Cash Flows From Investing Do Not Include Cash Flows From:

Understanding the nuances of cash flow statements is crucial for investors and financial analysts alike. Distinguishing between the different categories of cash flows, particularly the investing activities section, helps in accurately assessing a company's financial health and strategic direction.

Confusion often arises regarding what items are specifically excluded from cash flows from investing activities. This article aims to clarify these exclusions, drawing on authoritative accounting standards and expert analysis to provide a comprehensive overview.

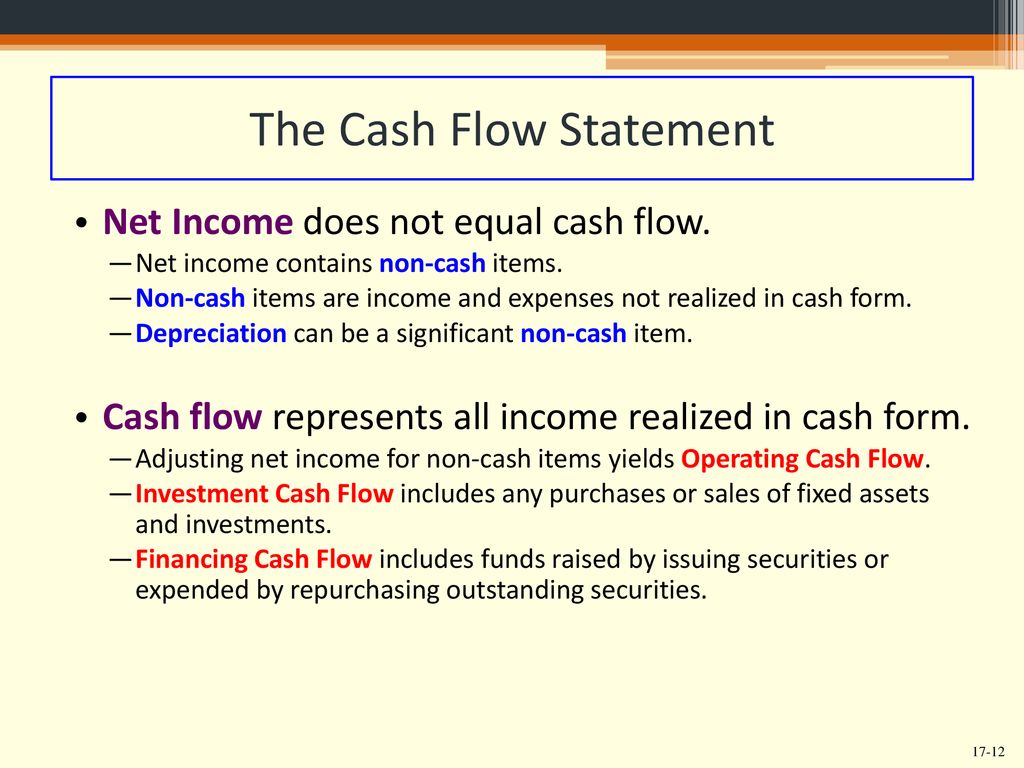

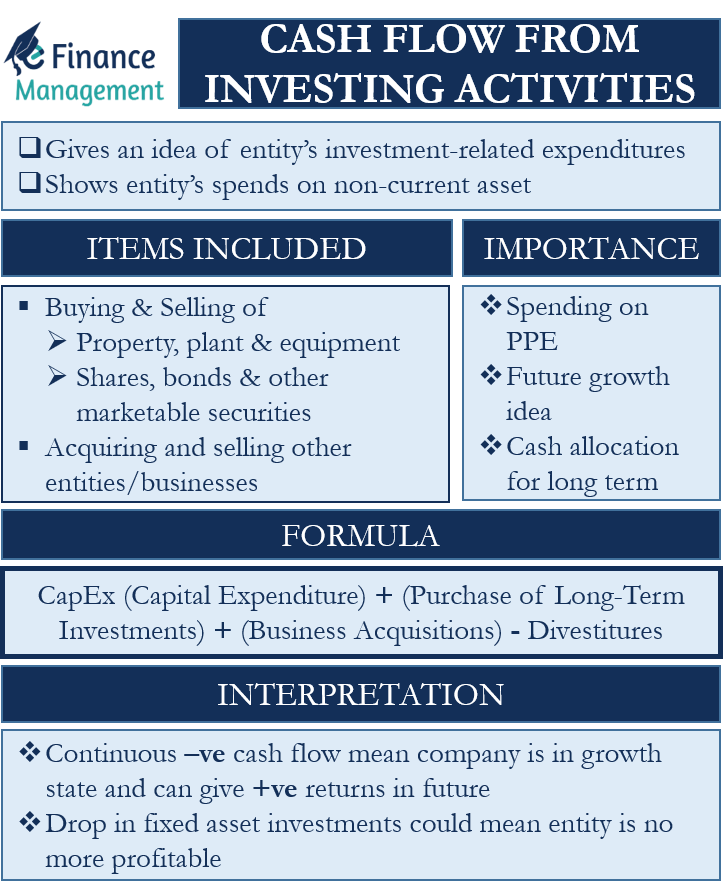

Cash Flows From Investing Activities: The Basics

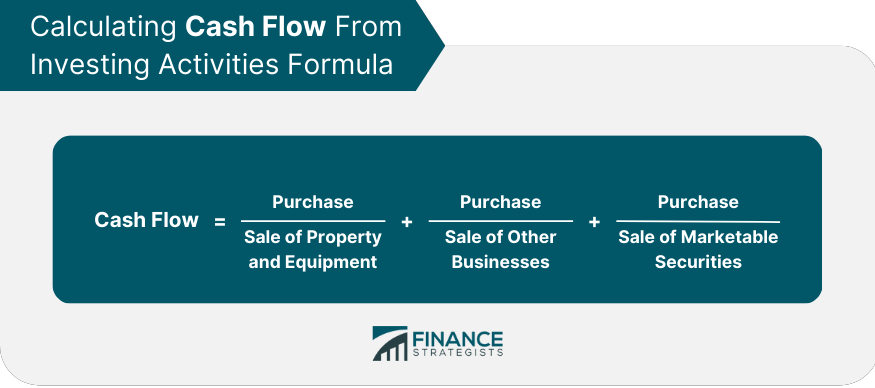

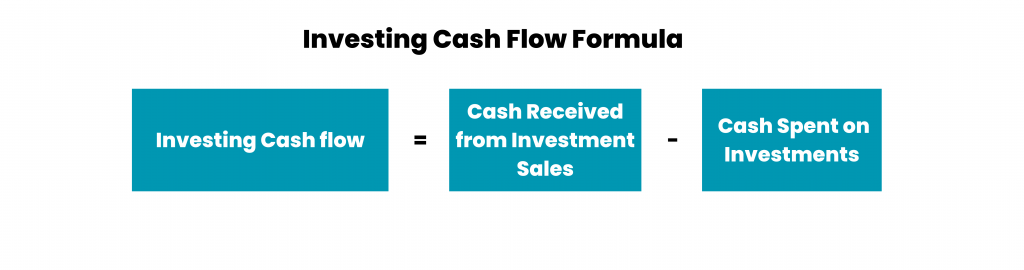

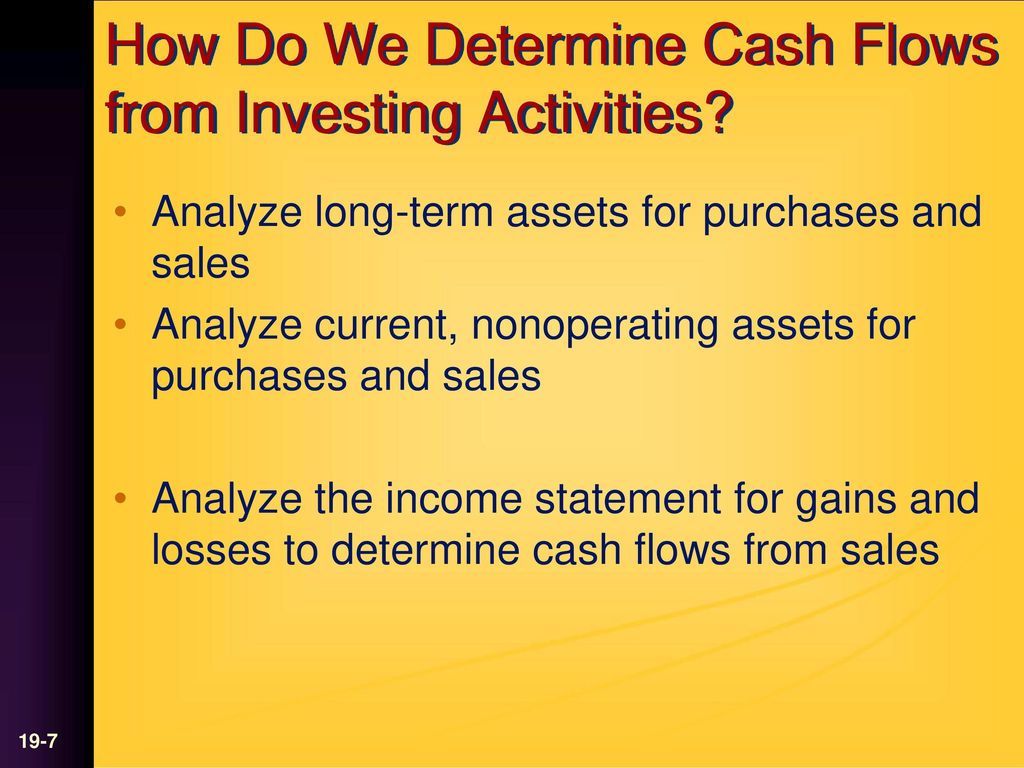

Cash flows from investing activities represent changes in a company's long-term assets, such as property, plant, and equipment (PP&E), investments in securities, and other assets not readily converted into cash. These activities reflect the company's strategic decisions regarding its future growth and profitability.

According to Generally Accepted Accounting Principles (GAAP), the investing section captures cash inflows from the sale of these long-term assets and cash outflows from their purchase.

A key distinction is that only transactions directly impacting long-term assets are included. This often leads to misunderstandings about what doesn't belong in this section.

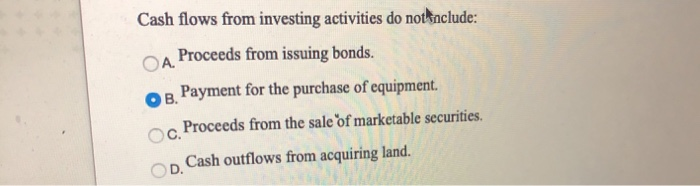

The Exclusions: What Doesn't Belong in Investing Activities

Several types of cash flows are explicitly excluded from the investing activities section. These exclusions are primarily related to operating and financing activities.

Cash Flows From Operating Activities

