Intraday Trend And Target Calculator

Imagine staring at a fluctuating stock chart, the green and red candles dancing like fireflies in a digital meadow. The rhythm seems chaotic, yet within that chaos, seasoned traders believe, lie patterns, whispers of impending price movements. Deciphering these whispers, however, can feel like an impossible task, a pursuit reserved for the mathematically gifted or those with years of market experience. But what if there was a tool that could help level the playing field, bringing clarity to the seeming randomness of the market?

The Intraday Trend and Target Calculator is emerging as a significant tool for traders navigating the fast-paced world of intraday trading. This calculator helps users estimate potential trends and price targets within a single trading day, offering a data-driven approach to short-term market analysis. By automating complex calculations, it empowers both novice and experienced traders to make more informed decisions.

The Genesis of Data-Driven Trading

The quest to predict market movements is as old as the markets themselves. Traditional technical analysis often relies on subjective interpretations of chart patterns and indicators. However, the rise of computational power and readily available market data has fueled the development of quantitative tools that offer a more objective perspective.

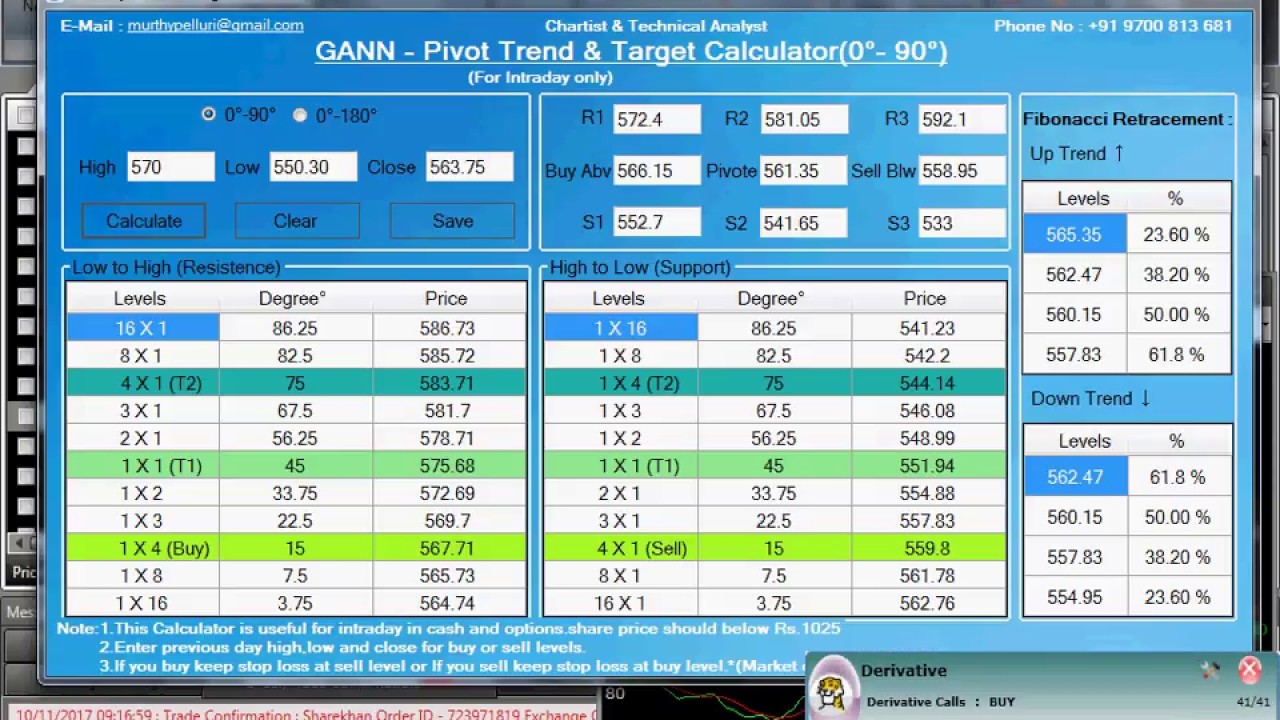

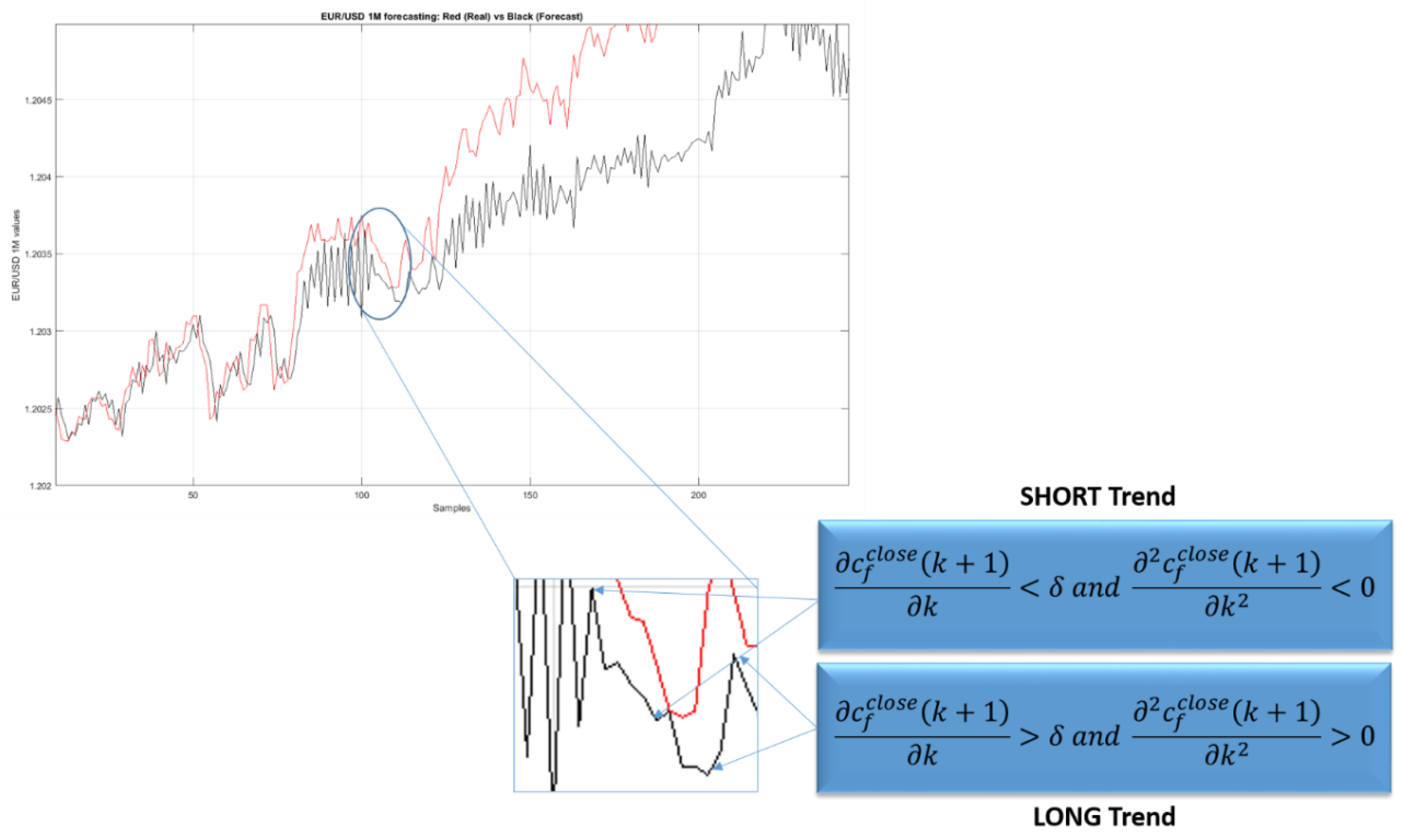

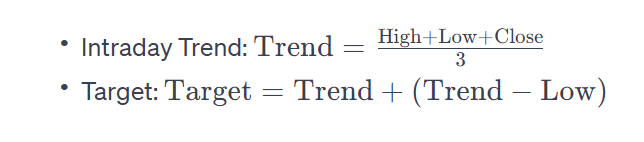

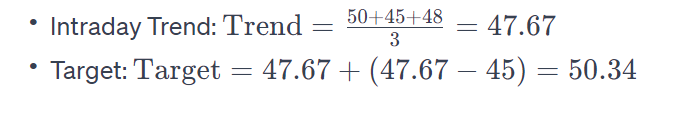

The Intraday Trend and Target Calculator represents a step in this direction. It utilizes mathematical formulas, often based on concepts like pivot points, Fibonacci retracements, and moving averages, to project potential support and resistance levels. These levels, in turn, can serve as potential entry and exit points for trades.

