Is Mrny Etf A Good Investment

Imagine a bustling marketplace, not filled with fruits and spices, but with data streams, charts, and whispered predictions. Investors, both seasoned and novice, navigate this digital space, searching for the next promising opportunity. One name keeps surfacing in their conversations: the Mrny ETF. But is it truly a golden ticket, or just another brightly colored stall in the crowded bazaar?

The Mrny ETF has garnered attention for its focus on innovative sectors, promising high growth potential. However, like any investment, understanding its composition, risk factors, and alignment with your personal financial goals is crucial before diving in. This article will explore the Mrny ETF in detail, providing insights to help you make an informed investment decision.

Understanding the Mrny ETF

To understand whether the Mrny ETF is right for you, we need to look under the hood. What companies does it invest in? What is its investment strategy?

The Mrny ETF, from our understanding, appears to be an exchange-traded fund designed to track a specific index of companies. This index likely focuses on companies exhibiting strong growth potential, particularly within sectors like technology, renewable energy, or healthcare.

The specific composition of the Mrny ETF is key. Investors should research the top holdings to understand the underlying companies driving the ETF's performance. A diverse portfolio within the ETF helps mitigate risk, whereas a heavy concentration in a few companies increases volatility.

Performance History and Benchmarking

Past performance is not indicative of future results, but it provides valuable context. How has the Mrny ETF performed relative to its benchmark index and similar ETFs?

