Is Zomedica Going Out Of Business

Rumors and speculation have swirled recently around the future of Zomedica Corp. (ZOM), a veterinary health company focused on point-of-care diagnostics. Whispers of potential financial struggles and even the possibility of the company going out of business have prompted concern among investors, customers, and industry observers. This article aims to provide an objective analysis of Zomedica's current situation based on publicly available information and industry trends.

At the heart of this discussion lies the question of Zomedica's financial health and its ability to sustain operations in the long term. Understanding the company's current financial standing, its strategic direction, and the competitive landscape it operates within is crucial to assessing the validity of these concerns. This article will examine these factors to provide a balanced perspective on Zomedica's future prospects.

Analyzing Zomedica's Financial Performance

Zomedica's financial results have been a key area of scrutiny. The company has reported revenue growth in recent quarters. However, it also experienced a net loss. Investors are closely watching to see if the company can reach sustainable profitability.

According to their latest financial reports, Zomedica is actively working to optimize its operational expenses. The company aims to improve its financial performance by increasing sales, and reducing unnecessary costs. Furthermore, the company holds a notable amount of cash and cash equivalents, which can provide a buffer during periods of financial uncertainty.

Strategic Initiatives and Market Positioning

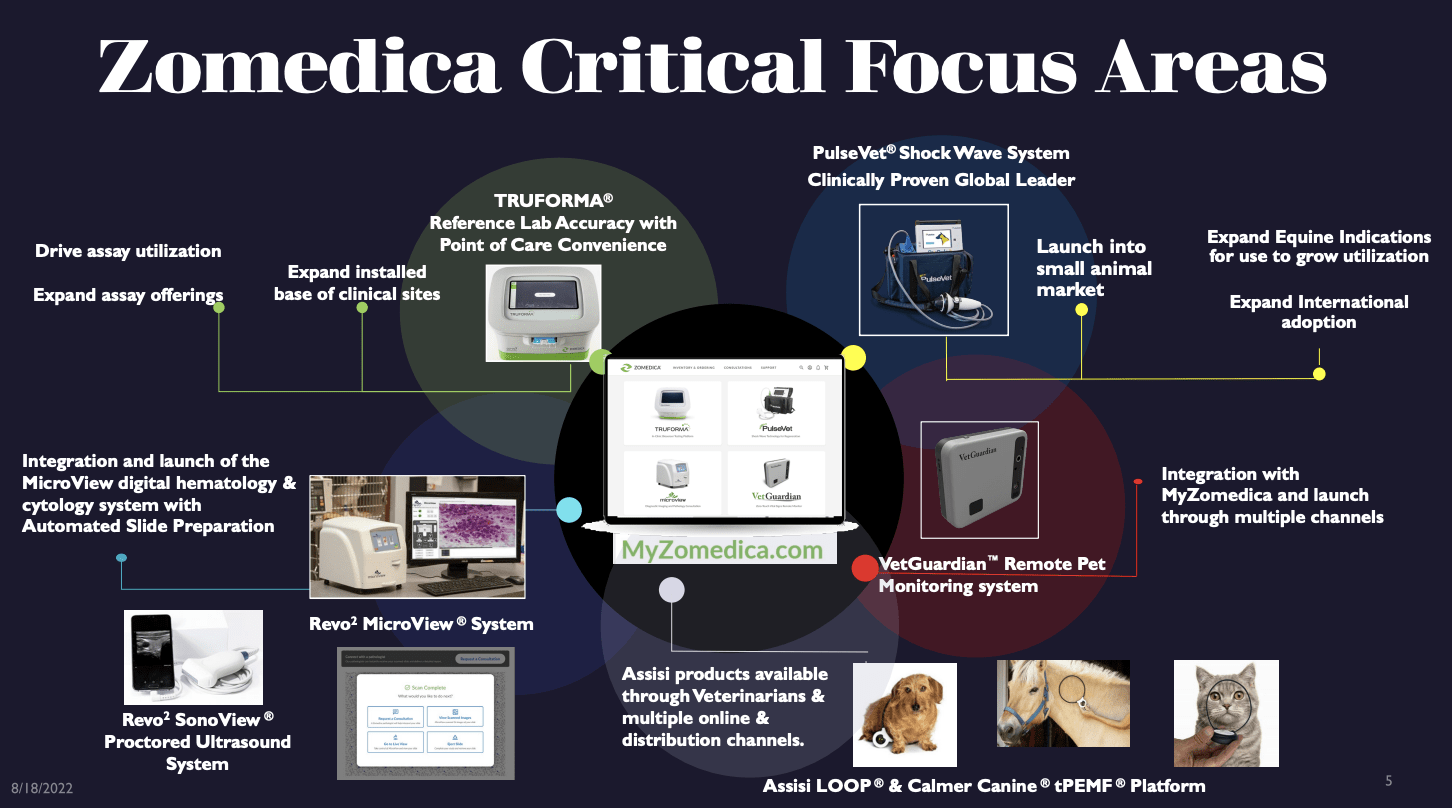

Zomedica has been actively pursuing strategic initiatives to strengthen its market position. A key element is the Truforma platform. It focuses on point-of-care diagnostics for common conditions in dogs and cats.

The company has expanded its product offerings through acquisitions and partnerships. These expansion efforts have broadened its diagnostic capabilities and market reach. The success of these strategic initiatives will be crucial to Zomedica's long-term growth and sustainability.

The veterinary diagnostics market is a competitive landscape with established players and emerging technologies. Zomedica faces challenges from larger, more established companies. It must also contend with innovative startups. The company's ability to differentiate itself and capture market share will be critical to its success.

Expert Opinions and Analyst Ratings

Industry analysts offer varied perspectives on Zomedica's future. Some analysts maintain a cautious outlook, citing concerns about profitability and competition. Others express optimism. They highlight the potential of Truforma and the company's expansion efforts.

