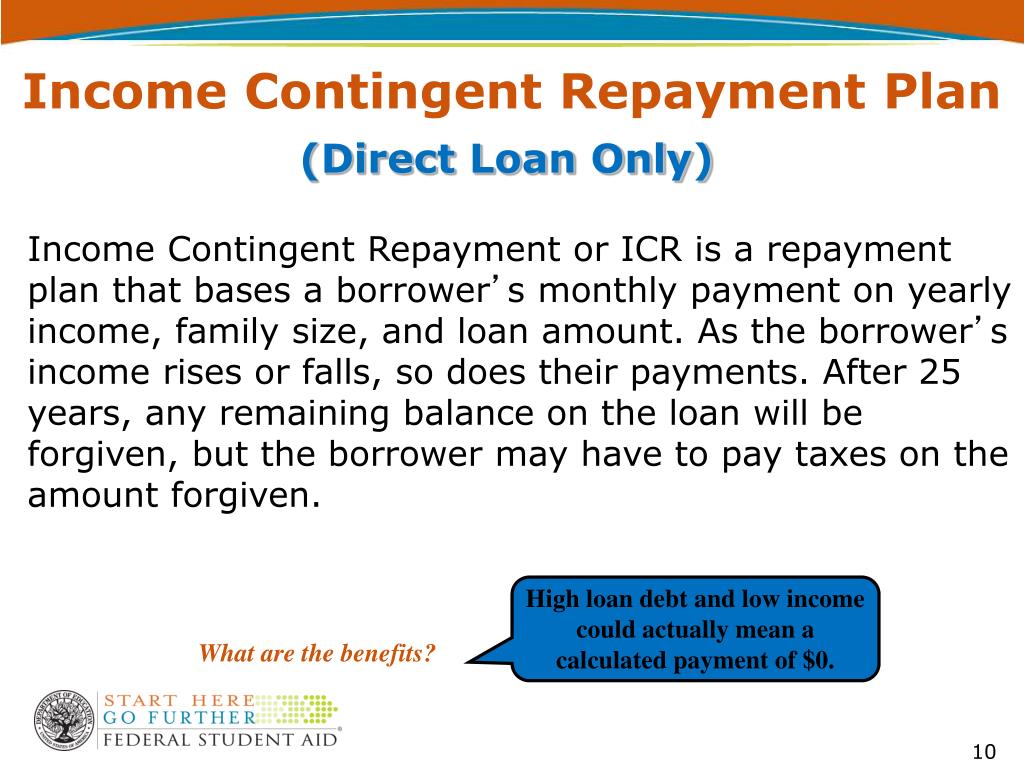

Yelofunding's ICR plan is designed to alleviate the financial strain of student loan repayment by tying monthly payments to a borrower's income and family size. The plan's core value proposition revolves around providing a safety net against financial hardship and preventing default, potentially offering loan forgiveness after a set period. Understanding the intricacies of this plan, its eligibility requirements, and its potential long-term financial implications is crucial for borrowers contemplating this alternative.

Understanding Yelofunding's ICR Plan

Yelofunding's ICR plan shares similarities with existing federal income-driven repayment plans. However, Yelofunding asserts several key differentiators. These points include more flexible income thresholds and potentially faster paths to loan forgiveness.

