Questions To Ask When Buying A Small Business

The dream of owning a small business is a powerful lure, promising independence and financial reward. But beneath the glossy surface lies a complex reality, fraught with potential pitfalls for the unprepared buyer.

Far too many aspiring entrepreneurs jump in headfirst, blinded by optimism, only to discover critical flaws after the deal is sealed, leading to financial hardship and dashed hopes.

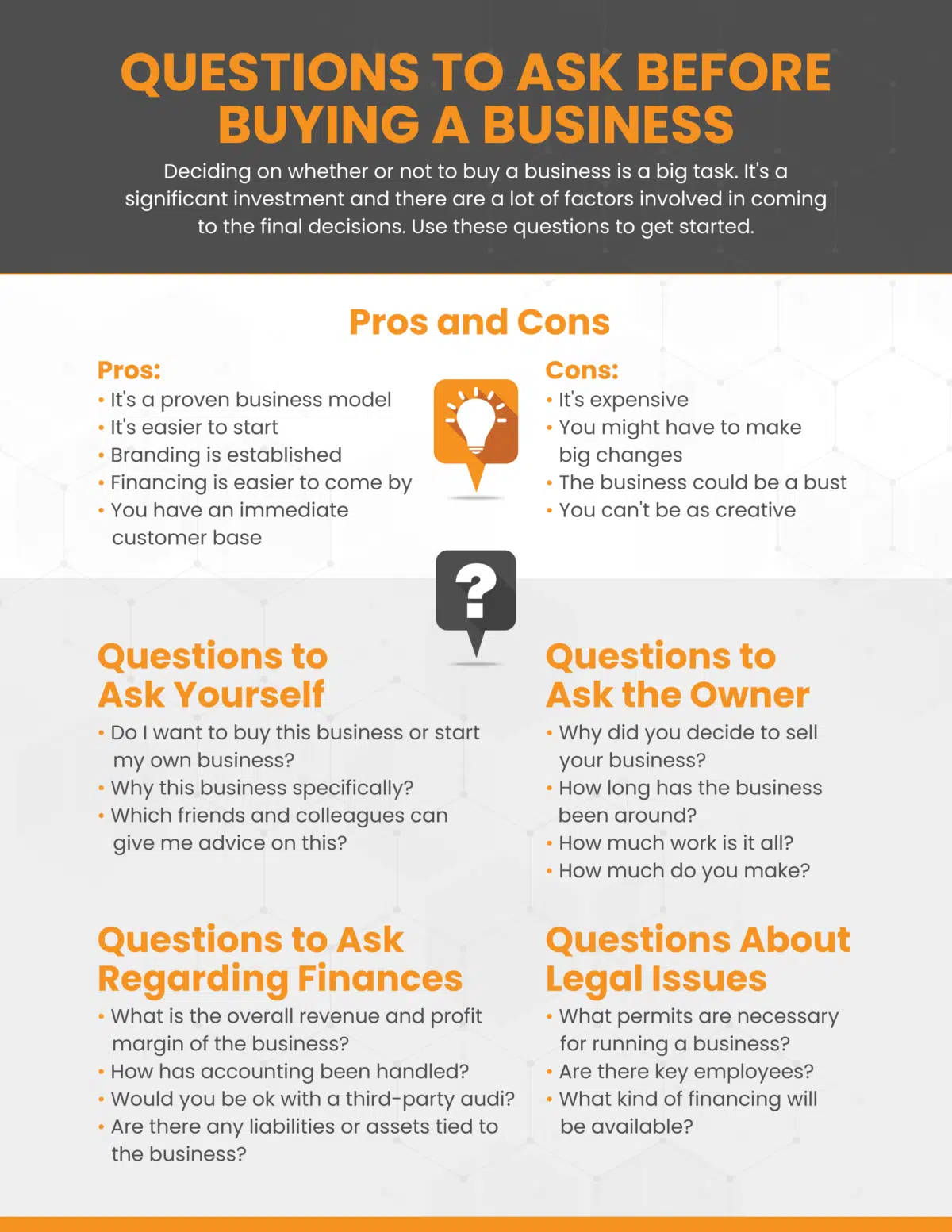

Navigating the Labyrinth: Key Questions to Ask

The purchase of a small business is a significant undertaking. Diligence is paramount. Asking the right questions can be the difference between success and failure.

This article outlines crucial inquiries every prospective buyer should make, turning the daunting process into a manageable and informed investment.

