Interest Rate With A 600 Credit Score

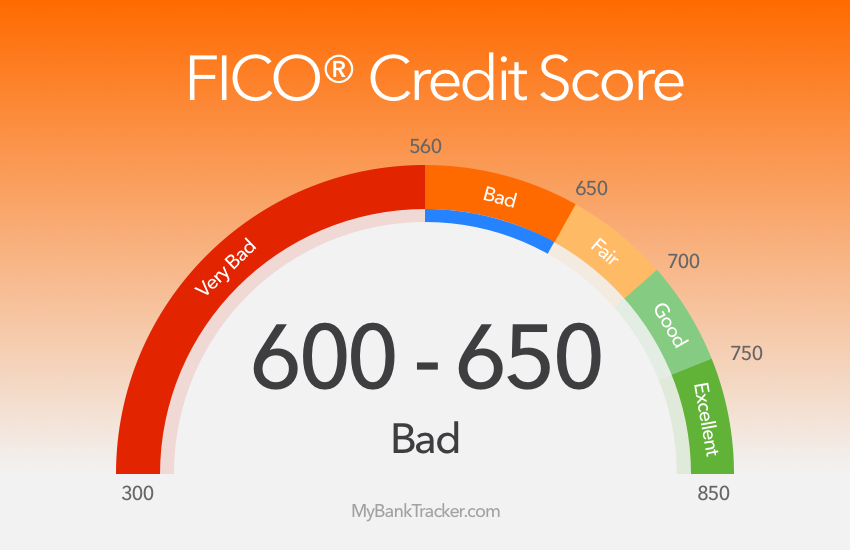

For many Americans, the dream of homeownership or financing a car hinges on a single, often elusive number: their credit score. A score of 600, while not considered "bad," places borrowers in a challenging position when navigating the world of interest rates.

This article explores the landscape of interest rates available to individuals with a 600 credit score, delving into the specifics of auto loans, mortgages, and personal loans.

