Is Optima Tax Relief A Good Company

Imagine receiving a notice from the IRS, the weight of unpaid taxes suddenly pressing down on you. A wave of anxiety washes over, and you begin searching for a lifeline. Among the many options promising relief, Optima Tax Relief emerges, a beacon of hope for those navigating the complexities of tax debt.

But is Optima Tax Relief a genuine solution, a trustworthy partner in resolving tax burdens? This article dives deep into the company's operations, reputation, and customer experiences, aiming to provide a balanced perspective on whether it lives up to its promises of tax relief.

The Rise of Optima Tax Relief

Founded in 2012, Optima Tax Relief quickly established itself as a major player in the tax resolution industry. Headquartered in Santa Ana, California, the company boasts a large team of enrolled agents, CPAs, and attorneys.

Their core mission centers on helping individuals and businesses navigate the intricate world of tax debt and find workable solutions. They achieve this through various services, including negotiating with the IRS, preparing offers in compromise (OIC), and assisting with installment agreements.

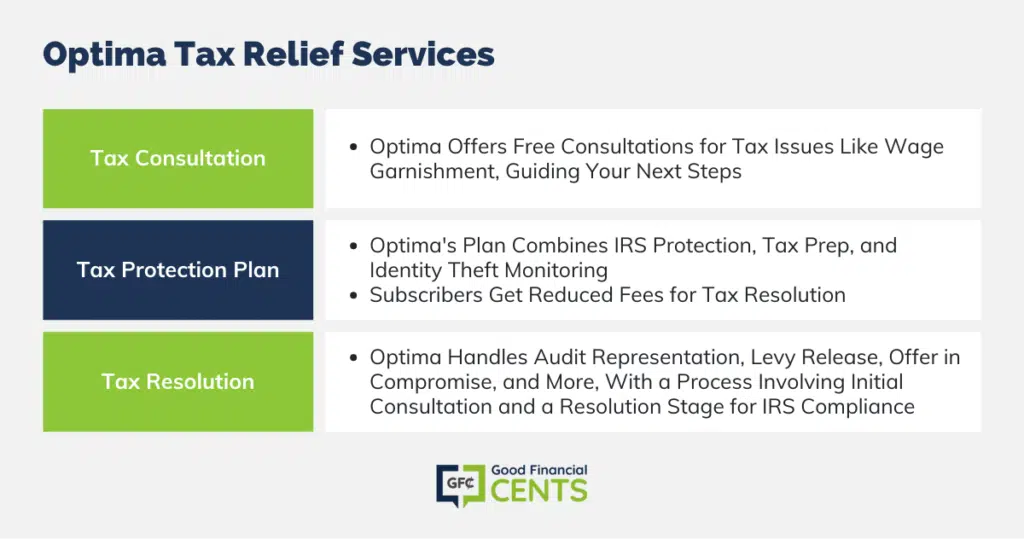

What Services Do They Offer?

Optima Tax Relief provides a comprehensive suite of services designed to address diverse tax situations. A key offering is their initial consultation, a crucial first step for assessing a client's unique needs.

Following the consultation, they offer services such as tax preparation, audit defense, and penalty abatement. They also specialize in more complex resolution strategies like offers in compromise (OIC), which allow taxpayers to settle their debt for less than the full amount owed.

Another critical service is their assistance with installment agreements, enabling taxpayers to pay off their debt in manageable monthly payments. These various services demonstrate Optima's commitment to tailoring solutions to fit individual circumstances.

Reputation and Customer Reviews

A crucial aspect of evaluating any company is understanding its reputation. Examining customer reviews and ratings provides valuable insights into the experiences of those who have used Optima Tax Relief's services.

Many customers report positive experiences, praising the company's professionalism and effectiveness in resolving their tax issues.

"Optima Tax Relief was a lifesaver! They helped me negotiate with the IRS and significantly reduce my tax debt,"one satisfied client stated in an online review.

However, not all feedback is glowing. Some customers have reported dissatisfaction with the company's fees, communication, or the outcome of their cases. These varied experiences highlight the importance of thorough research and understanding the potential risks and rewards before engaging any tax resolution firm.

Accreditations and Industry Standing

Optima Tax Relief holds an A+ rating with the Better Business Bureau (BBB), reflecting their commitment to resolving customer complaints and maintaining ethical business practices. This accreditation provides a level of assurance to potential clients.

However, it's important to note that a BBB rating is not an endorsement of the company's services, but rather an indicator of their responsiveness to customer concerns. Furthermore, the tax resolution industry has faced scrutiny over the years, with some companies engaging in deceptive practices.

Therefore, verifying the credentials of enrolled agents, CPAs, and attorneys associated with Optima Tax Relief is crucial to ensuring you receive competent and ethical advice.

Making an Informed Decision

Deciding whether to work with Optima Tax Relief or any tax resolution company is a personal choice that requires careful consideration. Thorough research, understanding your own tax situation, and exploring all available options are essential steps.

Consider consulting with multiple tax professionals and comparing their fees, services, and approaches. Don't hesitate to ask questions about their experience, success rates, and any potential risks involved.

Remember that no tax resolution company can guarantee a specific outcome. The IRS ultimately makes the final decision on any proposed settlement or agreement.

Ultimately, navigating tax debt is a challenging process. Optima Tax Relief offers a range of services that can be beneficial for some individuals and businesses.

However, it's crucial to approach their services with realistic expectations, conduct thorough due diligence, and ensure they align with your specific needs and financial situation. By making an informed decision, you can increase your chances of achieving a positive resolution and regaining control of your financial well-being.