Is A Negative Operating Cash Flow Concerning

Alarm bells are ringing as a growing number of companies report negative operating cash flow. This critical financial metric, indicating a company is spending more cash than it's generating from its core business, is raising concerns about long-term sustainability and potential liquidity crises.

Negative operating cash flow isn't always a death knell, especially for rapidly growing companies or those making substantial upfront investments. However, sustained negative cash flow demands immediate scrutiny, potentially signaling deeper problems within the business model.

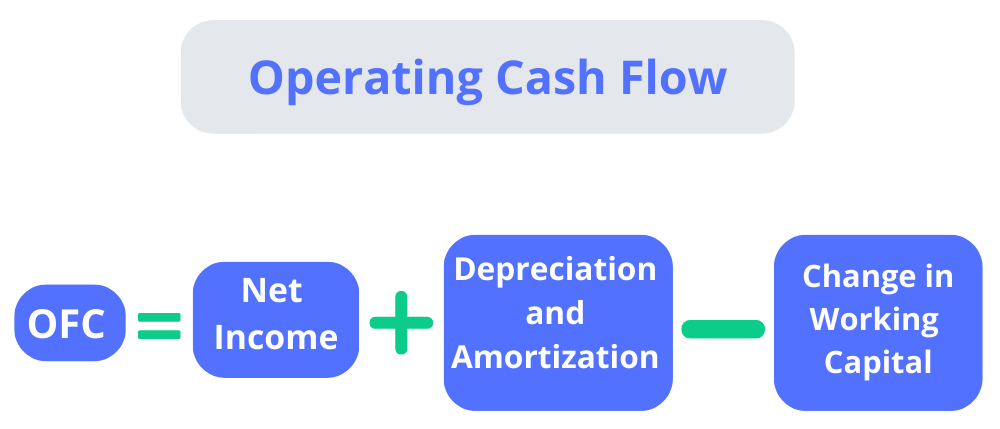

What is Operating Cash Flow?

