Large Language Model Provider Market Consolidation

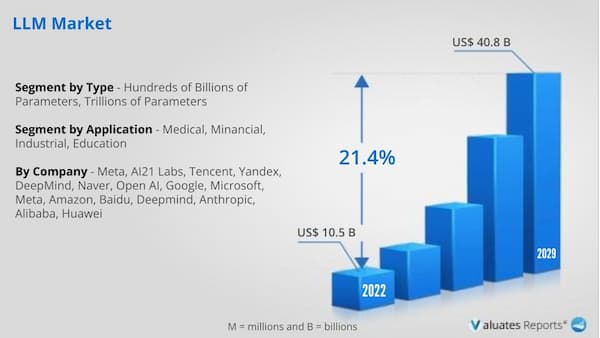

The race to dominate the Large Language Model (LLM) landscape, once a vibrant field teeming with contenders, is showing clear signs of consolidation. Fueled by the exorbitant costs of training and maintaining these sophisticated AI systems, and the increasing demand for specific, high-performing models, the market is poised for a significant power shift, with a select few giants emerging at the forefront.

This shift has significant implications for innovation, competition, and accessibility within the burgeoning AI sector, impacting everyone from startups to established enterprises, and ultimately, the end users who will rely on these technologies.

The Nut Graf: A Market Under Pressure

The LLM provider market is undergoing a period of intense pressure, driven by several converging factors. These include the escalating costs of development, the growing demand for specialized LLMs tailored to specific industries and tasks, and the increasing regulatory scrutiny surrounding AI development and deployment.

This confluence of forces is creating an environment ripe for consolidation, where smaller players struggle to compete with the resources and scale of larger, well-funded organizations.

The High Cost of Entry: Training and Infrastructure

Training a state-of-the-art LLM requires massive computational power, vast datasets, and specialized expertise. According to a report by Stanford's AI Index, the cost of training a single large language model can easily reach tens of millions of dollars, a barrier to entry that excludes many potential competitors.

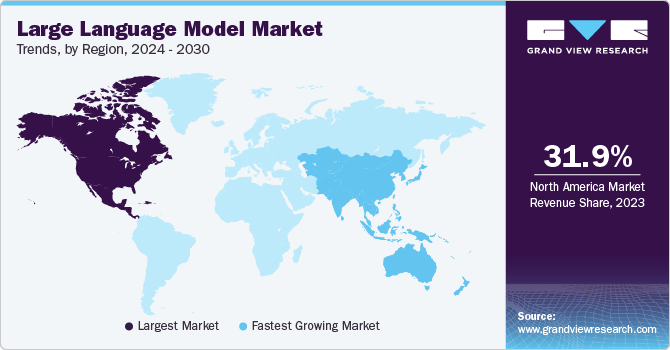

Furthermore, maintaining and updating these models requires ongoing investment in infrastructure and personnel. This creates a significant advantage for companies with deep pockets, such as Microsoft, Google, and Amazon, who can afford to invest in the necessary resources to stay ahead of the curve.

The Rise of Specialized LLMs: A Niche for Consolidation?

