Usda Loan With 500 Credit Score

The dream of homeownership, often considered a cornerstone of the American ideal, can seem tragically out of reach for millions grappling with less-than-perfect credit. A common misconception is that a low credit score slams the door shut on government-backed mortgage options, particularly the USDA loan, designed to aid rural homebuyers. However, the reality, while complex, isn't always so bleak, sparking both hope and cautious optimism within the real estate market.

This article delves into the nuanced landscape of securing a USDA loan with a credit score hovering around 500. We'll unpack the USDA's underwriting guidelines, explore alternative pathways to approval, and examine the practical implications for prospective homeowners. We'll also consider the risks involved and offer insights from industry experts on navigating this challenging terrain.

Understanding the USDA Loan Program

The USDA, or United States Department of Agriculture, offers a mortgage program aimed at stimulating homeownership in rural and suburban areas. These loans boast zero down payment requirements and are often easier to qualify for than conventional mortgages. The goal is to encourage economic development and improve the quality of life in less populated regions.

However, the USDA doesn't directly lend money. Instead, it guarantees mortgages issued by approved lenders. This guarantee reduces the lender's risk, making them more willing to offer loans to borrowers who might otherwise be considered too risky.

The Credit Score Conundrum

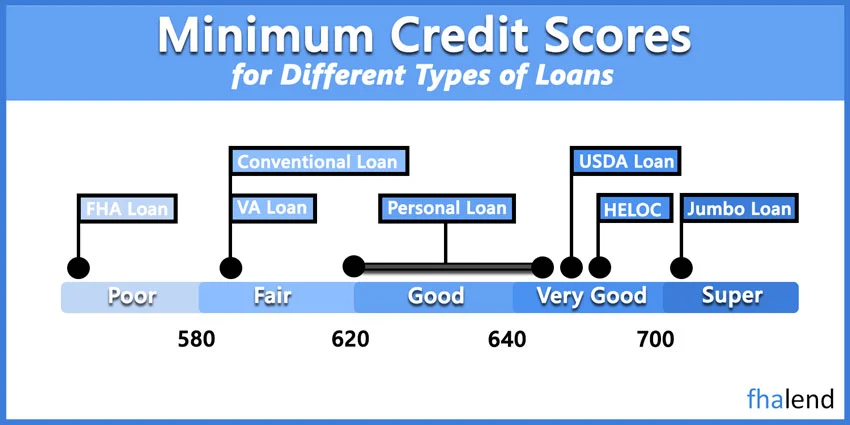

The USDA's official guidelines generally prefer a credit score of 640 or higher. This threshold signals to lenders that the borrower has a reasonable track record of managing debt. Borrowers below this score are often subject to stricter scrutiny.

A credit score of 500 falls considerably below this preferred benchmark. It suggests a history of significant credit challenges, such as late payments, defaults, or even bankruptcy. This can make securing a USDA loan incredibly difficult, but not necessarily impossible.

Navigating the Low Credit Score Landscape

While a 500 credit score presents a significant hurdle, it's crucial to understand that USDA loan approvals are not solely based on credit score. Lenders consider the borrower's overall financial profile, including income, employment history, and debt-to-income ratio (DTI).

Borrowers with a low credit score but a stable income and low DTI may still be considered. A strong compensating factor, like a large down payment (though unusual for USDA), could also sway a lender.

Manual Underwriting: A Potential Lifeline

The USDA allows lenders to use manual underwriting for borrowers who don't meet the automated underwriting system's criteria. This process involves a more thorough review of the borrower's financial situation by a human underwriter.

Manual underwriting provides an opportunity for borrowers with extenuating circumstances to explain their credit history. If a borrower can demonstrate that past credit issues were due to temporary setbacks, such as job loss or medical expenses, they may still be approved.

Documenting these circumstances meticulously is crucial. Providing evidence of consistent bill payment in recent months and a clear plan for managing future debt can significantly improve the chances of approval.

Alternative Strategies and Considerations

If obtaining a USDA loan with a 500 credit score proves insurmountable, prospective homebuyers should explore alternative strategies. These might include credit repair, saving for a larger down payment on a different type of loan, or seeking assistance from first-time homebuyer programs.

Credit repair involves addressing inaccuracies on credit reports and establishing a positive payment history. This process takes time and effort but can gradually improve a credit score over several months or even years.

