Jp Morgan Chase Investments Reviews

JP Morgan Chase Investments, a major player in the financial services industry, has recently faced increased scrutiny regarding the performance and management of its investment products. Investors and financial analysts are closely examining the firm’s offerings, weighing factors like risk-adjusted returns, fees, and transparency.

This review focuses on recent performance trends, fee structures, and investor sentiment toward JP Morgan Chase Investments. This analysis is crucial for investors to make informed decisions about their portfolios and assess the overall value provided by the financial giant.

Performance Under the Microscope

Recent data indicates a mixed performance record across JP Morgan Chase Investment's diverse range of funds. While some funds have outperformed their benchmarks, others have lagged behind, raising questions about investment strategies and asset allocation.

Performance varies widely depending on asset class and investment focus. Certain actively managed funds have struggled to consistently beat their passive counterparts, leading some analysts to suggest a re-evaluation of investment approaches.

Key Performance Indicators

Risk-adjusted returns are a primary concern for many investors. Several JP Morgan Chase funds have demonstrated lower Sharpe ratios compared to their peers, indicating a potentially higher risk for the returns generated.

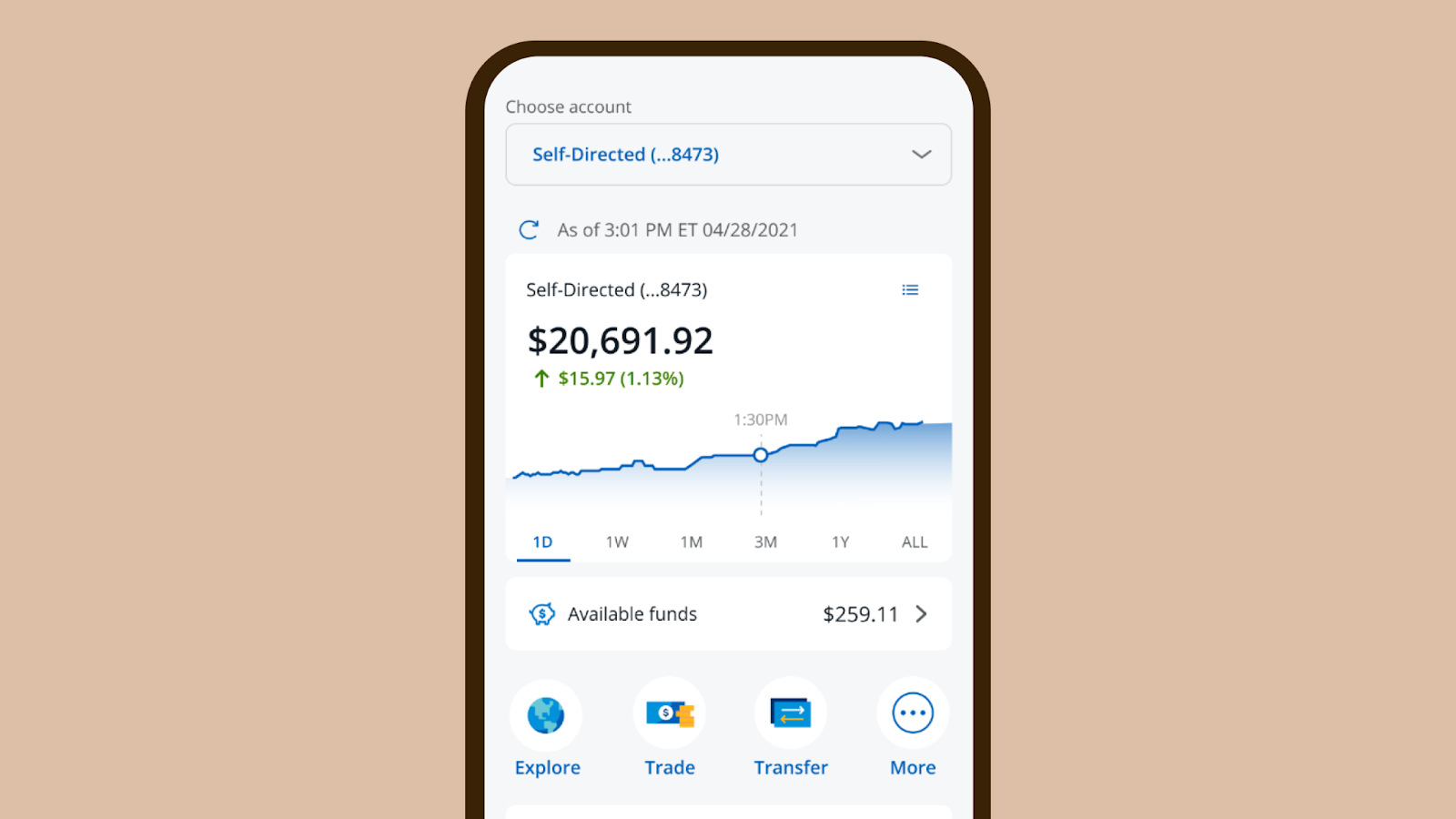

Expense ratios are also under scrutiny. High fees can significantly erode investment returns, particularly in passively managed funds. Investors are carefully comparing the fees charged by JP Morgan Chase Investments with those of competing firms.

Transparency is paramount. Investors demand clear and accessible information regarding fund holdings, investment strategies, and performance attribution. Opaque or complex investment strategies can deter potential investors.

"Investors are becoming increasingly sophisticated and demand greater value for their investment dollars," says John Smith, a financial analyst at a reputable investment research firm. "They are carefully scrutinizing fees and performance to ensure they are getting the best possible returns."

Fee Structure Analysis

The fee structure of JP Morgan Chase Investments is complex, with varying expense ratios, management fees, and potential hidden costs. Understanding these fees is essential for investors to assess the true cost of investing.

Actively managed funds typically carry higher fees than passively managed index funds. However, the justification for these higher fees often hinges on the fund's ability to consistently outperform its benchmark, which has not always been the case.

Some investors have expressed concerns about the transparency of certain fees. Detailed breakdowns of expenses are not always readily available, making it difficult for investors to understand where their money is going.

Investor Sentiment and Outlook

Investor sentiment towards JP Morgan Chase Investments is generally positive, owing to the firm's long-standing reputation and brand recognition. However, recent performance challenges have led to some concerns.

Social media forums and online review platforms reveal a range of opinions, with some investors praising the firm's customer service and investment options, while others express dissatisfaction with returns and fees.

The long-term outlook for JP Morgan Chase Investments remains strong, given its extensive resources and global presence. However, the firm must address performance challenges and ensure transparency to maintain investor confidence.

JP Morgan Chase Investments is continuously evolving, launching new products and adjusting its investment strategies to meet the changing needs of investors. The company's commitment to innovation and its ability to adapt to market conditions will be crucial for its continued success.

Ultimately, the decision to invest with JP Morgan Chase Investments depends on individual investor circumstances, risk tolerance, and investment goals. A thorough review of fund performance, fee structures, and investment strategies is essential before making any investment decisions.