Personal And Small Business Finance Software

The financial landscape for individuals and small businesses is increasingly complex, demanding sophisticated tools for effective management. Overspending, missed investment opportunities, and tax compliance headaches are common pitfalls. The rise of personal and small business finance software promises to alleviate these challenges, but choosing the right solution is critical.

This article explores the current state of personal and small business finance software, examining its benefits, drawbacks, key players, and future trends. The analysis draws on industry reports, expert opinions, and user data to provide a comprehensive overview. This empowers readers to make informed decisions about leveraging these powerful tools for financial success.

The Rise of Finance Software: A Necessary Evolution

Traditionally, managing finances involved manual tracking, spreadsheets, and reliance on professional accountants. These methods are often time-consuming, prone to errors, and lack real-time insights. Finance software offers a streamlined and automated alternative.

Technological advancements, increased internet access, and a growing awareness of financial literacy have fueled the adoption of these solutions. Cloud-based platforms are particularly popular, providing accessibility from anywhere with an internet connection.

Key Benefits for Individuals

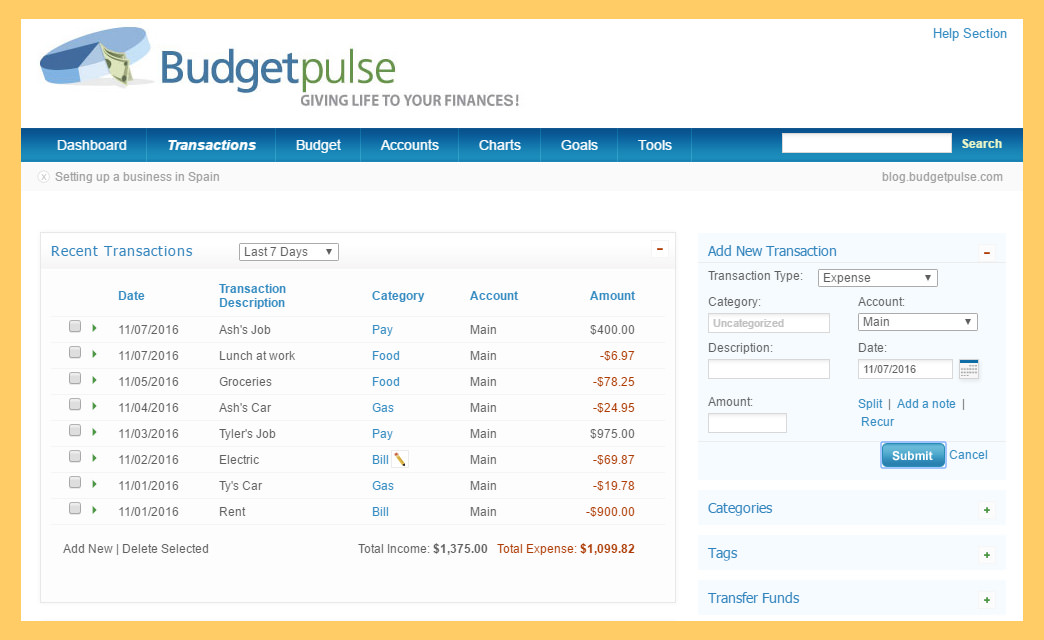

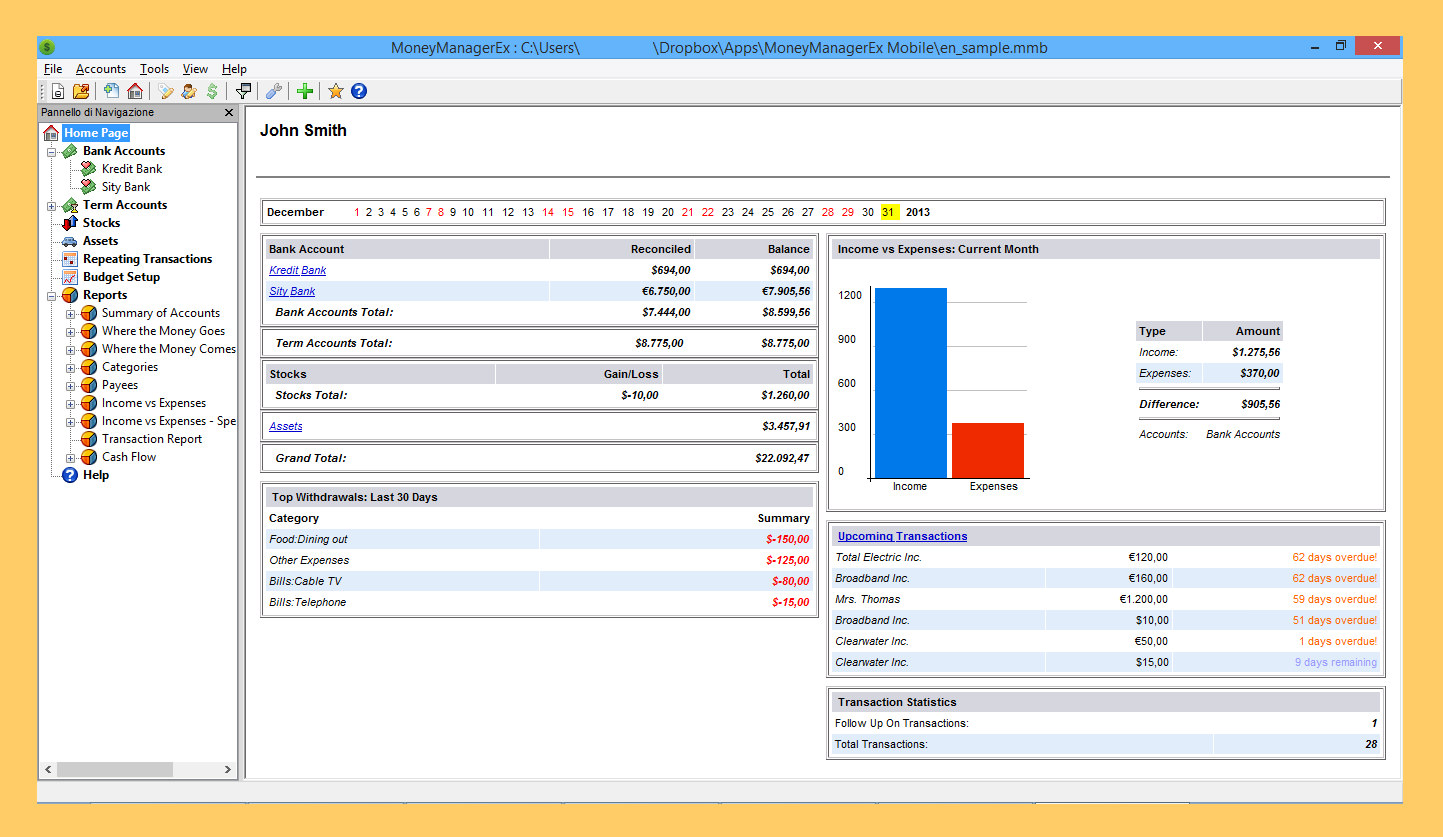

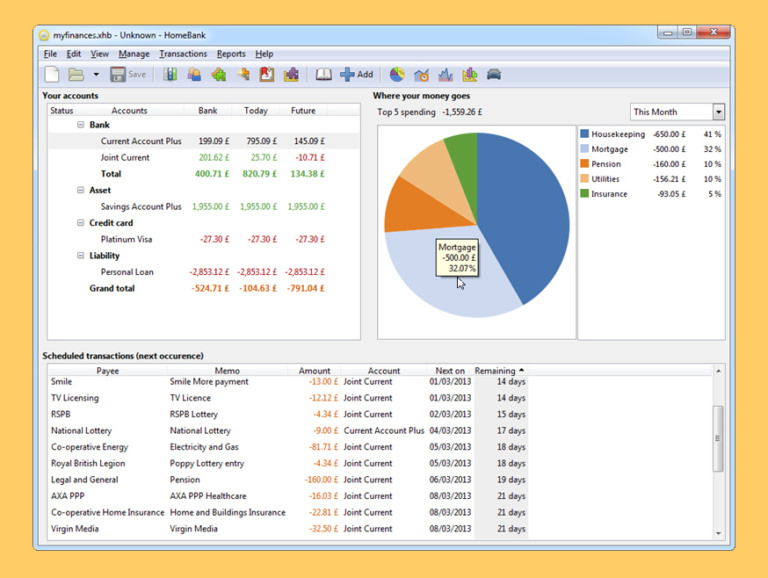

