Is Monogram Orthopedics A Good Investment

Imagine a world where knee replacement surgery is as personalized as a tailored suit. Where robotic precision and bespoke implants converge to offer not just relief, but a restored sense of natural movement. This is the promise, the potential, that Monogram Orthopedics is striving to deliver. But is this vision a sound investment, or a high-risk gamble in the complex landscape of medical technology?

At its core, Monogram Orthopedics is betting on a future of personalized orthopedic surgery, using advanced imaging, 3D printing, and robotics to create implants and surgical procedures tailored to each individual patient. While the company's approach is undeniably innovative, potential investors must carefully weigh the significant challenges and risks inherent in bringing such a disruptive technology to market against the potential rewards.

A Novel Approach to an Age-Old Problem

Knee replacement surgery is a common procedure, yet patient satisfaction rates can vary widely. Traditional, off-the-shelf implants often fail to perfectly match a patient's unique anatomy, leading to discomfort, limited range of motion, and even the need for revision surgery.

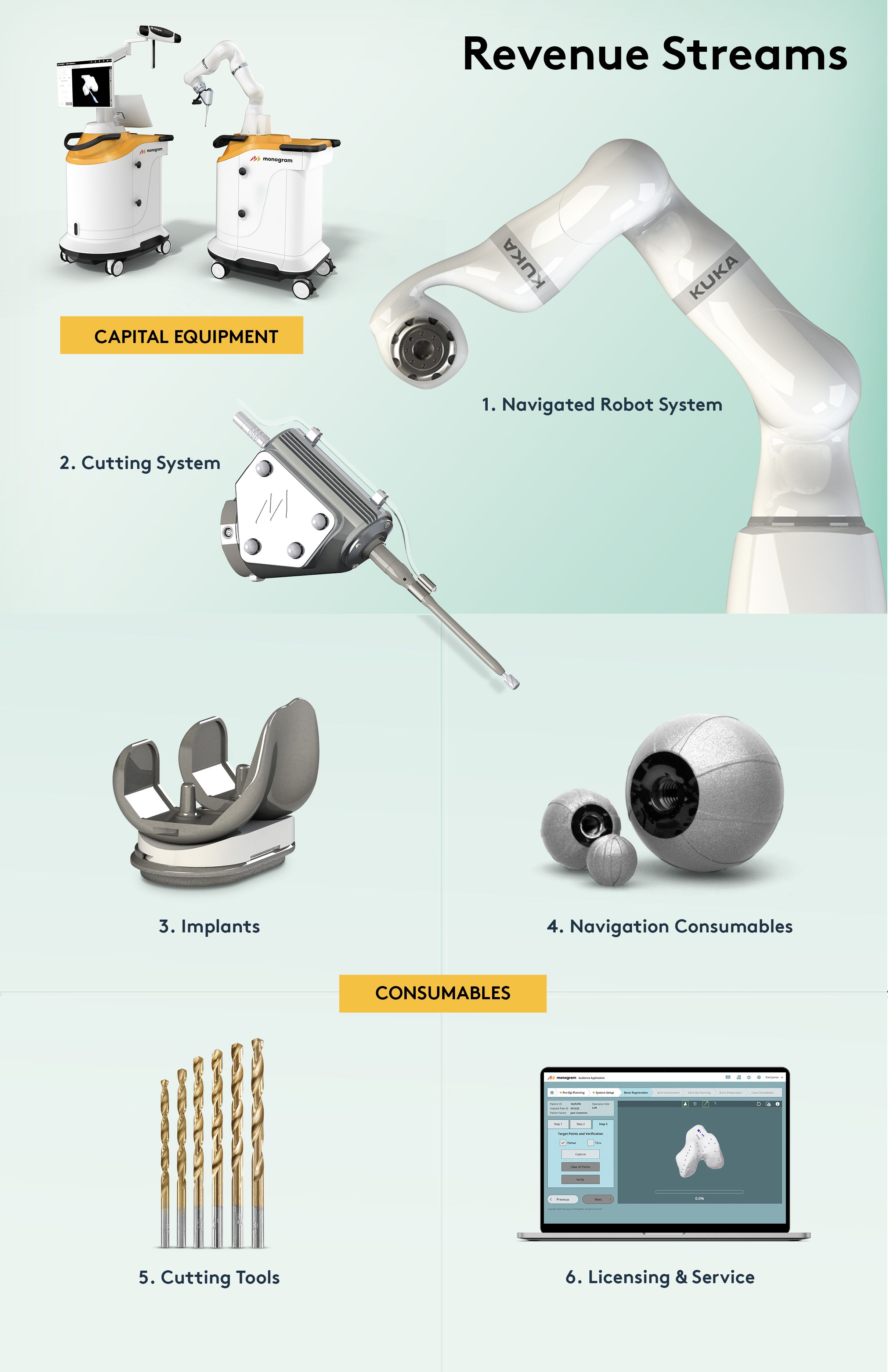

Monogram Orthopedics aims to address these limitations with its integrated platform. This platform incorporates 3D pre-operative planning software, robotic surgical guidance, and patient-specific implants.

