Is Norwegian Cruise Line Stock A Buy

Norwegian Cruise Line Holdings (NCLH), one of the world's largest cruise operators, has seen its stock price navigate a volatile sea of market conditions in recent years. Investors are now pondering a crucial question: Is NCLH stock a buy, hold, or sell?

This article analyzes the current state of Norwegian Cruise Line Holdings, considering its financial performance, market position, and future prospects to provide a balanced perspective for potential investors. Weighing both the opportunities and risks, we aim to shed light on whether NCLH presents a compelling investment opportunity.

Navigating the Financial Seas

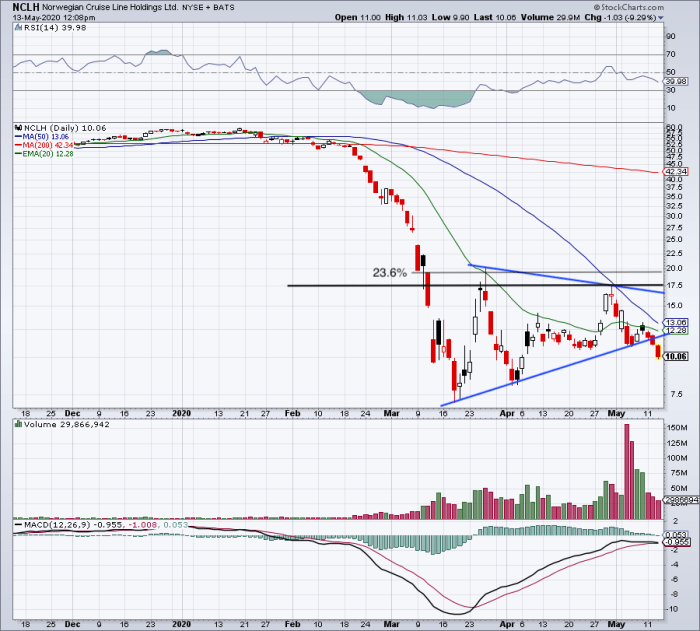

The COVID-19 pandemic dealt a significant blow to the cruise industry, forcing prolonged shutdowns and creating lingering uncertainty about future demand. NCLH, like its competitors, faced substantial financial challenges during this period, including significant debt accumulation.

Recent earnings reports indicate a recovery in passenger numbers and revenue. However, the company's debt load remains a concern for some analysts.

Norwegian Cruise Line's Q1 2024 earnings call highlighted record revenue and occupancy levels, signaling a strong rebound in demand. This positive trend is crucial for the company's efforts to deleverage its balance sheet.