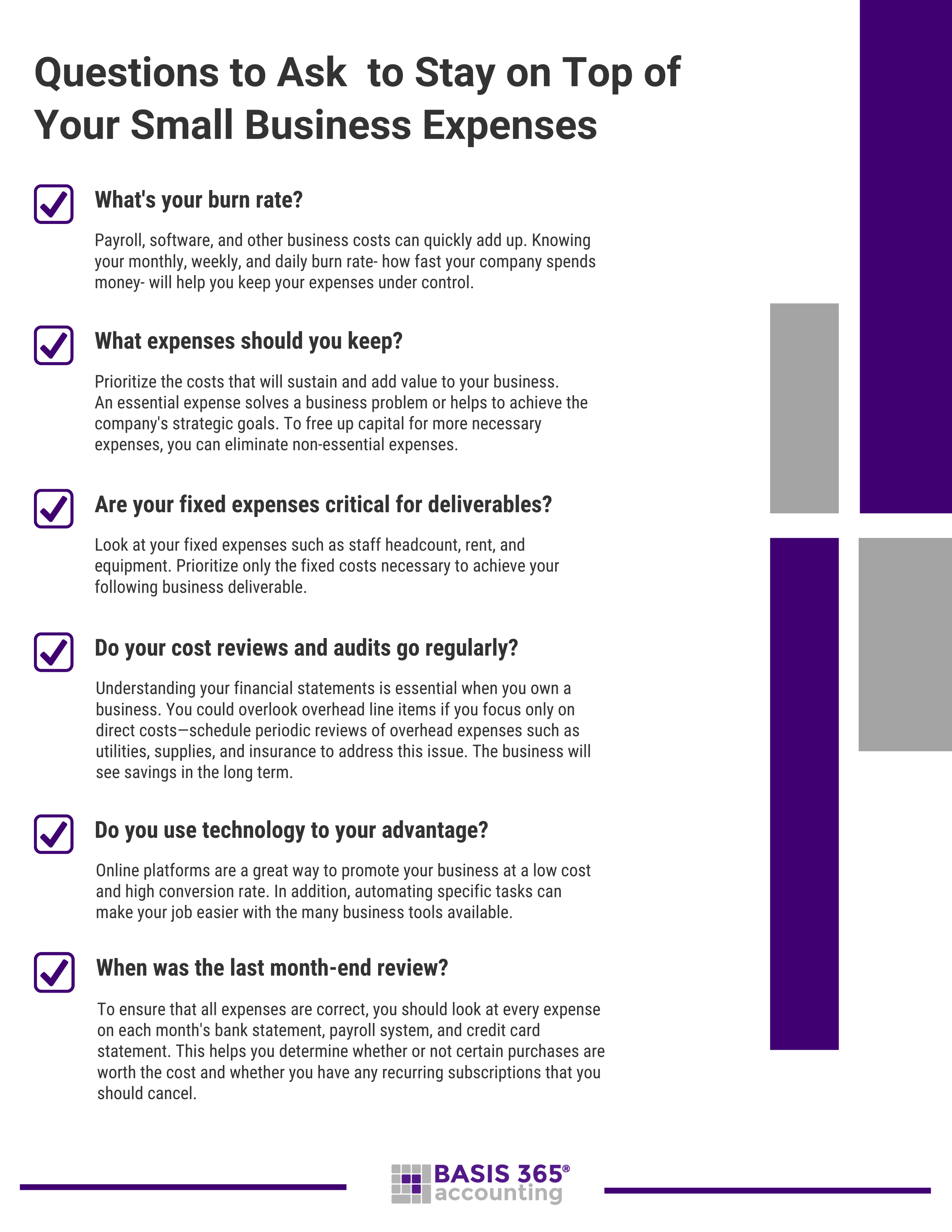

Financial Due Diligence: Unmasking the Numbers

Understanding the business's financial health is non-negotiable. Examine at least three to five years of financial statements, including profit and loss statements, balance sheets, and cash flow statements.

Pay close attention to revenue trends, profitability margins, and debt levels. Are the financials audited? If not, consider engaging a CPA to perform an independent review.

Question: Can you provide independently audited financial statements for the past five years? What are the key performance indicators (KPIs) and how have they trended?

