Last 20 Years Home Loan Interest Rates In India

The dream of owning a home, often the cornerstone of financial security for Indian families, has been intricately linked to the fluctuating landscape of home loan interest rates. For the past two decades, these rates have danced between affordability and constraint, shaping the decisions of millions and significantly impacting the real estate market. Understanding this historical trajectory is crucial for potential homeowners, investors, and policymakers alike.

This article delves into the roller coaster ride of home loan interest rates in India over the last 20 years, examining the factors that influenced these shifts and their consequences on the housing sector and individual borrowers. By analyzing data from reputable financial institutions and expert opinions, we aim to provide a comprehensive overview of this vital aspect of the Indian economy. This also explores the future outlook for interest rates and what it means for the aspiring homeowner.

Early 2000s: A Period of Relative Stability

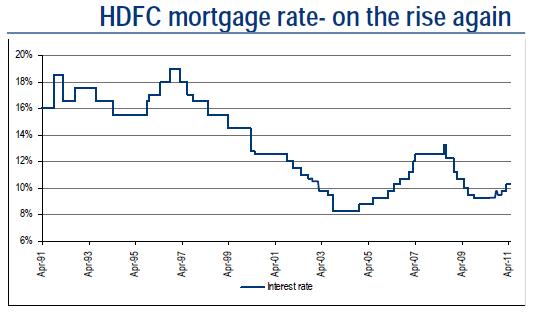

The early 2000s saw relatively stable home loan interest rates, generally hovering around 11-13%. This period was characterized by moderate economic growth and a cautious approach to lending. The availability of home loans was also more limited compared to later years, primarily concentrated in public sector banks.

Factors influencing these rates included the prevailing inflation levels and the Reserve Bank of India (RBI)'s monetary policy stance. Lower borrowing costs and increased competition gradually led to a softening of rates.

The Mid-2000s Boom: Riding the Wave of Growth

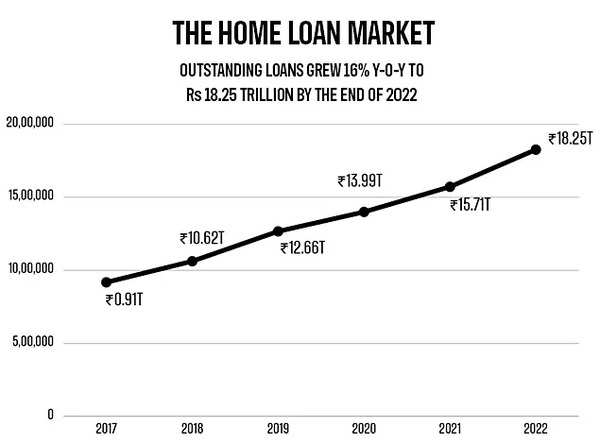

The mid-2000s marked a period of rapid economic expansion in India, fueling a surge in demand for housing and subsequently, home loans. Interest rates began to fall, reaching a low of around 7.5-8.5% in some cases.

This period saw increased participation from private sector banks and housing finance companies, intensifying competition and driving down lending rates. The attractive interest rates led to a boom in the real estate market, with property prices rising significantly.

