Instant $500 Loan No Credit Check

A new wave of lenders are offering instant $500 loans with no credit check, promising quick access to funds for those in urgent need. These offers are rapidly gaining traction, but also sparking concerns about potential risks and long-term financial implications.

The Rise of No-Credit-Check Loans

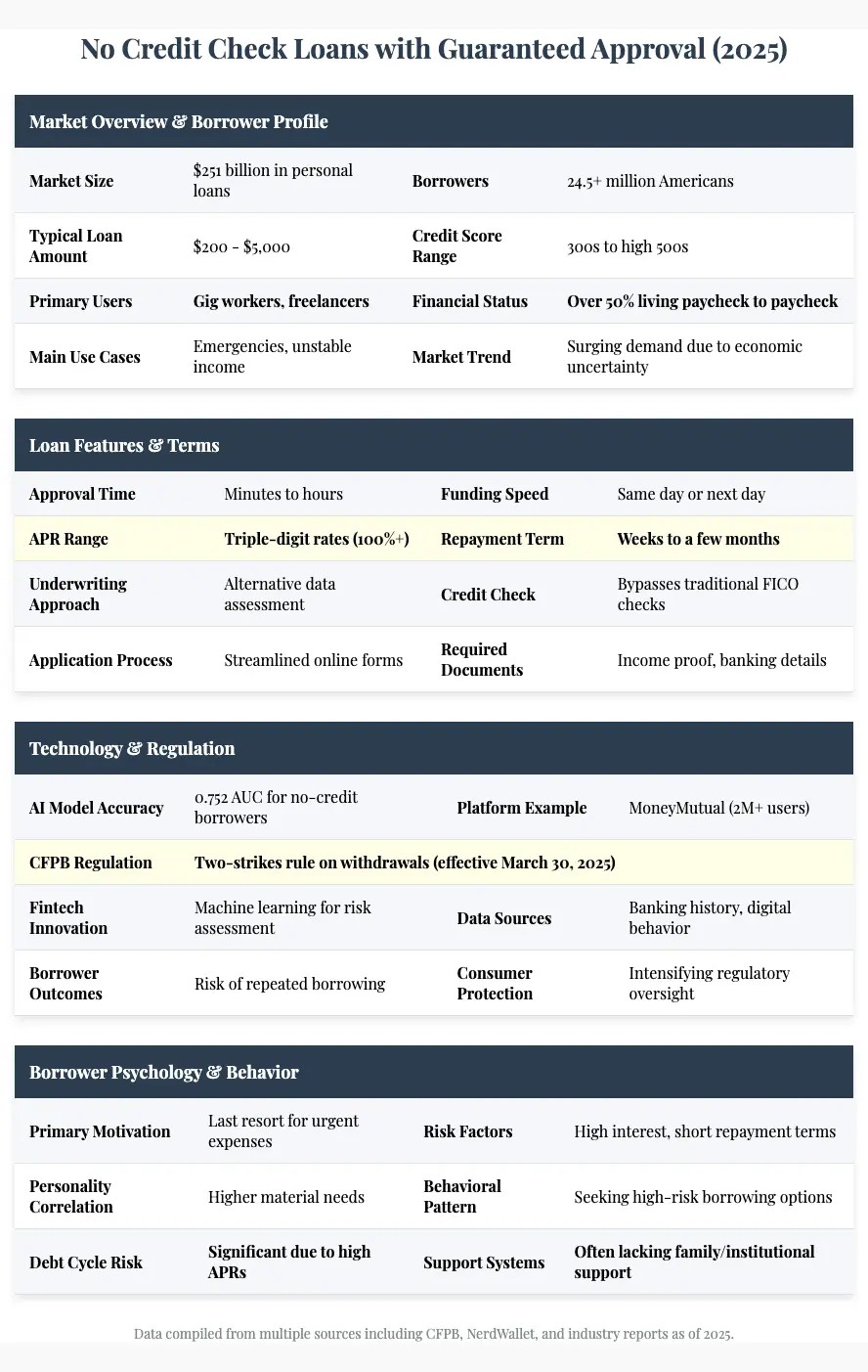

These loans target individuals with low or no credit scores, offering immediate financial assistance without the traditional hurdles of credit assessments.

This accessibility is particularly appealing in emergency situations where time is of the essence.

The rapid growth of these services raises questions about their ethical implications and the potential for predatory lending practices.

What's Being Offered?

The central offering is a $500 loan, disbursed almost instantaneously upon approval.

The key selling point is the absence of a credit check, making it an attractive option for those with damaged or non-existent credit histories.

Repayment terms vary, but many providers require repayment within a short timeframe, often weeks, accompanied by significant interest rates or fees.

Who Are the Providers?

Numerous online lenders are now entering the market, offering these no-credit-check loans.

Companies like Speedy Cash and Check Into Cash, already known for payday loans, are expanding their services to include instant, small-dollar loans.

Several new fintech startups are also emerging, leveraging technology to streamline the application and disbursement processes.

The Process: How It Works

The application process is typically conducted entirely online, requiring minimal documentation.

Applicants usually need to provide basic personal information, proof of income (such as a bank statement or pay stub), and a valid bank account.

Upon approval, the $500 is directly deposited into the applicant's bank account, often within minutes.

Potential Benefits and Risks

The primary benefit is the speed and accessibility of funds, particularly in emergencies.

However, the high interest rates and fees can quickly lead to a debt cycle if borrowers are unable to repay on time.

Consumer advocacy groups warn that these loans can be particularly damaging for vulnerable individuals already struggling with financial instability.

Regulatory Landscape

The regulatory landscape surrounding these no-credit-check loans is evolving.

Some states have stricter regulations on payday lending and small-dollar loans, while others have more lenient frameworks.

The Consumer Financial Protection Bureau (CFPB) is currently reviewing these lending practices to ensure fair and transparent operations.

Impact on Consumers

For some, these loans provide a crucial safety net in times of unexpected expenses.

For others, they become a source of long-term financial strain due to the high cost of borrowing.

The ease of access can also lead to impulsive borrowing, further exacerbating financial difficulties.

Expert Opinions

Financial advisors caution against relying on no-credit-check loans as a long-term solution.

They recommend exploring alternative options such as credit counseling, community resources, or negotiating payment plans with creditors.

"While these loans may seem appealing in a pinch, the long-term costs often outweigh the immediate benefits," warns Jane Doe, a certified financial planner.

Ongoing Developments

Legislators are considering new regulations to protect consumers from predatory lending practices associated with these loans.

The CFPB is expected to release updated guidelines on small-dollar lending in the coming months.

Consumers should carefully research and compare loan options before committing to a no-credit-check loan.

Individuals considering these loans should thoroughly understand the terms and conditions, including the interest rates, fees, and repayment schedule.

They should also assess their ability to repay the loan on time to avoid incurring additional charges and damaging their financial standing.

Always explore alternative financial solutions before resorting to high-cost, no-credit-check loans.