Is There Sales Tax On Gold Bars

The glint of gold has always captivated, but the allure of gold bars extends beyond mere aesthetics. Increasingly, investors are turning to physical gold as a hedge against economic uncertainty, a store of value in turbulent times. But one crucial question hangs heavy in the minds of potential buyers: Is there sales tax on gold bars?

The answer, unfortunately, is not a simple yes or no. The application of sales tax to gold bars is a complex issue, varying significantly depending on the state, local laws, and even the specific characteristics of the gold bar itself. This article will delve into the intricate landscape of gold sales tax across the United States, examining exemptions, thresholds, and the reasons behind these varied regulations, providing a comprehensive guide for anyone considering adding gold bars to their investment portfolio.

The State-by-State Sales Tax Maze

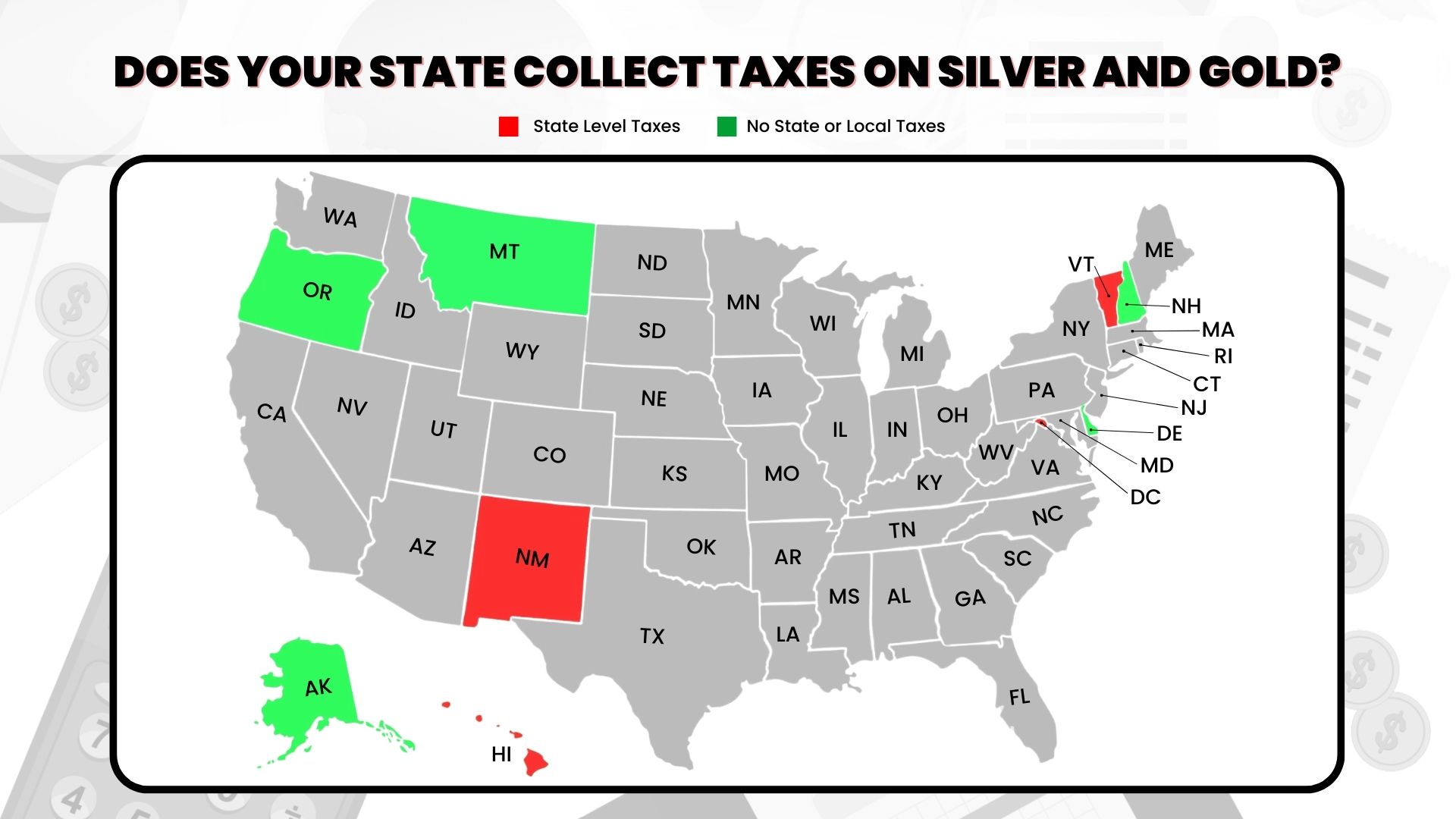

The United States operates under a system of state-level sales tax laws, meaning that the rules regarding taxation of gold bars can differ dramatically from one state to another. Some states treat gold bars like any other tangible personal property, subjecting them to the standard sales tax rate. Others offer exemptions, either outright or with certain conditions.

For instance, states like Oregon, Delaware, Montana, New Hampshire and Alaska, have no sales tax at all, effectively making gold bar purchases tax-free. However, the vast majority of states do impose a sales tax in some form, requiring investors to carefully examine the specific regulations in their jurisdiction.

Understanding Exemptions and Thresholds

Even within states that generally impose sales tax, exemptions may exist for certain types of gold transactions. Many exemptions hinge on the monetary value of the gold being purchased. Several states have established minimum purchase thresholds below which sales tax does not apply.

For example, in Ohio, sales of investment bullion and coins are exempt from sales tax. Similarly, Texas exempts sales of precious metals bullion if the value exceeds $1,000. These thresholds are intended to encourage investment in precious metals, recognizing their role as a safe haven asset.

Furthermore, the definition of "bullion" itself can be crucial. Some states may only exempt gold bars that meet specific purity standards, often requiring a minimum fineness of .995 or .999. Investors must ensure that the gold bars they purchase meet these criteria to qualify for the exemption.

The Rationale Behind the Varied Regulations

