Under A Trustee Group Life Policy

A significant portion of Canadians and their families rely on group life insurance provided through their employers or other membership organizations. Among these arrangements, Trustee Group Life Policies stand out as a common, yet often misunderstood, form of coverage. Recent industry trends and regulatory developments highlight the importance of understanding the intricacies of these policies and their impact on beneficiaries.

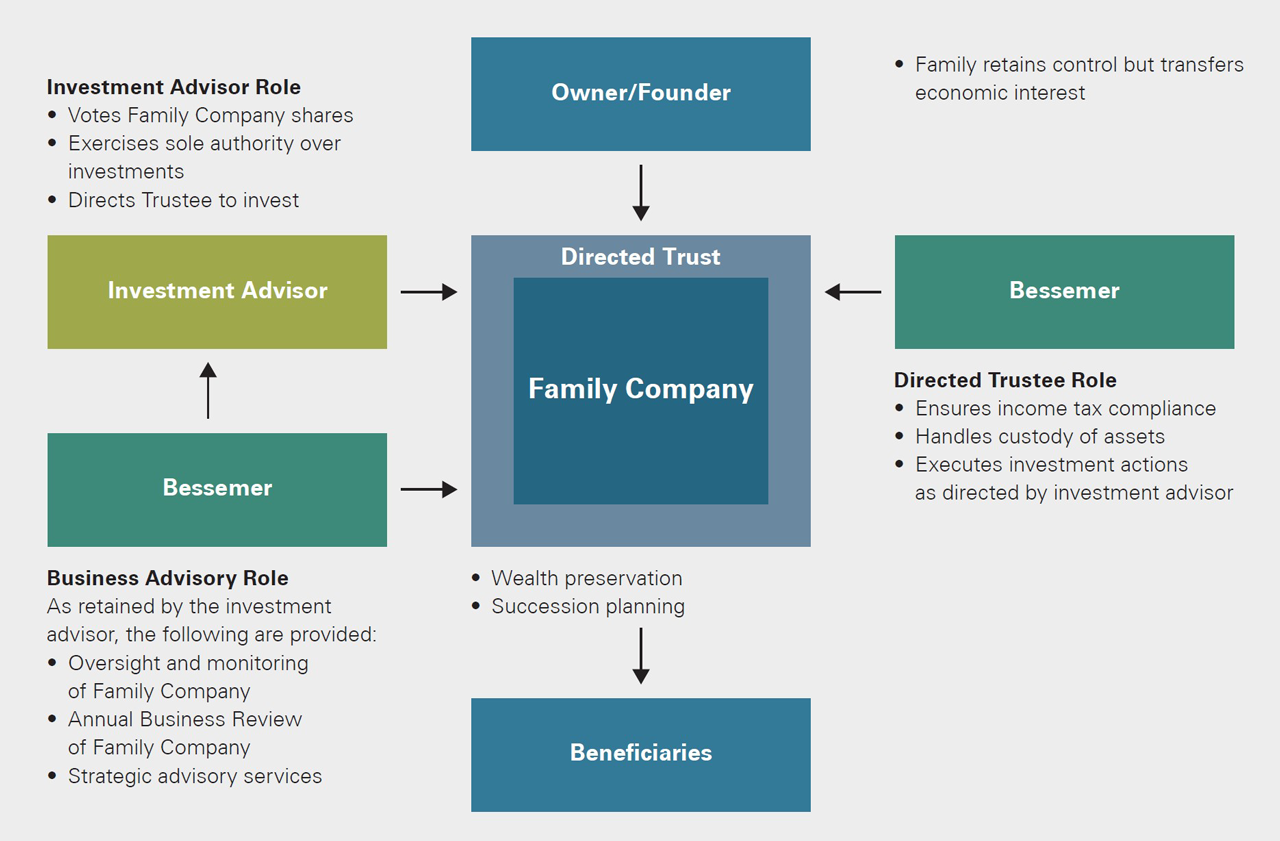

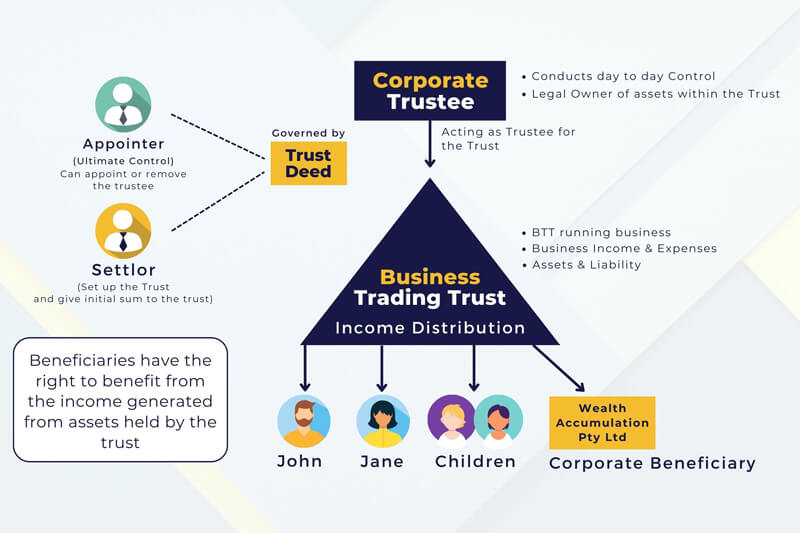

Trustee Group Life Policies are insurance plans where a trustee, often a financial institution or a designated organization, holds the master policy on behalf of a group of individuals. These individuals, typically members of an association or employees of several affiliated companies, are the insured. This structure offers a collective approach to life insurance, leveraging the group's size to potentially secure more favorable rates and terms than individual policies.

Key Features of Trustee Group Life Policies

The core mechanism involves the trustee maintaining the master policy. Individual members receive certificates of insurance outlining their specific coverage details. Premiums are usually paid by the members themselves or sometimes subsidized in part by the affiliated organization.