The Global Financial Crisis (2008-2009): A Sudden Jolt

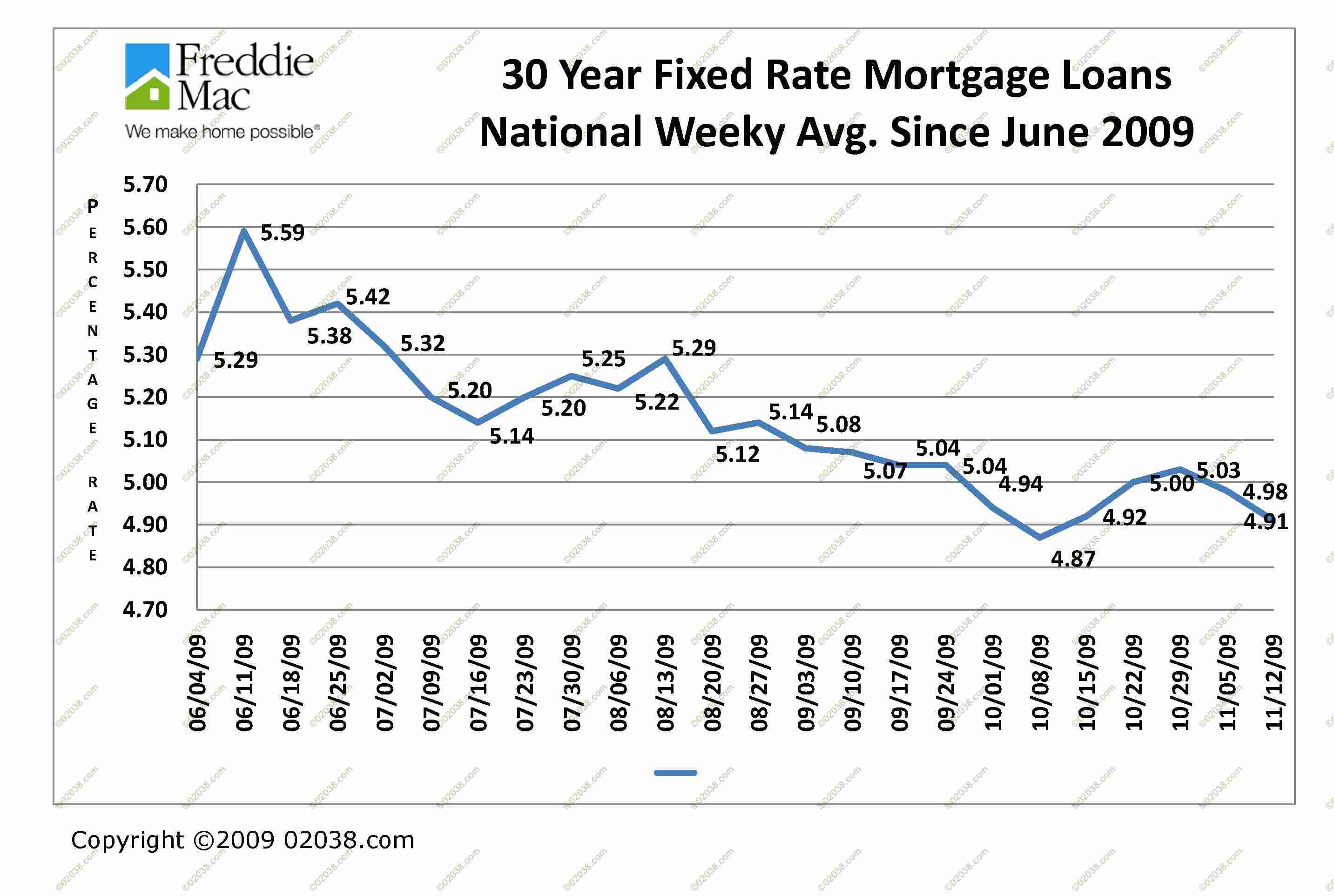

The 2008 global financial crisis brought the booming party to an abrupt halt. The RBI intervened to inject liquidity into the market and initially lowered policy rates to ease the burden on borrowers.

However, the crisis also led to increased risk aversion among lenders, resulting in a temporary spike in home loan interest rates. The uncertainty in the global economy and the tightening of credit conditions impacted the Indian housing market significantly.

Post-Crisis Recovery and Fluctuations (2010-2015)

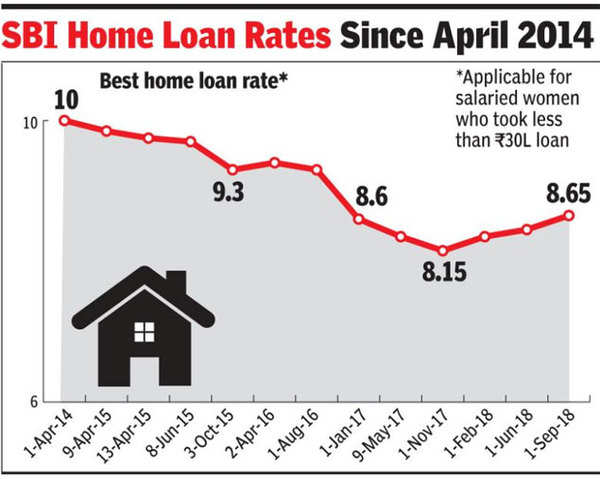

Following the crisis, the Indian economy gradually recovered, but home loan interest rates remained volatile. The RBI battled inflationary pressures and growth concerns, leading to frequent adjustments in policy rates.

Rates generally fluctuated between 10% and 12% during this period. Borrowers witnessed a period of uncertainty, making long-term financial planning challenging. The real estate market also experienced a period of consolidation, with prices stabilizing in some areas.

Demonetization and RERA: Impact on Interest Rates and the Market

The government's demonetization initiative in 2016 and the implementation of the Real Estate (Regulation and Development) Act (RERA) had a significant impact on the housing sector. Demonetization initially led to a temporary dip in demand, while RERA aimed to bring transparency and accountability to the real estate market.

The RBI responded by lowering policy rates to stimulate demand, resulting in a gradual decline in home loan interest rates. This period saw increased focus on affordable housing, with the government introducing various schemes and subsidies to encourage homeownership.