Understanding the Landscape

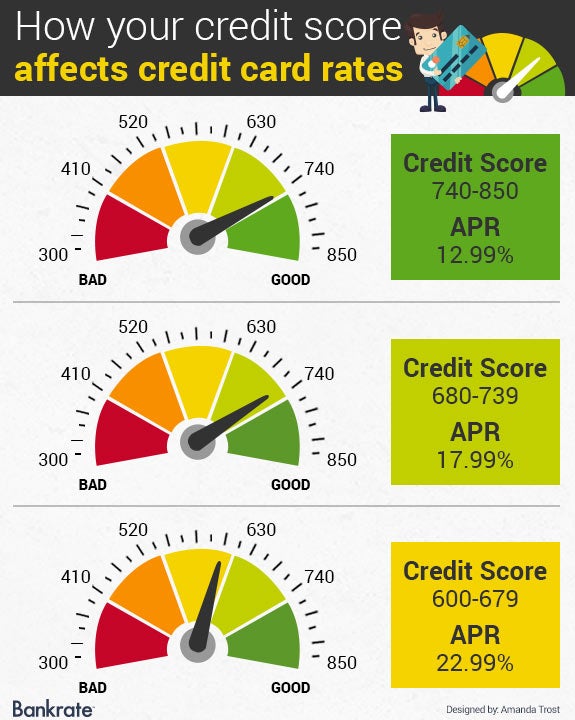

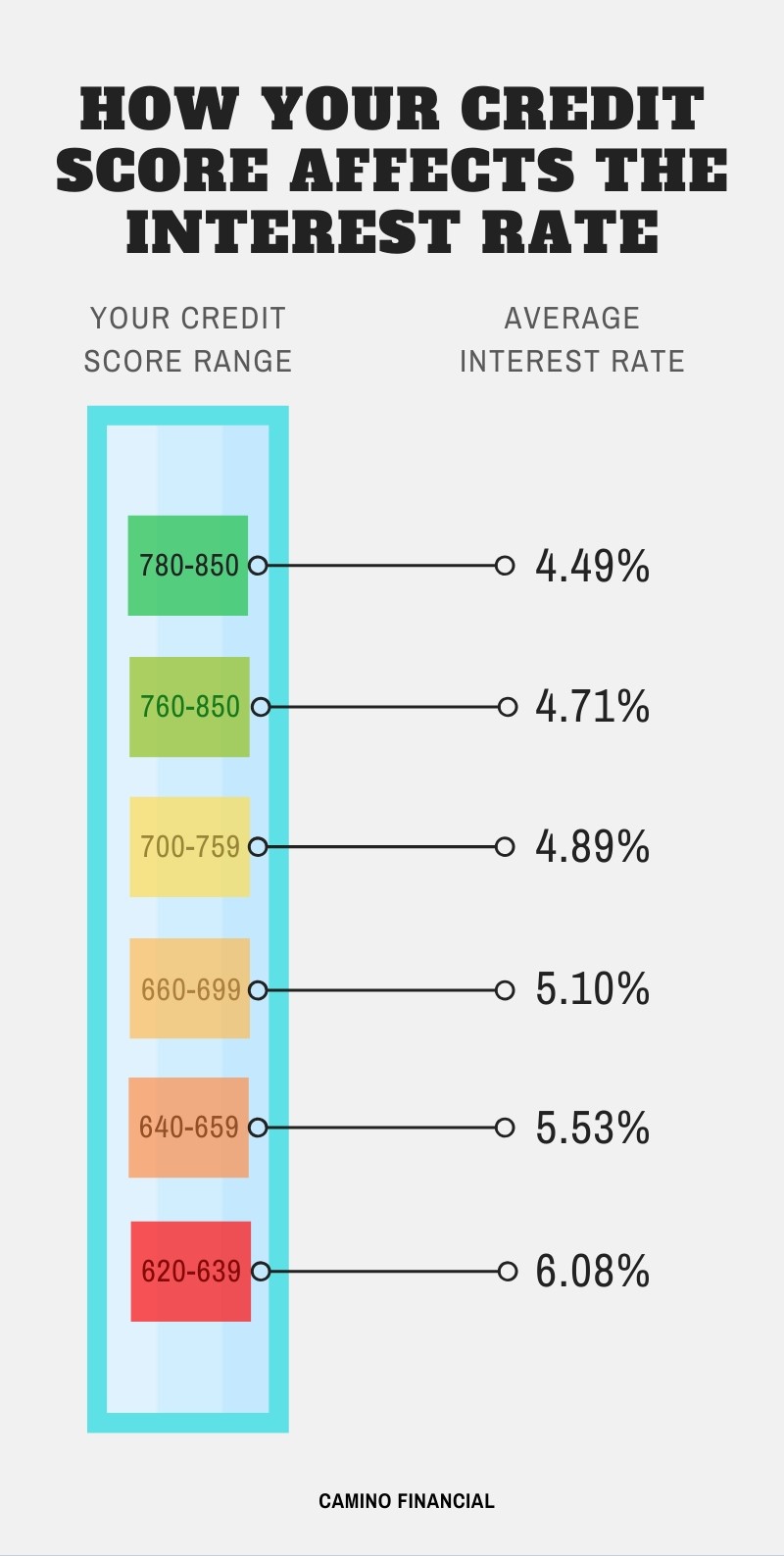

A 600 credit score typically falls within the "fair" credit range. This designation means lenders perceive borrowers with this score as having a higher risk of default compared to those with excellent credit.