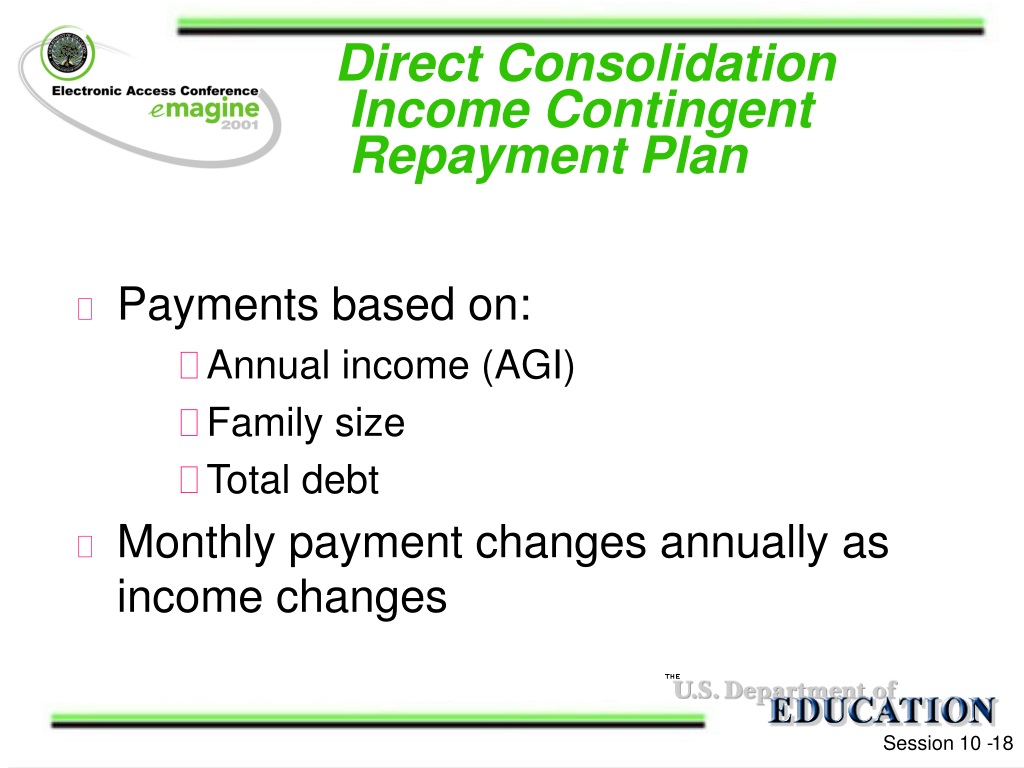

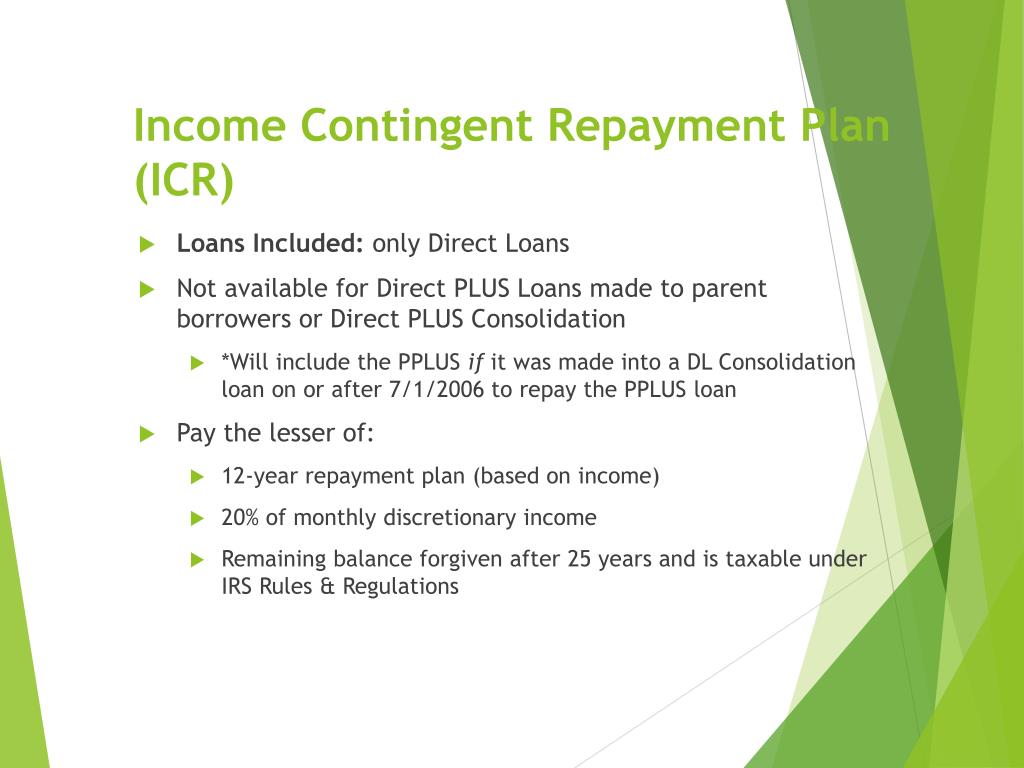

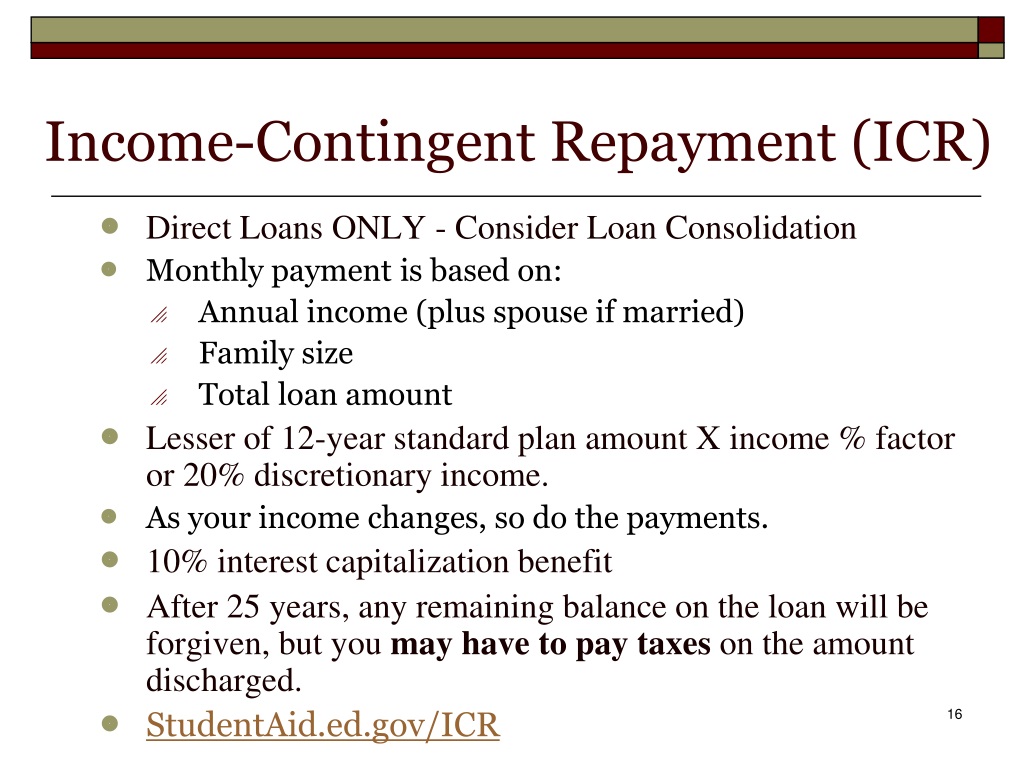

The plan typically calculates monthly payments as a percentage of discretionary income. This is defined as the difference between a borrower's annual income and a predetermined poverty level based on family size. The exact percentage varies depending on the specific terms of the loan agreement and the borrower's individual financial situation.

Eligibility for the Yelofunding ICR plan is contingent upon several factors. Borrowers must have qualifying loan types, which typically include private student loans or refinancing options through Yelofunding partners. Furthermore, they need to demonstrate a financial hardship, typically measured by the ratio of their debt payments to their income.