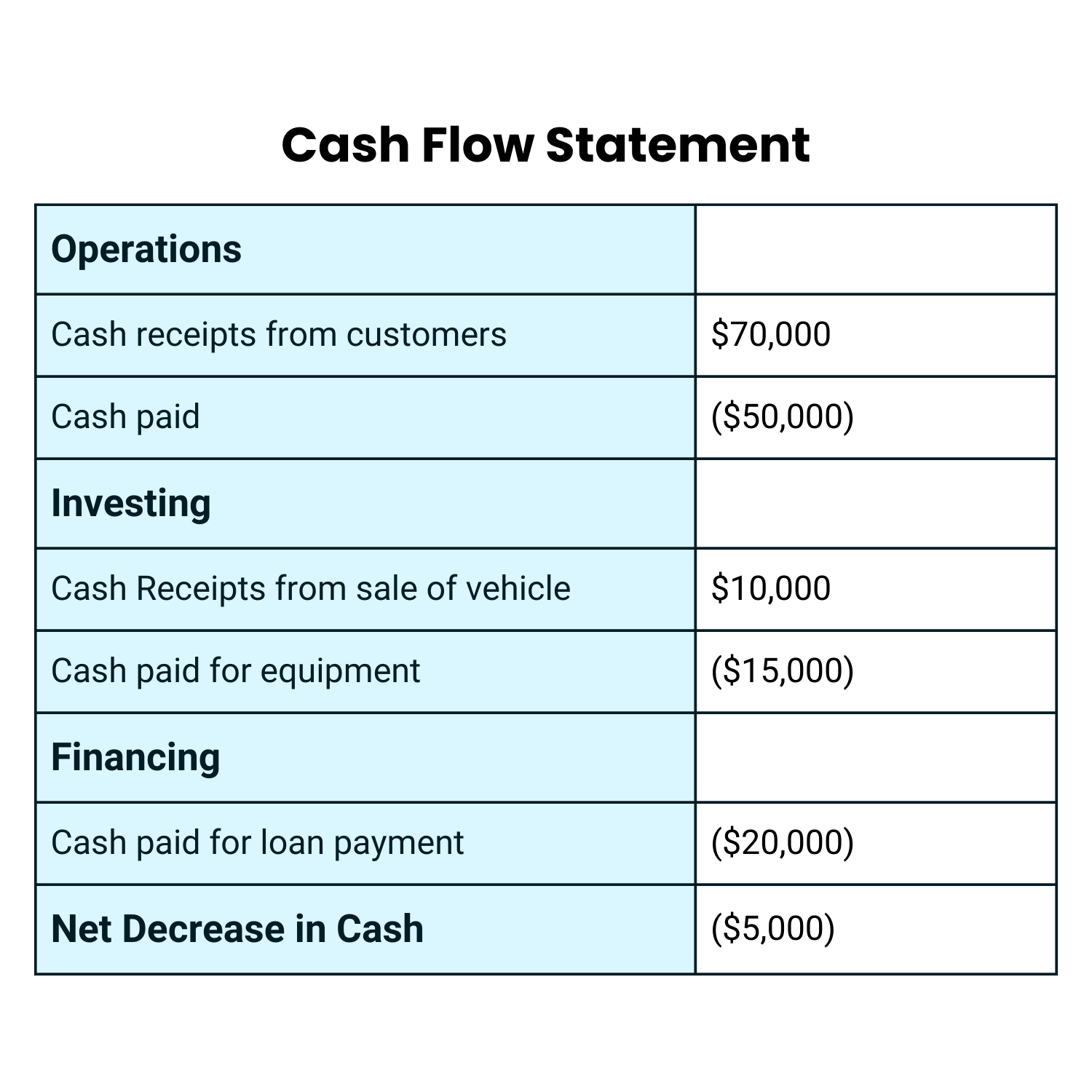

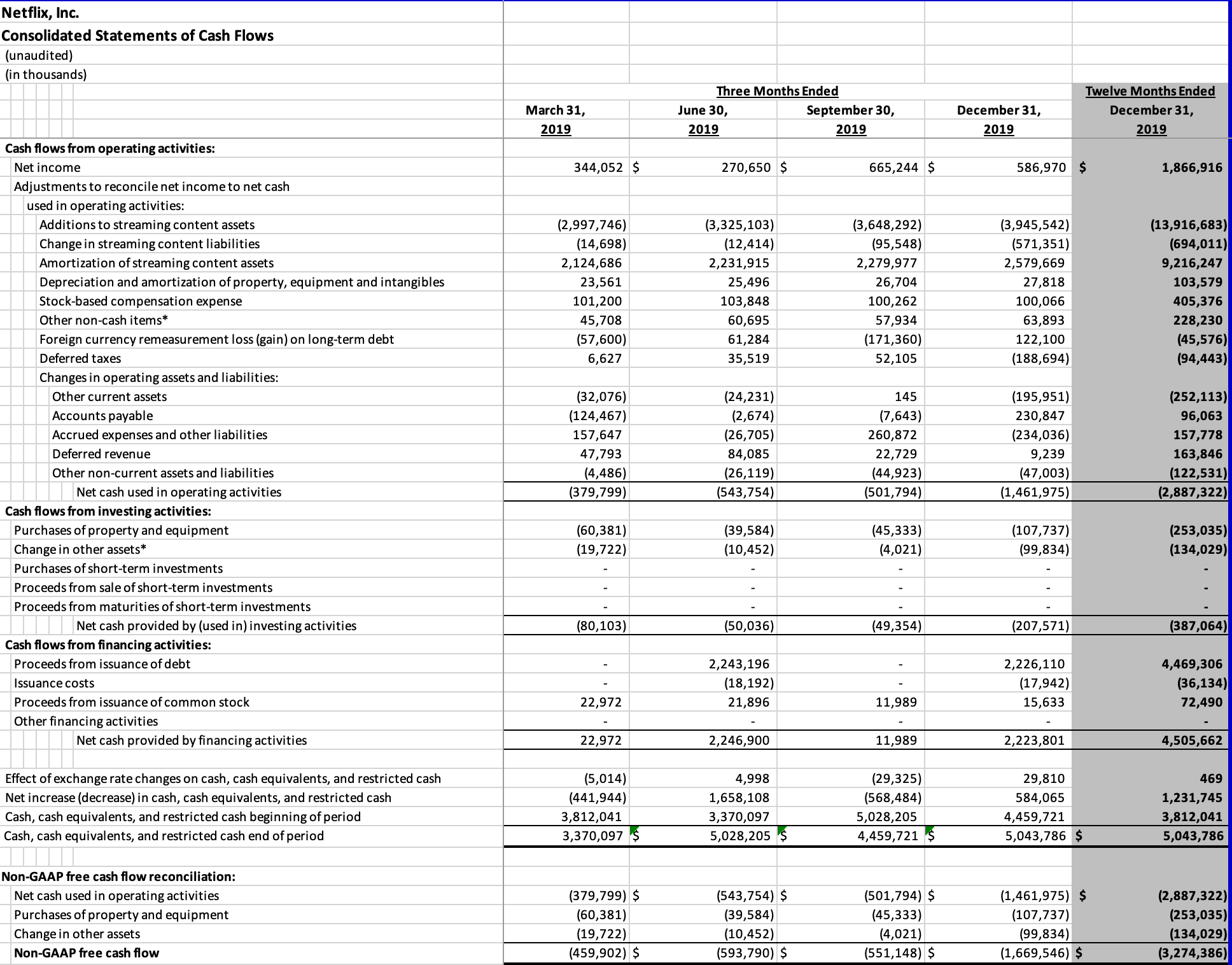

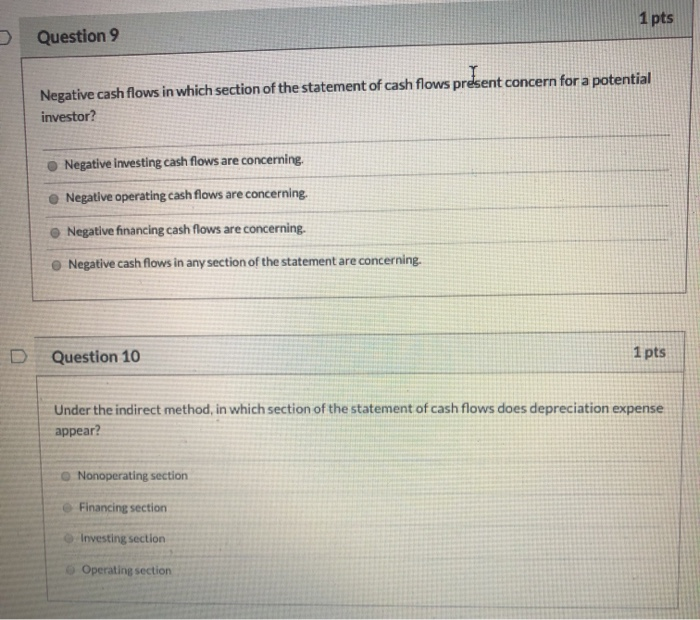

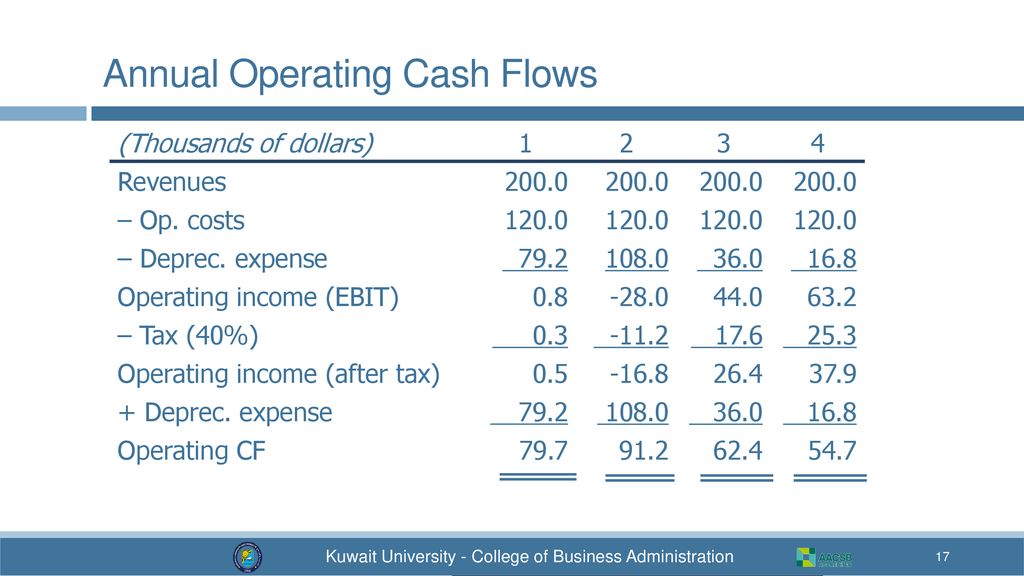

Operating cash flow (OCF) reflects the cash a company generates from its regular business activities. It's calculated by adjusting net income for non-cash items like depreciation and changes in working capital, providing a clearer picture of the company's ability to fund its operations.