How It Works: A Simplified Overview

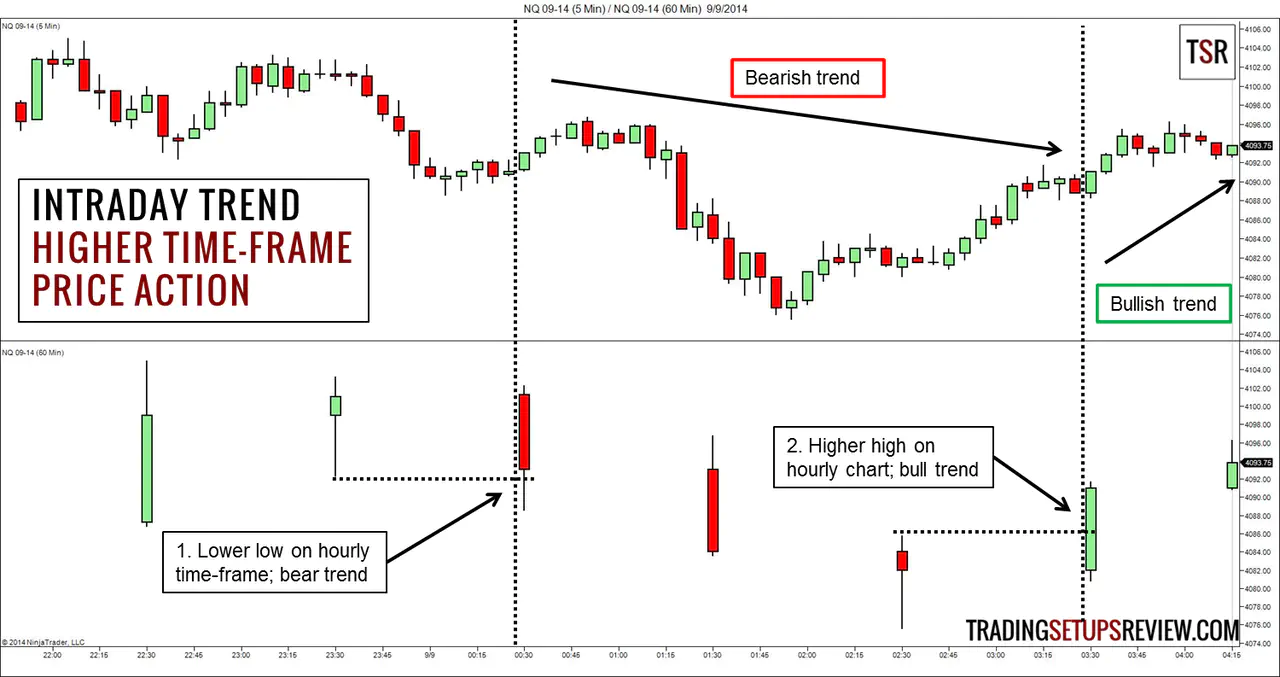

The calculator typically requires users to input specific data points, such as the previous day's high, low, and closing prices. Based on these inputs, the calculator automatically generates potential trend directions (upward or downward) and corresponding price targets. These targets provide a range within which the price is expected to move during the current trading day.

Many calculators also incorporate different timeframes. This means a trader can analyze trends and targets not only for the current day, but also for shorter periods within the day, such as hourly or even 15-minute intervals.

Important Note: It's essential to remember that the Intraday Trend and Target Calculator is a tool, not a crystal ball. Market behavior is inherently unpredictable, and no calculator can guarantee profits. Responsible usage involves understanding the underlying principles of the calculations, applying sound risk management techniques, and considering the calculator's output alongside other forms of market analysis.

Beyond the Numbers: Integrating with Trading Strategies

The true value of the calculator lies in its ability to augment existing trading strategies. For example, a trader who primarily uses candlestick patterns might use the calculator to confirm potential reversal signals or identify optimal profit-taking levels.

Furthermore, the calculator can be particularly useful for setting stop-loss orders. By identifying key support and resistance levels, traders can strategically place stop-loss orders to limit potential losses if the market moves against their position.

Consider the views of financial analyst, Sarah Chen: "Tools like the Intraday Trend and Target Calculator offer a valuable starting point for traders. They should be combined with other analysis methods, and always used with a strong understanding of market risk. Over-reliance on any single tool can lead to suboptimal decision-making."

The Democratization of Trading?

Perhaps the most significant impact of tools like the Intraday Trend and Target Calculator is their potential to democratize trading. By making sophisticated calculations accessible to a wider audience, these calculators lower the barrier to entry for individuals who may not have formal financial training.

“Making complex calculations available to anyone is a great step forward,” says financial consultant Michael Davies.

While experience and skill still play a crucial role in successful trading, these tools can provide a valuable framework for beginners to learn and develop their own strategies.

Ultimately, the Intraday Trend and Target Calculator represents a fascinating intersection of technology and finance. It is a reminder that the world of trading is constantly evolving, and that embracing data-driven approaches can potentially lead to more informed and strategic decision-making. The future of trading might very well be one where human intuition and algorithmic precision work hand in hand to navigate the complexities of the market.