The Par Value Per Share Of Common Stock Represents The

Imagine a bustling marketplace, where fortunes are made and lost in the blink of an eye. Instead of fruits and spices, however, the wares are slices of companies, hopes for future prosperity packaged neatly into shares of stock. Amidst the chatter and the flashing screens, there's a quiet, often overlooked, number that sits at the heart of it all: the par value. This seemingly insignificant figure, once a cornerstone of corporate finance, continues to whisper secrets about a company's past and the promises it has made.

The par value per share of common stock is a nominal value assigned to a share during the initial company chartering process. While its practical importance has diminished in modern finance, understanding its historical context and implications provides valuable insight into corporate structure and shareholder rights. This article will delve into the history, significance, and contemporary relevance of par value, shedding light on why it remains a noteworthy, if sometimes arcane, concept in the world of stock ownership.

A Journey Back in Time: The Origins of Par Value

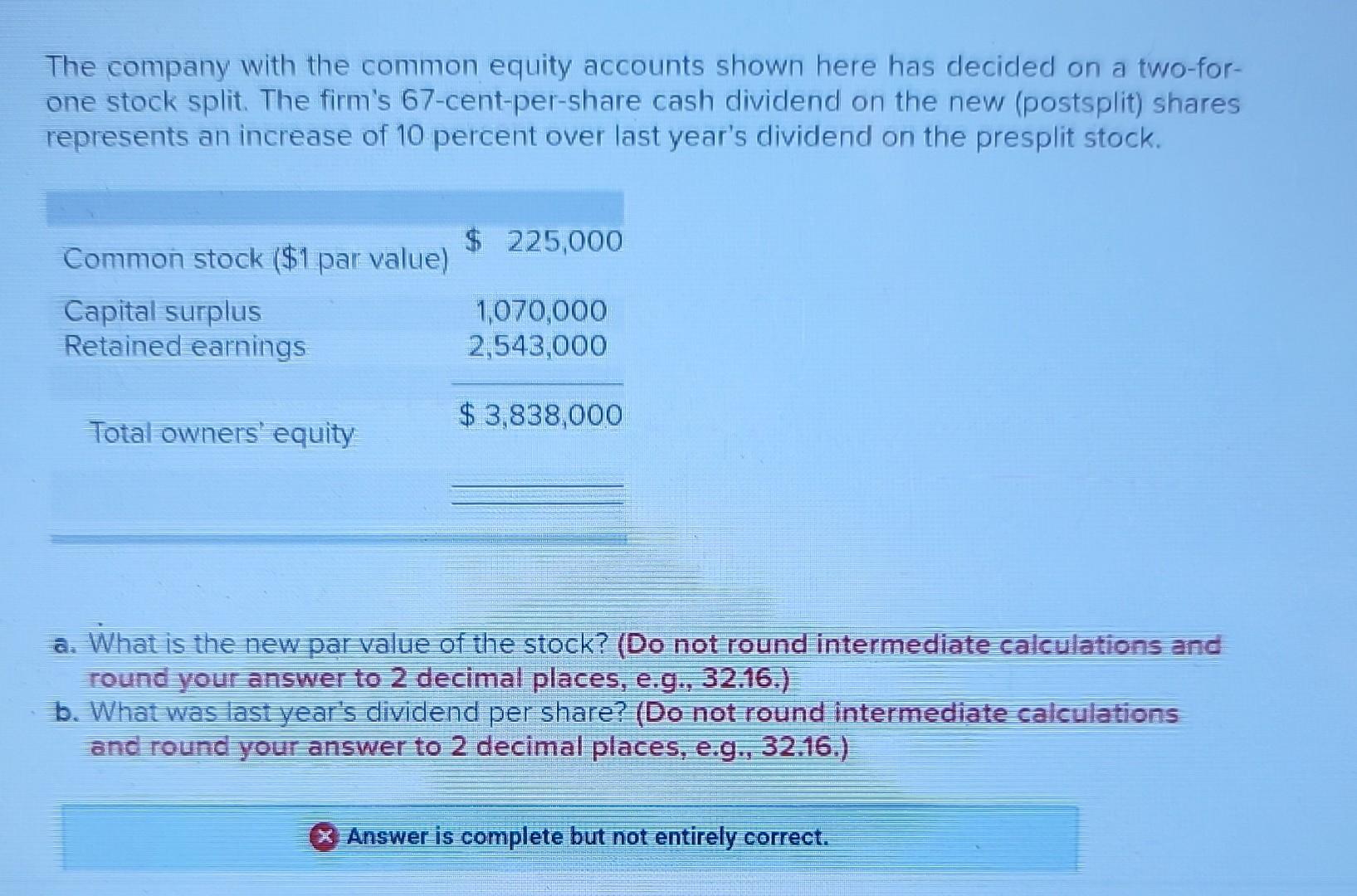

The concept of par value arose during a time when investors needed greater assurance about the capital companies held. In the early days of corporate finance, it was common for companies to issue shares with a stated par value, representing the minimum amount that shareholders were expected to contribute to the company's capital. This value was intended to act as a safeguard for creditors and other stakeholders, ensuring that a certain level of capital remained within the business.

Think of it as a promise: when a company issued stock with a $1 par value, investors knew the company had received at least $1 for each share originally issued. This provided a sense of security in an era with less regulatory oversight than we have today. It’s a historical artifact that continues to impact financial reporting today.

Understanding Par Value: A Closer Look

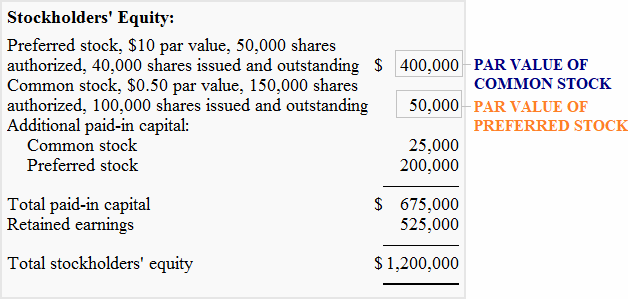

At its core, par value represents the minimum legal capital per share that a company must maintain. This is not indicative of the market value or the price at which the stock is traded. It’s an accounting concept.

