Jp Morgan Private Client Requirements

Imagine stepping into a world where your financial aspirations are met with bespoke strategies and unwavering support. A realm where your legacy is meticulously crafted, not just for today, but for generations to come. This isn't a scene from a movie, but the reality for clients of J.P. Morgan Private Client, a name synonymous with wealth management excellence.

But what exactly does it take to become a part of this exclusive circle? What are the specific requirements and expectations that potential clients need to meet to unlock the doors to J.P. Morgan's personalized services? This article delves into the world of J.P. Morgan Private Client, shedding light on its eligibility criteria, the benefits it offers, and the overall experience of entrusting your wealth to one of the world's leading financial institutions.

Unveiling the Gateway: Eligibility and Net Worth

The primary requirement for accessing J.P. Morgan Private Client services centers around investable assets. While the exact figure can fluctuate based on market conditions and specific offerings, a general benchmark is typically around $10 million in investable assets.

This figure represents the readily available capital, excluding personal residences and other illiquid holdings, that J.P. Morgan would manage on the client's behalf. This threshold reflects the scale at which the firm can effectively deploy its comprehensive suite of services and resources.

It's important to note that exceptions can occur. Potential clients with significant earning potential or those managing substantial trusts or foundations may also be considered.

Beyond the Numbers: A Holistic Approach

While net worth is a significant factor, J.P. Morgan Private Client adopts a more holistic approach. They also assess a potential client's overall financial picture, including their income, debt, and long-term financial goals.

The firm seeks clients who demonstrate a commitment to financial planning and a desire for a long-term partnership. This collaborative approach allows for tailored strategies aligned with individual circumstances and aspirations.

Furthermore, understanding the client's risk tolerance and investment preferences is crucial. This ensures that the proposed investment strategies are comfortable and suitable for the individual.

The Perks of Exclusivity: Services and Expertise

The substantial entry requirement unlocks access to a wide array of services and expertise. Clients gain access to a dedicated team of professionals, including private bankers, investment specialists, and estate planning experts.

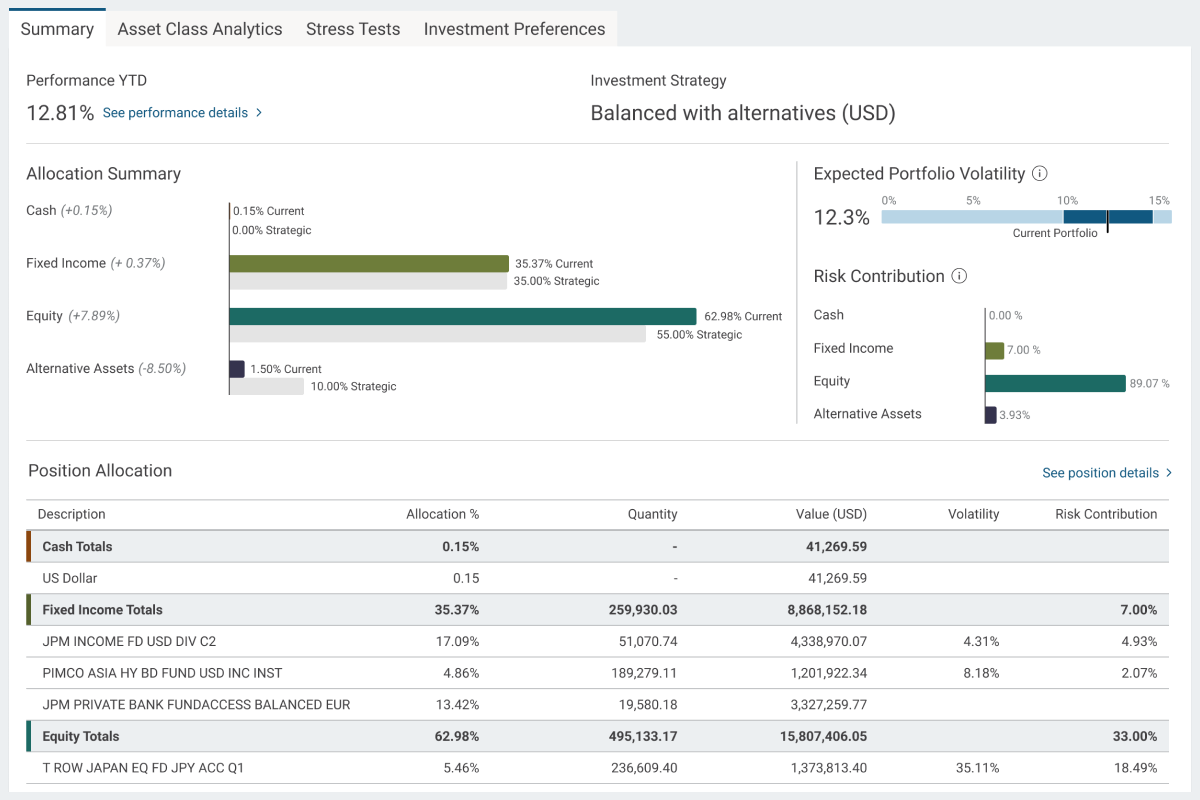

These teams work collaboratively to develop personalized financial plans, manage investments, provide credit and lending solutions, and navigate complex tax and estate planning matters. J.P. Morgan provides access to investment opportunities unavailable to the average investor.