The Potential Benefits of Yelofunding's ICR

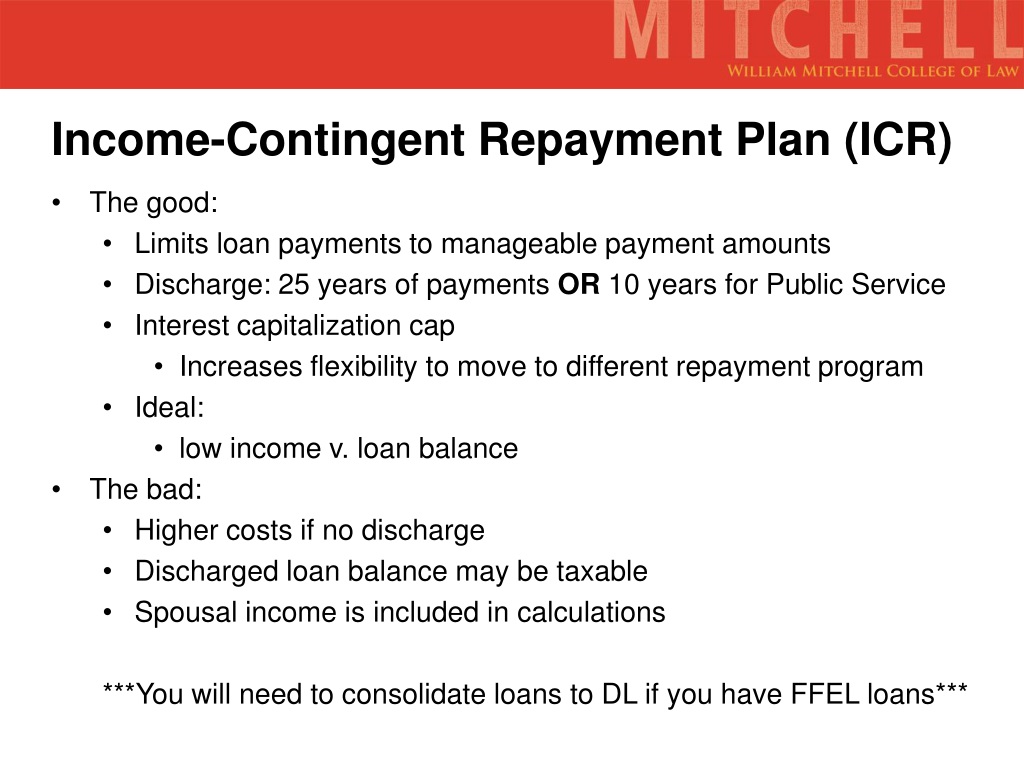

The most significant advantage of the Yelofunding ICR plan is its potential to lower monthly payments. This can provide immediate relief to borrowers struggling to make ends meet. This is especially beneficial for individuals in low-paying jobs or those experiencing temporary financial setbacks.

Another potential benefit is the possibility of loan forgiveness after a specified repayment period. This provides a light at the end of the tunnel for borrowers with large debt burdens. Specific loan forgiveness terms depend on the borrower's agreement.

By offering manageable payments aligned with income, the plan aims to prevent loan defaults. Defaulting can have devastating consequences on a borrower's credit score and overall financial health.

Potential Drawbacks and Considerations

One of the main concerns surrounding any ICR plan is the potential for accruing more interest over the life of the loan. Because monthly payments are lower, the principal balance may decrease very slowly or even increase if the payment doesn't cover the accruing interest. This effect will lead to higher overall costs.

The loan forgiveness feature, while attractive, may have tax implications. The amount of debt forgiven is often treated as taxable income by the IRS. This could potentially lead to a significant tax burden in the year the loan is forgiven.

Borrowers need to carefully evaluate the terms and conditions of the Yelofunding ICR plan. Seek independent financial advice before making a decision. Understanding the fine print is crucial to avoiding unexpected costs or complications in the future.