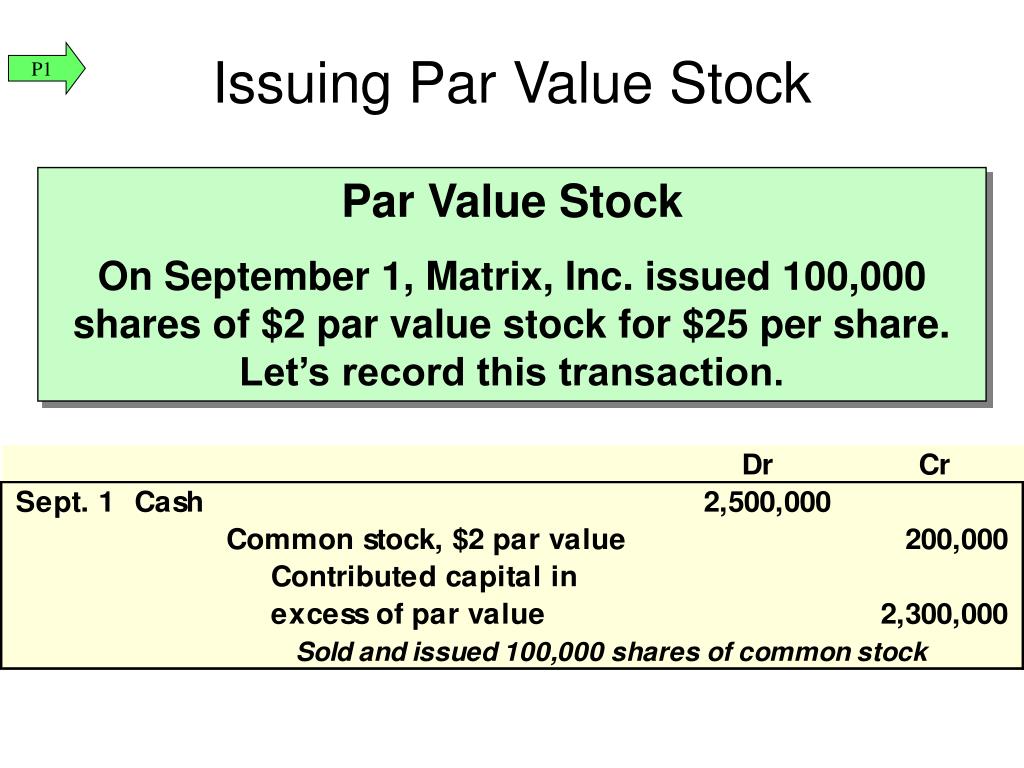

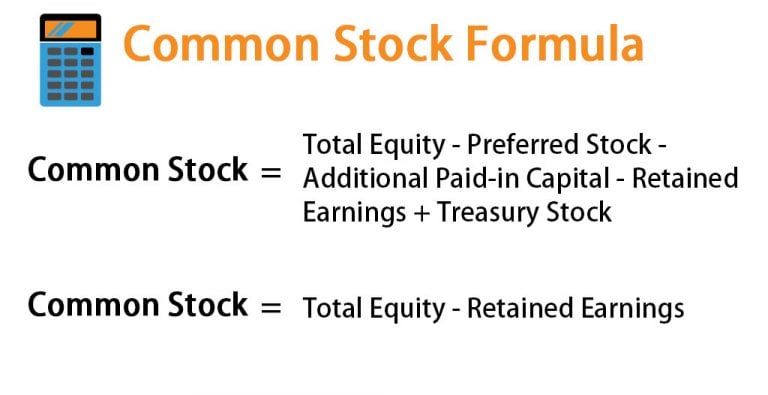

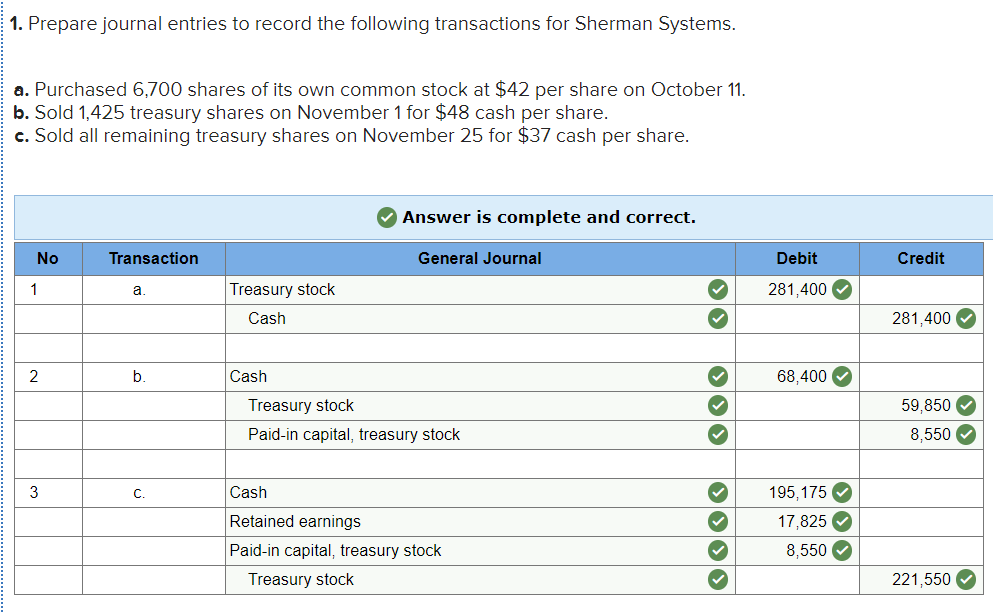

Let's say "Tech Solutions Inc." issues 1 million shares of common stock with a par value of $0.01 per share. The company's common stock account will show a value of $10,000 (1,000,000 shares x $0.01). The excess amount the company receives above the par value when selling the shares goes into an account called Additional Paid-In Capital (APIC).

