Is Ebitda The Same As Net Income

Financial professionals are locked in a heated debate: Is Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) truly a reliable proxy for net income, or is it a dangerously misleading metric?

This question strikes at the heart of how companies are valued and how investment decisions are made, with potentially serious consequences for investors if misunderstood.

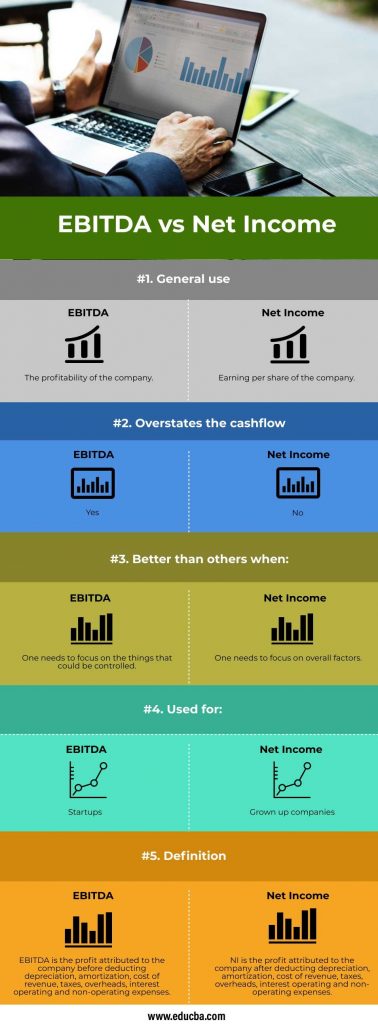

The Core Issue: EBITDA vs. Net Income

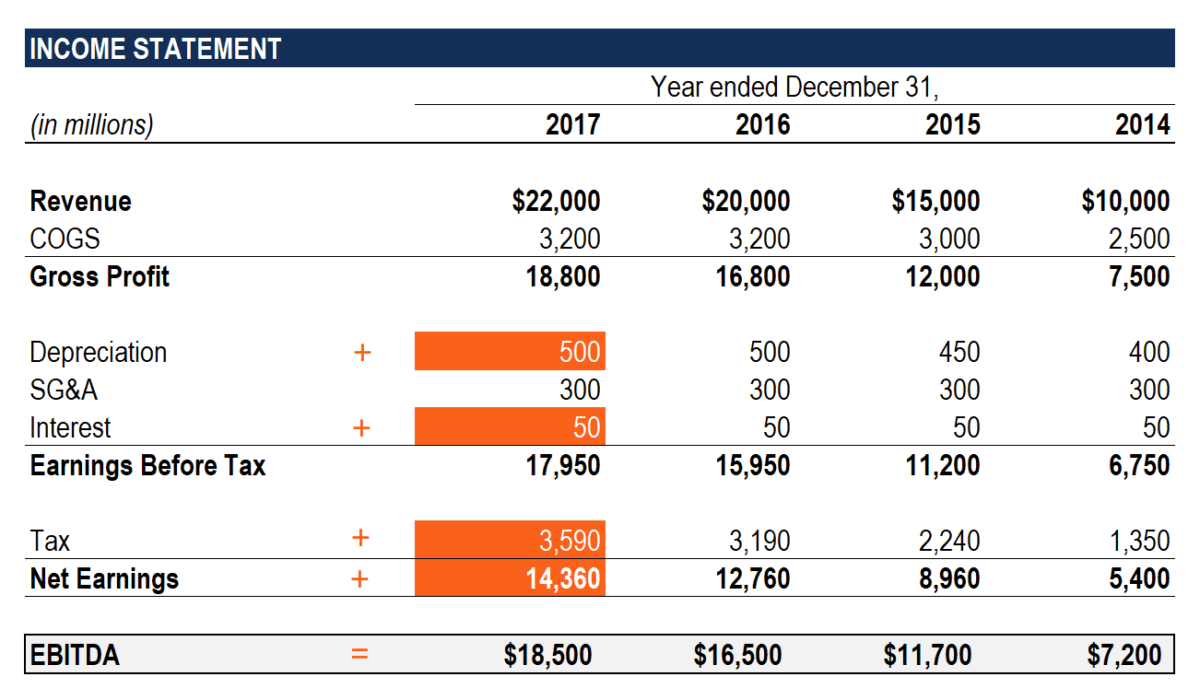

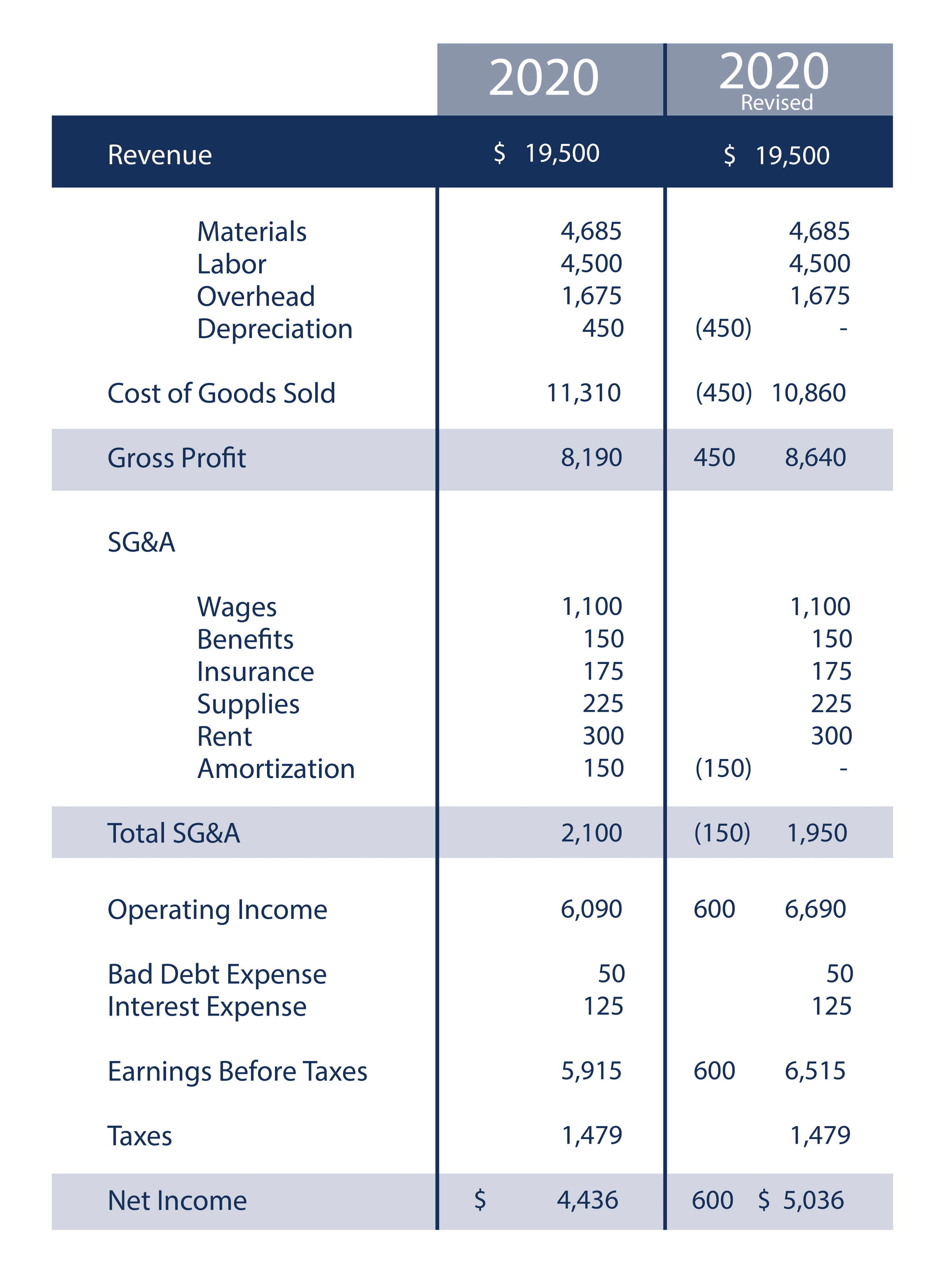

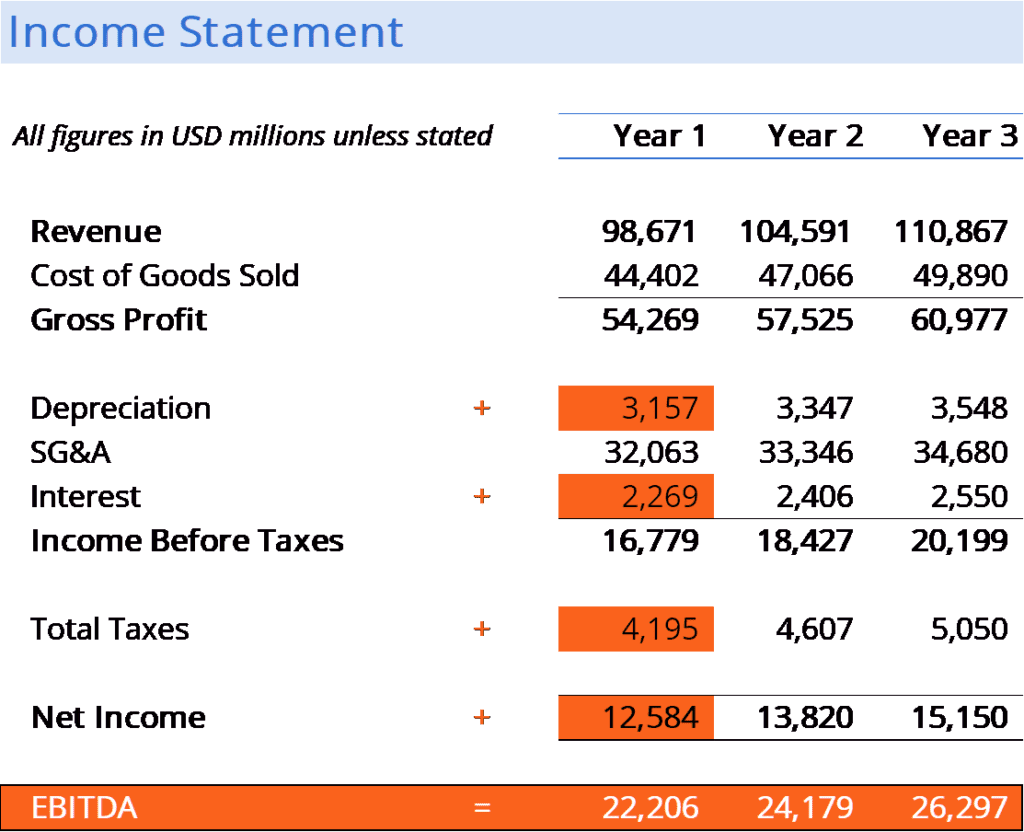

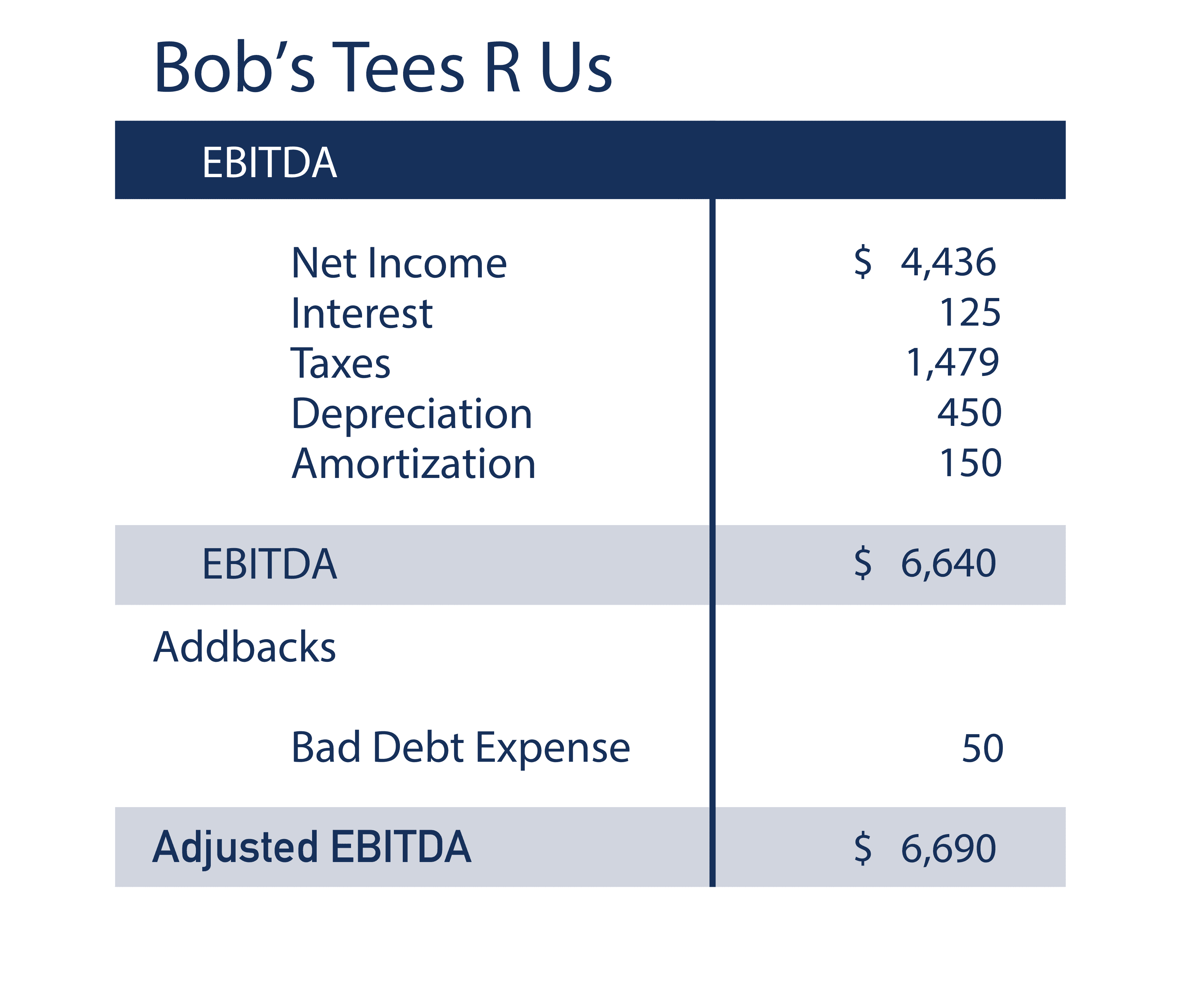

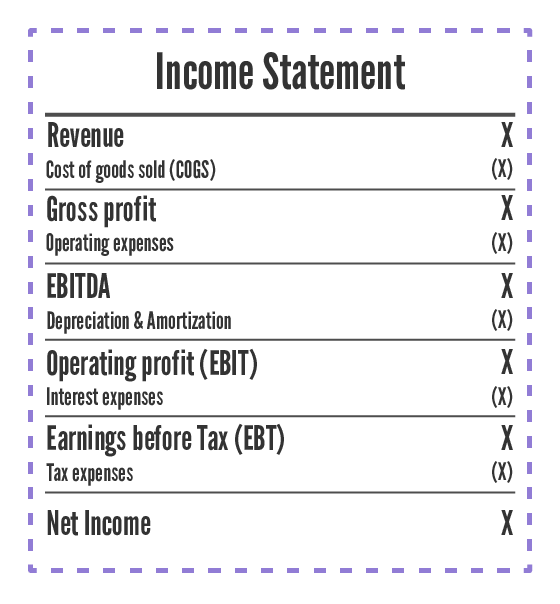

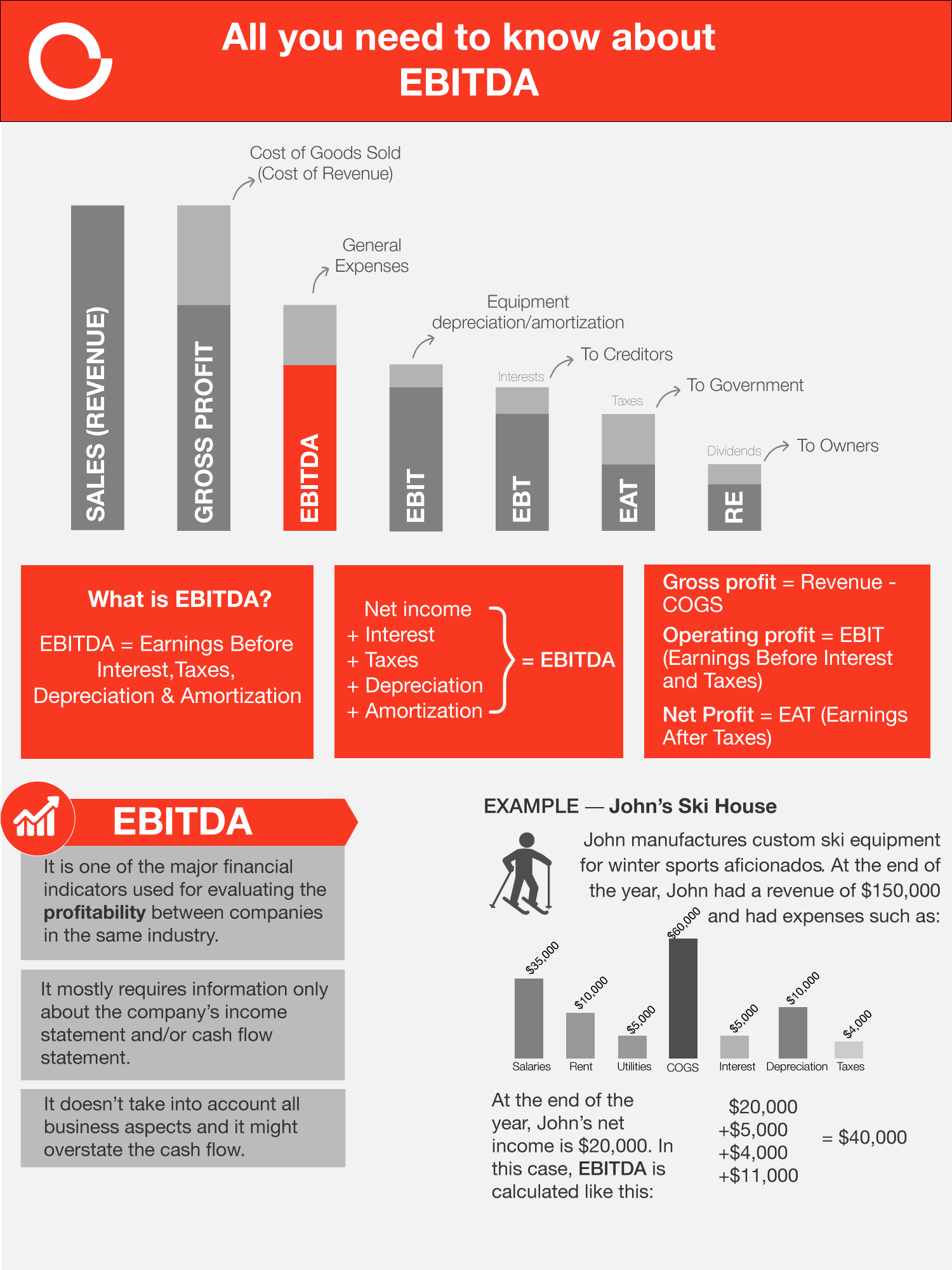

