Is Allstate Better Than Progressive

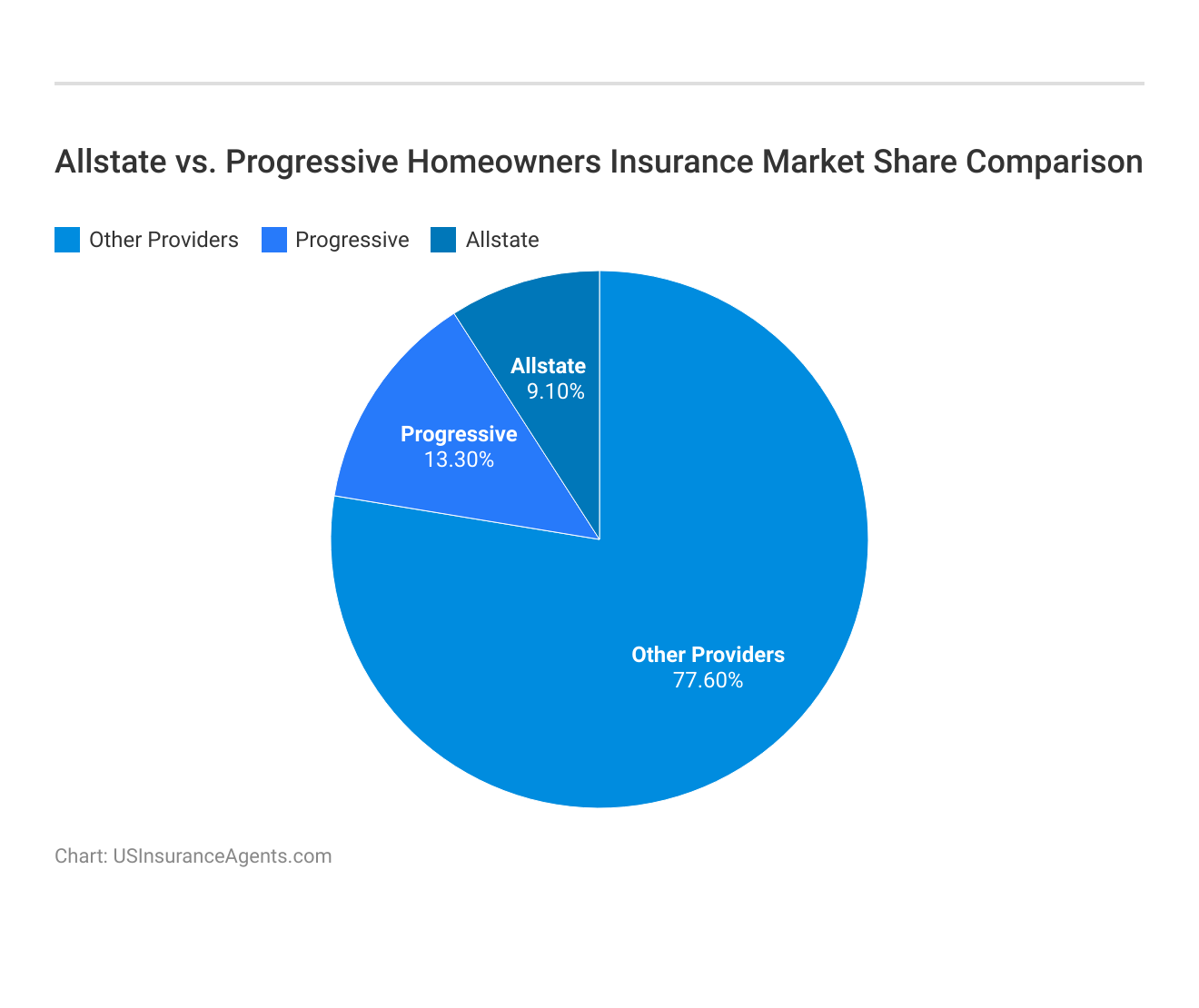

The battle of the insurance giants is heating up: Allstate and Progressive are locked in a fierce competition for market dominance. Customers are demanding to know: Which insurer truly offers better value?

This article cuts through the marketing noise, delivering a data-driven comparison of Allstate and Progressive, analyzing policy options, pricing, customer satisfaction, and financial stability to empower you with the information needed to make the right choice for your insurance needs.

Coverage Options: A Side-by-Side Glance

Both Allstate and Progressive offer standard auto insurance coverage, including liability, collision, and comprehensive. However, notable differences emerge when examining specialized add-ons.

Progressive is known for its "Name Your Price" tool and "Snapshot" program, rewarding safe drivers with discounts based on real-time driving data. Allstate counters with "Drivewise," a similar safe driving program, and offers unique coverages like deductible rewards and accident forgiveness.