Analyst ratings and price targets for Zomedica vary widely, reflecting the uncertainty surrounding the company's future. Investors should conduct thorough research and consider multiple viewpoints when making investment decisions. These are the basics of sound investing practices.

"The veterinary diagnostics market is experiencing rapid growth, driven by increasing pet ownership and a greater focus on preventative care," said Dr. Emily Carter, a veterinary industry consultant. "Zomedica has the potential to capitalize on this trend, but it will need to execute its strategy effectively and manage its expenses carefully."

Potential Impact on Stakeholders

The uncertainty surrounding Zomedica's future has implications for various stakeholders. Investors face the risk of potential losses if the company's financial situation deteriorates. On the other hand, they stand to gain if the company succeeds in its turnaround efforts.

Veterinarians who rely on Zomedica's diagnostic tools could be affected by any disruption to the company's operations. The availability of affordable and reliable point-of-care diagnostics is crucial for providing timely and effective care for animals. Clients are also affected because they want the best care for their pets.

Zomedica's employees and partners also have a stake in the company's future. Their livelihoods and business relationships depend on the company's success and stability. Continued success of the company is something that all stakeholders desire.

Addressing the "Going Out of Business" Rumors

While Zomedica faces financial challenges and operates in a competitive market, there is no definitive evidence at this time to suggest that the company is imminently going out of business. The company is actively pursuing strategic initiatives to improve its financial performance and strengthen its market position. However, the rumors highlight the real risks that investors are feeling.

The rumors surrounding Zomedica's future serve as a reminder of the inherent risks associated with investing in emerging growth companies. Investors should exercise caution, conduct thorough due diligence, and carefully consider their risk tolerance before investing in Zomedica or any other company.

Ultimately, Zomedica's future will depend on its ability to execute its strategic plan effectively, manage its expenses prudently, and adapt to the evolving dynamics of the veterinary diagnostics market. The next few quarters will be critical in determining whether the company can achieve sustainable profitability and long-term success.

![Is Zomedica Going Out Of Business Top Six Reasons Why Businesses Fail [Updated 2023]](https://www.ukbusinessmentoring.co.uk/images/blog/top-six-reasons-small-businesses-fail/out-of-business-sign.jpg)