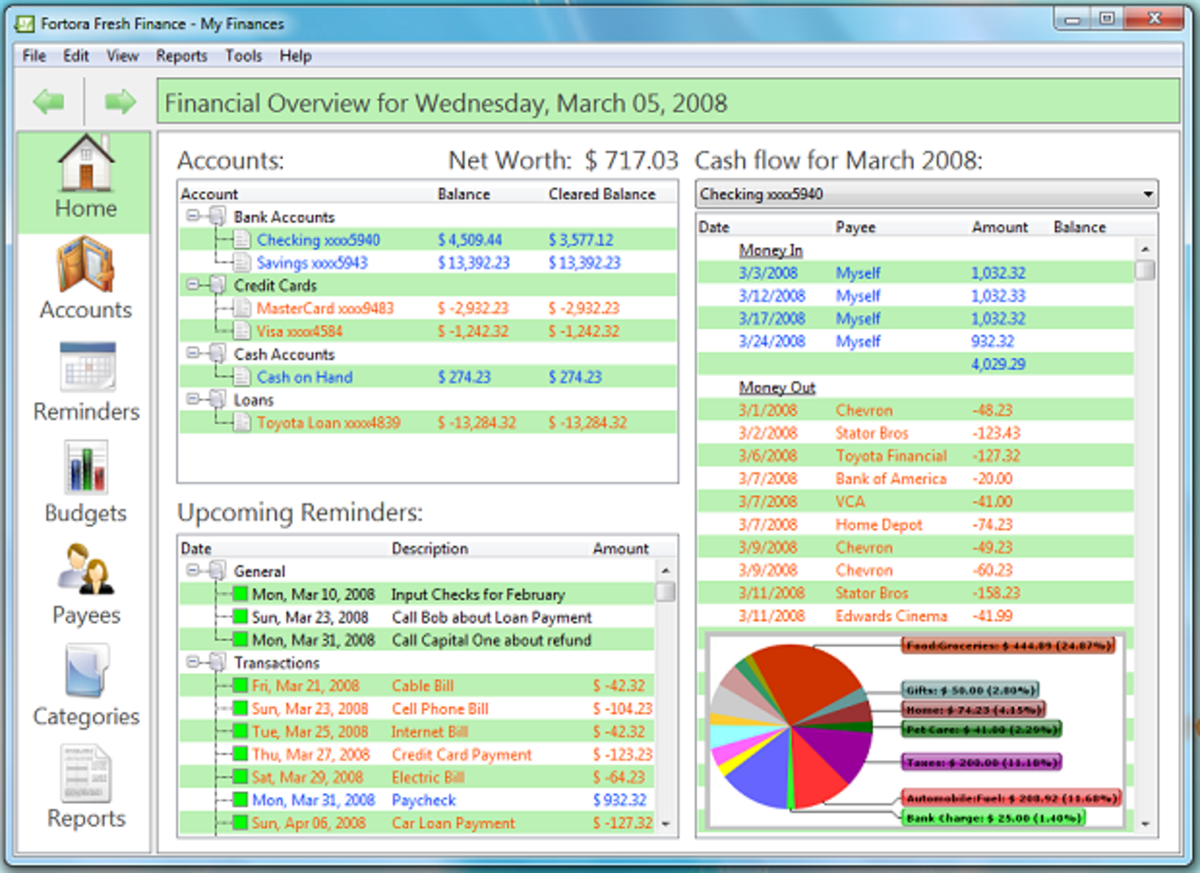

For individuals, finance software simplifies budgeting, tracking expenses, and monitoring investments. Many platforms offer features like automatic transaction categorization and personalized financial advice. This enables users to gain a clearer understanding of their cash flow and identify areas for improvement.

Software like Mint and Personal Capital aggregate financial data from various sources, providing a holistic view of an individual's financial health. These tools help users set financial goals, track progress, and make informed decisions about saving and spending.

Furthermore, some platforms offer credit score monitoring and identity theft protection features, adding an extra layer of security and peace of mind.

