Is Transparent Financial A Pyramid Scheme

Allegations of pyramid scheme practices have recently surfaced against Transparent Financial, a company that claims to offer financial literacy and investment opportunities. These accusations raise serious questions about the legitimacy of its business model and the potential risks for individuals involved.

The central question remains: Is Transparent Financial a legitimate financial education platform, or is it operating as a pyramid scheme, where profits are derived primarily from recruiting new members rather than from actual investments or services? This article seeks to explore these allegations, examine the company's structure, and analyze the potential impact on investors and the broader financial landscape.

Understanding Transparent Financial

Transparent Financial describes itself as a platform dedicated to empowering individuals with the knowledge and tools necessary to navigate the complexities of the financial world. Their website promotes access to courses on investing, personal finance management, and building wealth, all offered at varying membership levels.

The company operates through a network of independent representatives who recruit new members, earning commissions based on the number of recruits and their subsequent membership purchases. This multi-level marketing (MLM) structure is a key point of contention in the ongoing scrutiny.

Pyramid Scheme Allegations

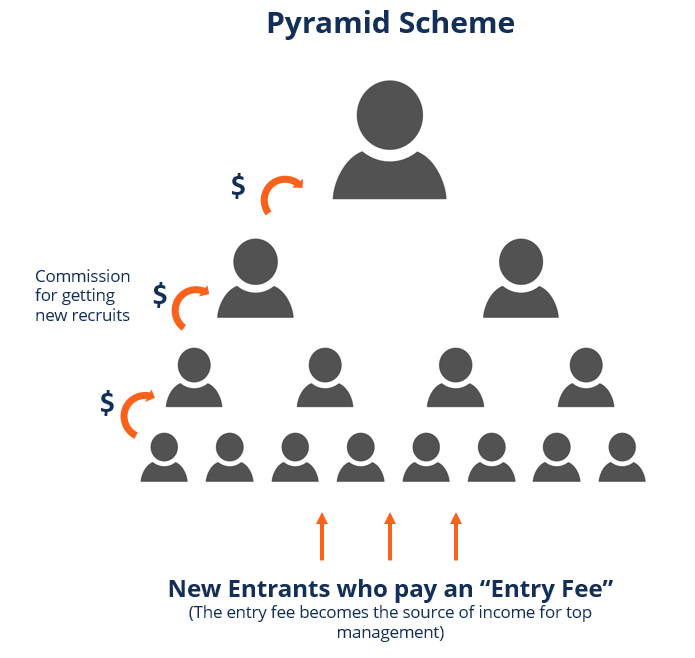

The core of the controversy lies in the claim that Transparent Financial's revenue primarily stems from recruitment fees rather than from the value of its educational products.

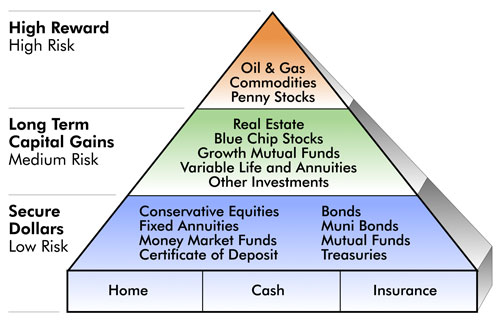

Critics argue that the emphasis on recruitment over genuine financial education suggests a pyramid scheme, where early participants benefit from the influx of new members, while those who join later struggle to recoup their investments. Pyramid schemes are illegal in many jurisdictions, including the United States, due to their unsustainable nature and potential for significant financial harm.

Key Indicators of a Potential Pyramid Scheme

Several factors are being examined to determine the legitimacy of Transparent Financial's business model.

One key indicator is the proportion of revenue generated from membership fees versus sales of actual educational products or investment returns. If the majority of revenue comes from recruitment, it raises a red flag.

Another crucial aspect is the requirement for members to purchase substantial inventory or expensive training materials. Such requirements can burden new recruits and suggest that the focus is on selling products to internal members rather than to external customers.