The most significant exclusion is cash flows related to day-to-day business operations. These are reported in the operating activities section of the cash flow statement.

Examples include cash received from customers for goods or services, cash paid to suppliers for inventory, and cash paid for salaries and wages.

It's crucial to remember that operating activities relate to the core revenue-generating activities of the company, unlike investing activities that involve long-term assets.

Cash Flows From Financing Activities

Transactions related to debt and equity financing are classified as financing activities. These include items like issuing stock, repurchasing stock, paying dividends, and borrowing money.

For instance, cash received from issuing bonds is a financing inflow, while cash used to repay debt is a financing outflow.

These cash flows are completely separate from the acquisition or disposal of long-term assets, which define the investing section.

Internal Transfers and Non-Cash Transactions

Internal transfers of funds within the company don't qualify as cash flows from investing activities. For example, transferring money from a checking account to a savings account does not represent an investing activity.

More importantly, non-cash transactions, such as the exchange of assets without the movement of cash, are excluded. These transactions are usually disclosed in the footnotes to the financial statements.

An example is acquiring a building by issuing stock rather than paying cash. Although significant, this transaction doesn't appear in the cash flow statement itself.

Interest and Dividends Received

The treatment of interest and dividends received can be a point of confusion. According to GAAP, companies have a choice: they can classify interest and dividends received as either operating or investing activities. However, they must be consistent in their classification.

Under IFRS (International Financial Reporting Standards), interest and dividends received are usually classified as investing cash flows.