The Red Flags

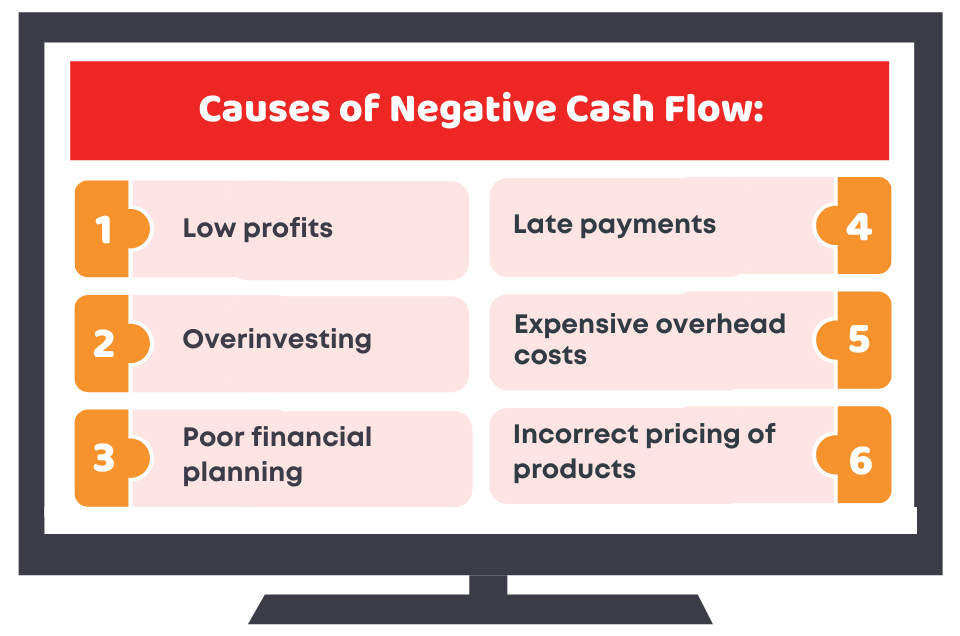

A consistently negative OCF suggests the company isn't generating enough cash to cover its operating expenses. This can lead to increased borrowing, asset sales, or even potential bankruptcy if not addressed.

Declining profitability, poor inventory management, or aggressive expansion strategies are common culprits behind negative OCF.

Who is Affected?

A wide range of companies across various sectors are currently grappling with negative operating cash flow. Early-stage startups aggressively investing in growth, struggling retail chains adapting to changing consumer preferences, and cyclical industries facing economic downturns are particularly vulnerable.

Publicly traded companies reporting negative OCF face increased scrutiny from investors, analysts, and regulatory bodies like the SEC.

The Case of Tech Startups

Many tech startups, particularly in sectors like ride-sharing and food delivery, operate with negative OCF for extended periods. They prioritize rapid user acquisition and market share over immediate profitability, relying heavily on venture capital funding.

However, this strategy becomes precarious when funding dries up or investors demand a clear path to profitability. We have recently witness WeWork, who have had struggles with negative operating cash flow and have been bailed out by investors many times.

Where is This Happening?

This trend is not confined to any single geographical region. Companies across the globe, from the United States to Europe and Asia, are reporting negative OCF.

Regions with high operating costs, intense competition, or challenging economic conditions are particularly susceptible.

When Did This Become a Concern?

While negative OCF has always been a potential concern, recent economic headwinds have exacerbated the issue. Rising interest rates, inflation, and supply chain disruptions have put significant pressure on companies' cash flow.

The increased cost of capital has made it more difficult for companies to finance their operations and maintain positive cash flow.

Data Speaks Volumes

According to recent data from Refinitiv, the number of publicly listed companies in the S&P 500 reporting negative operating cash flow has increased by 15% in the last year.

This trend is even more pronounced among small-cap and mid-cap companies, indicating a widening financial strain.

How Can Companies Address Negative OCF?

Companies facing negative OCF need to take decisive action to improve their cash flow position. This may involve cost-cutting measures, such as reducing operating expenses, streamlining operations, or divesting non-core assets.

Other strategies include improving revenue generation, negotiating better payment terms with suppliers, and raising additional capital through debt or equity financing.

However, these measures must be carefully considered to avoid jeopardizing long-term growth and competitiveness.

The Importance of Transparency

Companies must be transparent with investors about their cash flow situation and the steps they are taking to address it. Clear and honest communication can help maintain investor confidence and avoid panic selling.

SEC regulations require companies to disclose material information about their financial condition, including any significant risks related to cash flow.

What's Next?

The coming months will be critical for companies struggling with negative operating cash flow. Those that can effectively manage their expenses, improve their revenue generation, and secure adequate funding will be best positioned to weather the storm.

Conversely, companies that fail to address their cash flow problems risk financial distress and potential failure. Keep your eyes on Tesla who's operating cash flow is going to be highly affected by Chinese made cars.

Investors should carefully analyze companies' cash flow statements and management commentary to assess their long-term viability.