Law Firm Profits Per Partner 2025

The aroma of freshly brewed coffee hung in the air, mingling with the low hum of hushed conversations. Sunlight streamed through the panoramic windows of downtown offices, illuminating the crisp lines of power suits and the gleam of accomplishment in seasoned eyes. Partners gathered, not for the usual Monday morning grind, but for a much-anticipated glimpse into the financial health of their firms – the release of the 2025 Profits Per Partner (PPP) figures.

Today, we delve into the captivating world of law firm finances, exploring the just-released 2025 PPP data. These figures provide a crucial barometer of success, reflecting not only financial performance but also strategic decisions and overall market dynamics within the legal industry.

The Big Picture: 2025 PPP Landscape

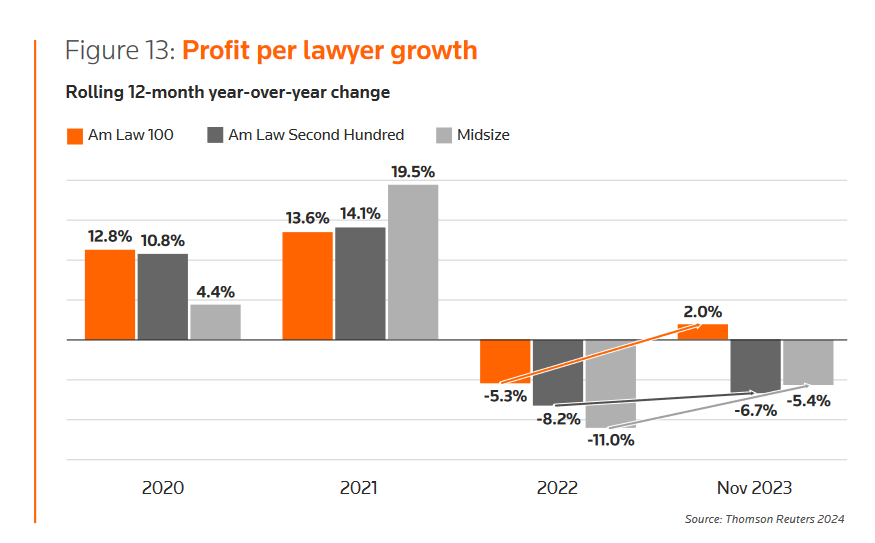

The year 2025 presented a mixed bag for law firms. While some firms soared to new heights, others faced headwinds amidst evolving economic conditions and increased competition.

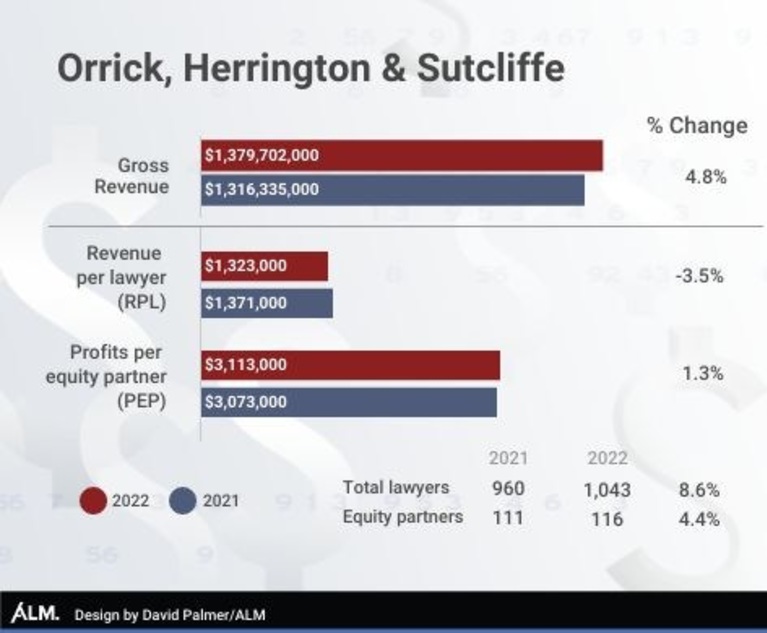

According to the latest report from Am Law, the top 10 firms saw an average PPP increase of 8%, while the Am Law 200 experienced a more modest growth of 3.5%.