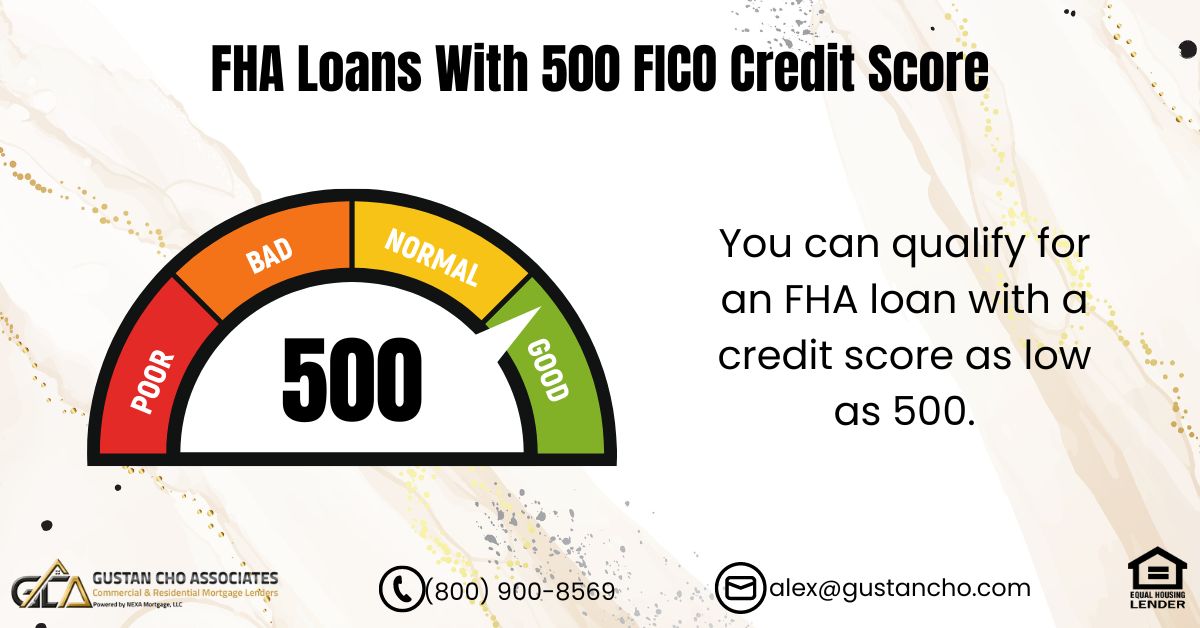

Another option is to consider FHA loans, which have less stringent credit score requirements than conventional mortgages. However, FHA loans typically require mortgage insurance, which can add to the overall cost of homeownership.

The Importance of Financial Counseling

Regardless of the chosen path, seeking guidance from a qualified financial counselor is highly recommended. A counselor can provide personalized advice on credit repair, budgeting, and debt management.

They can also help borrowers understand the long-term financial implications of homeownership. This ensures that they are making an informed decision and are prepared for the responsibilities that come with owning a home.

Risks and Rewards

While securing a USDA loan with a low credit score may seem appealing, it's essential to weigh the risks involved. Borrowers with poor credit are more likely to default on their mortgages, potentially leading to foreclosure.

Additionally, loans with higher interest rates are typically offered to borrowers with lower credit scores. This means that they will pay more in interest over the life of the loan, increasing the overall cost of homeownership.

However, for those who can manage their finances responsibly, a USDA loan can be a valuable tool for achieving the dream of homeownership. It provides access to affordable financing and allows individuals to build equity in their homes.

Looking Ahead

The availability of USDA loans for borrowers with low credit scores remains a topic of ongoing debate. Some argue that it's crucial to provide opportunities for low-income individuals to access affordable housing. Others express concern about the increased risk of defaults and foreclosures.

The USDA continues to monitor the performance of its loan program and make adjustments as needed. It's likely that the agency will continue to emphasize the importance of responsible lending practices and provide resources to help borrowers succeed.

Ultimately, navigating the USDA loan process with a 500 credit score requires careful planning, diligent effort, and a realistic assessment of one's financial capabilities. While the path may be challenging, it's not entirely closed, offering a glimmer of hope for those seeking to achieve the American dream of homeownership.