The idea is that by precisely mapping the patient's knee, creating a customized implant, and using a robot to execute the surgical plan with unparalleled accuracy, the outcomes will be significantly improved. This translates to less pain, faster recovery, and a more natural feeling joint.

The Technology Behind the Hype

The company's technology hinges on several key components. First, advanced imaging techniques, like CT scans, are used to create a detailed 3D model of the patient's knee.

Next, Monogram's proprietary software allows surgeons to meticulously plan the surgery, determining the optimal size and placement of the implant. This plan is then translated into instructions for the robot, which assists the surgeon during the procedure.

Finally, the implants themselves are designed to perfectly match the patient's anatomy. Monogram intends to manufacture these implants using 3D printing technology, allowing for a high degree of customization and potentially reducing manufacturing costs over time.

The Investment Landscape

Investing in medical technology companies, especially those developing novel surgical platforms, is inherently risky. The path from concept to commercialization is often long, expensive, and fraught with regulatory hurdles.

Monogram Orthopedics is no exception. The company is still in the early stages of development, with its technology currently undergoing clinical trials. Securing regulatory approval from the FDA is a critical milestone that will determine the company's future.

Beyond regulatory approval, Monogram faces the challenge of convincing surgeons and hospitals to adopt its platform. This requires demonstrating not only the clinical benefits of the technology, but also its ease of use and cost-effectiveness. Furthermore, the initial robot cost could be substantial and a hinderance to immediate widespread adoption.

Financial Considerations

As a publicly traded company, Monogram Orthopedics' financial performance and stock price are subject to market fluctuations and investor sentiment. Potential investors should carefully review the company's financial statements, including its revenue, expenses, and cash flow.

It's important to understand how the company plans to fund its operations and future growth. Will it rely on further equity offerings, debt financing, or revenue generation? The answers to these questions will provide insights into the company's financial stability and long-term prospects.

According to recent financial reports, Monogram Orthopedics is still in the pre-revenue stage, meaning it is not yet generating significant income from sales. This is typical for companies in this phase of development, but it also underscores the importance of careful financial management.

The Competitive Environment

The orthopedic implant market is dominated by established players like Stryker, Johnson & Johnson (DePuy Synthes), and Zimmer Biomet. These companies have significant resources, established distribution networks, and strong relationships with surgeons and hospitals.

Monogram Orthopedics faces the daunting task of competing against these giants. To succeed, it must offer a truly differentiated product that provides demonstrably better outcomes and justifies the higher initial investment.

However, the established players are not standing still. They are also investing in robotics, 3D printing, and personalized medicine. This means that Monogram must continue to innovate and stay ahead of the curve to maintain its competitive advantage.

Potential Advantages

Despite the challenges, Monogram Orthopedics has several potential advantages. Its integrated platform, combining pre-operative planning, robotic surgery, and patient-specific implants, offers a more comprehensive solution than many of its competitors.

The company's focus on personalized medicine also resonates with a growing trend in healthcare. Patients are increasingly demanding treatments that are tailored to their individual needs and preferences.

If Monogram can successfully demonstrate the clinical and economic benefits of its technology, it could carve out a significant niche in the orthopedic implant market. The smaller size of Monogram potentially enables it to be more agile and innovative than the big players in the space.

Expert Opinions and Analysis

Industry analysts offer a mixed perspective on Monogram Orthopedics' prospects. Some are optimistic about the company's innovative technology and its potential to disrupt the orthopedic implant market.

Others are more cautious, citing the significant challenges and risks associated with bringing a novel surgical platform to market. The opinion of surgeons who have experience with the product may carry more weight as they have real experience with the device.

Ultimately, the success of Monogram Orthopedics will depend on its ability to execute its business plan, secure regulatory approval, and convince surgeons and hospitals to adopt its technology.

The Role of Clinical Trials

Clinical trials are crucial for evaluating the safety and effectiveness of Monogram Orthopedics' technology. The results of these trials will provide critical data to support regulatory submissions and marketing claims.

Investors should carefully monitor the progress of these trials and pay attention to any announcements regarding interim or final results. Positive trial outcomes will likely boost investor confidence and drive up the company's stock price.

Conversely, negative or inconclusive results could have a significant negative impact on the company's prospects. Investors should review the trial design carefully, noting the sample sizes and primary endpoints of the trials.

A Reflective Conclusion

Investing in Monogram Orthopedics is not for the faint of heart. It is a high-risk, high-reward proposition. The company's innovative technology holds immense promise, but it also faces significant challenges. However, those same challenges create the potential for high reward if resolved.

Potential investors should carefully weigh the risks and rewards before making a decision. They should conduct thorough due diligence, review the company's financial statements, and monitor the progress of its clinical trials.

The future of knee replacement surgery may well be personalized and robotic. Whether Monogram Orthopedics will be a leader in that future remains to be seen, but its journey is certainly one worth watching closely. The potential to improve the lives of millions suffering from knee pain is undeniable. The question is: can Monogram deliver?