This divergence highlights the growing gap between the elite firms and the rest of the pack.

Factors Driving Performance

Several key factors influenced law firm profitability in 2025. Demand for legal services in areas like technology, cybersecurity, and renewable energy continued to surge, benefiting firms with a strong presence in these sectors.

Merger and acquisition activity, while not as frenzied as in previous years, still provided significant revenue streams for firms specializing in corporate law.

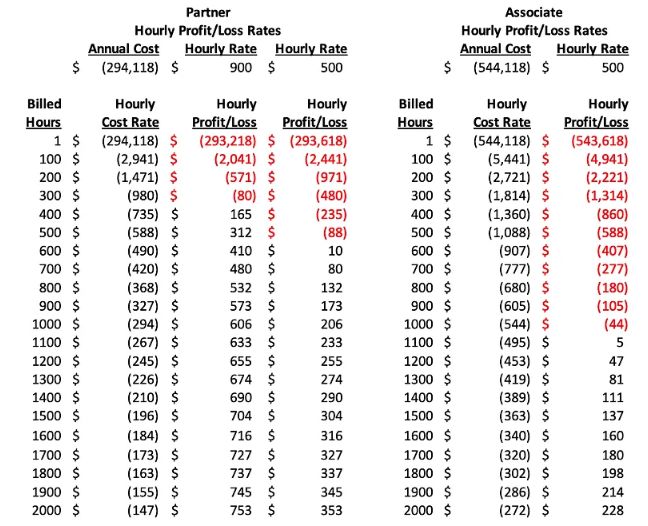

However, rising operating costs, particularly associate salaries and technology investments, put pressure on profit margins for many firms.

The talent war also played a crucial role. Firms that successfully attracted and retained top talent were better positioned to capitalize on market opportunities.

Those that struggled with attrition and recruitment faced challenges in maintaining their competitive edge.