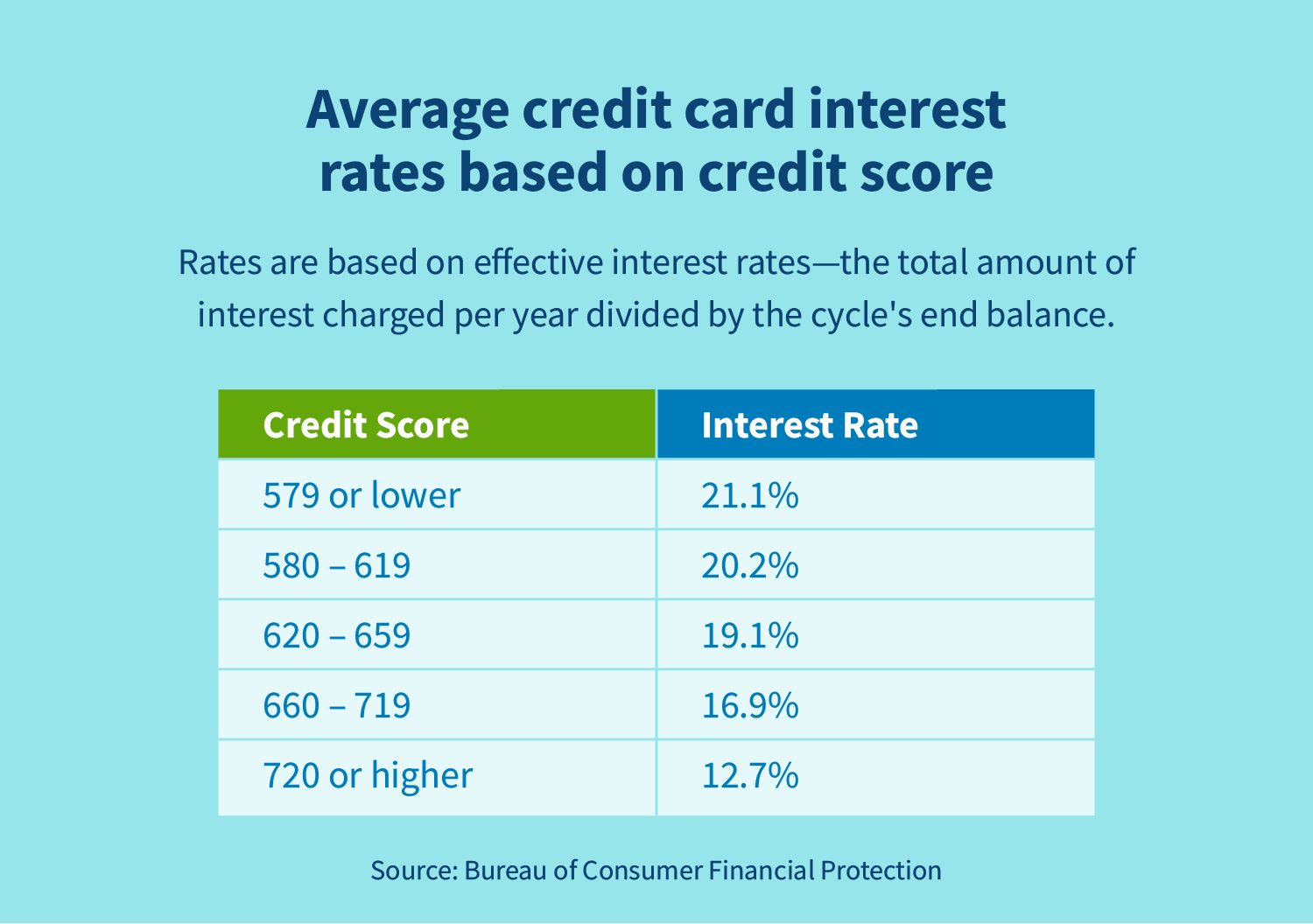

Consequently, individuals with a 600 credit score can expect to face higher interest rates than those with better scores.

Auto Loans

According to data from Experian, the average interest rate for a new car loan in the fourth quarter of 2023 was significantly higher for borrowers with a 600 credit score compared to those with prime credit.

Borrowers with a 600 score could anticipate rates upwards of 10%, while those with scores above 720 enjoyed rates in the 6-7% range. The difference can translate to thousands of dollars over the life of the loan.

Used car loan rates are even more disparate, potentially reaching 15% or higher for a 600 credit score.