If Tech Solutions Inc. sells those shares for $10 each, the company would record $10,000 in common stock and $9,990,000 in APIC. This structure reflects the total capital contributed by shareholders, separating the legal minimum from the additional investment.

No-Par Value Stock: A Modern Alternative

Over time, the significance of par value has diminished, leading to the emergence of "no-par value" stock. Many jurisdictions now allow companies to issue stock without a stated par value. This simplifies accounting procedures and reduces the legal complexities associated with par value.

When a company issues no-par value stock, the entire amount received from the sale of the shares is typically credited to the common stock account. This eliminates the need for an additional paid-in capital account, simplifying the company's balance sheet.

Furthermore, no-par value stock offers greater flexibility for companies to issue shares at prices that reflect market conditions. It removes the potential legal complications that can arise when issuing shares below par value, a practice often prohibited due to concerns about shareholder liability.

The Lingering Relevance of Par Value

While its importance has waned, par value still plays a role in certain aspects of corporate finance. It can impact the calculation of dividends, as some jurisdictions restrict the payment of dividends if it would reduce the company's capital below the aggregate par value of its outstanding shares.

Additionally, par value can affect shareholder liability in specific circumstances. In some cases, if shares are initially issued below par value, shareholders may be liable to creditors for the difference between the issue price and the par value. This potential liability is a reminder of the historical role of par value as a protection for creditors.

Moreover, understanding par value remains crucial for interpreting financial statements and comprehending a company's capital structure. It provides historical context and helps investors understand the evolution of corporate finance practices.

Navigating the Modern Landscape: Par Value Today

In today's financial environment, most publicly traded companies issue shares with a very low par value, often just a fraction of a cent. This minimal par value serves primarily as a legal formality, allowing companies to comply with regulations while retaining flexibility in their capital structure.

Investors are generally more focused on factors such as a company's earnings, growth prospects, and market valuation than on the par value of its shares. The stock price reflects market sentiment and the perceived future value of the company.

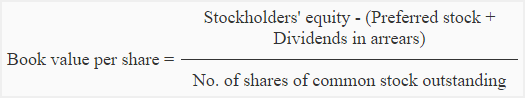

Financial analysts primarily focus on metrics such as earnings per share (EPS), price-to-earnings ratio (P/E), and return on equity (ROE) to assess a company's financial performance and investment potential. These measures provide a more comprehensive view of a company's value than the outdated metric of par value.

The Future of Par Value

The future of par value is likely to involve a continued decline in its significance. As corporate finance practices evolve and regulatory frameworks adapt, the emphasis will continue to shift towards more relevant and informative metrics for evaluating companies.

However, par value will likely remain a part of the corporate lexicon, serving as a historical reminder of the importance of capital preservation and shareholder accountability. Its continued presence is a testament to the enduring legacy of early corporate finance principles.

As we navigate the complex world of finance, understanding concepts like par value enriches our perspective and allows us to appreciate the evolution of financial practices. It connects us to the past while equipping us with the knowledge to make informed decisions in the present.

Conclusion: A Quiet Echo in the Marketplace

The par value per share of common stock, though a seemingly small detail, represents a rich history of corporate finance. It whispers tales of a time when investor protection was paramount and companies needed to provide concrete assurances of their financial stability. While the marketplace has evolved and new metrics have taken center stage, understanding par value offers a valuable glimpse into the roots of modern corporate structure.

Like an old, forgotten coin unearthed in a bustling city, the par value reminds us of the enduring principles that underpin the world of finance. It may no longer be the currency of choice, but its historical significance continues to resonate, adding depth and context to our understanding of stock ownership and corporate responsibility. The lessons learned from this relic of the past inform our present, shaping a more nuanced and insightful approach to investing and financial analysis.

So, the next time you encounter the term par value, remember the bustling marketplace of yesteryear, where this humble number stood as a promise, a safeguard, and a foundation upon which companies built their futures. It's a quiet echo in today's marketplace, a reminder of the past, and a subtle guide for the future.