Operational Insights: Peering Behind the Curtain

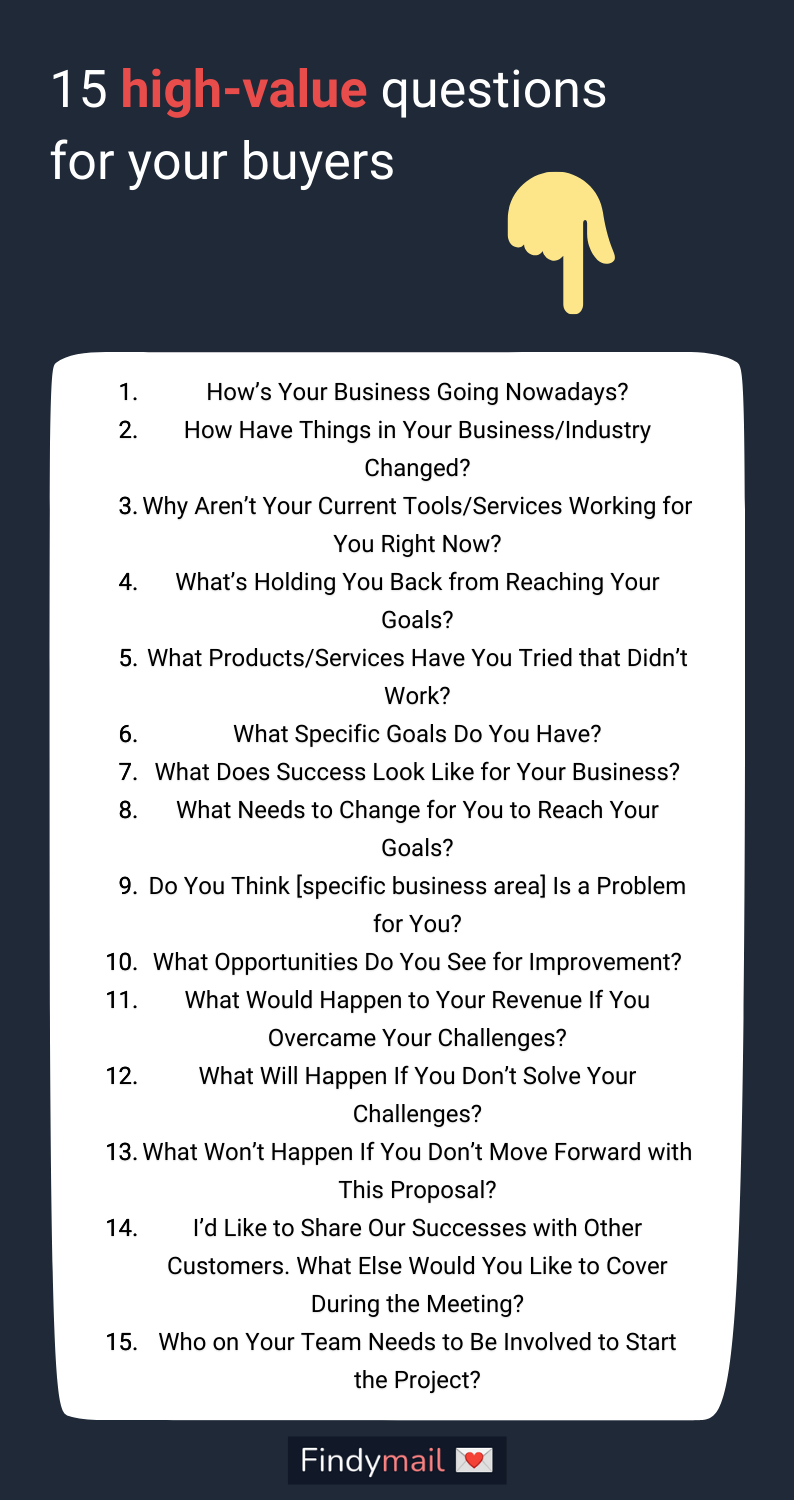

Beyond the numbers, delve into the day-to-day operations. Understanding the business model, its strengths, and weaknesses is critical.

Investigate the customer base. Is it diversified or heavily reliant on a few key clients? Understanding the supply chain, operational procedures, and technological infrastructure will help to assess risks.

Question: What are the key operational processes? What are the biggest operational challenges? What is the customer retention rate? What is the relationship with the key suppliers?

Legal and Compliance: Avoiding Future Headaches

Legal and regulatory compliance can be a minefield. Unresolved legal issues or non-compliance can result in costly penalties and legal battles.

Review all contracts, leases, permits, and licenses. Conduct a thorough legal due diligence to identify any potential liabilities or lawsuits.

Question: Are there any pending lawsuits or legal claims? Are all permits and licenses up to date and transferable? What are the terms of the lease agreement?

Employee Matters: Understanding the Human Factor

Employees are often the backbone of a small business. Understanding the existing employee structure, compensation, and benefits packages is essential.

Assess employee morale and turnover rates. A disgruntled workforce can significantly impact productivity and customer service. Understand the status of existing employees after the business transaction.

Question: What is the employee turnover rate? What are the current salary and benefits packages? Are there any existing employment contracts or union agreements?