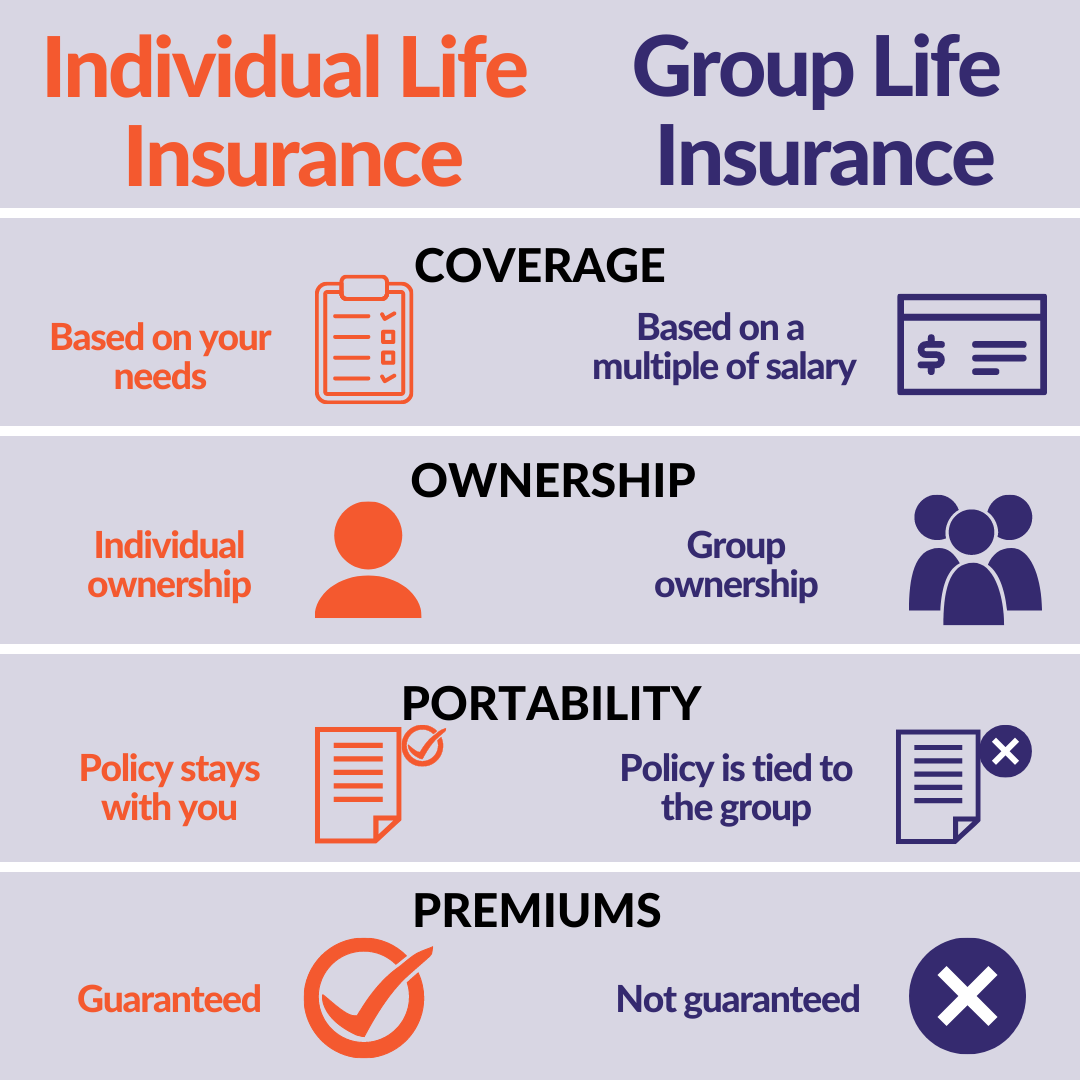

Eligibility for coverage is generally tied to membership or employment within the relevant group. Benefits are paid to the designated beneficiaries upon the death of the insured member. Coverage amounts can vary based on factors such as salary, age, or chosen coverage levels.

Flexibility and portability are crucial elements to consider. Many Trustee Group Life Policies offer some degree of portability, allowing members to continue their coverage, often at adjusted rates, even if they leave the group. Beneficiary designations are typically made by the individual members, providing control over who receives the benefits.

