Lic Jeevan Vriddhi Surrender Value Calculator

Calculating the surrender value of a Life Insurance Corporation of India (LIC) Jeevan Vriddhi policy has become more transparent with the advent of online surrender value calculators.

These digital tools aim to simplify a process often perceived as complex, providing policyholders with a clearer understanding of the financial implications of surrendering their policies before maturity. This article explores the features, benefits, and limitations of the LIC Jeevan Vriddhi Surrender Value Calculator, examining its significance for policyholders.

Understanding Jeevan Vriddhi and Surrender Value

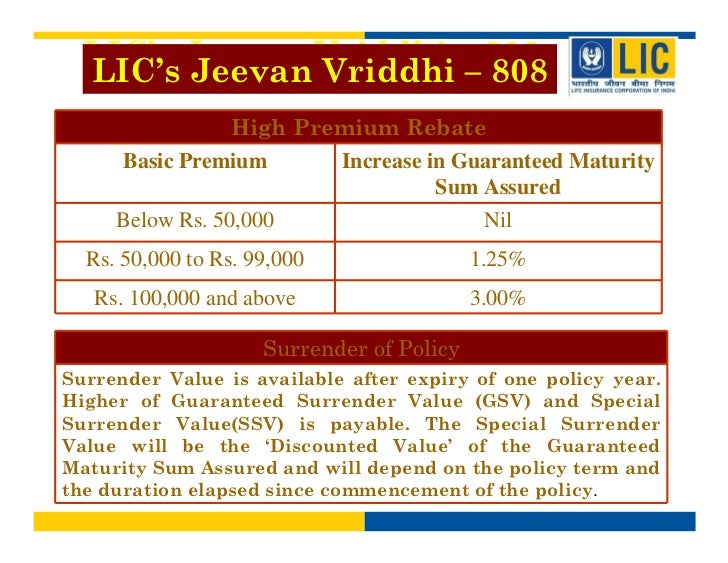

Jeevan Vriddhi is a single premium plan offered by LIC, designed to provide financial protection and savings. Policyholders can surrender the policy before its maturity date, but doing so involves receiving a "surrender value," which is typically less than the total premiums paid.

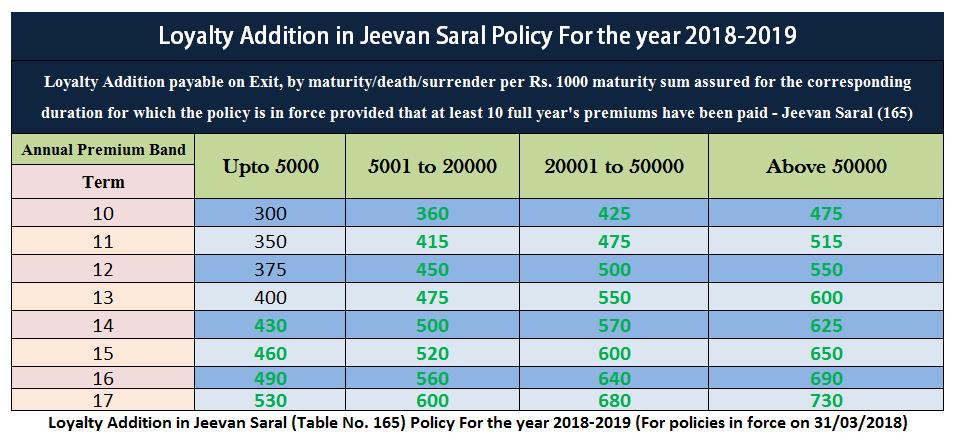

The surrender value depends on various factors, including the policy term, the number of premiums paid, and the timing of the surrender. Calculating this value manually can be confusing, leading to uncertainty for policyholders.