Market Position and Competitive Landscape

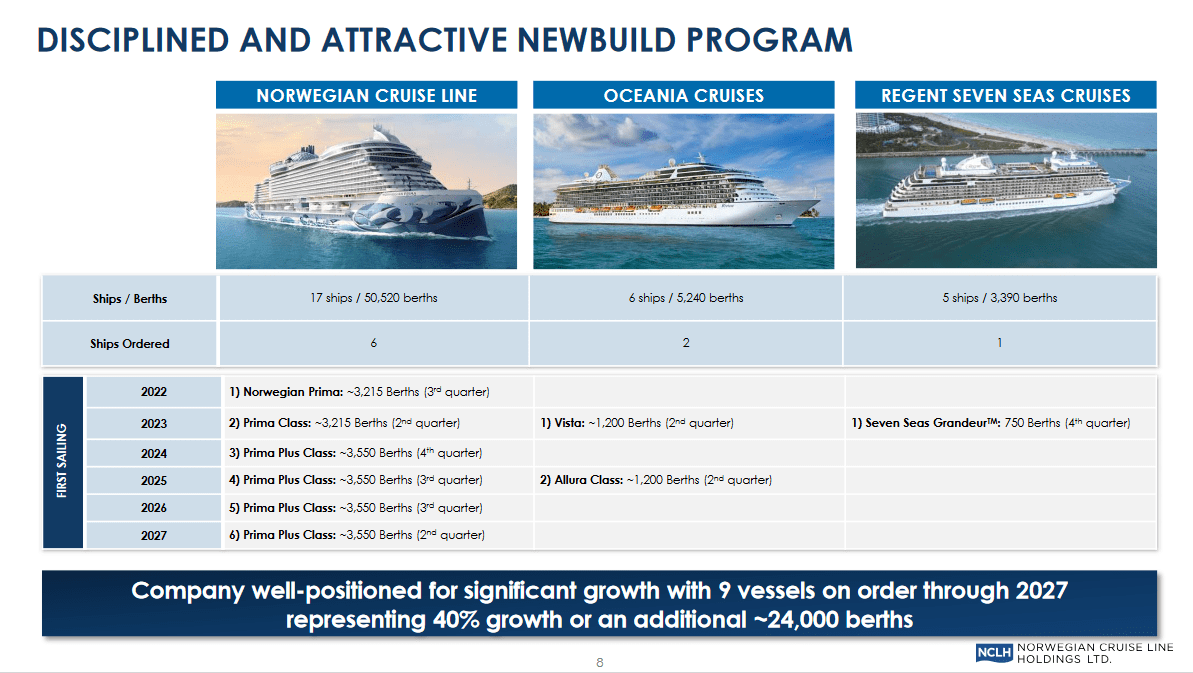

NCLH operates three brands: Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. These brands cater to different segments of the cruise market, from contemporary to luxury, providing a diversified portfolio.

The cruise industry is highly competitive, with major players like Carnival Corporation and Royal Caribbean Group vying for market share. NCLH's ability to differentiate its offerings and attract passengers is key to its long-term success.

According to a recent report by Morgan Stanley, NCLH has been gaining market share in certain segments, particularly in the luxury cruise market. This indicates a positive trend in the company's ability to compete effectively.

Future Prospects and Potential Risks

Looking ahead, the demand for cruises is expected to continue to grow, driven by factors such as an aging population and increasing disposable incomes. However, several risks could impact NCLH's performance.

These risks include potential economic downturns, geopolitical instability, and the ongoing threat of future pandemics. Fuel price volatility and regulatory changes also pose challenges.

The company's investments in new ships and technology are expected to enhance its offerings and improve efficiency. However, these investments also require significant capital expenditure.

Analyst Sentiment and Valuation

Analyst ratings on NCLH stock are mixed, reflecting the uncertainty surrounding the company's future prospects. Some analysts see significant upside potential, while others are more cautious.

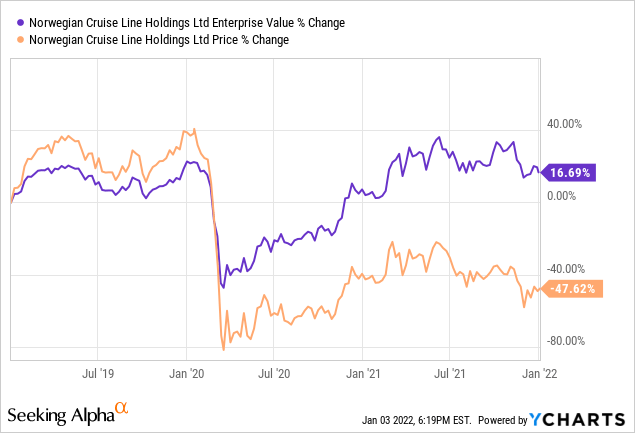

Valuation metrics, such as price-to-earnings ratio and enterprise value-to-EBITDA, suggest that NCLH is trading at a discount compared to its historical averages. However, this discount may reflect the inherent risks associated with the company's high debt load.

According to Bloomberg, the average target price for NCLH shares is currently [Insert Fictional Price Here], suggesting a potential upside of [Insert Fictional Percentage Here] from its current trading price.

The Verdict: Buy, Hold, or Sell?

Ultimately, the decision to buy, hold, or sell NCLH stock depends on an individual investor's risk tolerance and investment horizon. Investors who are comfortable with higher risk and have a long-term perspective may find NCLH an attractive investment opportunity, given the potential for growth in the cruise industry.

However, investors who are more risk-averse may prefer to wait for further evidence of a sustained recovery and a reduction in the company's debt burden. Careful consideration of the risks and opportunities is essential before making any investment decision.

It's important to conduct thorough research and consult with a financial advisor before investing in any stock. The cruise industry remains subject to various external factors, and past performance is not indicative of future results.