Comparing Yelofunding's ICR to Federal Options

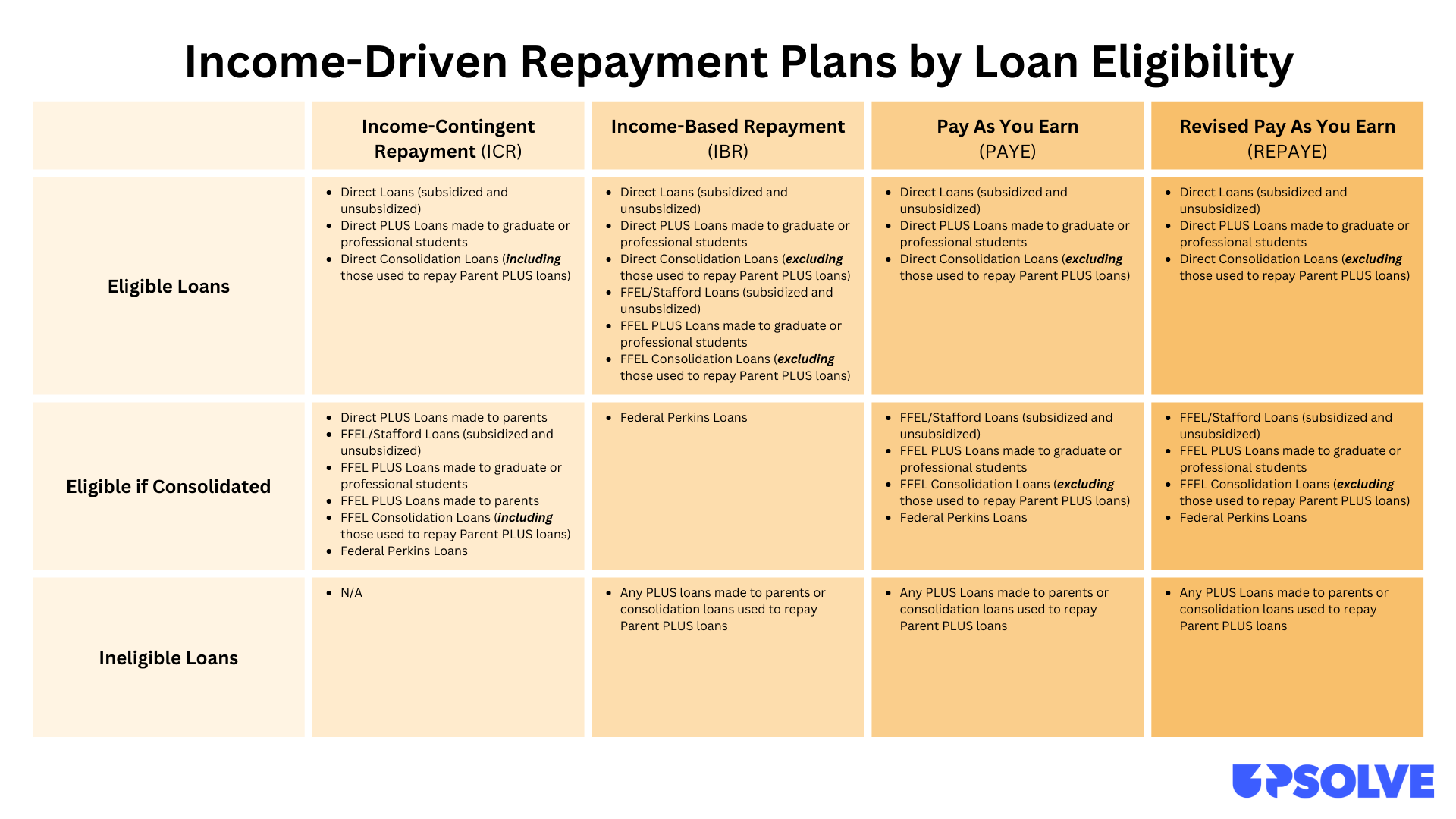

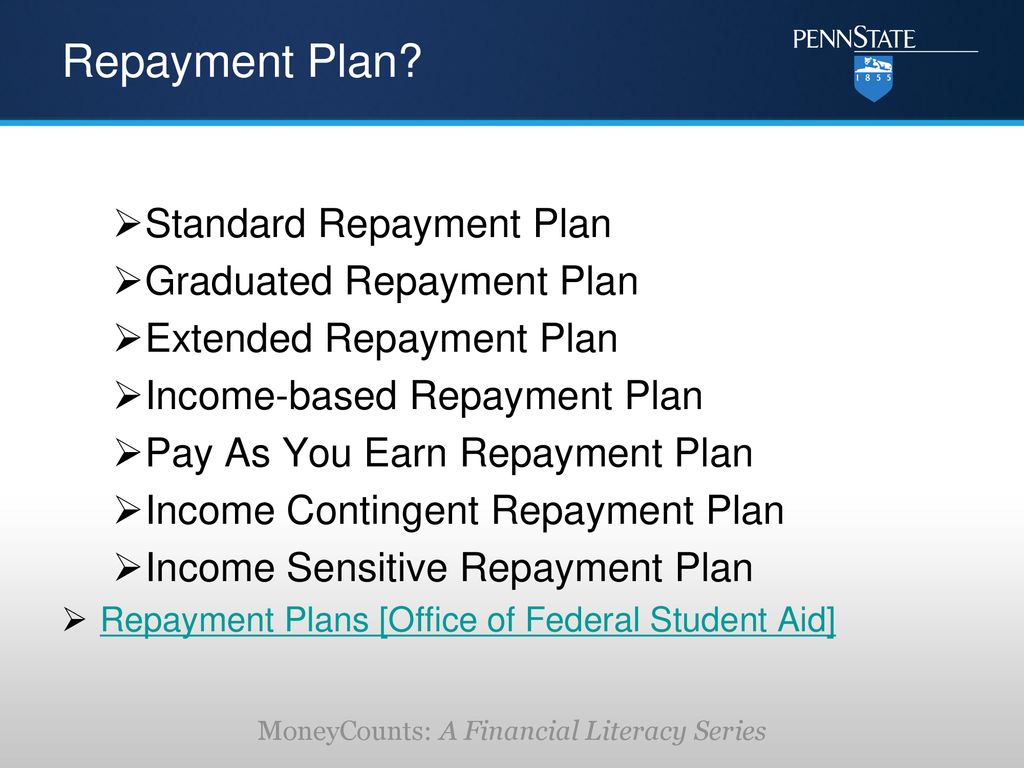

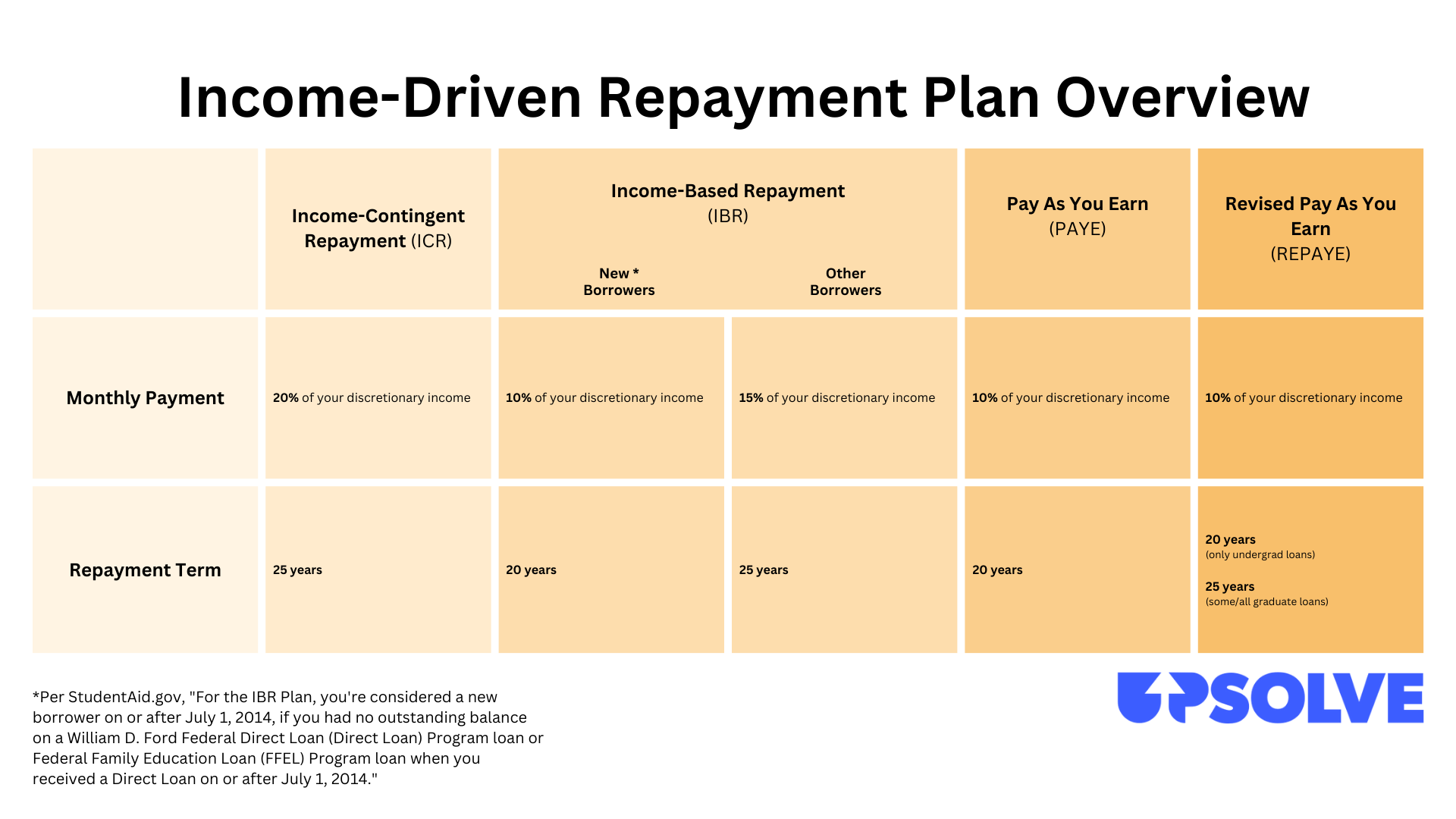

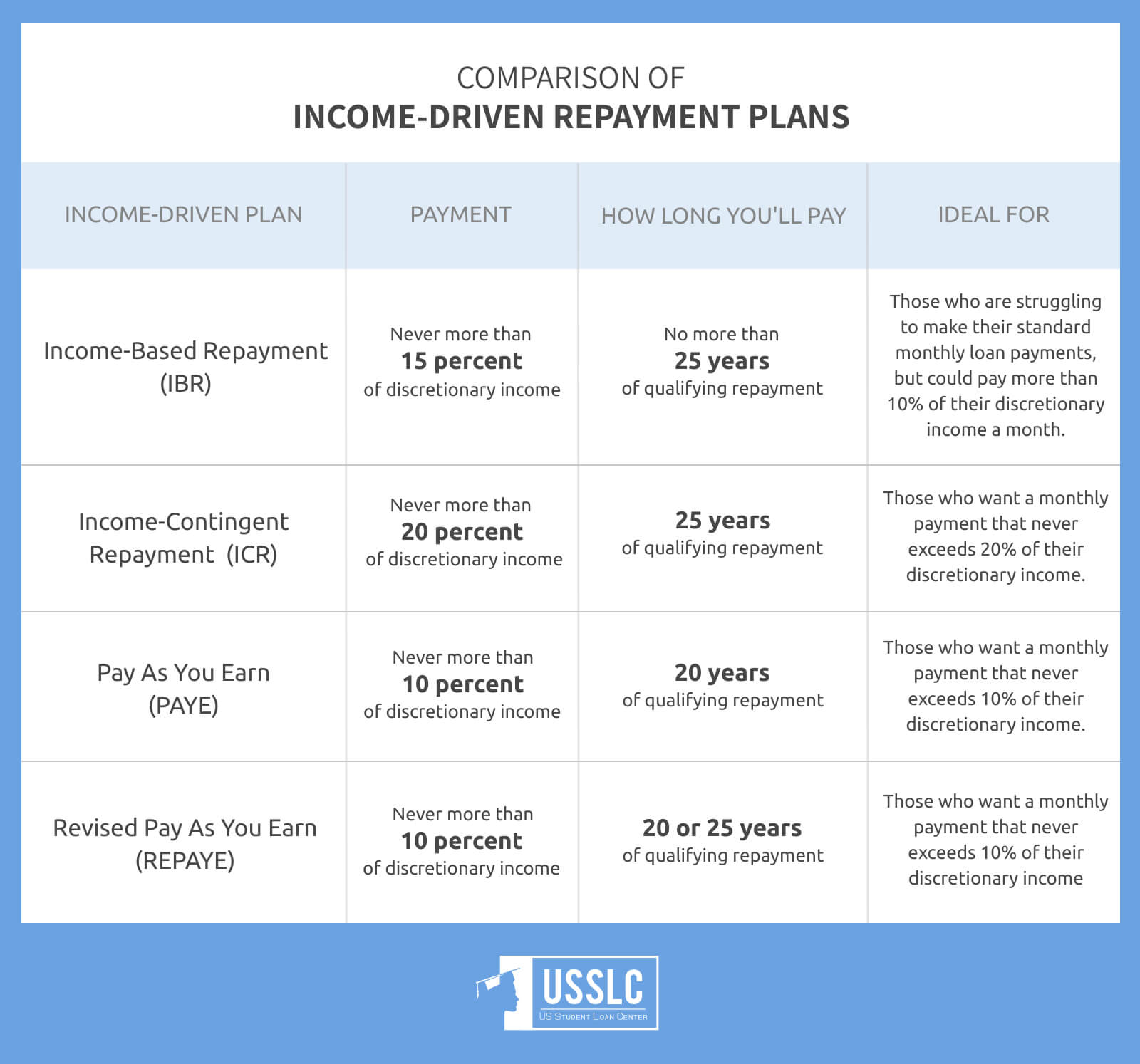

It is important to compare Yelofunding's ICR plan to existing federal income-driven repayment (IDR) plans. Federal IDR plans, such as Income-Based Repayment (IBR) and Pay As You Earn (PAYE), offer similar benefits, but with key differences.

Federal IDR plans typically have more standardized eligibility criteria. These are often based on federal poverty guidelines. They also come with fixed percentages of discretionary income that are used for payment calculations. Federal plans are generally available to borrowers with federal student loans.

