Keyboard Rich Challenge Dream Life Calculator

Amidst the relentless churn of viral trends, a new online phenomenon is sparking both fascination and fierce debate. The "Keyboard Rich Challenge Dream Life Calculator," a seemingly innocuous web tool, is generating complex discussions about financial literacy, societal values, and the allure of instant gratification. While proponents tout its ability to inspire aspirational thinking, critics warn of its potential to fuel unrealistic expectations and deepen anxieties surrounding wealth inequality.

This article delves into the mechanics of the Keyboard Rich Challenge Dream Life Calculator, exploring its appeal, its potential pitfalls, and the broader societal context that has allowed it to gain such rapid traction. We'll examine the perspectives of financial experts, social commentators, and users themselves to understand the multifaceted impact of this digital trend.

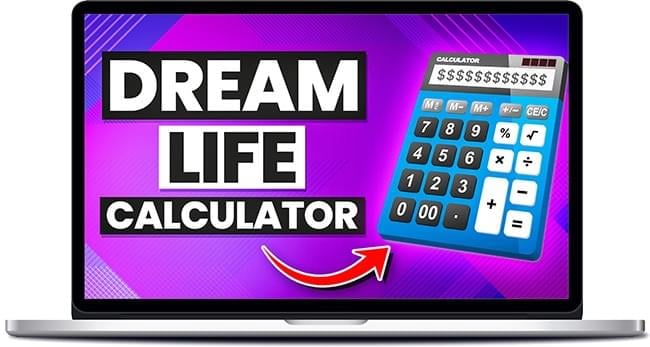

What is the Keyboard Rich Challenge Dream Life Calculator?

At its core, the "Keyboard Rich Challenge Dream Life Calculator" is a simple online tool. Users input their current occupation, desired "dream life" expenses (including housing, travel, entertainment, and material possessions), and the calculator supposedly determines how many hours they would need to work – often portrayed as relentless "keyboard time" – to achieve that lifestyle. The calculations, typically based on idealized scenarios and highly variable income projections, frequently result in figures that are both staggering and seemingly unattainable for most individuals.

The appeal lies in the seductive promise of visualizing a path, however improbable, to achieving immense wealth and a luxurious lifestyle. Social media platforms, particularly TikTok and Instagram, have become breeding grounds for videos showcasing users' results, often accompanied by exaggerated reactions and motivational slogans.

The Allure of Instant Gratification and Aspirational Content

The calculator taps into a deep-seated human desire for upward mobility and financial security. In a world increasingly characterized by economic precarity, the idea of escaping financial hardship through sheer hard work, even if digitally simulated, holds undeniable appeal.

The trend also leverages the power of aspirational content, a staple of social media. Users are drawn to the vicarious thrill of imagining themselves living a life of luxury, regardless of its feasibility.

Furthermore, the gamified nature of the calculator, with its quantifiable results and challenge-oriented framing, encourages users to share their scores and compare themselves to others, further fueling its virality.

The Potential Pitfalls: Unrealistic Expectations and Financial Anxiety

Despite its seemingly harmless facade, the Keyboard Rich Challenge Dream Life Calculator has drawn significant criticism. Financial experts caution that the tool often presents a wildly inaccurate and potentially harmful picture of financial planning and wealth accumulation.

"These calculators often rely on overly optimistic assumptions about income growth, investment returns, and the cost of living," warns Dr. Anya Sharma, a professor of finance at the University of California, Berkeley. "They fail to account for taxes, inflation, unexpected expenses, and the inherent risks associated with different investment strategies."

Critics also argue that the calculator can exacerbate feelings of inadequacy and financial anxiety, particularly among younger users. By presenting an idealized and often unattainable lifestyle as the benchmark for success, it can contribute to a sense of failure and disillusionment.

The Impact on Mental Health and Social Comparison

The constant bombardment of unrealistic financial goals on social media can have a detrimental impact on mental health. Studies have shown a correlation between social media use and increased levels of anxiety, depression, and low self-esteem, particularly when users engage in social comparison.

The Keyboard Rich Challenge Dream Life Calculator, by encouraging users to compare their financial standing to an idealized and often fabricated standard, can further amplify these negative effects. The pressure to achieve an unrealistic level of wealth can lead to feelings of inadequacy and a distorted perception of financial reality.

Moreover, the challenge often fails to acknowledge the role of privilege and systemic inequalities in wealth accumulation.

"The idea that anyone can become 'keyboard rich' through sheer hard work ignores the reality of unequal access to opportunities, resources, and social capital,"says Mark Johnson, a social commentator writing for The Atlantic.

A Balanced Perspective: Inspiration vs. Misinformation

While the Keyboard Rich Challenge Dream Life Calculator has its drawbacks, it's important to acknowledge that it can also serve as a source of inspiration for some users. For individuals who lack a clear understanding of their financial goals, the calculator can provide a starting point for exploring different career paths and developing a financial plan.

However, it's crucial to approach the tool with a critical eye and to supplement its findings with reliable financial advice. Responsible financial planning requires a comprehensive understanding of personal finances, realistic goal setting, and a willingness to adapt to changing circumstances.

Furthermore, it's essential to remember that wealth is not the sole determinant of happiness or fulfillment. A balanced life that encompasses meaningful relationships, personal growth, and community involvement is often more fulfilling than the pursuit of material possessions.

Moving Forward: Promoting Financial Literacy and Responsible Social Media Use

The rise of the Keyboard Rich Challenge Dream Life Calculator highlights the urgent need for improved financial literacy education, particularly among young people. Schools and community organizations should prioritize programs that teach essential financial skills, such as budgeting, saving, investing, and debt management.

Social media platforms also have a responsibility to promote responsible content creation and to combat the spread of financial misinformation. This could include implementing stricter guidelines for financial advice, partnering with financial experts to create educational content, and providing users with tools to identify and report misleading information.

Ultimately, navigating the complexities of the digital age requires a critical and informed approach. By promoting financial literacy, encouraging responsible social media use, and fostering a more nuanced understanding of wealth and success, we can help individuals make informed decisions about their financial futures and avoid the pitfalls of unrealistic expectations.