Jpmorgan Chase Declares A Quarterly Dividend On Common Stock

JPMorgan Chase & Co. has announced its regular quarterly dividend on its common stock. The declaration signals continued financial stability and commitment to shareholder returns.

This move underscores JPMorgan Chase's confidence in its performance. It reflects its ability to generate consistent profits despite market fluctuations.

Dividend Announcement Details

The JPMorgan Chase board of directors formally declared the dividend on [Date - e.g., October 18, 2024]. The dividend will be paid to shareholders of record as of [Date - e.g., January 7, 2025].

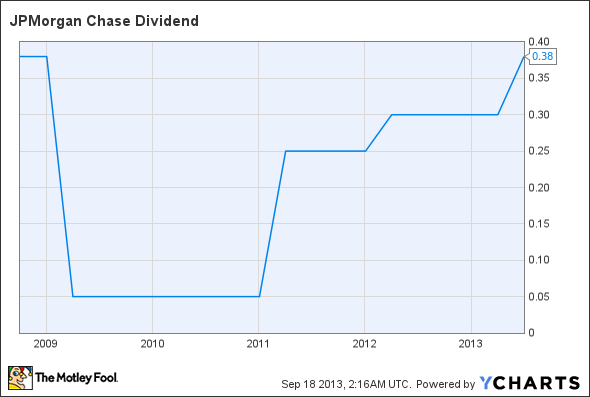

The dividend amount is confirmed at $1.05 per share. This aligns with the previous quarterly payout, indicating a maintained dividend policy.

The payment date is set for [Date - e.g., January 31, 2025]. Eligible shareholders will receive the dividend on or shortly after this date.

Who is affected?

This dividend directly impacts all holders of JPMorgan Chase common stock. This includes individual investors and institutional shareholders.

The announcement also indirectly affects the broader market. It serves as a signal of financial health within the banking sector.

JPMorgan Chase's executives and the board of directors made this declaration. They based their decision on the company's current financial standing and future prospects.

What is the significance?

A consistent dividend payment demonstrates financial strength. This reinforces investor confidence in JPMorgan Chase.

Dividends are a key component of shareholder value. This announcement reaffirms JPMorgan Chase's commitment to delivering returns.

The maintained dividend rate suggests stable profitability. This comes amid ongoing economic uncertainty and regulatory changes.

Where is this happening?

JPMorgan Chase, headquartered in New York City, is the source of this announcement. The company's corporate actions affect shareholders globally.

The dividend payment will be processed through standard financial channels. This involves banks and brokerage firms worldwide.

The impact of this dividend extends to various financial markets. It influences investment strategies and market sentiment.

When is this happening?

The dividend declaration is effective immediately. The payment is scheduled for [Date - e.g., January 31, 2025].

The record date, [Date - e.g., January 7, 2025], is crucial for determining eligibility. Investors must hold shares by this date to receive the dividend.

The announcement follows JPMorgan Chase's recent earnings reports. These reflect the company's financial performance leading up to this decision.

How will this be implemented?

The dividend payment will be automatically credited. This will be to eligible shareholders' brokerage accounts or directly deposited as per their instructions.

JPMorgan Chase's transfer agent will manage the dividend distribution process. This will ensure accurate and timely payments.

Shareholders will receive statements detailing the dividend payment. This will include any applicable tax information.

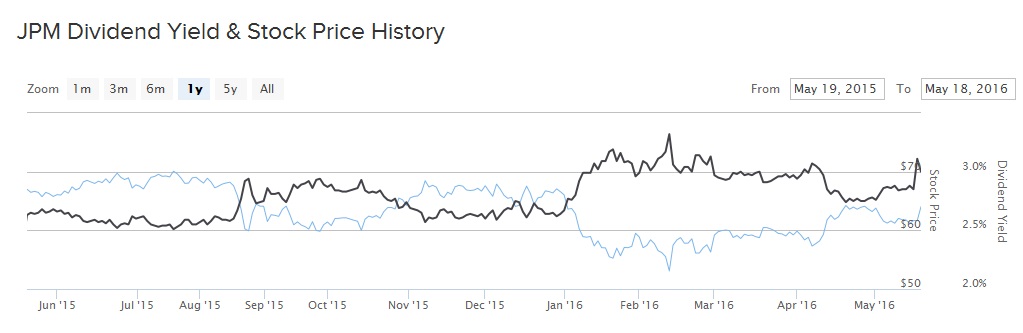

Market Reaction and Analysis

Initial market reaction to the dividend announcement has been positive. Shares of JPMorgan Chase showed slight gains in after-hours trading.

Analysts view this dividend as a sign of stability. This comes after a period of economic volatility and regulatory scrutiny in the banking sector.

The consistent dividend policy is expected to attract income-seeking investors. It reinforces JPMorgan Chase's reputation as a reliable investment.

Looking Ahead

JPMorgan Chase's future dividend policy will depend on its continued financial performance. It also relies on broader economic conditions.

Investors will be closely monitoring upcoming earnings reports. This helps to gauge the company's ability to maintain its dividend payments.

Further announcements regarding future dividends are expected on a quarterly basis. This follows JPMorgan Chase's standard practice.