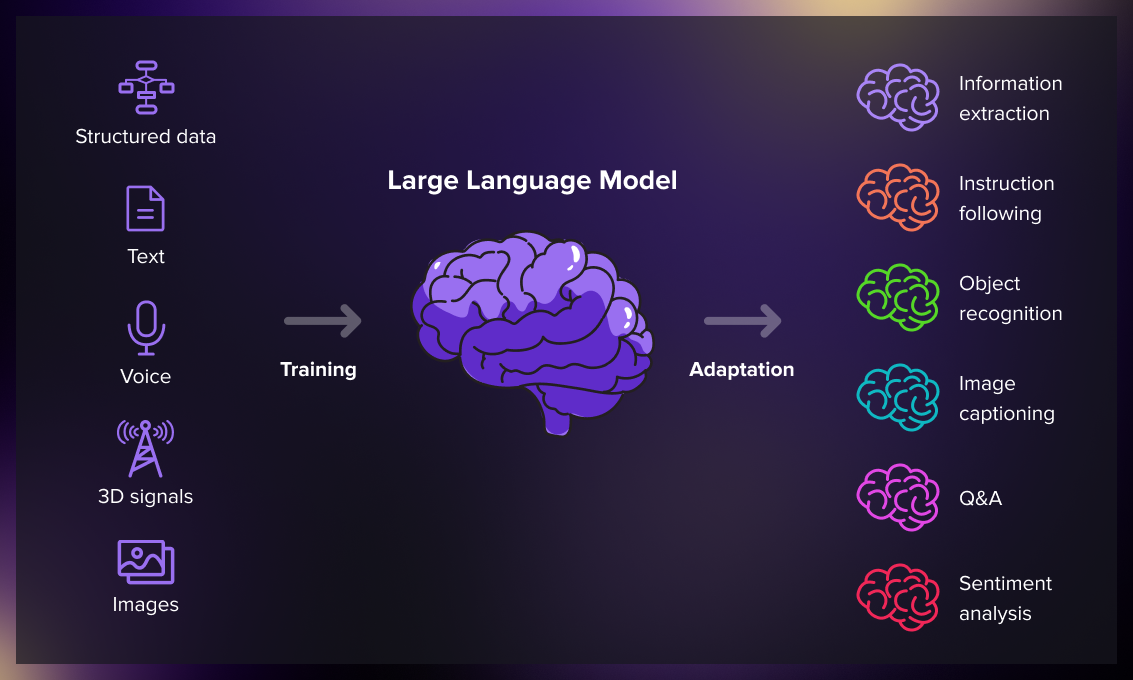

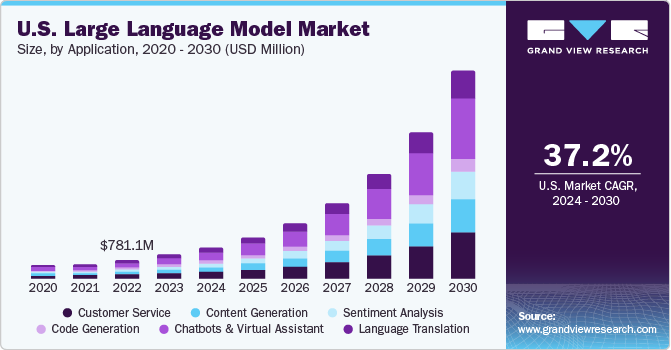

While general-purpose LLMs like GPT-4 and Gemini have captured widespread attention, the demand for specialized models tailored to specific industries and tasks is rapidly growing. These specialized LLMs, designed for areas such as finance, healthcare, or legal research, often outperform general-purpose models within their specific domains.