Regardless of the classification chosen, they are definitively not included by default in the investing section if the company opted for operating activities classification.

Interest Paid

Similar to dividends received, interest paid is typically classified as an operating or financing activity, not investing. GAAP allows for flexibility, requiring consistent application of the chosen method.

Under IFRS, interest paid is often classified as operating cash flows.

However, it’s crucial to note it’s never under investing cash flow.

Impact and Significance

Understanding these exclusions is vital for accurately interpreting a company's financial performance. Misclassifying cash flows can lead to a distorted view of a company's investment strategy and overall financial health.

Analysts and investors rely on accurate cash flow statements to assess a company's ability to generate cash, meet its obligations, and fund its growth.

Incorrect classification can significantly impact these assessments, potentially leading to poor investment decisions.

Conclusion

The cash flow statement, particularly the investing activities section, provides valuable insights into a company's long-term strategic investments. However, it's essential to recognize what items are excluded to avoid misinterpretations.

By understanding the exclusions, analysts and investors can gain a clearer picture of a company's core business operations, financing activities, and overall financial position. This ensures a more informed and accurate assessment of the company's financial performance.

Ultimately, a comprehensive understanding of cash flow statements, including the nuances of investing activities, is essential for making sound financial decisions.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/cashflowfinvestingactivities-recirc-8787bbde413f4036b2f8cfad5c4c6a99.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)