One of the biggest differences is that Federal IDR plans are legally mandated and regulated by the government. This adds a layer of security that may not be present with private ICR plans like Yelofunding's.

According to the Department of Education, millions of borrowers are currently enrolled in federal IDR plans. These programs have played a significant role in helping borrowers manage their debt, stated a senior official in a recent press conference.

Expert Perspectives

"Income-driven repayment plans can be a valuable tool for borrowers facing financial hardship," says Dr. Emily Carter, a financial aid expert at the Higher Education Research Institute. "However, it's crucial to understand the long-term cost implications and to carefully compare all available options."

Some consumer advocacy groups have expressed caution about private ICR plans. They are concerned about the lack of regulatory oversight and the potential for hidden fees. "Borrowers should thoroughly research any private student loan repayment option before enrolling," warns Sarah Johnson of the National Consumer Law Center.

A spokesperson for Yelofunding stated, "Our ICR plan is designed to provide a more flexible and personalized approach to student loan repayment. We are committed to transparency and ensuring that borrowers have all the information they need to make informed decisions."

The Future of Student Loan Repayment

Yelofunding's ICR plan represents a growing trend towards innovative solutions in the student loan market. As the national student loan debt continues to climb, there is increasing pressure on policymakers and private companies to find ways to make repayment more manageable.

The emergence of alternative repayment options, like Yelofunding's ICR, underscores the need for borrowers to carefully evaluate their individual circumstances. They must compare various repayment strategies to determine the most suitable path to financial freedom.

While these innovative programs offer potential benefits, borrowers must approach them with caution, conducting thorough due diligence and seeking expert financial advice. The landscape of student loan repayment is evolving, and informed decision-making is key to navigating it successfully.

.jpg)

.jpg)

+Plan.jpg)