Mortgages

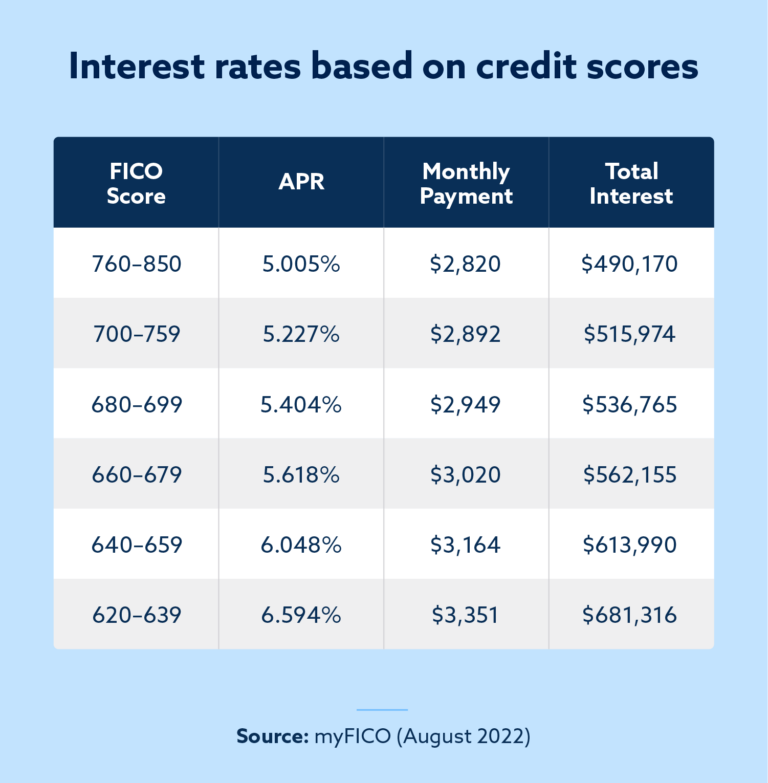

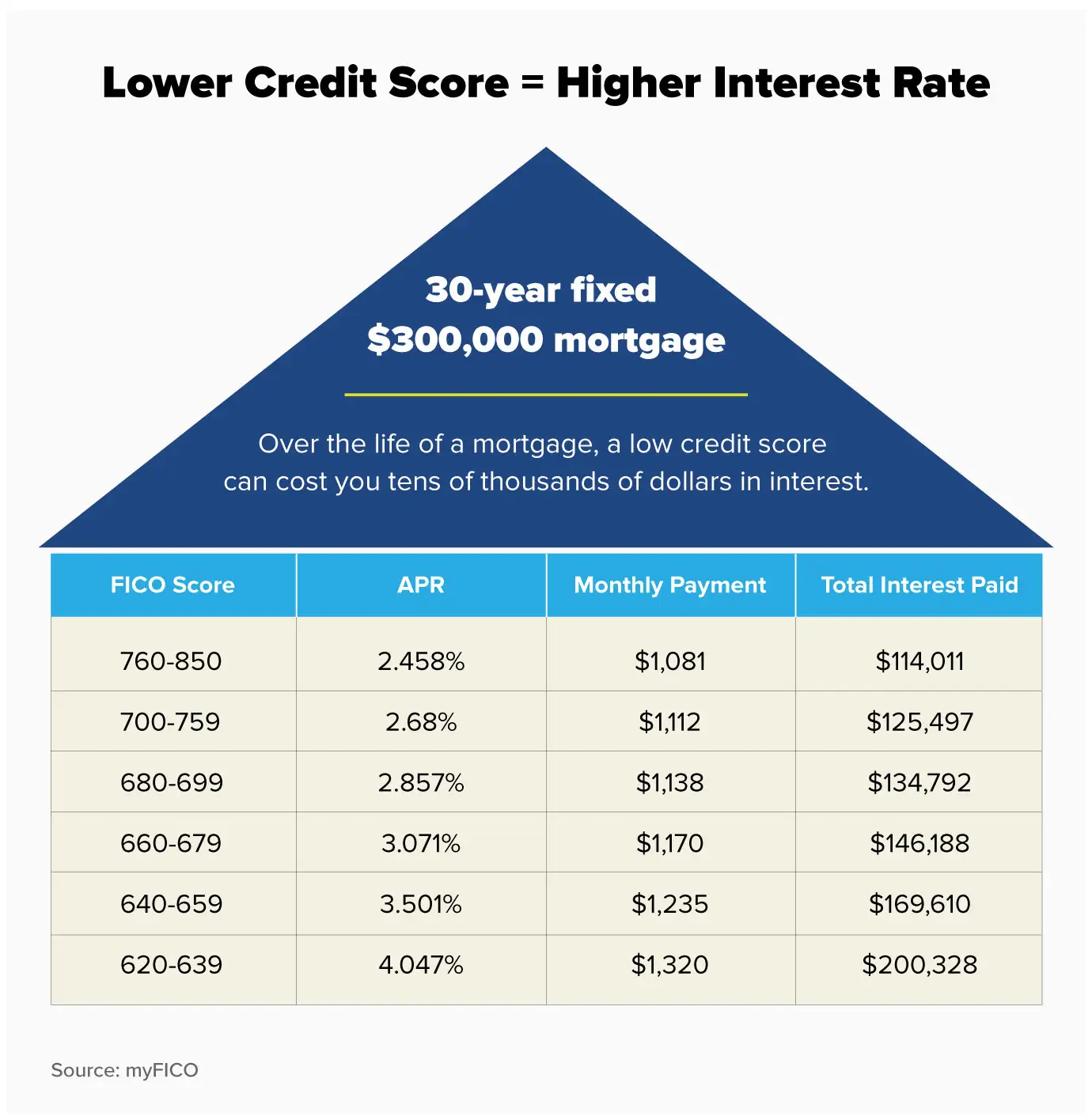

Securing a mortgage with a 600 credit score presents its own set of hurdles. While Federal Housing Administration (FHA) loans can be an option, they often come with higher interest rates and mortgage insurance premiums.

According to Freddie Mac, the average 30-year fixed-rate mortgage hovered around 7% in early 2024. Borrowers with a 600 credit score might encounter rates closer to 8% or higher, substantially increasing monthly payments and the overall cost of the home.

It's important to shop around and compare offers from multiple lenders, as interest rates can vary considerably.

Personal Loans

Personal loans, often used for debt consolidation or unexpected expenses, also reflect the higher risk associated with a 600 credit score. Rates can range from 15% to 30% or even higher, depending on the lender and the borrower's overall financial profile.

Caution is advised when considering short-term loans or payday loans, as these typically carry exorbitant interest rates and fees, potentially leading to a cycle of debt.

Factors Influencing Interest Rates

Several factors beyond the credit score influence the interest rate offered to a borrower. These include the loan term, the loan amount, and the borrower's debt-to-income ratio.

Lenders also consider the stability of the borrower's employment and their overall credit history. A larger down payment on a car or home can sometimes offset the risk associated with a lower credit score, potentially leading to a slightly lower interest rate.

Improving Your Credit Score

For individuals with a 600 credit score, the best strategy is to focus on improving their creditworthiness.

"This involves paying bills on time, reducing credit card debt, and avoiding new credit applications,"advises credit.org, a non-profit credit counseling agency.

Reviewing credit reports for errors and disputing any inaccuracies can also lead to an improvement in the credit score.

Even small increases in the credit score can translate to significant savings on interest rates over time.

The Human Cost

The impact of higher interest rates extends beyond just the financial burden. It can delay important life milestones, limit access to affordable housing, and create significant stress for individuals and families.

For example, Sarah M., a single mother working two jobs, struggled to secure a decent car loan with her 600 credit score. "The high interest rates meant I could barely afford the monthly payments," she shared.

"I felt trapped because I needed a reliable car to get to work."

Conclusion

Navigating the world of interest rates with a 600 credit score requires diligence, research, and a commitment to improving creditworthiness. While higher rates are a reality, understanding the available options and actively working to improve one's credit score can lead to more favorable financial outcomes.

Seeking advice from a qualified financial advisor or credit counselor can provide valuable guidance and support in achieving long-term financial stability.

:max_bytes(150000):strip_icc()/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png)