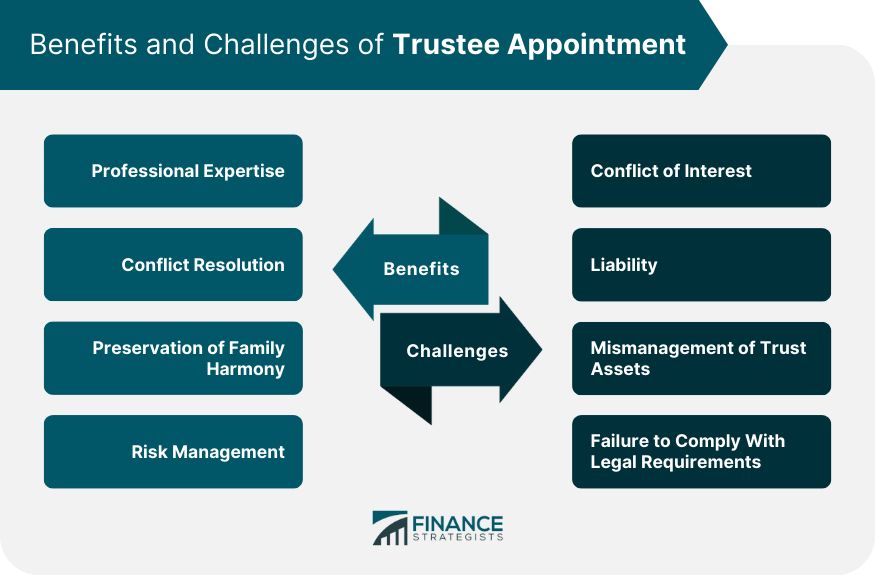

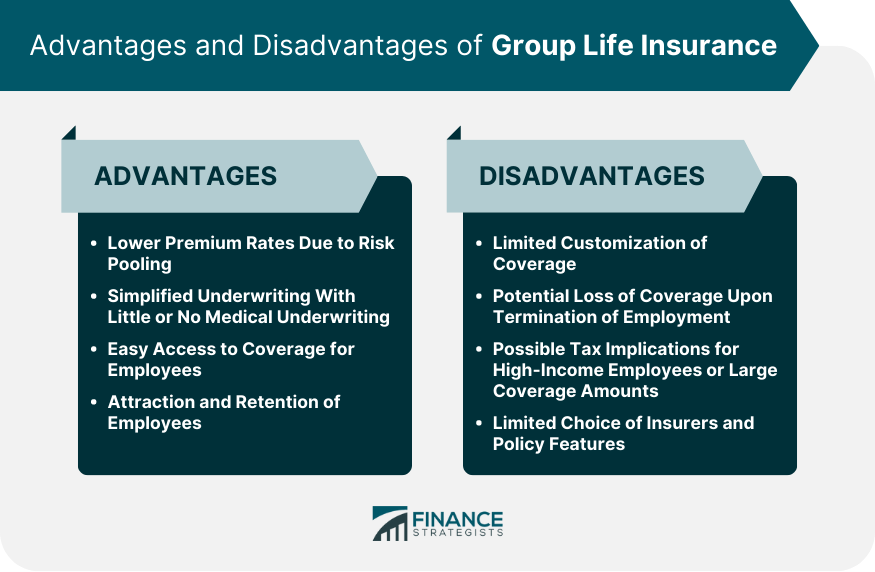

Advantages and Disadvantages

One of the primary advantages of Trustee Group Life Policies is often the accessibility and affordability. Group rates can be significantly lower than individual policy premiums, particularly for younger individuals or those with pre-existing health conditions.

The ease of enrollment is another benefit. Often, minimal underwriting is required, making it easier for members to obtain coverage quickly.

However, there are also potential drawbacks. Coverage amounts may be limited compared to individual policies, potentially leaving some families underinsured. Portability options, while often available, may come with increased premiums, potentially making it less appealing upon leaving the group.

Potential Limitations

Another crucial aspect is the reliance on the trustee's ability to manage the policy effectively. Any mismanagement or financial instability within the trustee organization could potentially impact the coverage provided to members.

Changes in the group's membership demographics can also affect the policy's overall cost and terms. A significant shift towards older members, for instance, could lead to premium increases for everyone.

Industry Trends and Regulatory Oversight

The life insurance industry is continuously evolving. Increasing regulatory scrutiny and a growing emphasis on consumer protection are shaping the landscape of Trustee Group Life Policies.

Organizations like the Canadian Life and Health Insurance Association (CLHIA) play a crucial role in setting industry standards and advocating for responsible practices. Provincial insurance regulators also oversee the operations of insurance companies and ensure compliance with relevant laws and regulations.