The inconsistent application of sales tax to gold bars reflects a broader debate about the role of precious metals in the economy. Proponents of exemptions argue that taxing gold bars discourages investment and hinders economic diversification. They view gold as a store of value, not merely a consumer good, and believe that taxing it punishes savers and investors.

"Taxing gold bars is essentially taxing savings," argues John Smith, a financial advisor specializing in precious metals investments. "It makes it more expensive for people to protect their wealth against inflation and economic downturns."

On the other hand, some argue that gold bars should be treated like any other commodity and subjected to sales tax. They contend that exemptions create loopholes that benefit wealthy investors and erode the tax base, putting a strain on public services.

State governments also consider revenue needs when deciding on tax policies. States struggling with budget deficits may be less inclined to offer exemptions, even if they acknowledge the potential benefits of encouraging precious metals investment.

Navigating the Complexities

Given the intricacies of state sales tax laws, investors should take several steps to ensure they comply with regulations and minimize their tax burden. First, consulting with a qualified tax advisor is essential.

A tax professional can provide personalized guidance based on the investor's location, the specific types of gold bars being considered, and the applicable state and local laws. Second, buyers should carefully research the sales tax laws in their state and any other state where they might take delivery of the gold.

Official state government websites are the best source of up-to-date information. Finally, retaining detailed records of all gold bar purchases, including invoices and receipts, is crucial for documentation purposes.

The Future of Gold Sales Tax

The debate over sales tax on gold bars is likely to continue as economic conditions evolve and states grapple with fiscal challenges. Several organizations, including the Sound Money Defense League, actively lobby for the repeal of sales taxes on precious metals, arguing that they impede economic growth and undermine monetary freedom.

Whether more states will follow suit and enact exemptions remains to be seen. What is certain is that the legal landscape surrounding gold sales tax will continue to be a significant factor for investors to consider when making decisions about their precious metals portfolios. Careful planning and a thorough understanding of the relevant laws are essential for navigating this complex area.

Ultimately, the decision of whether to invest in gold bars, and how to minimize any applicable sales tax, should be made in consultation with a trusted financial advisor and a qualified tax professional, ensuring compliance and maximizing the potential benefits of this unique asset class.