This access includes alternative investments, private equity deals, and exclusive real estate ventures. Clients also benefit from J.P. Morgan's global reach and extensive research capabilities.

A Legacy of Trust: The J.P. Morgan Difference

J.P. Morgan Private Client isn't just about managing wealth; it's about building a legacy. The firm emphasizes long-term relationships built on trust and transparency.

Their approach involves a deep understanding of each client's values and goals. The firm aims to create a lasting positive impact on their families and communities.

This legacy-focused approach extends beyond investments. It encompasses philanthropic endeavors, family governance, and the transfer of wealth across generations.

The Evolving Landscape of Wealth Management

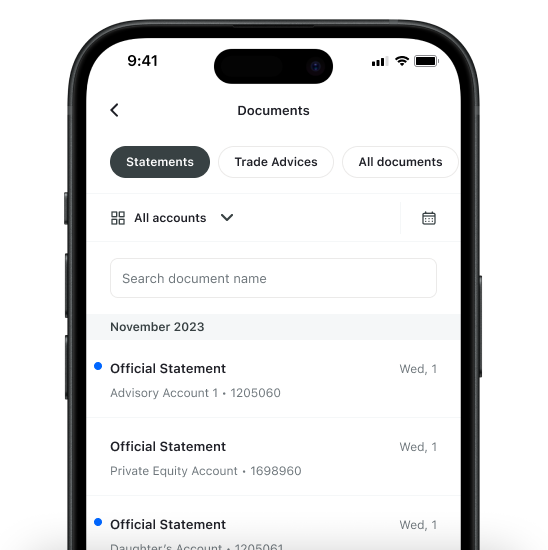

The wealth management landscape is constantly evolving, with new technologies and changing client expectations. J.P. Morgan Private Client is adapting to these changes by embracing digital innovation and enhancing its service offerings.

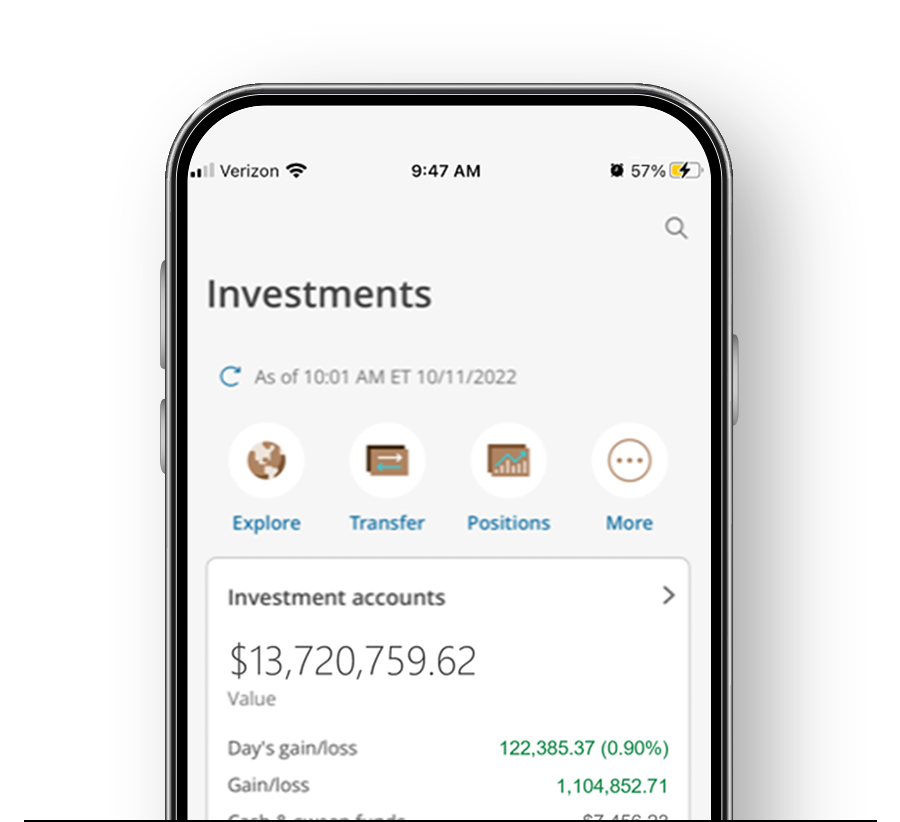

The firm continues to invest in technology to provide clients with seamless access to their accounts and investment information. Furthermore, they are expanding their sustainable investing options to cater to the growing demand for socially responsible investments.

By staying ahead of the curve, J.P. Morgan aims to remain a trusted partner for generations of wealthy families.

Beyond the Horizon: A Partnership for the Future

Becoming a J.P. Morgan Private Client isn't simply about meeting a financial threshold. It's about entering a partnership built on trust, expertise, and a shared vision for the future.

While the requirements may seem stringent, they reflect the level of personalized service and sophisticated investment strategies offered. For those who qualify, the rewards extend far beyond financial returns.

It's about peace of mind, knowing that your wealth is being managed by a team dedicated to preserving and growing your legacy for years to come. Ultimately, choosing J.P. Morgan Private Client is about investing in a future where your financial goals are not just met, but exceeded with unwavering commitment and personalized attention.