Is California Debt Relief Legit Reddit

California, a state renowned for its innovation and economic prowess, is also burdened by a significant debt landscape. Millions of residents grapple with credit card debt, student loans, and other financial obligations. Amidst this struggle, the promise of debt relief has emerged as a beacon of hope, but the legitimacy of these services is often questioned, fueling heated debates on platforms like Reddit and other online forums. Is California debt relief legitimate, or is it just another scam preying on vulnerable individuals?

The question of the legitimacy of California debt relief programs is complex. The answer hinges on a number of factors: the specific company offering the service, the terms of the agreement, and the individual's financial situation. While some reputable organizations provide genuine assistance, the industry is also rife with fraudulent actors making unrealistic promises and charging exorbitant fees, leaving consumers in a worse financial predicament than before. This article will delve into the intricacies of California debt relief, examining the types of services offered, the red flags to watch out for, and the resources available to consumers seeking legitimate help.

Understanding the Landscape of California Debt Relief

Debt relief encompasses a variety of strategies aimed at reducing or eliminating debt. These include debt consolidation, credit counseling, debt management plans (DMPs), and debt settlement. Each approach has its own set of advantages and disadvantages, and the most suitable option depends on the debtor's unique circumstances.

Debt Consolidation

Debt consolidation involves taking out a new loan to pay off existing debts. This can simplify repayment by combining multiple debts into a single monthly payment, ideally at a lower interest rate. However, it's crucial to compare interest rates and fees carefully, as some consolidation loans may end up costing more in the long run.

Credit Counseling and Debt Management Plans (DMPs)

Nonprofit credit counseling agencies offer advice and guidance on managing debt. They may also offer DMPs, where they negotiate with creditors to lower interest rates and create a more manageable repayment schedule. These plans require consistent monthly payments, and failure to comply can lead to penalties.

Debt Settlement

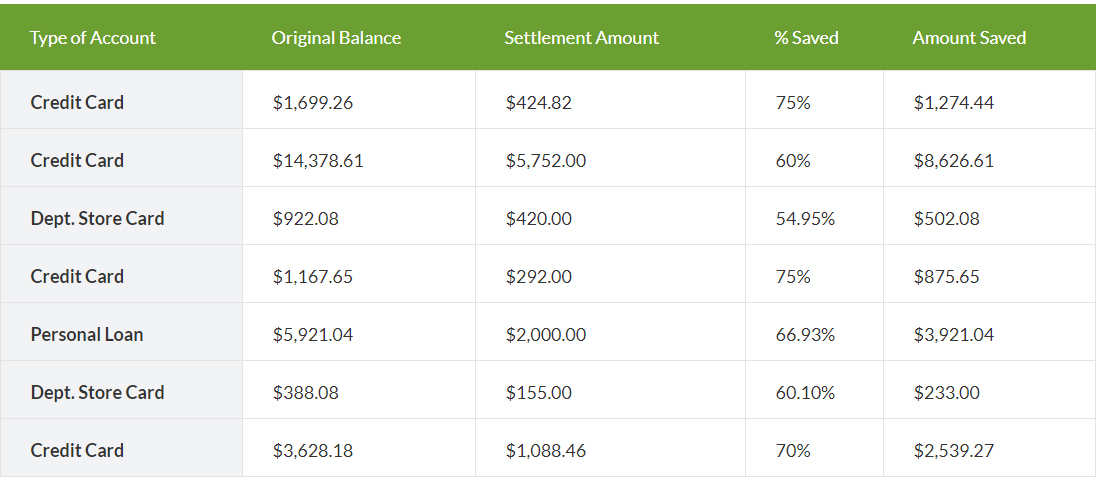

Debt settlement involves negotiating with creditors to settle debts for less than the full amount owed. This can be a risky option, as it can negatively impact credit scores and there's no guarantee that creditors will agree to a settlement. Moreover, fees are typically charged as a percentage of the debt settled, potentially costing a significant sum.

Navigating the Reddit Maze: Unveiling Real User Experiences

Reddit serves as a valuable, albeit sometimes unreliable, source of information and personal experiences. Threads discussing California debt relief often reveal a mixed bag of opinions, with some users praising legitimate programs and others recounting horror stories of scams and predatory practices. A common concern raised is the high-pressure sales tactics employed by some companies.

Many Reddit users also highlight the importance of thorough research and due diligence before engaging with any debt relief company. Checking the company's credentials with the Better Business Bureau (BBB) and reading reviews from multiple sources are frequently recommended steps. It is vital to remain skeptical of services promising unrealistic results or asking for upfront fees before any service is rendered.

Red Flags and Warning Signs

Identifying red flags is crucial when evaluating debt relief options. Unrealistic promises, such as guaranteeing debt elimination or significantly reducing debt without explaining the process, should raise immediate suspicion. Requiring upfront fees, pressuring you to sign up immediately, or failing to provide clear and transparent information about fees and services are also warning signs.

Avoid companies that advise you to stop communicating with your creditors. Legitimate debt relief programs encourage open communication and aim to negotiate on your behalf. A reputable company will be transparent about its fees, the potential impact on your credit score, and the likelihood of success.

Protecting Yourself: Resources and Due Diligence

Several resources are available to help consumers navigate the debt relief landscape. The Federal Trade Commission (FTC) offers guidance on avoiding debt relief scams and provides information on consumer rights. Nonprofit credit counseling agencies, such as those certified by the National Foundation for Credit Counseling (NFCC), offer free or low-cost counseling services.

Before enrolling in any debt relief program, research the company thoroughly. Check their credentials with the BBB and state regulatory agencies. Read customer reviews and testimonials from multiple sources. Get everything in writing and carefully review the terms of the agreement before signing anything.

The Future of Debt Relief in California

The need for debt relief services in California is likely to persist given the state's high cost of living and economic vulnerabilities. Increased regulatory scrutiny and consumer awareness are crucial to combating fraudulent practices and ensuring that debt relief services are genuinely helpful and ethical. Ongoing education and access to reliable information will empower consumers to make informed decisions and avoid falling prey to scams.

Moving forward, it's essential for consumers to approach debt relief with caution and skepticism. While legitimate programs can provide valuable assistance, the industry remains vulnerable to fraud. By educating themselves, researching their options, and understanding their rights, Californians can navigate the debt relief landscape safely and effectively, ultimately paving the way for a more secure financial future. It is crucial to remain vigilant and ensure you are dealing with a reputable organization.