Recent Trends (2018-2023): The Era of Low Interest Rates and Subsequent Rise

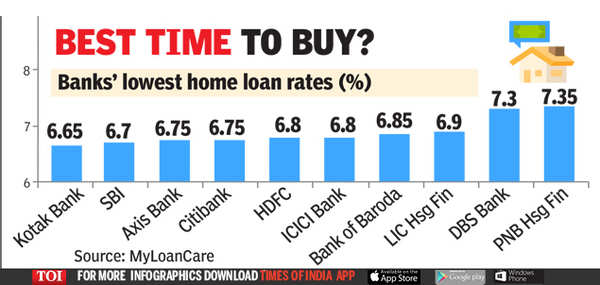

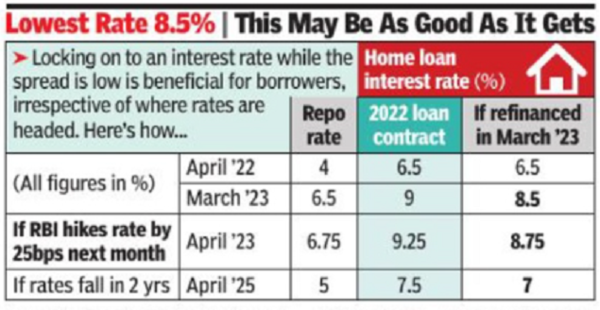

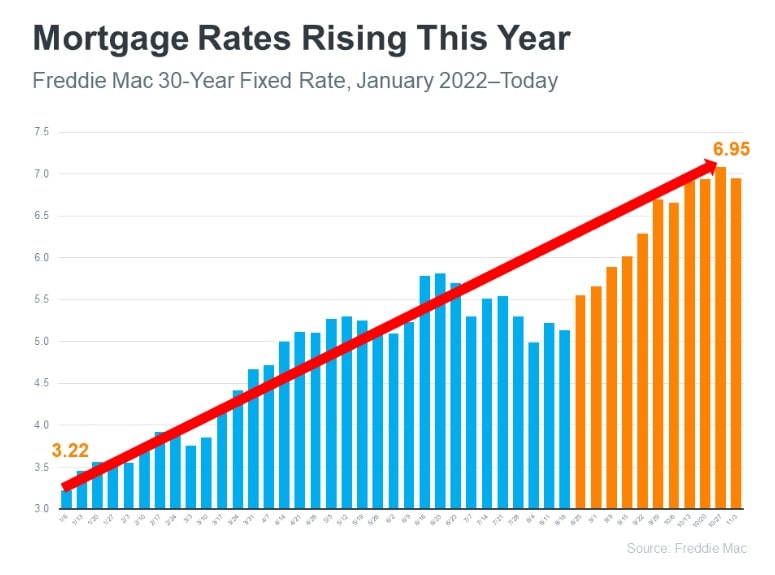

In the years leading up to the COVID-19 pandemic, home loan interest rates reached historic lows, falling to around 6.5-7%. The RBI adopted an accommodative monetary policy stance to support economic growth.

The pandemic further accelerated this trend, with the RBI slashing policy rates to cushion the impact of the lockdown. However, with the global economy recovering and inflation surging, the RBI began to tighten monetary policy in 2022, leading to a steady increase in home loan interest rates.

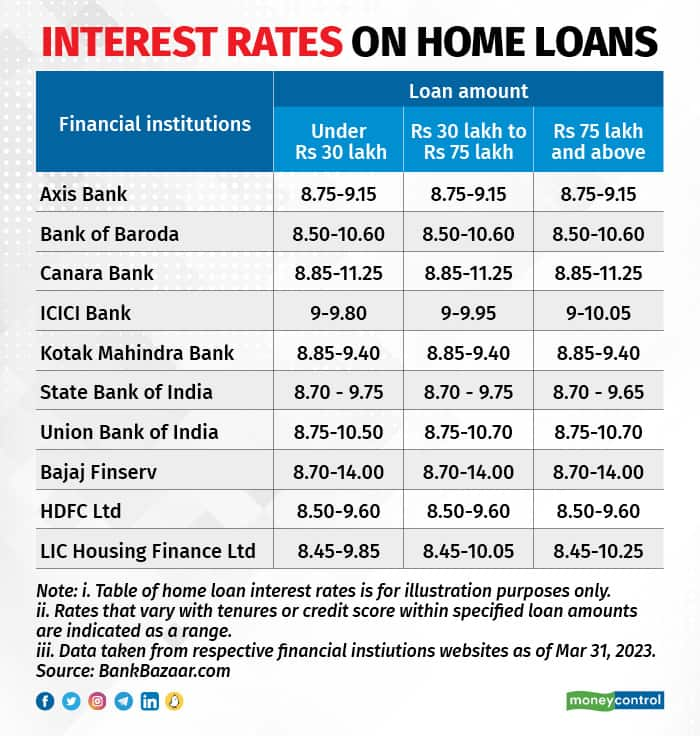

Currently, rates are hovering in the 8.5%-9.5% range and are expected to potentially go even higher. This shift has impacted affordability and dampened the demand in the housing market.

The Future Outlook

The future trajectory of home loan interest rates in India remains uncertain, heavily dependent on global economic conditions, inflation trends, and the RBI's policy decisions. Experts predict a period of consolidation, with rates likely to remain elevated in the near term.

Potential homebuyers should carefully assess their financial situation and consider the long-term implications of higher interest rates. Exploring options like fixed vs. floating rates and optimizing loan tenure can help mitigate the impact of fluctuations. Seeking advice from financial advisors can also provide valuable insights.

Ultimately, the dream of owning a home remains attainable, but requires careful planning and a thorough understanding of the prevailing economic landscape. Navigating the complexities of home loan interest rates is a key step towards achieving that dream. Borrowers are advised to shop around for the best deals and explore various government initiatives that offer subsidies and incentives for homeownership.

It is not time to panic but to plan carefully.