Inexpensive Small Business Accounting Software

For small business owners, every penny counts. Navigating the complexities of financial management can be daunting, and often expensive. However, the rise of inexpensive accounting software is leveling the playing field, offering powerful tools without breaking the bank.

This article delves into the world of budget-friendly accounting software for small businesses, examining their features, benefits, and potential drawbacks. It will also explore how these solutions are empowering entrepreneurs to take control of their finances and drive growth.

The Rise of Affordable Accounting Solutions

Traditionally, robust accounting software came with a hefty price tag, often reserved for larger enterprises. Cloud-based technology and increased competition have dramatically changed the landscape, leading to a surge in affordable options tailored for small businesses.

These solutions often operate on a subscription model, eliminating the need for large upfront investments. Many offer scalable plans, allowing businesses to pay only for the features they need.

Key Features and Benefits

Inexpensive accounting software typically offers a range of essential features. These include invoicing, expense tracking, bank reconciliation, and basic financial reporting. Automated processes are a key benefit, saving business owners time and reducing the risk of errors.

According to a recent survey by Gusto, small businesses that utilize accounting software experience a 20% improvement in cash flow management. Furthermore, these tools provide real-time insights into financial performance, enabling data-driven decision-making.

The accessibility of cloud-based software is another significant advantage. Owners can manage their finances from anywhere with an internet connection.

Popular Inexpensive Options

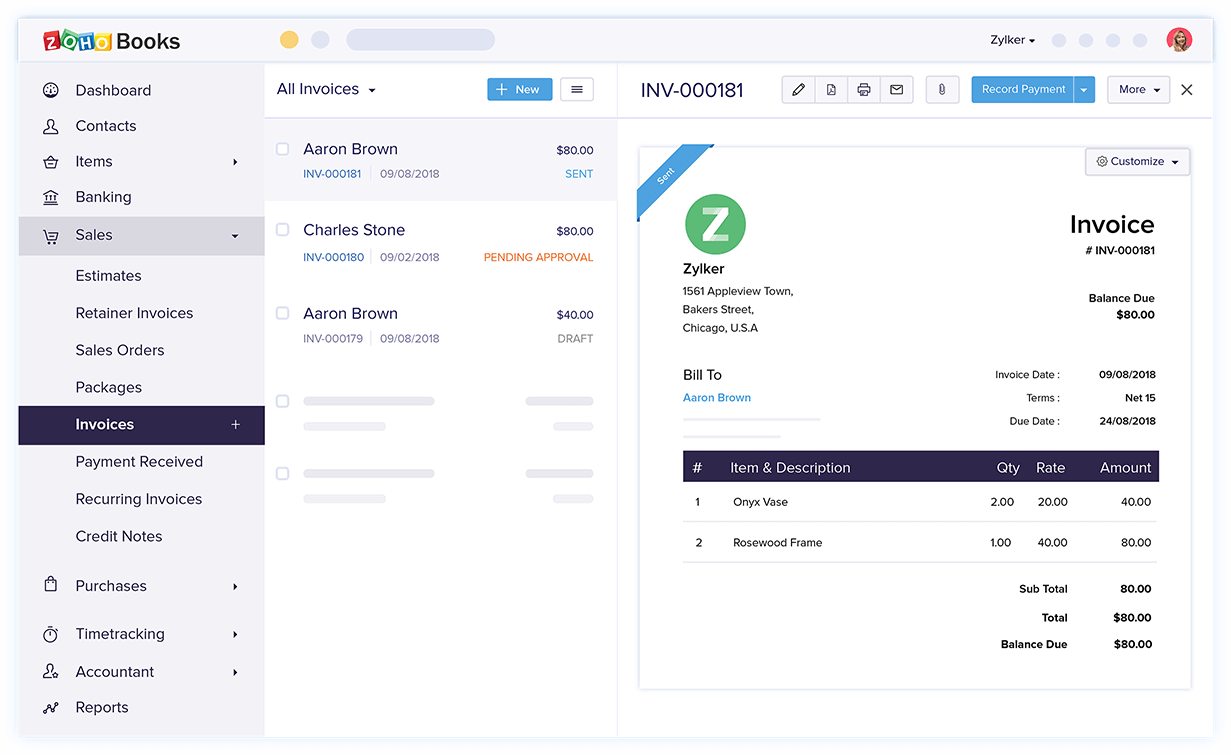

Several software providers have emerged as leaders in the affordable accounting space. These include companies like Zoho Books, Wave Accounting, and QuickBooks Self-Employed, each offering a unique blend of features and pricing.

Zoho Books is known for its comprehensive features and integration with other Zoho products. Wave Accounting stands out as a completely free option for basic accounting needs. QuickBooks Self-Employed is tailored to freelancers and independent contractors.

Choosing the right software depends on the specific needs of the business. Factors to consider include the size of the business, the complexity of its financial transactions, and the level of accounting expertise.

Potential Drawbacks and Considerations

While inexpensive accounting software offers numerous advantages, it's important to be aware of potential limitations. Some free or low-cost options may have restricted features or transaction limits.

Scalability can also be a concern. As a business grows, it may eventually outgrow the capabilities of its initial software choice.

Customer support may be limited with some providers. It's essential to research and read reviews to ensure adequate support is available when needed.

"Small business owners should carefully evaluate their needs and compare different software options before making a decision," says Sarah Johnson, a CPA specializing in small business accounting. "A free trial or demo is highly recommended."

The Future of Small Business Accounting

The trend towards affordable and accessible accounting software is expected to continue. Artificial intelligence (AI) and machine learning are poised to play an increasingly important role. This can automate tasks and provide more sophisticated insights.

Integration with other business tools, such as e-commerce platforms and CRM systems, will become even more seamless. This will creating a unified ecosystem for managing all aspects of the business.

Increased competition among software providers will likely drive further innovation and price reductions. This is making these essential tools even more accessible to small businesses.

By embracing inexpensive accounting software, small business owners can gain a competitive edge. They can also streamline their financial management, and ultimately achieve greater success.