Key Features of the Online Calculator

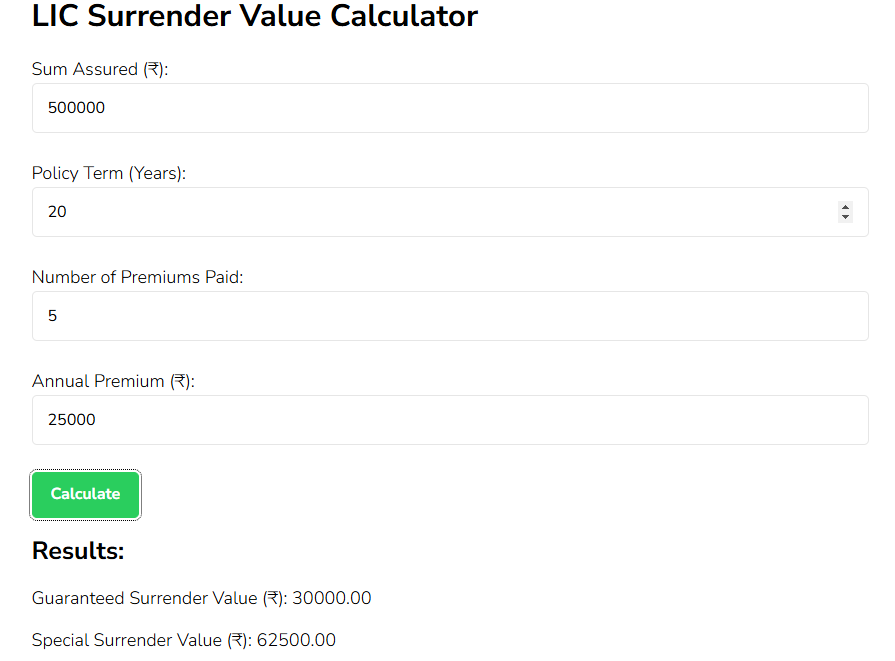

LIC and several third-party financial websites now offer surrender value calculators for Jeevan Vriddhi. These calculators typically require users to input policy details such as the policy number, premium amount, date of commencement, and date of surrender.

Once the information is entered, the calculator processes the data based on LIC's surrender value formula, which factors in the guaranteed surrender value (GSV) and potentially a special surrender value (SSV). The GSV is usually a percentage of the premiums paid, while the SSV may depend on the policy's performance and market conditions.

The calculator then presents an estimated surrender value, giving the policyholder a clearer picture of the amount they would receive upon surrendering the policy.

Benefits of Using the Calculator

The primary benefit of the Jeevan Vriddhi Surrender Value Calculator is its ability to provide a quick and convenient estimate. Policyholders no longer need to rely solely on LIC agents or lengthy policy documents to understand their surrender options.

This transparency empowers policyholders to make informed decisions about their financial planning. It allows them to compare the surrender value with other investment options and assess whether surrendering the policy aligns with their financial goals.

Furthermore, the calculator can help policyholders avoid surprises and manage their expectations. Understanding the potential surrender value can prevent disappointment or financial strain when considering surrendering the policy.

Limitations and Considerations

While these calculators offer significant benefits, it's crucial to acknowledge their limitations. The calculated value is an estimate, and the actual surrender value may vary slightly depending on LIC's internal calculations and prevailing market conditions.

It's advisable to verify the estimated value with LIC directly before making any final decisions. Policyholders should also understand the implications of surrendering the policy, including the loss of insurance coverage and potential tax consequences.

Moreover, these calculators should not be the sole basis for financial decisions. Consulting a financial advisor can provide a more comprehensive understanding of the policyholder's financial situation and help them explore alternative options, such as taking a loan against the policy.

Impact on Policyholders

The availability of the LIC Jeevan Vriddhi Surrender Value Calculator marks a positive step towards greater transparency in the insurance industry. By providing policyholders with easy access to crucial information, these tools promote financial literacy and empower individuals to take control of their investments.

This increased transparency may also encourage LIC and other insurance providers to improve their policy terms and customer service. As policyholders become more informed, they are likely to demand clearer explanations of policy features, fees, and surrender options.

Ultimately, the Jeevan Vriddhi Surrender Value Calculator serves as a valuable resource for policyholders, promoting responsible financial planning and empowering them to make informed decisions about their life insurance investments.