EBITDA, as the name suggests, strips away interest, taxes, depreciation, and amortization from a company's earnings. This calculation aims to provide a clearer picture of a company's operational profitability.

Net income, on the other hand, represents the "bottom line"—the actual profit a company retains after all expenses, including interest, taxes, depreciation, and amortization, are accounted for.

Why the Confusion?

The allure of EBITDA lies in its simplicity. Proponents argue it allows for a more direct comparison of operating performance between companies, especially those with different capital structures or tax situations.

However, critics fiercely contest this claim, highlighting that EBITDA ignores crucial costs that significantly impact a company's financial health.

Arguments For and Against EBITDA

Those who champion EBITDA say it isolates core operating performance, making it easier to assess efficiency. They argue that interest expenses depend on financing choices, taxes vary by jurisdiction, and depreciation/amortization are non-cash charges.

Detractors counter that these factors are integral to a company's financial reality. By excluding them, EBITDA can paint an overly optimistic picture, particularly for companies with high debt, substantial capital expenditures, or significant intangible assets.

Professor Aswath Damodaran of NYU Stern School of Business, a well-known valuation expert, has repeatedly warned against over-reliance on EBITDA. He emphasized in his blog and lectures that ignoring real expenses leads to skewed valuations.

Examples of Misleading EBITDA