Recent trends indicate a growing demand for transparency and clarity in policy terms. Members are increasingly seeking more detailed information about their coverage options, portability rights, and the financial stability of the trustee organizations.

The Human Impact

Consider the story of Maria Rodriguez, a single mother who relied on the Trustee Group Life Policy provided through her professional association. Upon her unexpected passing, the policy provided crucial financial support to her children, helping them with education expenses and daily living costs. The policy served as a safety net, mitigating the devastating financial impact of her loss.

Or think of John Smith, who was diagnosed with a serious illness. His Trustee Group Life Policy provided a measure of comfort knowing his family would be financially secure after his passing. These policies offer more than just a financial payout; they offer peace of mind.

Conclusion

Trustee Group Life Policies represent a significant component of the insurance landscape in Canada. Their unique structure offers both advantages and disadvantages for those covered.

Understanding the intricacies of these policies, including eligibility requirements, coverage amounts, portability options, and the role of the trustee, is crucial for making informed decisions. As the industry continues to evolve, staying informed about regulatory changes and industry trends is essential for ensuring adequate protection and peace of mind.

Ultimately, Trustee Group Life Policies can provide a valuable safety net for families, offering financial security in times of need. However, careful consideration and due diligence are paramount to maximizing the benefits and mitigating potential risks.