The Winners and Losers

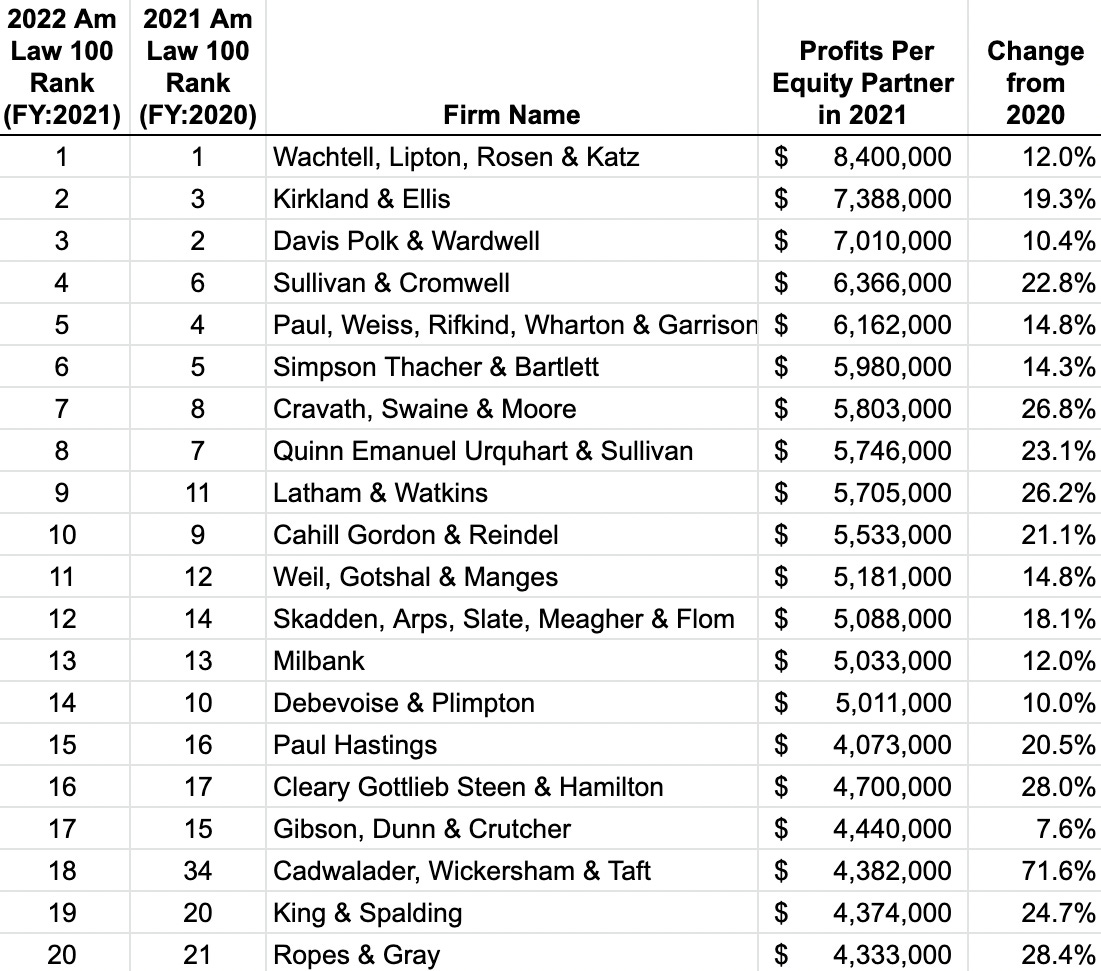

Certain firms emerged as clear winners in 2025. Kirkland & Ellis maintained its position as the top-performing firm, boasting a PPP of over $8 million.

Their diversified practice areas and global reach allowed them to weather market fluctuations and consistently deliver strong financial results.

Other firms, like Latham & Watkins and DLA Piper, also demonstrated impressive growth, driven by strategic investments in key practice areas and international expansion.

However, not all firms experienced such positive outcomes. Some firms, particularly those heavily reliant on traditional practice areas like litigation and real estate, saw their PPP decline.

These firms faced challenges in adapting to the changing legal landscape and were forced to implement cost-cutting measures to maintain profitability.

The mid-market firms, in particular, felt the squeeze. They struggled to compete with the deep pockets and brand recognition of the larger firms.

Regional Variations

The PPP landscape also varied significantly across different regions. Firms in New York and California, traditionally the most lucrative markets, continued to thrive, benefiting from their concentration of corporate headquarters and financial institutions.

However, firms in emerging markets, such as Texas and Florida, experienced even faster growth, driven by strong economic expansion and an influx of new businesses.

These regions presented attractive opportunities for firms looking to expand their footprint and tap into new client bases.

The Impact of Technology

Technology played an increasingly important role in law firm profitability in 2025. Firms that embraced innovative technologies, such as artificial intelligence and automation, were able to streamline their operations, reduce costs, and improve client service.

These technologies enabled firms to handle larger volumes of work with fewer resources, leading to significant efficiency gains.

Conversely, firms that lagged behind in technology adoption faced challenges in competing with their more tech-savvy peers.

Cybersecurity also became a major concern, with law firms facing increasing threats from cyberattacks. Firms that invested in robust cybersecurity measures were better positioned to protect client data and maintain their reputation.

Data breaches could be catastrophic, leading to significant financial losses and reputational damage.

Looking Ahead: The Future of PPP

What does the future hold for law firm PPP? Experts predict that the trend of divergence between the elite firms and the rest of the pack will continue. The top firms will likely continue to grow, driven by their global reach, diversified practice areas, and strong brand recognition.

Mid-market firms will need to find ways to differentiate themselves and offer specialized services to compete effectively.

Technology will continue to play a crucial role in shaping the legal industry. Firms that embrace innovation and invest in technology will be best positioned to thrive in the years to come.

The ability to attract and retain top talent will remain a key differentiator. Firms that offer competitive compensation packages, opportunities for professional development, and a supportive work environment will be best positioned to attract and retain the best and brightest lawyers.

Additionally, focus on diversity, equity, and inclusion will be paramount to foster a positive work environment and resonate with clients.

The 2025 PPP figures offer a valuable snapshot of the legal industry's financial health. They highlight the challenges and opportunities facing law firms in a rapidly changing world.

As the legal landscape continues to evolve, firms that embrace innovation, invest in talent, and adapt to market dynamics will be best positioned to achieve long-term success.

Ultimately, the pursuit of higher PPP is not just about financial gain. It's about building a sustainable and thriving practice that serves clients effectively, provides opportunities for employees, and contributes to the broader legal community.

The Profit Per Partner is not the only measure of success, but it reflects many other factors.