Pricing Strategies: Where Can You Save?

Pricing is highly individualized, varying based on factors like driving history, location, and vehicle type. According to a Forbes Advisor study from October 2023, rates can vary significantly between the two companies depending on the driver's profile.

While some reports suggest Progressive generally offers slightly lower premiums, this is not universally true. Getting personalized quotes from both companies is crucial to determining which offers the most competitive rate for your specific circumstances.

Customer Satisfaction: What Are Policyholders Saying?

Customer satisfaction is a key indicator of overall service quality. Recent data from J.D. Power’s 2023 U.S. Auto Insurance Study, published in June 2023, shows nuanced results.

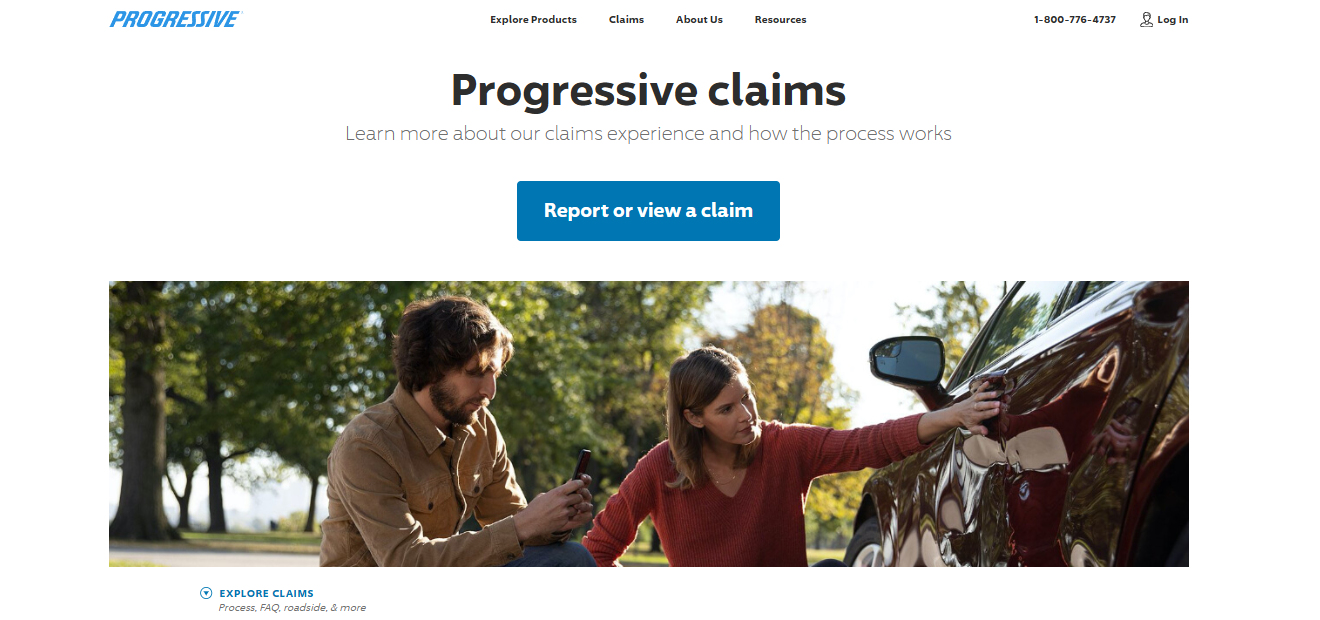

Allstate and Progressive often score similarly in claims satisfaction, but regional variations exist. Checking independent review sites like the Better Business Bureau (BBB) and Consumer Reports provides a more complete picture of customer experiences with each insurer.

Financial Stability: Can They Pay Claims?

Financial strength ratings from agencies like A.M. Best indicate an insurer's ability to meet its financial obligations. Both Allstate and Progressive consistently receive high ratings, reflecting their stability.

A.M. Best rating, updated as of November 2023, confirms both insurers possess robust financial footing, assuring policyholders they can confidently rely on either company to handle claims.

The Verdict: No One-Size-Fits-All Answer

There is no definitive "better" insurer between Allstate and Progressive. The optimal choice hinges on individual needs and priorities.

Progressive may appeal to budget-conscious drivers seeking straightforward coverage. Allstate could be more attractive to those valuing extensive coverage options and established brand reputation.

Next Steps: Informed Decision-Making

The best course of action is to obtain personalized quotes from both Allstate and Progressive, meticulously comparing coverage options, pricing, and potential discounts. Research recent customer reviews and financial ratings.

Consider consulting with an independent insurance agent who can provide unbiased guidance and navigate the complexities of insurance policies. Remember, the ideal insurer is the one that best aligns with your specific needs and financial situation.