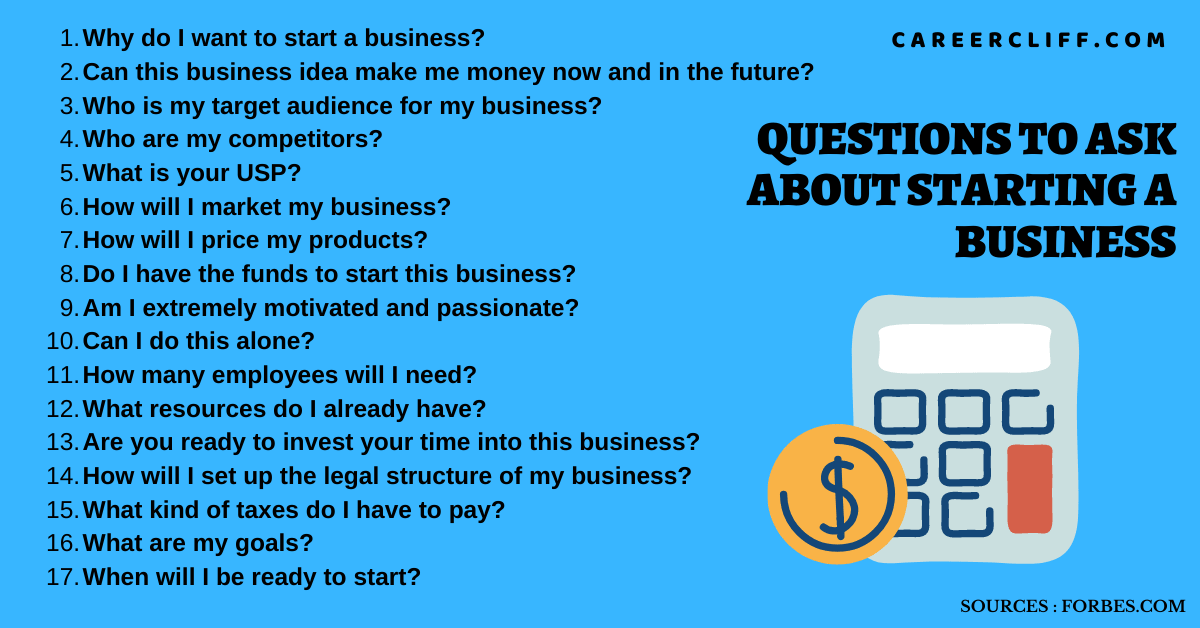

Market Analysis: Assessing the Competitive Landscape

Understanding the market and competitive landscape is crucial for future growth. Assess the market size, growth potential, and competitive pressures.

Identify the business's unique selling proposition (USP) and competitive advantages. Evaluate the impact of potential market disruptions and technological advancements.

Question: What is the market share and competitive landscape? Who are the main competitors and what are their strengths and weaknesses? What are the potential growth opportunities?

Hidden Liabilities: Unearthing Potential Risks

Hidden liabilities can be a deal-breaker. Unpaid taxes, environmental issues, or undisclosed legal obligations can significantly impact the business's value.

Engage qualified professionals to conduct thorough environmental assessments and tax audits. Obtain representations and warranties from the seller to protect against undisclosed liabilities.

Question: Are there any undisclosed liabilities or potential risks? Has an environmental assessment been conducted? Are all taxes paid up to date?

The Seller's Perspective: Uncovering Motivations

Understanding the seller's motivations for selling can provide valuable insights. Are they retiring, pursuing other ventures, or facing financial difficulties?

The answer can reveal potential issues or opportunities. Try to understand the seller's reasoning for the sales.

Question: What are your reasons for selling the business? What are your plans after the sale?

The Transition Plan: Ensuring a Smooth Handover

A smooth transition is critical for maintaining business continuity. A well-defined transition plan ensures a seamless handover of operations, customer relationships, and employee responsibilities.

Clarify the seller's role in the transition process and the duration of their involvement. Get all the important contacts during the transition period.

Question: What is your proposed transition plan? How long are you willing to stay on to assist with the transition?

Seeking Professional Guidance: The Importance of Expert Advice

Navigating the complexities of buying a small business requires professional expertise. Engage experienced advisors, including attorneys, accountants, and business brokers.

They can provide valuable guidance and ensure that you make informed decisions. Seeking professional guidance is essential for protecting your interests and maximizing your chances of success. Quote:"Engaging experienced advisors can be the difference between a successful acquisition and a costly mistake," said Jane Doe, a business consultant.

Looking Ahead: Building a Sustainable Future

Buying a small business is a significant investment that requires careful planning and execution. By asking the right questions and seeking professional guidance, aspiring entrepreneurs can navigate the complexities of the acquisition process and build a sustainable future.

The key is to approach the process with diligence, skepticism, and a commitment to thorough due diligence. The journey can be challenging, but the rewards of owning a thriving business can be substantial.

+(1).png?format=1500w)