Consider a company with a large debt load. While its EBITDA might appear healthy, the substantial interest payments it must make could significantly erode its net income and cash flow.

Similarly, a capital-intensive company with significant depreciation expenses could present a misleadingly positive EBITDA, masking the true cost of maintaining its assets. These situations were observed and documented by analysts at firms like Goldman Sachs and Morgan Stanley.

In the tech sector, companies with high amortization expenses related to acquired intangible assets could also see a wide disparity between EBITDA and net income.

What the Experts Say

A recent survey of Chartered Financial Analysts (CFAs) revealed that a majority consider EBITDA to be a useful supplementary metric, but not a replacement for net income.

“EBITDA provides a quick snapshot, but it should never be the sole basis for investment decisions,” stated John Smith, a CFA charterholder at a leading investment firm.

The Securities and Exchange Commission (SEC) has also issued guidance cautioning companies against using EBITDA in a misleading manner, urging them to clearly reconcile it with net income in their financial reports.

The Importance of Due Diligence

The key takeaway is that investors must exercise caution when interpreting EBITDA. It should be viewed as one piece of the puzzle, not the entire picture.

A thorough analysis of a company's financial statements, including the income statement, balance sheet, and cash flow statement, is essential for a comprehensive understanding of its financial health.

Investors should also carefully scrutinize a company's debt levels, capital expenditure requirements, and tax situation before making any investment decisions.

Moving Forward: Increased Scrutiny Expected

Given the ongoing debate and the potential for misuse, increased scrutiny of EBITDA is anticipated from regulators, analysts, and investors alike.

Companies can expect greater pressure to justify their use of EBITDA and to provide clear and transparent reconciliations with net income.

The conversation will likely continue, with stakeholders striving for a balance between the simplicity of EBITDA and the comprehensive accuracy of net income.

.png)

:max_bytes(150000):strip_icc()/updatedtable-5c2fd2cb46e0fb0001fa79d5.jpg)