Small Business Solutions: Streamlining Operations

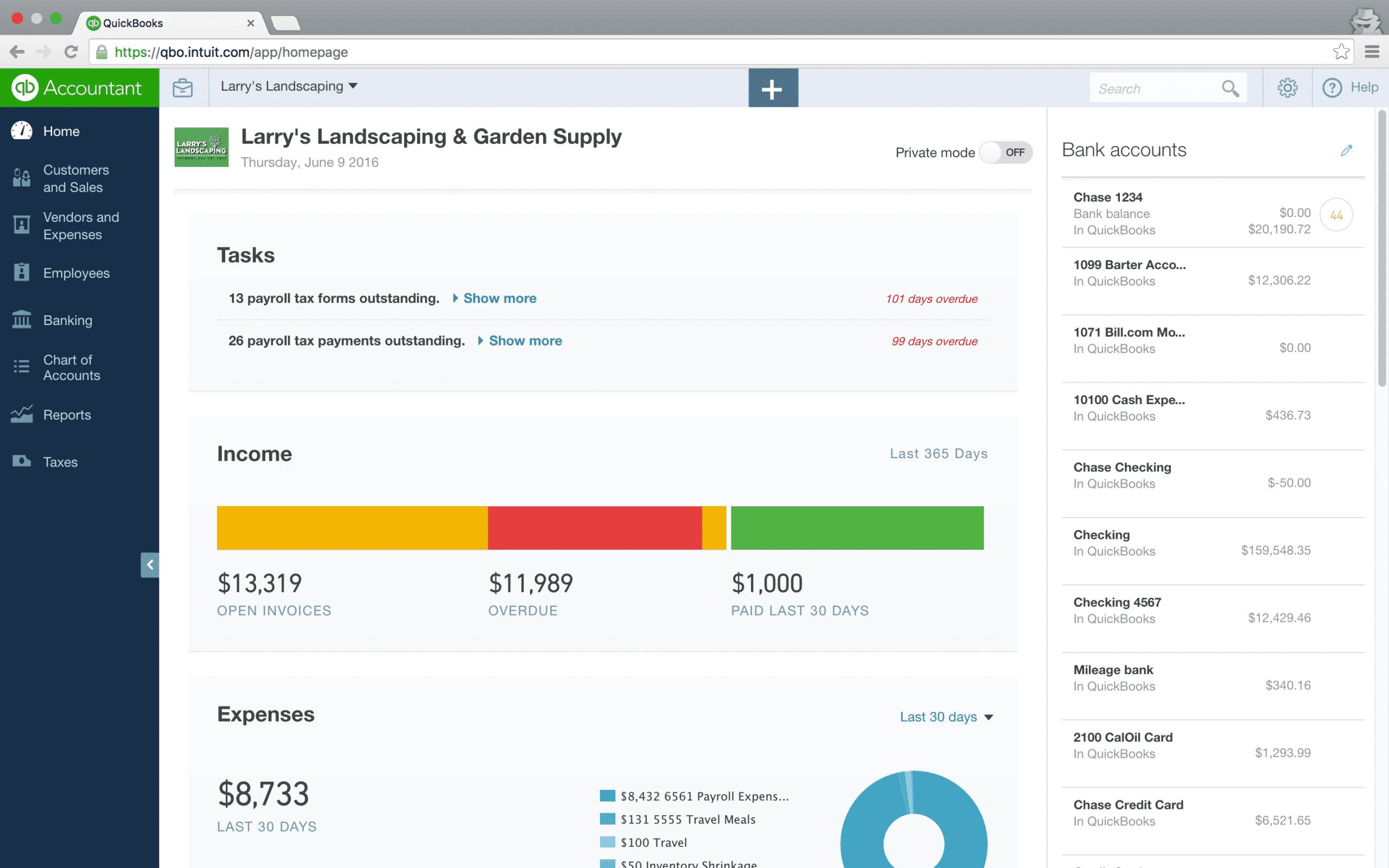

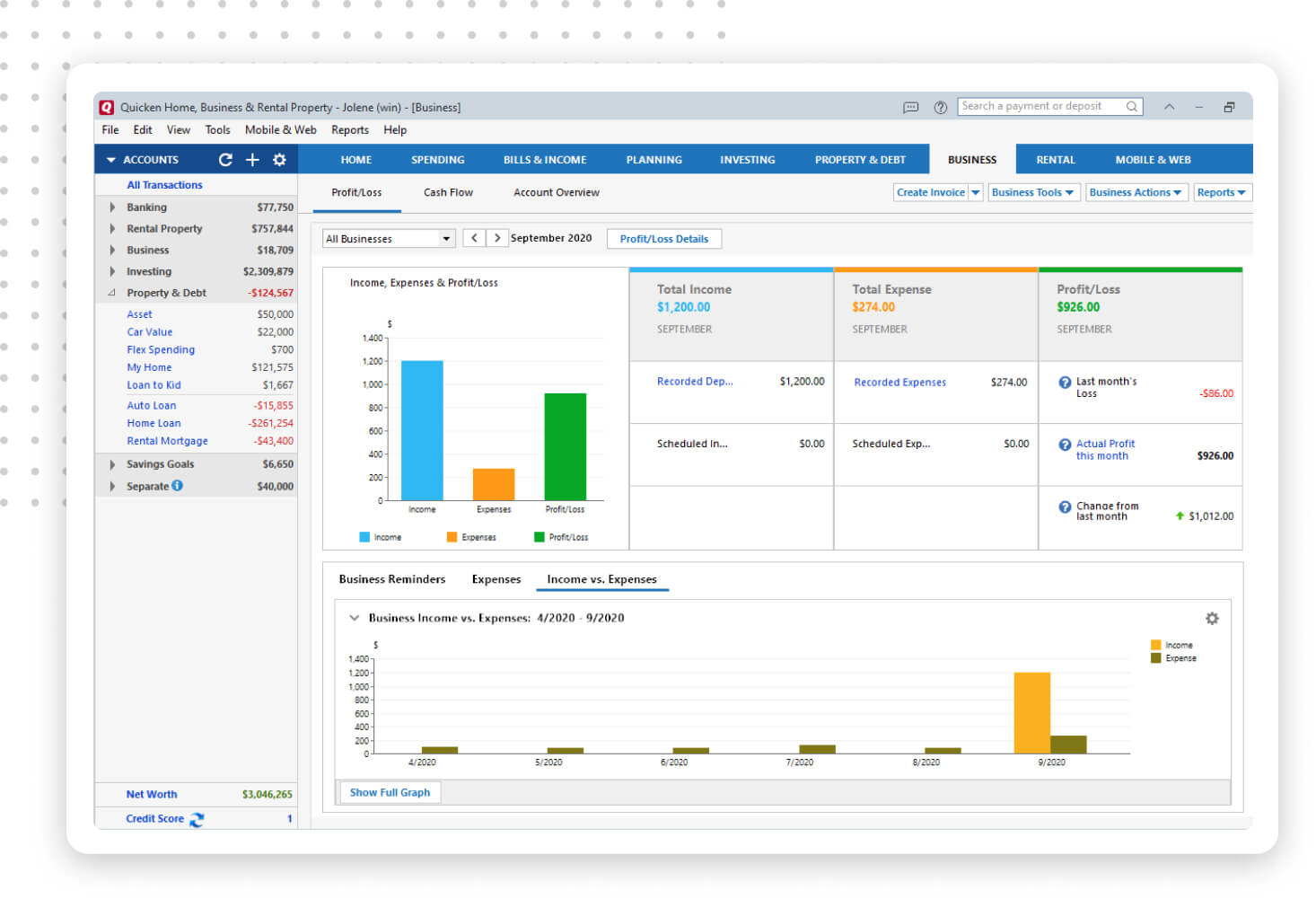

Small businesses face unique financial challenges, including managing cash flow, invoicing clients, and preparing taxes. Finance software can automate these tasks, freeing up valuable time for business owners to focus on growth. Software like QuickBooks and Xero are dominant players in this space.

These platforms offer features such as invoice generation, expense tracking, payroll management, and financial reporting. They integrate with other business tools, like CRM and e-commerce platforms, to streamline workflows.

According to a report by the Small Business Administration (SBA), businesses that utilize accounting software are more likely to report accurate financial data and experience improved cash flow management.

Challenges and Considerations

Despite the numerous benefits, there are challenges associated with using finance software. Data security is a major concern, as these platforms store sensitive financial information. Users must choose providers with robust security measures and be vigilant about protecting their login credentials.

Another challenge is the learning curve associated with some platforms. Complex features and unfamiliar terminology can be overwhelming for some users. Therefore, it's important to select software that is user-friendly and offers adequate customer support.

"The key to successful implementation lies not just in choosing the right software, but also in understanding how to leverage its features effectively," says Sarah Jones, a financial advisor specializing in small businesses.

Finally, cost is a factor to consider. While many platforms offer free or low-cost options, more comprehensive features often require a subscription fee. Businesses must carefully evaluate their needs and budget before committing to a particular solution.

The Future of Finance Software

The future of finance software is likely to be driven by advancements in artificial intelligence (AI) and machine learning (ML). AI-powered platforms can provide personalized financial advice, automate tasks, and detect fraudulent activity.

Integration with other technologies, such as blockchain and open banking, will also play a significant role. These technologies will enable more seamless data sharing and enhanced security.

Moreover, the demand for mobile-first solutions will continue to grow. Users want to access their financial information and manage their finances on the go. Software developers will need to prioritize mobile optimization to meet this demand.

Conclusion

Personal and small business finance software offers a powerful toolkit for managing money and achieving financial goals. However, careful consideration of needs, security, and cost is crucial. By embracing these tools strategically, individuals and businesses can unlock greater financial control and build a more secure future.

As technology continues to evolve, finance software will become even more sophisticated and accessible. Staying informed about the latest trends and innovations is essential for maximizing the benefits of these transformative tools.

.jpg)