Official Statements and Investigations

To date, no official regulatory body has formally declared Transparent Financial a pyramid scheme.

However, several state securities regulators have confirmed that they are aware of the allegations and are monitoring the company's activities. These regulators are actively investigating potential violations of securities laws and consumer protection regulations.

Transparent Financial has consistently denied the allegations, asserting that its primary focus is on providing valuable financial education and that its compensation structure is compliant with all applicable laws. Their representatives claim that the company promotes ethical business practices and encourages members to focus on acquiring financial knowledge.

Impact on Investors and the Public

The allegations against Transparent Financial have already had a chilling effect on its membership base.

Many individuals have expressed concerns about the sustainability of the company and the potential for financial losses. The ongoing scrutiny has also fueled public debate about the risks associated with MLM companies and the importance of conducting thorough due diligence before investing in any financial opportunity.

"I joined Transparent Financial hoping to improve my financial literacy, but I'm now worried that I've been caught up in something potentially illegal," said one former member, who wished to remain anonymous. "The pressure to recruit new members was intense, and I struggled to see the value in the actual educational content."

The Importance of Due Diligence

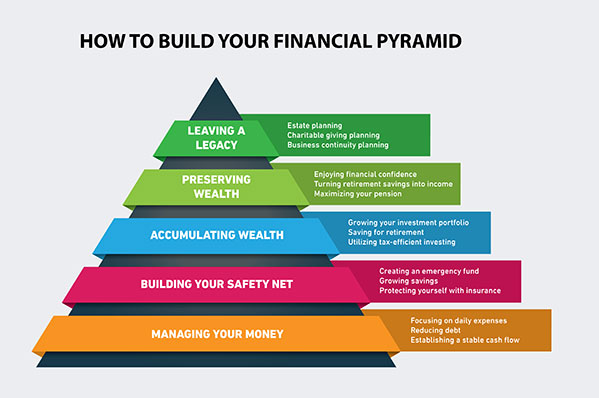

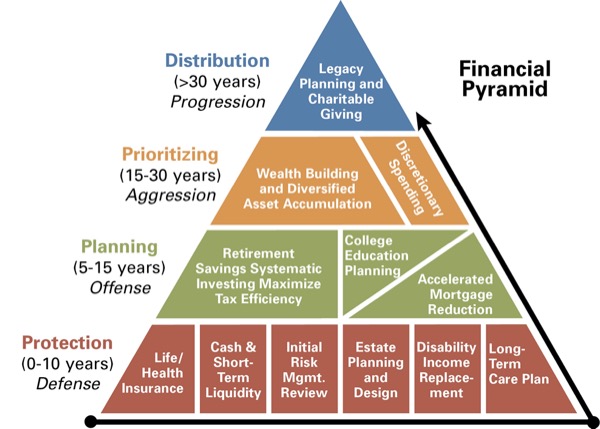

The Transparent Financial case underscores the critical importance of conducting thorough due diligence before investing in any financial venture, especially those involving multi-level marketing structures.

Investors should carefully examine the company's business model, revenue sources, and compensation plan. It is essential to determine whether the primary focus is on selling genuine products or services to external customers, or on recruiting new members for financial gain.

Consulting with a qualified financial advisor is also crucial. An advisor can provide objective guidance and help investors assess the risks and potential rewards of any investment opportunity.

Conclusion

The question of whether Transparent Financial is a pyramid scheme remains a subject of ongoing debate and investigation.

While the company vehemently denies the allegations, the concerns raised by regulators, critics, and former members warrant careful consideration. As the investigations unfold, it is imperative that investors exercise caution and prioritize thorough due diligence to protect their financial well-being.

The outcome of this case will not only affect the future of Transparent Financial but will also set a precedent for how regulatory bodies scrutinize and address potential pyramid schemes within the evolving landscape of financial education and investment opportunities.