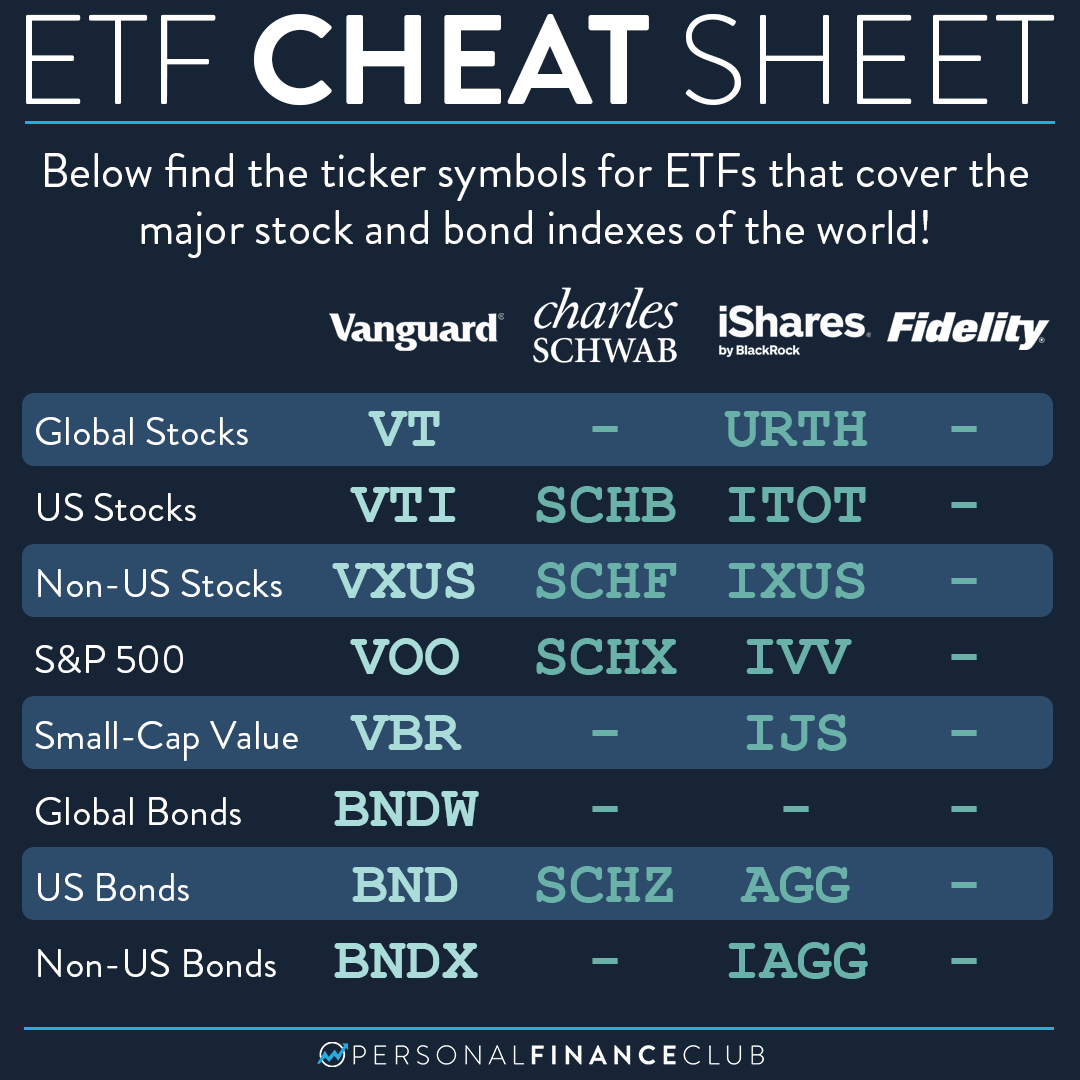

Comparing the Mrny ETF's performance to a relevant benchmark index, such as the S&P 500 or a sector-specific index, offers a perspective on its relative strength. It's important to look at performance over various time periods (e.g., one year, three years, five years) to get a more comprehensive view.

Investors should also examine the Mrny ETF's expense ratio, which is the annual fee charged to manage the fund. A lower expense ratio generally translates to higher returns over the long term.

Risk Factors to Consider

Investing always involves risk, and the Mrny ETF is no exception. Understanding these risks is essential before investing.

One primary risk associated with growth-oriented ETFs like the Mrny ETF is volatility. Companies in these sectors often experience rapid price swings, which can impact the ETF's overall value.

Market corrections and economic downturns can significantly affect the Mrny ETF. Diversification within the ETF and across your overall portfolio can help mitigate these risks.

Another factor to consider is sector-specific risk. If the sectors in which the Mrny ETF invests face regulatory challenges or technological disruptions, the ETF's performance could suffer.

The Importance of Due Diligence

Making an informed decision requires more than just reading articles like this. Do your own research and consult with a financial advisor.

Investors should carefully review the Mrny ETF's prospectus, which provides detailed information about the fund's investment objectives, strategies, risks, and expenses. This document is available on the fund's website or through your brokerage platform.

Consulting with a qualified financial advisor can provide personalized guidance based on your individual financial situation and risk tolerance. An advisor can help you determine whether the Mrny ETF aligns with your long-term investment goals.

Is the Mrny ETF Right for You?

Ultimately, the decision of whether to invest in the Mrny ETF depends on your individual circumstances.

If you have a long-term investment horizon, a high-risk tolerance, and believe in the growth potential of the sectors in which the Mrny ETF invests, it might be a suitable option. However, if you are risk-averse or have a short-term investment horizon, other investment options might be more appropriate.

Consider your overall portfolio diversification. Allocating a small percentage of your portfolio to the Mrny ETF can provide exposure to high-growth sectors without unduly increasing your overall risk profile.

Remember that investing is a marathon, not a sprint. Patience and a long-term perspective are crucial for success.

A Final Thought

The allure of high-growth ETFs like the Mrny ETF is understandable. The promise of significant returns is tempting.

However, it's crucial to approach investing with a clear understanding of the risks involved. Thorough research, diversification, and professional guidance are essential for making informed decisions.

The Mrny ETF might be a valuable tool in your investment arsenal, but only if it aligns with your personal financial goals and risk tolerance. Invest wisely, and may your portfolio flourish.

![Is Mrny Etf A Good Investment 5 Best Gold ETFs in India for Investment [2025]](https://lakshmishree.com/blog/wp-content/uploads/2024/03/Best-Gold-ETFs-in-India-for-Investment-You-Should-Know-1024x576.jpg)