Quick Loans No Credit Check Instant Approval

The aroma of freshly brewed coffee mingled with the quiet hum of a Tuesday morning in Sarah's kitchen. Sunlight streamed through the window, illuminating dust motes dancing in the air, but Sarah barely noticed. Her gaze was fixed on the laptop screen, a knot of anxiety tightening in her stomach. An unexpected car repair had thrown her budget into disarray, and the looming deadline for rent payment felt like a heavy weight on her shoulders. She typed, "Quick loans no credit check instant approval," her fingers trembling slightly.

This article explores the world of "quick loans no credit check instant approval," examining their allure, their potential pitfalls, and offering a balanced perspective for individuals facing urgent financial needs.

The Allure of Instant Relief

The promise of quick cash without the hassle of credit checks is undoubtedly appealing, especially when facing unexpected expenses. These loans often target individuals with poor credit histories or those who need funds urgently, presenting themselves as a lifeline in times of financial stress.

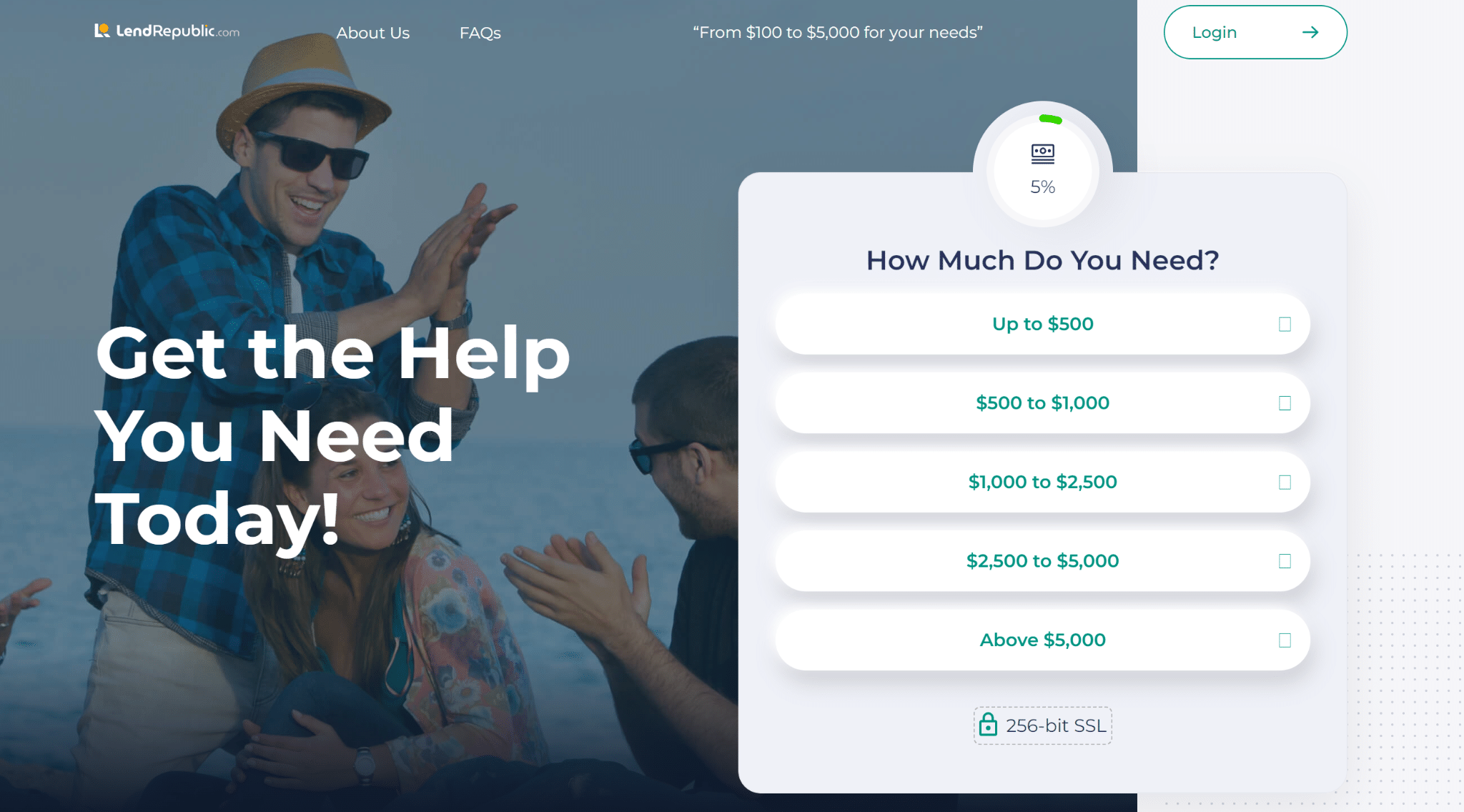

The advertising is pervasive: "Instant approval!" "No credit check!" "Funds deposited in minutes!" These slogans paint a picture of immediate financial relief, a tempting solution for those struggling to make ends meet. But, as with most things that seem too good to be true, a closer look is warranted.

