Kalyan Jewellers Share Price Target

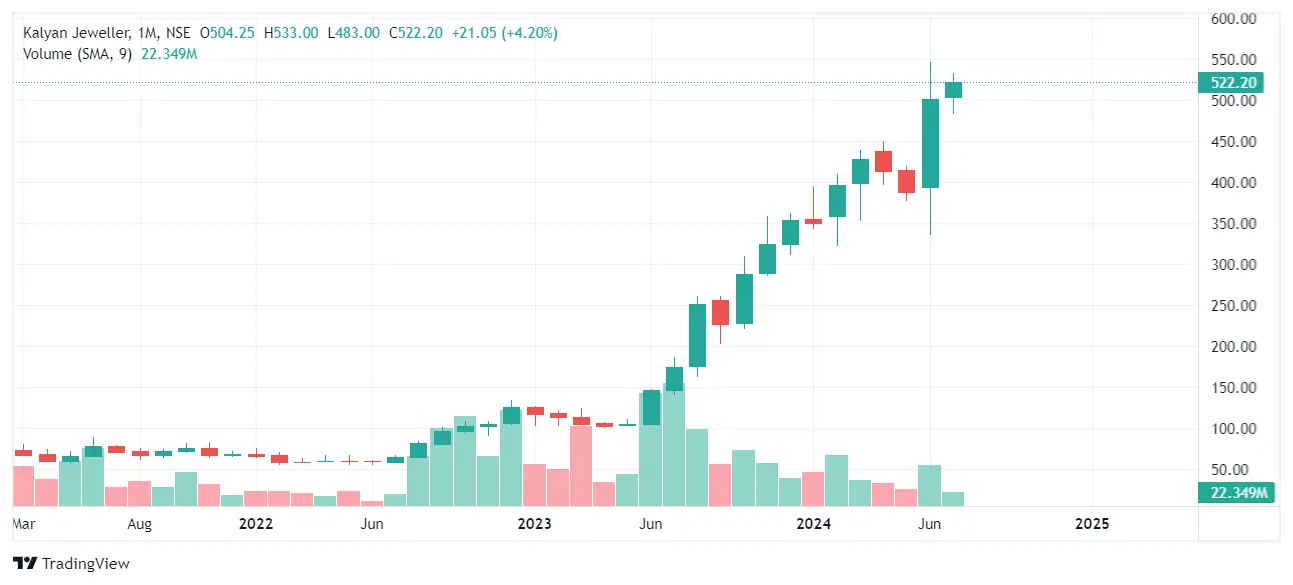

Kalyan Jewellers shares are under the spotlight as brokerages revise their price targets, signaling potential shifts for investors. Updated valuations reflect evolving market dynamics and company performance analysis.

Revised Targets Spark Investor Interest

Several leading brokerage firms have adjusted their price targets for Kalyan Jewellers following the company's recent financial results and strategic announcements. These revisions are crucial for investors gauging the stock's future trajectory.

Motilal Oswal has set a price target of ₹400, while ICICI Securities suggests a target of ₹385. Emkay Global Financial Services offers a slightly more conservative target of ₹365. These figures represent potential upsides from the current market price.

Who is Impacted?

Existing shareholders, potential investors, and market analysts are all directly impacted by these revised targets. The targets provide a benchmark for evaluating the stock's potential returns and making informed investment decisions.

Management at Kalyan Jewellers will also be closely monitoring these analyst opinions. It will influence strategic planning and investor relations.

What's Driving the Change?

The revised targets are primarily driven by Kalyan Jewellers' financial performance, expansion plans, and overall market conditions. Brokerages are factoring in the company's revenue growth, profitability, and competitive landscape.

Factors influencing these targets include the company's strong brand presence, its focus on expanding its retail footprint, and its ability to adapt to changing consumer preferences. Also, gold price fluctuations and overall economic conditions influence the outlook.

Where Does Kalyan Jewellers Stand?

Kalyan Jewellers operates primarily in India and the Middle East, with a strong presence in key metropolitan areas. The company is expanding its reach through both company-owned stores and franchise partnerships.

The revised price targets reflect analysts' assessment of the company's performance within these regions. It shows expectations for future growth.

When Were the Targets Revised?

The most recent revisions to price targets were issued within the past few weeks, following the release of Kalyan Jewellers' latest quarterly earnings report. These updates provide the most current perspective on the stock's potential.

How to Interpret the Data

Investors should consider these price targets as one input among many when making investment decisions. It is essential to conduct thorough research, assess individual risk tolerance, and consult with a financial advisor before investing.

The average price target is a composite view from different brokerages. It is important to understand the assumptions and methodologies underlying each individual target.

Next Steps for Kalyan Jewellers

Kalyan Jewellers will likely focus on executing its expansion plans and improving its financial performance to meet or exceed these revised targets. Management's commentary in upcoming investor calls will be closely watched.

Investors should monitor the company's progress and adjust their strategies accordingly. Ongoing developments in the gold market and the broader economy should be considered.

.jpg)