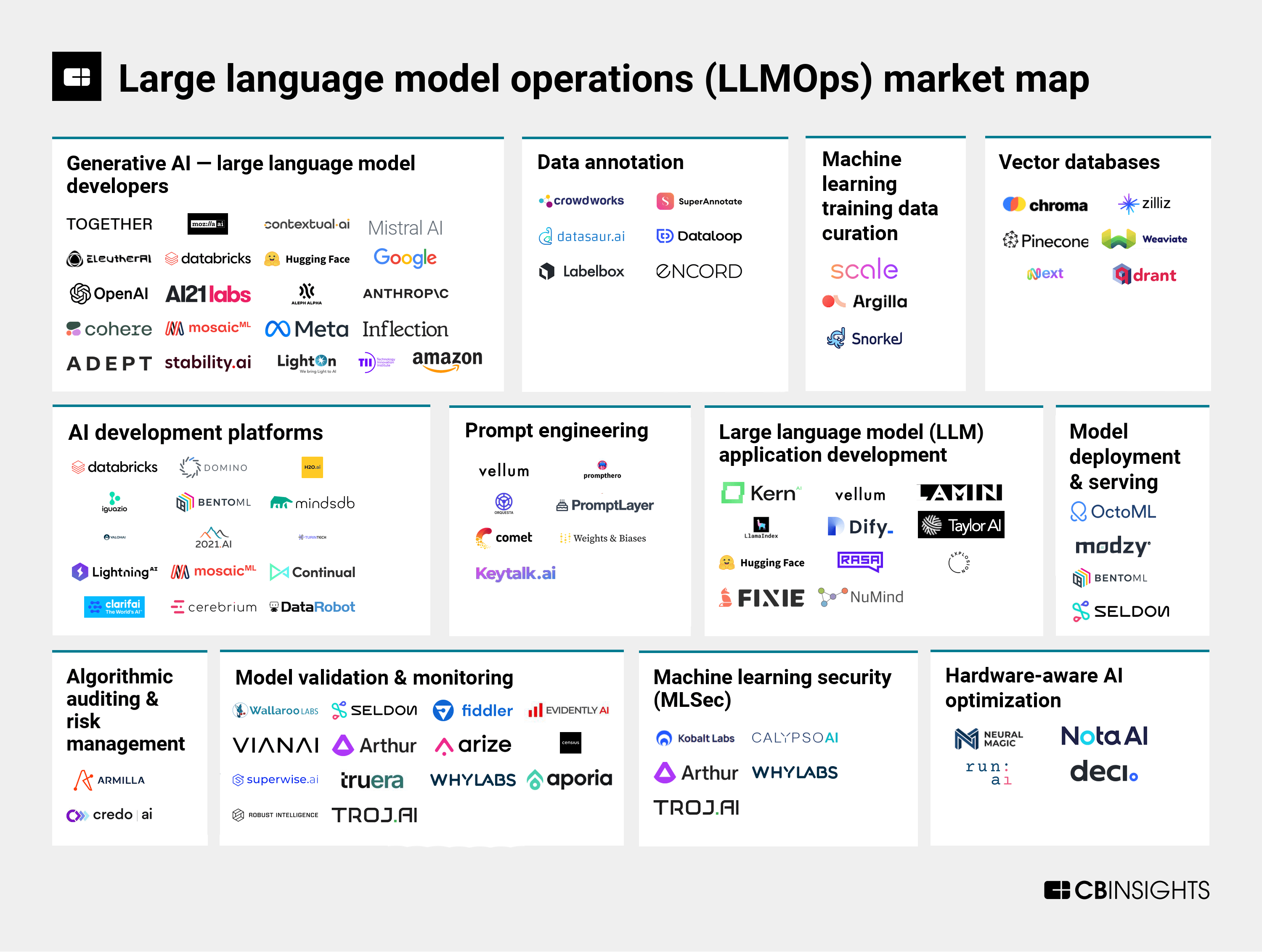

However, developing and maintaining these specialized models requires deep domain expertise and access to relevant data, further increasing the barriers to entry. This creates an opportunity for larger players to acquire smaller, specialized LLM providers, consolidating their expertise and market share.

Acquisitions and Partnerships: The Consolidation in Action

The consolidation of the LLM market is already underway, with several high-profile acquisitions and partnerships taking place in recent months. For example, Salesforce acquired MetaMind, a deep learning startup, in 2016 to enhance its AI capabilities. More recently, Databricks acquired MosaicML for $1.3 billion, a move that bolsters its position in the generative AI space.

These acquisitions demonstrate the strategic importance of LLMs and the willingness of larger companies to invest heavily in acquiring the talent and technology necessary to compete in this rapidly evolving market. Partnerships are also becoming increasingly common, as companies collaborate to share resources and expertise.

Regulatory Scrutiny: A Double-Edged Sword

The increasing regulatory scrutiny surrounding AI development and deployment is also contributing to market consolidation. Governments around the world are grappling with the ethical and societal implications of LLMs, and are developing regulations to address issues such as bias, privacy, and security.

Compliance with these regulations requires significant investment in governance, risk management, and transparency, placing an additional burden on smaller LLM providers. While regulation aims to protect consumers and promote responsible AI development, it may inadvertently favor larger companies with the resources to navigate the complex regulatory landscape.

The Impact on Innovation and Competition

The consolidation of the LLM market raises concerns about its impact on innovation and competition. As a few large players gain control of the market, there is a risk that they will stifle innovation by limiting access to resources and suppressing competition.

This could lead to a slowdown in the development of new and improved LLMs, and ultimately harm consumers who rely on these technologies. However, some argue that consolidation is necessary to drive investment in the costly research and development required to advance the field.

“The concentration of power in the hands of a few large players could stifle innovation and limit the diversity of perspectives in the AI field,” says Dr. Anya Sharma, a leading AI researcher at MIT.

Looking Ahead: The Future of the LLM Market

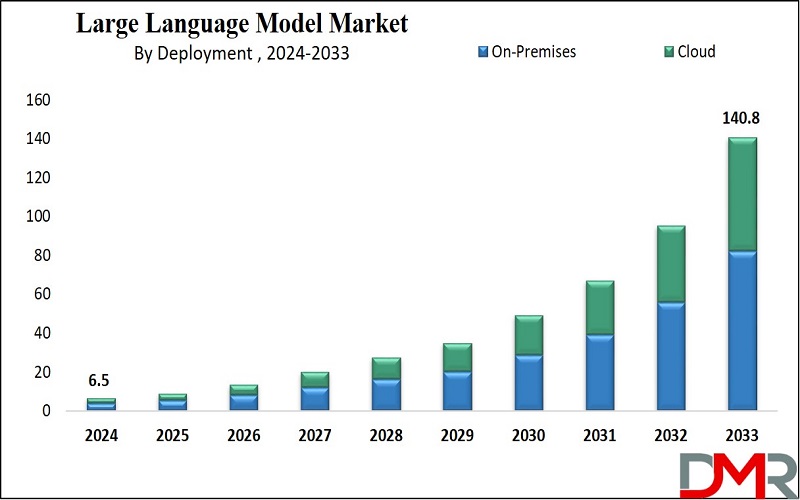

The consolidation of the LLM market is likely to continue in the coming years, as the costs of development and compliance continue to rise. While a few large players are likely to dominate the market, there will still be opportunities for smaller, specialized LLM providers to thrive in niche markets.

The key to success for these smaller players will be to focus on developing innovative solutions that address specific customer needs and to build strong partnerships with larger organizations. The future of the LLM market will depend on the ability of both large and small players to innovate and compete, while ensuring that these powerful technologies are developed and deployed responsibly.

Ultimately, the ongoing consolidation within the Large Language Model (LLM) provider market presents both opportunities and challenges. Careful monitoring of these trends will be crucial to ensuring a healthy and competitive AI ecosystem for all stakeholders.

Market New.png)

Market Reg.png)

Market.png)

![Large Language Model Provider Market Consolidation Large Language Models: What Is It & Its Applications [Updated]](https://cdn.labellerr.com/Foundation Models/Introduction to LLM/example of LLMs.webp)