Understanding the Landscape

The term "quick loans no credit check instant approval" encompasses a variety of loan products, often offered by online lenders. These can include payday loans, installment loans, and title loans, each with its own set of terms and conditions.

Payday loans are short-term, high-interest loans typically due on the borrower's next payday. Installment loans offer a longer repayment period with fixed monthly payments. Title loans use a vehicle's title as collateral, posing a significant risk of repossession if the borrower defaults.

According to the Consumer Financial Protection Bureau (CFPB), payday loans, in particular, can trap borrowers in a cycle of debt due to their high interest rates and short repayment periods.

The Reality Behind the Promise

While these loans may seem like a quick fix, they often come with significant drawbacks. The absence of a credit check doesn't mean the lender isn't assessing risk; it simply means they're using alternative methods, such as verifying income and employment.

Interest rates on these loans can be astronomically high, often exceeding 300% APR (Annual Percentage Rate). This means that a borrower could end up paying back significantly more than the original loan amount.

Fees and charges can also add up quickly, including application fees, late payment fees, and prepayment penalties. These hidden costs can further exacerbate the borrower's financial difficulties.

The Risks of No Credit Check Loans

One of the biggest risks associated with "quick loans no credit check instant approval" is the potential for a debt trap. The high interest rates and short repayment periods can make it difficult for borrowers to repay the loan on time, leading to further fees and penalties.

Borrowers may find themselves taking out additional loans to cover the initial debt, creating a cycle of borrowing that is difficult to break. This can have a devastating impact on their credit score and overall financial well-being.

Another risk is the potential for predatory lending practices. Some lenders may take advantage of vulnerable individuals by offering loans with unfair terms and conditions.

Responsible Alternatives

Before resorting to "quick loans no credit check instant approval," it's essential to explore other options. There are often more responsible and affordable ways to address short-term financial needs.

Consider exploring options such as: *Negotiating with creditors: Contact creditors to see if they will offer a payment plan or temporary deferment. *Seeking assistance from local charities: Many charitable organizations offer financial assistance to individuals in need. *Exploring a personal loan from a bank or credit union: These loans typically have lower interest rates than payday loans. *Using a credit card responsibly: If you have a credit card with available credit, consider using it for emergency expenses, but be sure to pay it off as soon as possible. *Looking into Government assistance programs: Check for government programs designed to help people with low income to cover expenses.

According to a report by the Financial Health Network, building a strong financial foundation involves understanding one's financial situation, creating a budget, and planning for the future.

Building a Sustainable Financial Future

Addressing the root causes of financial instability is crucial for long-term financial health. This involves creating a budget, tracking expenses, and setting financial goals.

It's also important to build an emergency fund to cover unexpected expenses. Even a small amount of savings can make a big difference in preventing the need for high-interest loans.

Seeking financial education and counseling can also be beneficial. Many non-profit organizations offer free or low-cost financial education programs to help individuals improve their financial literacy.

A Word of Caution

If you're considering a "quick loan no credit check instant approval," proceed with extreme caution. Carefully review the terms and conditions of the loan, paying close attention to the interest rate, fees, and repayment schedule.

Be wary of lenders who pressure you to borrow more than you need or who are not transparent about their fees. If anything seems unclear or suspicious, walk away.

Remember that there are always other options available. Don't let the allure of instant relief cloud your judgment and lead you into a potentially damaging financial situation.

Sarah's Choice

Back in her kitchen, Sarah closed her laptop, a thoughtful expression on her face. The quick loan option seemed appealing, but the warnings she'd read echoed in her mind. Instead, she decided to call her landlord and explain her situation, hoping to negotiate a short-term payment plan.

She also reached out to a local charity that offered assistance with car repairs. It wouldn't be a quick fix, but it felt like a more responsible and sustainable path forward.

The knot in her stomach loosened slightly. She had taken a step, not toward instant gratification, but toward a more secure and empowered financial future. Choosing a more responsible approach was the first step on the path to financial freedom.